Please solve the information below only. Everything above done is correct.

.

.

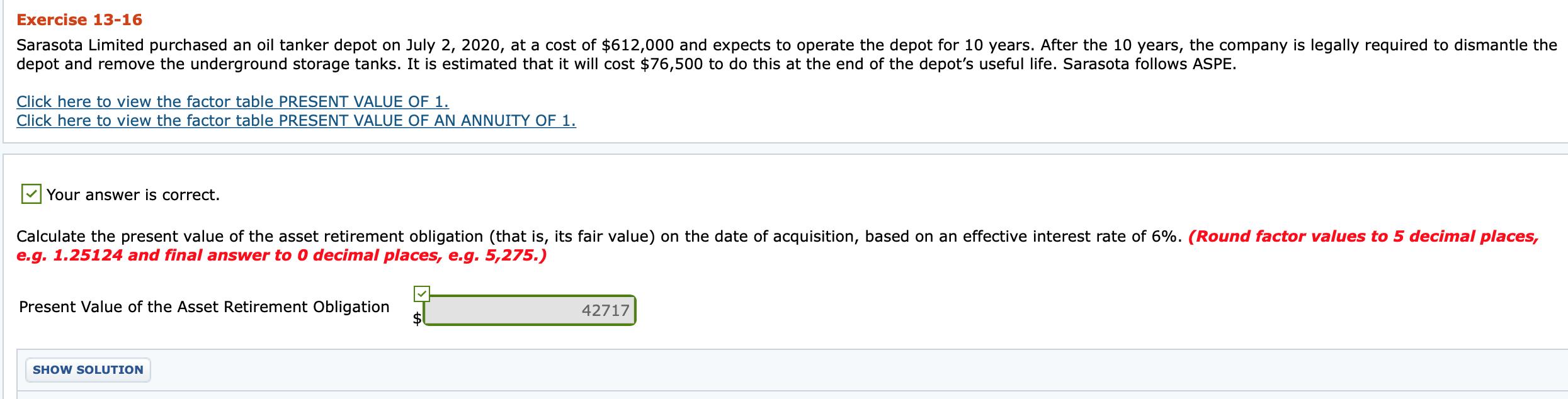

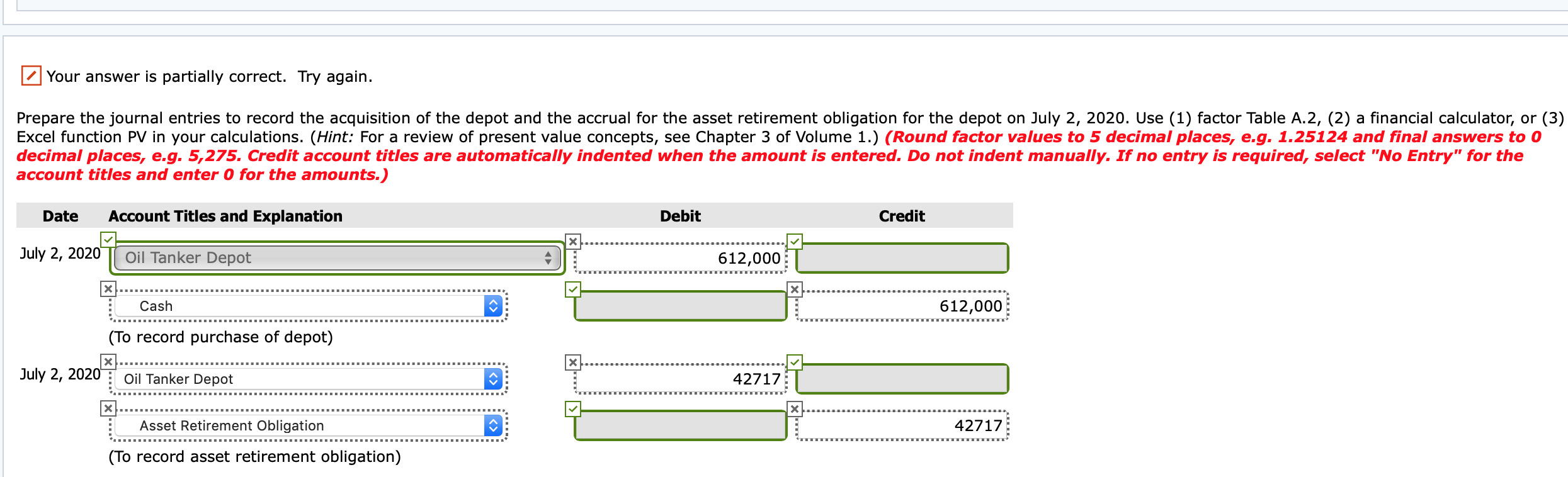

