Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please, solve the following problem related to real estate finance for construction. The topic of the problem is preferred equity. Solve it in the following

Please, solve the following problem related to real estate finance for construction. The topic of the problem is preferred equity.

Solve it in the following Excel template:

Please, do not copy the answer from someone else cause I will notice.

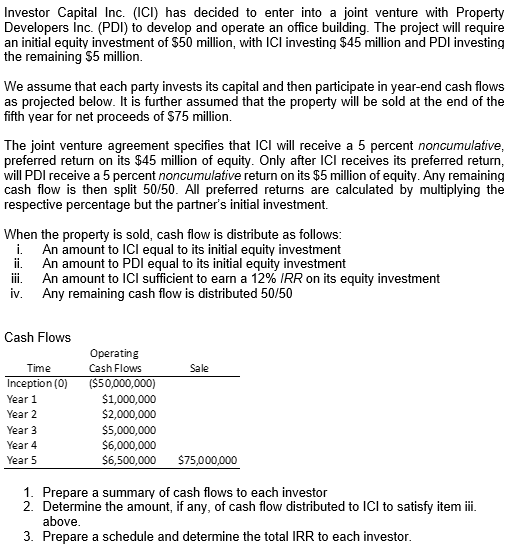

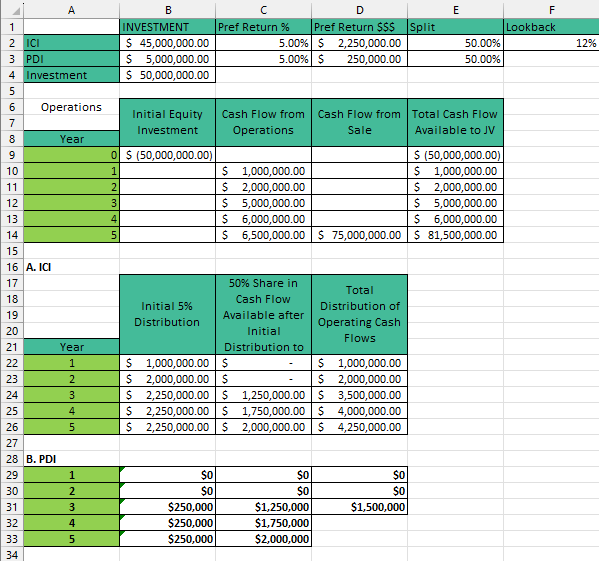

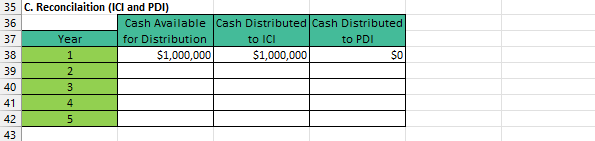

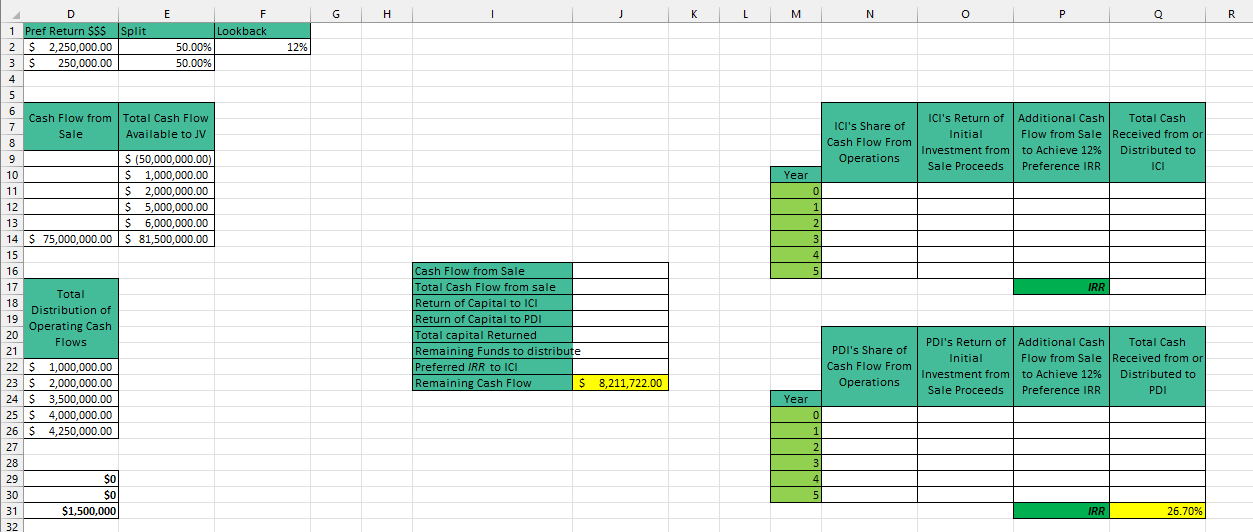

Investor Capital Inc. (ICl) has decided to enter into a joint venture with Property Developers Inc. (PDI) to develop and operate an office building. The project will require an initial equity investment of $50 million, with ICl investing $45 million and PDI investing the remaining $5 million. We assume that each party invests its capital and then participate in year-end cash flows as projected below. It is further assumed that the property will be sold at the end of the fifth year for net proceeds of $75 million. The joint venture agreement specifies that ICl will receive a 5 percent noncumulative, preferred return on its $45 million of equity. Only after ICl receives its preferred return, will PDI receive a 5 percent noncumulative return on its $5 million of equity. Any remaining cash flow is then split 50/50. All preferred returns are calculated by multiplying the respective percentage but the partner's initial investment. When the property is sold, cash flow is distribute as follows: i. An amount to ICl equal to its initial equity investment ii. An amount to PDI equal to its initial equity investment iii. An amount to ICl sufficient to earn a 12%/RR on its equity investment iv. Any remaining cash flow is distributed 50/50 1. Prepare a summary of cash flows to each investor 2. Determine the amount, if any, of cash flow distributed to ICl to satisfy item iii. above. 3. Prepare a schedule and determine the total IRR to each investor. 16 A. ICI B. PDI 35 C. Reconcilaition (ICI and PDI) Investor Capital Inc. (ICl) has decided to enter into a joint venture with Property Developers Inc. (PDI) to develop and operate an office building. The project will require an initial equity investment of $50 million, with ICl investing $45 million and PDI investing the remaining $5 million. We assume that each party invests its capital and then participate in year-end cash flows as projected below. It is further assumed that the property will be sold at the end of the fifth year for net proceeds of $75 million. The joint venture agreement specifies that ICl will receive a 5 percent noncumulative, preferred return on its $45 million of equity. Only after ICl receives its preferred return, will PDI receive a 5 percent noncumulative return on its $5 million of equity. Any remaining cash flow is then split 50/50. All preferred returns are calculated by multiplying the respective percentage but the partner's initial investment. When the property is sold, cash flow is distribute as follows: i. An amount to ICl equal to its initial equity investment ii. An amount to PDI equal to its initial equity investment iii. An amount to ICl sufficient to earn a 12%/RR on its equity investment iv. Any remaining cash flow is distributed 50/50 1. Prepare a summary of cash flows to each investor 2. Determine the amount, if any, of cash flow distributed to ICl to satisfy item iii. above. 3. Prepare a schedule and determine the total IRR to each investor. 16 A. ICI B. PDI 35 C. Reconcilaition (ICI and PDI)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started