Please solve the following question:

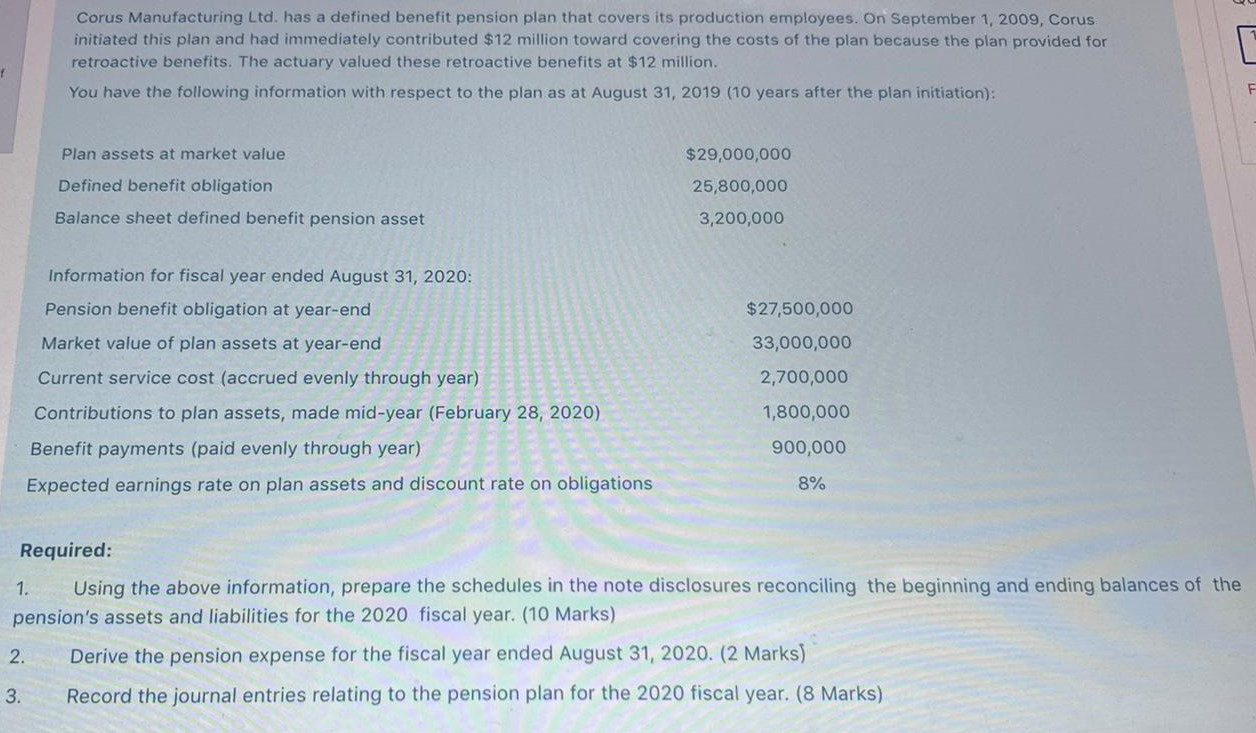

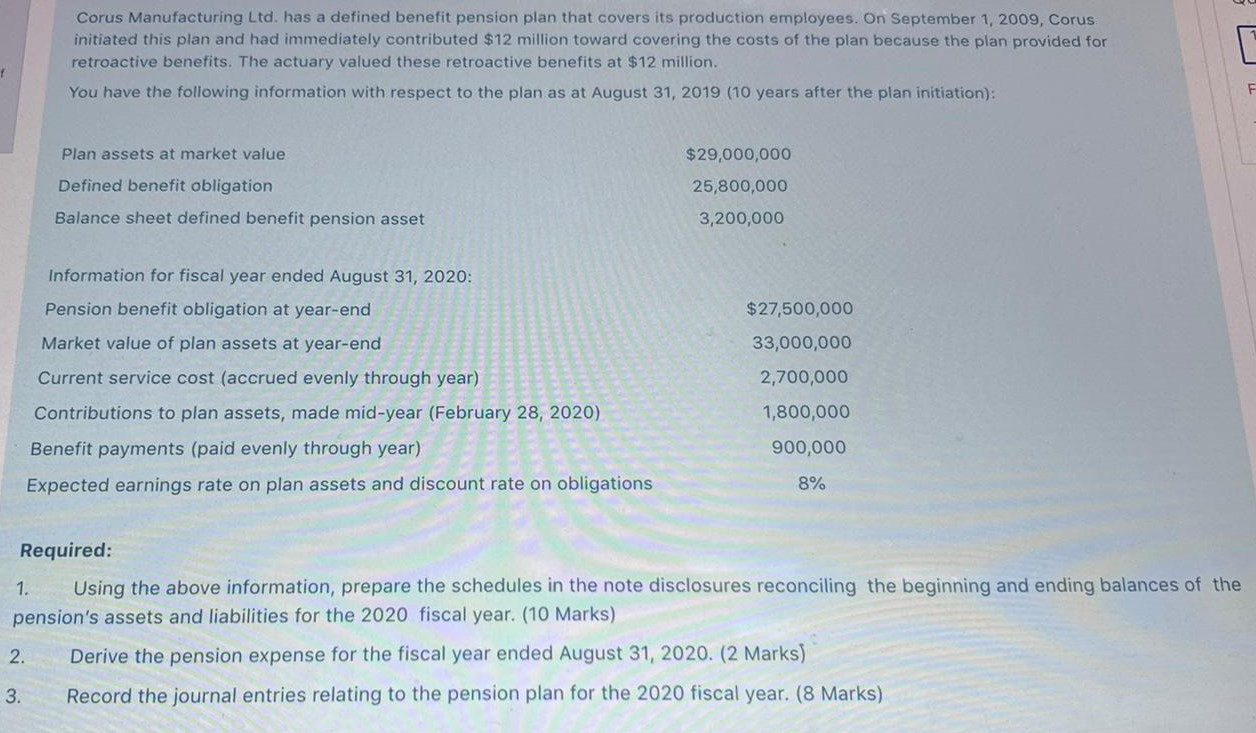

Corus Manufacturing Ltd. has a defined benefit pension plan that covers its production employees. On September 1, 2009, Corus initiated this plan and had immediately contributed $12 million toward covering the costs of the plan because the plan provided for retroactive benefits. The actuary valued these retroactive benefits at $12 million. You have the following information with respect to the plan as at August 31, 2019 (10 years after the plan initiation): F Plan assets at market value Defined benefit obligation $29,000,000 25,800,000 3,200,000 Balance sheet defined benefit pension asset Information for fiscal year ended August 31, 2020: Pension benefit obligation at year-end Market value of plan assets at year-end Current service cost (accrued evenly through year) $27,500,000 33,000,000 2,700,000 Contributions to plan assets, made mid-year (February 28, 2020) Benefit payments (paid evenly through year) Expected earnings rate on plan assets and discount rate on obligations 1,800,000 900,000 8% Required: 1. Using the above information, prepare the schedules in the note disclosures reconciling the beginning and ending balances of the pension's assets and liabilities for the 2020 fiscal year. (10 Marks) 2. Derive the pension expense for the fiscal year ended August 31, 2020. (2 Marks) 3. Record the journal entries