please solve the following problems: 1, 2, 3, 4, 6, 7, 13

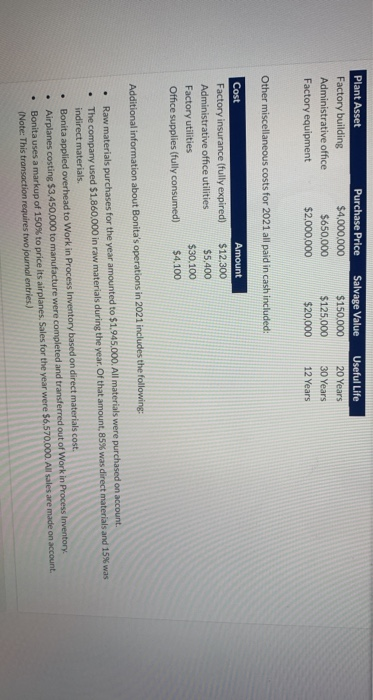

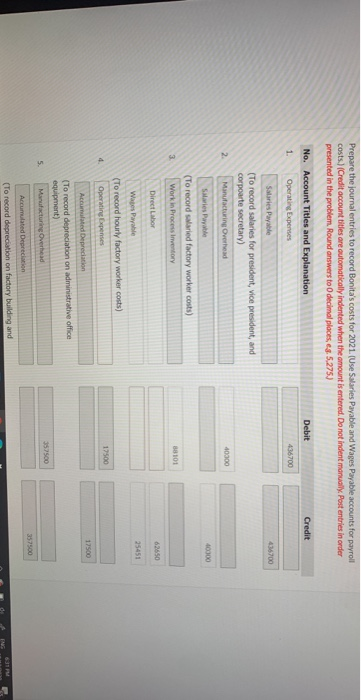

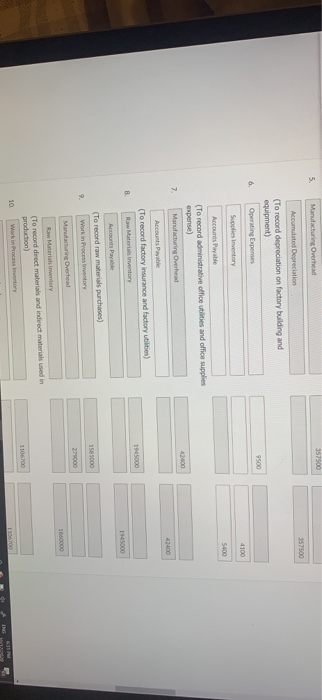

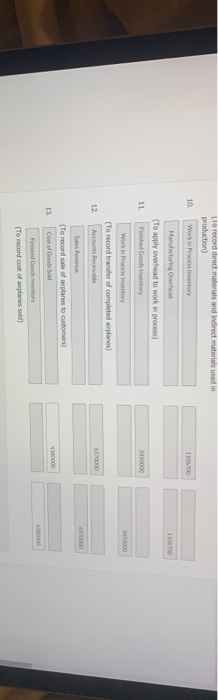

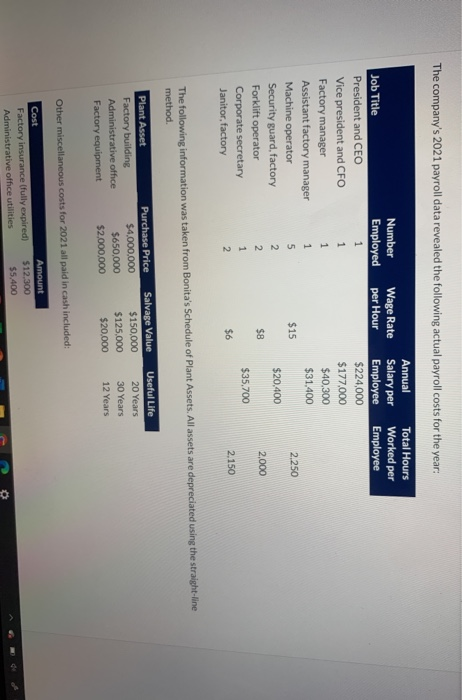

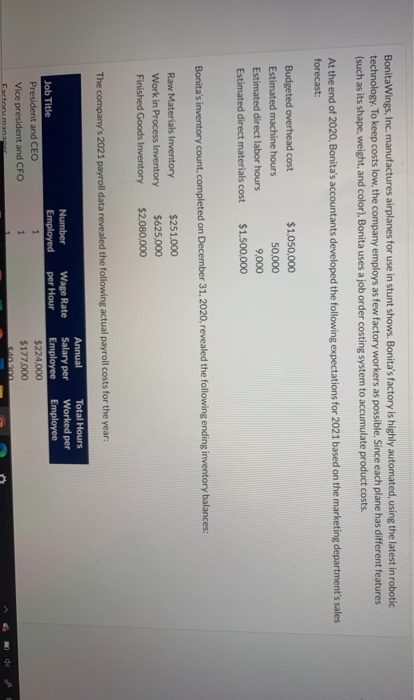

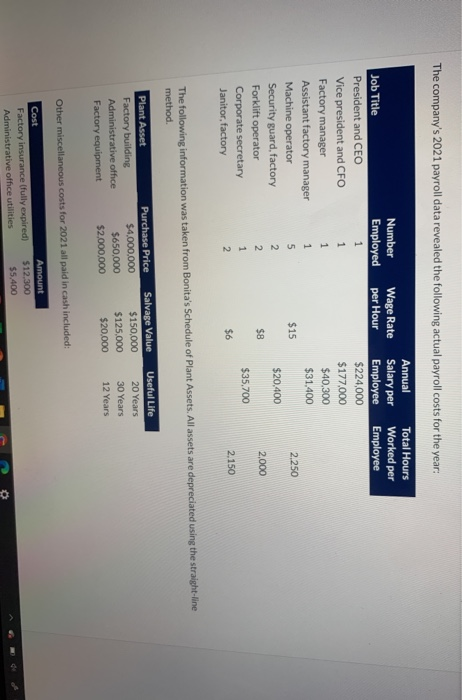

BonitaWings, Inc. manufactures airplanes for use in stunt shows. Bonita's factory is highly automated, using the latest in robotic technology. To keep costs low, the company employs as few factory workers as possible. Since each plane has different features (such as its shape, weight, and color), Bonita uses a job order costing system to accumulate product costs. At the end of 2020, Bonita's accountants developed the following expectations for 2021 based on the marketing department's sales forecast: Budgeted overhead cost $1,050,000 Estimated machine hours 50,000 Estimated direct labor hours Estimated direct materials cost $1,500,000 9,000 Bonita's inventory count completed on December 31, 2020, revealed the following ending inventory balances: Raw Materials Inventory $251.000 Work in Process Inventory $625,000 Finished Goods Inventory $2.080,000 The company's 2021 payroll data revealed the following actual payroll costs for the year: Number Employed Wage Rate per Hour Total Hours Worked per Employee Job Title President and CEO Vice president and CFO Factoruman Annual Salary per Employee $224.000 $177,000 The company's 2021 payroll data revealed the following actual payroll costs for the year: Number Employed 1 1 1 Job Title President and CEO Vice president and CFO Factory manager Assistant factory manager Machine operator Security guard, factory Forklift operator Corporate secretary Janitor, factory Annual Total Hours Wage Rate Salary per Worked per per Hour Employee Employee $224,000 $177,000 $40,300 $31.400 $15 2.250 $20.400 $8 2.000 $35,700 2.150 1 5 2 2 1 2 $6 The following information was taken from Bonita's Schedule of Plant Assets. All assets are depreciated using the straight-line method Plant Asset Factory building Administrative office Factory equipment Purchase Price $4,000,000 $650,000 $2.000.000 Salvage Value $150,000 $125.000 $20.000 Useful Life 20 Years 30 Years 12 Years Other miscellaneous costs for 2021 all paid in cash included: Cost Factory insurance (fully expired) Administrative office utilities Amount $12.300 $5,400 Plant Asset Factory building Administrative office Factory equipment Purchase Price $4,000,000 $650,000 $2,000,000 Salvage Value $150.000 $125,000 $20,000 Useful Life 20 Years 30 Years 12 Years Other miscellaneous costs for 2021 all paid in cash included: Cost Factory insurance (fully expired) Administrative office utilities Factory utilities Office