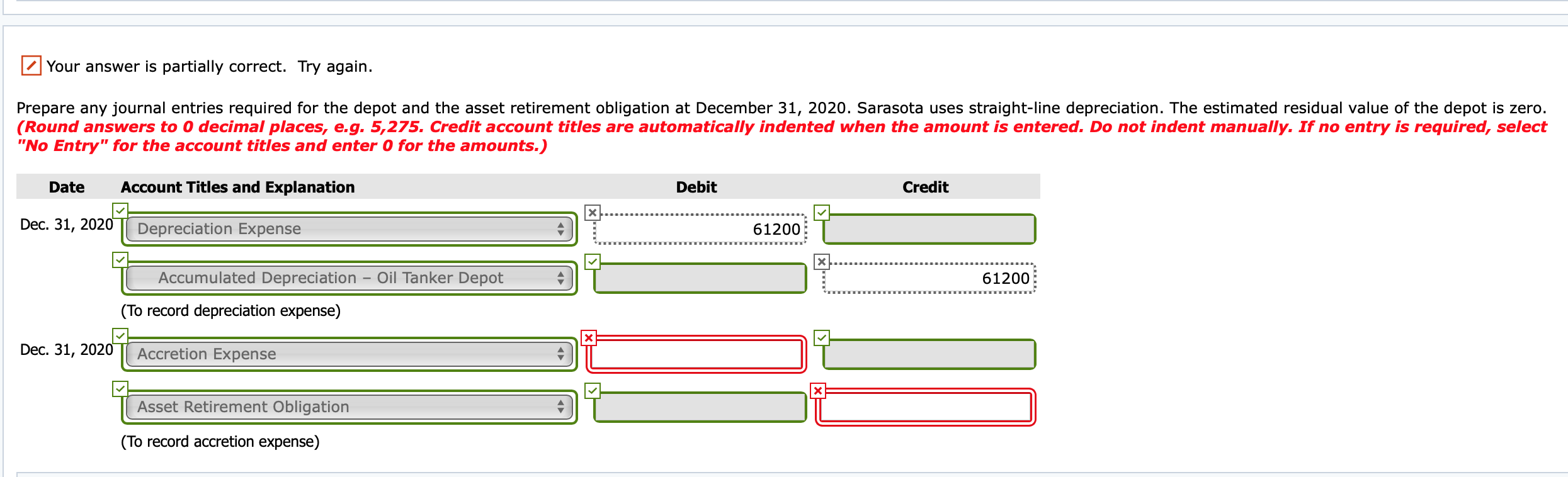

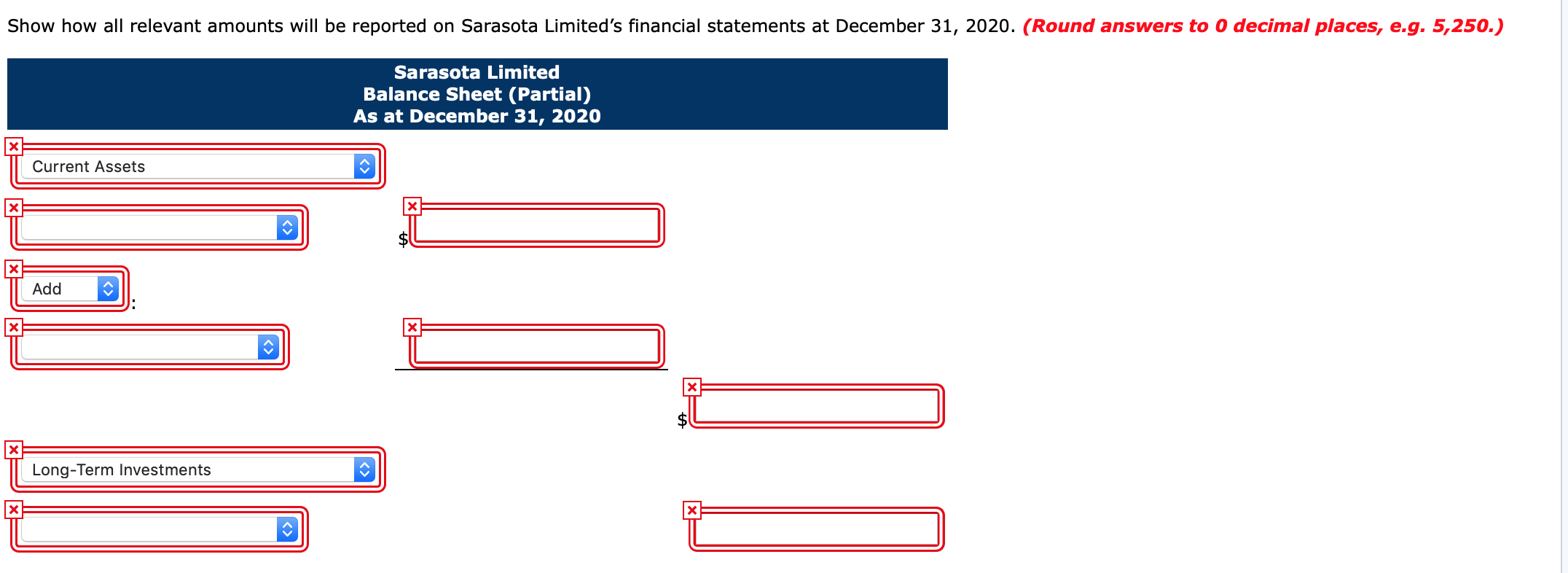

