Answered step by step

Verified Expert Solution

Question

1 Approved Answer

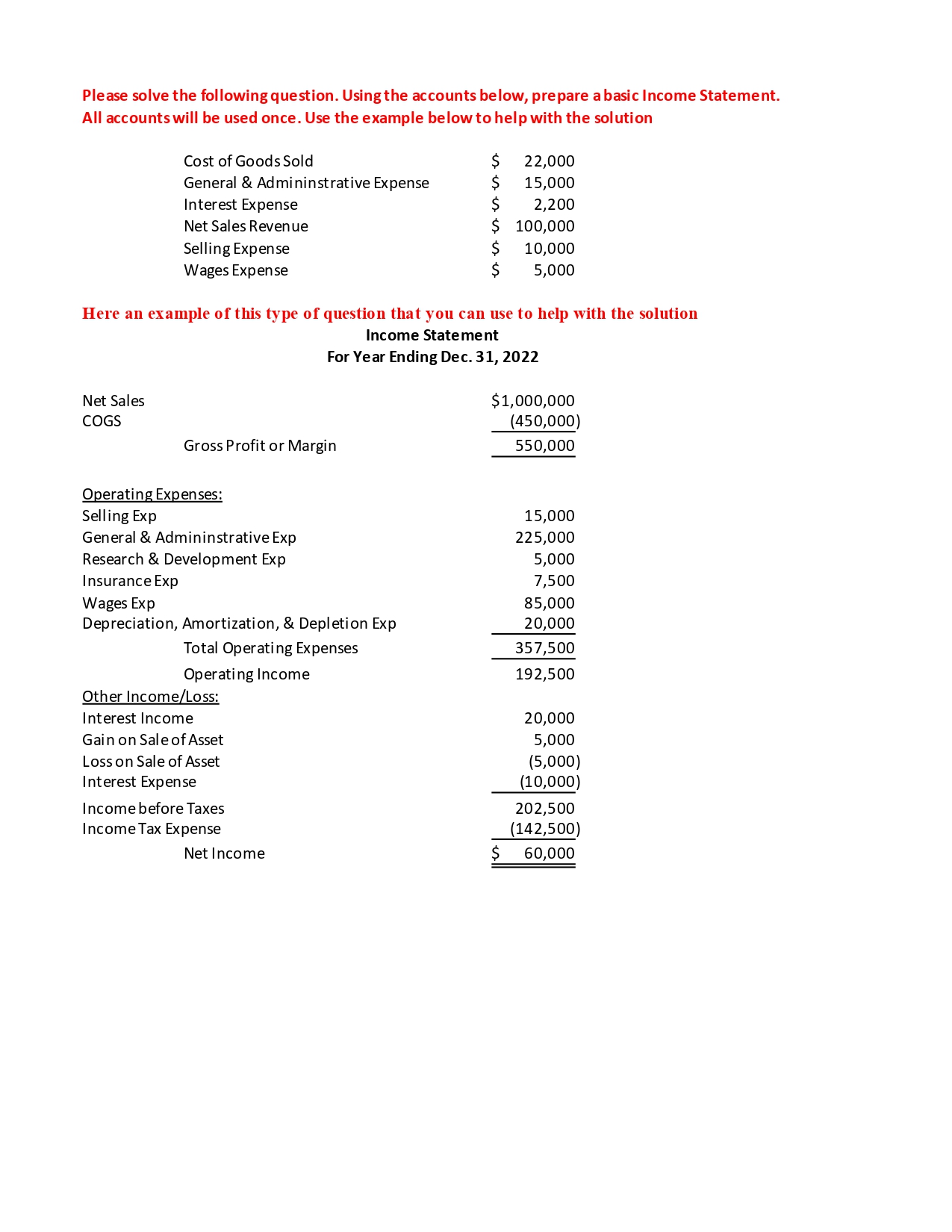

Please solve the following question. Using the accounts below, prepare a basic Income Statement. All accounts will be used once. Use the example below

Please solve the following question. Using the accounts below, prepare a basic Income Statement. All accounts will be used once. Use the example below to help with the solution Cost of Goods Sold $ 22,000 General & Admininstrative Expense $ 15,000 Interest Expense 2,200 Net Sales Revenue $ 100,000 Selling Expense $ 10,000 $ 5,000 Wages Expense Here an example of this type of question that you can use to help with the solution Income Statement For Year Ending Dec. 31, 2022 Net Sales COGS Gross Profit or Margin Operating Expenses: $1,000,000 (450,000) 550,000 Selling Exp General & Admininstrative Exp 15,000 225,000 Research & Development Exp 5,000 Insurance Exp Wages Exp Total Operating Expenses Operating Income Other Income/Loss: Interest Income 7,500 85,000 Depreciation, Amortization, & Depletion Exp 20,000 357,500 192,500 20,000 Gain on Sale of Asset Loss on Sale of Asset Interest Expense Income before Taxes Income Tax Expense 5,000 (5,000) (10,000) 202,500 (142,500) Net Income $ 60,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started