supplies (fully consumed) Amount $12,300 $5,400 $30.100 $4.100 Additional information about Bonita's operations in 2021 includes the following: . . Raw materials purchases for the year amounted to $1.945,000. All materials were purchased on account. The company used $1.860,000 in raw materials during the year. Or that amount, 85% was direct materials and 15% was indirect materials Bonita applied overhead to Work in Process Inventory based on direct materials cost. Airplanes costing $3,450,000 to manufacture were completed and transferred out of Work in Process Inventory. Bonita uses a markup of 150% to price its airplanes. Sales for the year were $6,570.000. All sales are made on account (Note: This transaction requires two journal entries.) . Prepare the journal entries to record Bonita's costs for 2021. (Use Salaries Payable and Wages Payable accounts for payroll costs.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Post entries in order presented in the problem. Round answers to decimal places, eg. 5.275.) Debit Credit No. Account Titles and Explanation 1. Operating Expenses 436700 436700 Salaries Payable (To record salaries for president, vice president, and corpoarte secretary) Manufacturing Overhead 2. 40000 40000 Salaries Payable (To record salaried factory worker costs) Work in Process inventory 3. 88101 Direct Labor 62650 25451 Wapes Payable 17500 (To record hourly factory worker costs) Operating Expenses Accumulated Depreciation (To record depreciation on administrative office equipment) Manufacturing Overhead 357500 5. 357900 Accumulated Depreciation (To record depreciation on factory building and 63 357500 5 Manufacturing Overhead 357500 Accumulated Depreciation (To record depreciation on factory building and equipment) Operating Expenses 9500 6. 4100 Supplies inventory 5400 Accounts Payable (To record administrative office utilities and office supplies expense) Manufacturing Overhead 40 7 3400 Accounts Poble (To record factory insurance and factory utilities) Raw Material ventory 15000 B 1140 Accounts Payable (To record raw materials purchases) Work in Process Inventory Manufacturing Overhead 1581000 9. 279000 Materials inventory (To record direct materials and indirect materials used in production) Work in Processory 1106700 10 to record direct materials and indirect materials used in production) Work in Pretory 10 110 11000 11 3450000 Maracturing Overhead (To apply overhead to work in process) Finished Goods Story Work in Processor (To record transfer of completed airplanes) Accounts Receivable 12 570000 (To record sale of airplanes to customers) Cost of Goods 13 300 (To record cost of airplanes sold)

please solve the following problems: 1, 2, 3, 4, 6, 7, 13

please solve the following problems: 1, 2, 3, 4, 6, 7, 13