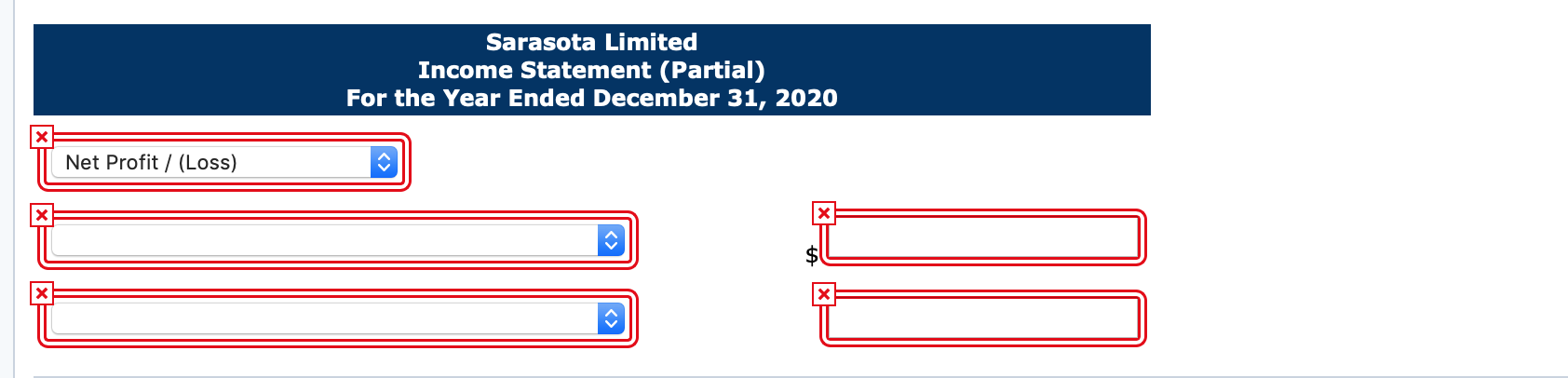