relating to the pension plan for the 2020 fiscal year. (8 Marks) Corus Manufacturing Ltd. has a defined benefit pension plan that covers its production employees. On September 1, 2009, Corus initiated this plan and had immediately contributed $12 million toward covering the costs of the plan because the plan provided for retroactive benefits. The actuary valued these retroactive benefits at $12 million. You have the following information with respect to the plan as at August 31, 2019 (10 years after the plan initiation): F Plan assets at market value Defined benefit obligation $29,000,000 25,800,000 3,200,000 Balance sheet defined benefit pension asset Information for fiscal year ended August 31, 2020: Pension benefit obligation at year-end Market value of plan assets at year-end Current service cost (accrued evenly through year) $27,500,000 33,000,000 2,700,000 Contributions to plan assets, made mid-year (February 28, 2020) Benefit payments (paid evenly through year) Expected earnings rate on plan assets and discount rate on obligations 1,800,000 900,000 8% Required: 1. Using the above information, prepare the schedules in the note disclosures reconciling the beginning and ending balances of the pension's assets and liabilities for the 2020 fiscal year. (10 Marks) 2. Derive the pension expense for the fiscal year ended August 31, 2020. (2 Marks) 3. Record the journal entries relating to the pension plan for the 2020 fiscal year. (8 Marks)