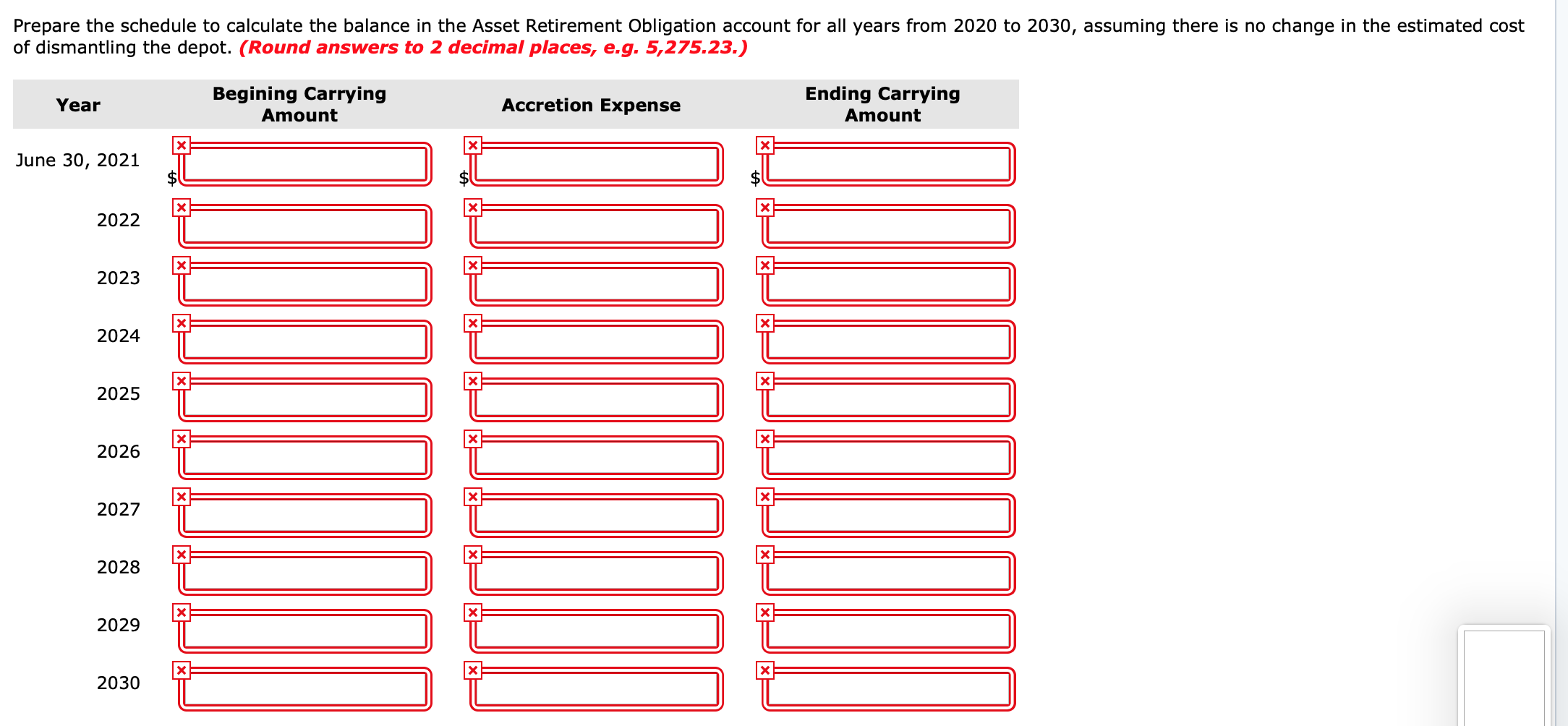

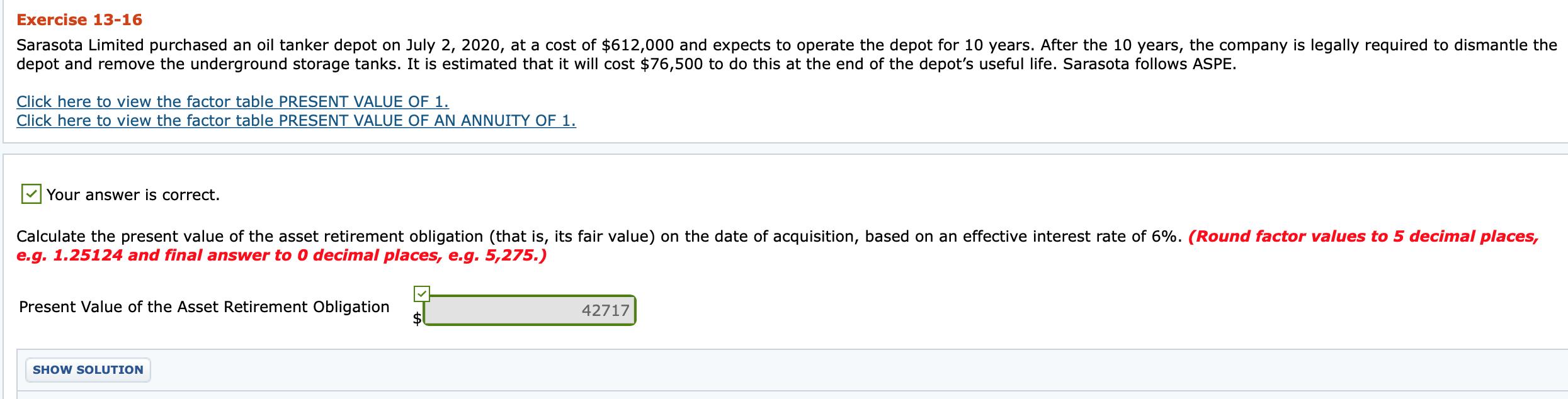

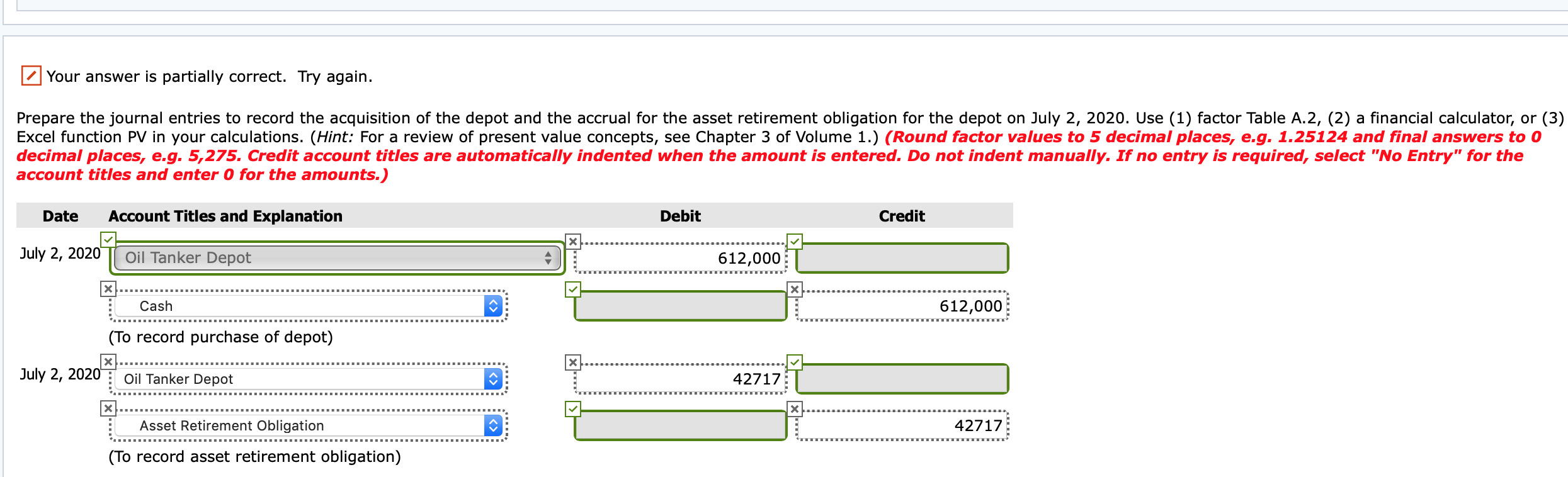

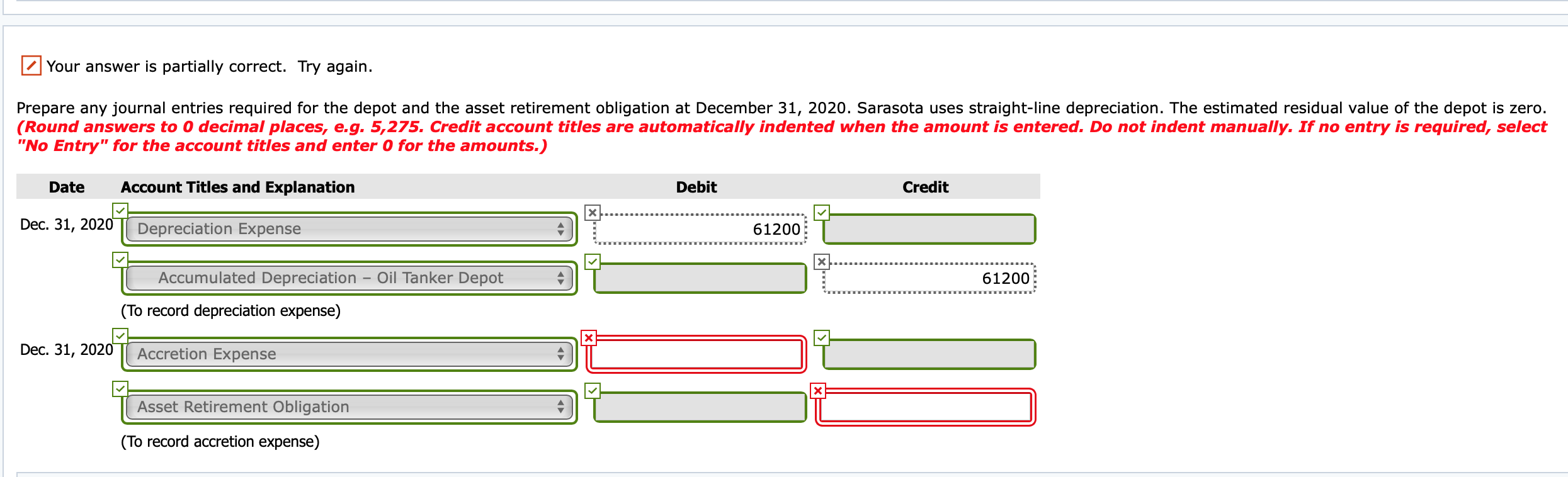

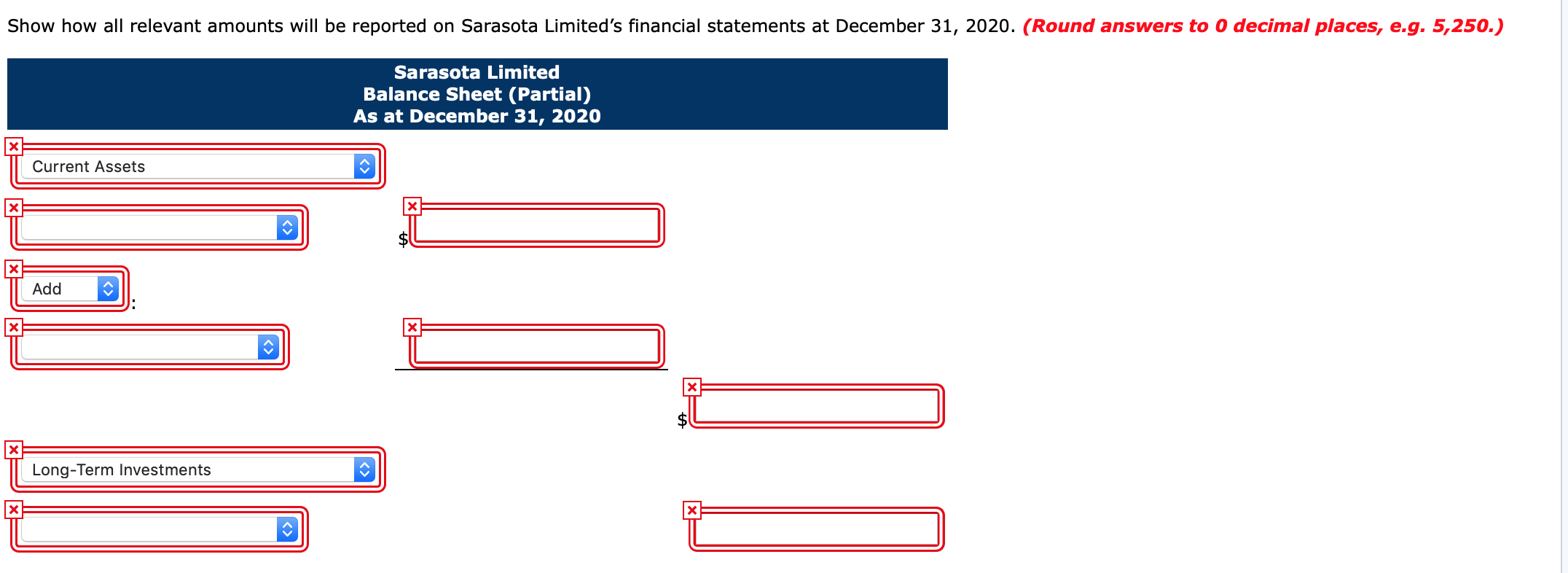

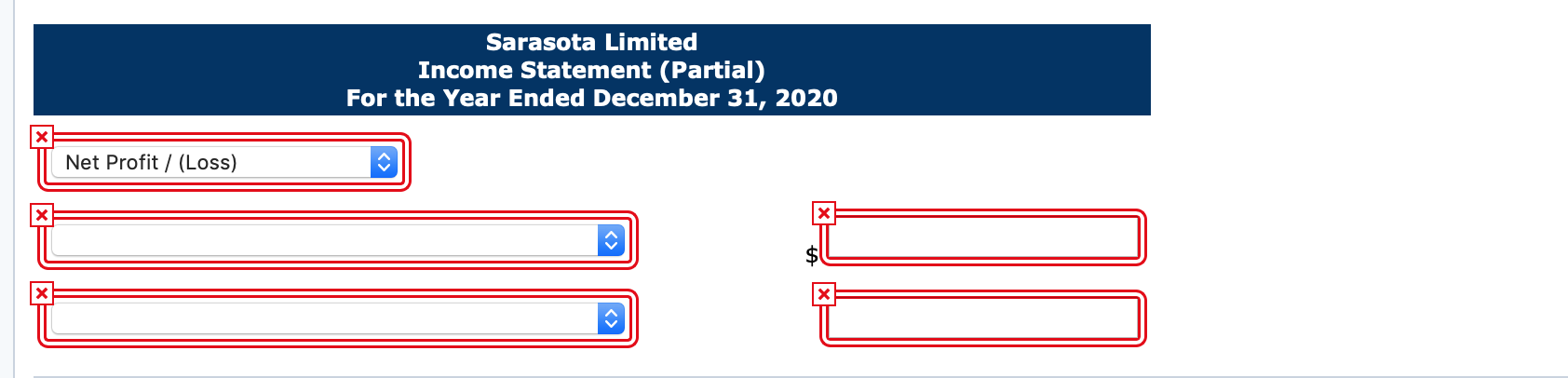

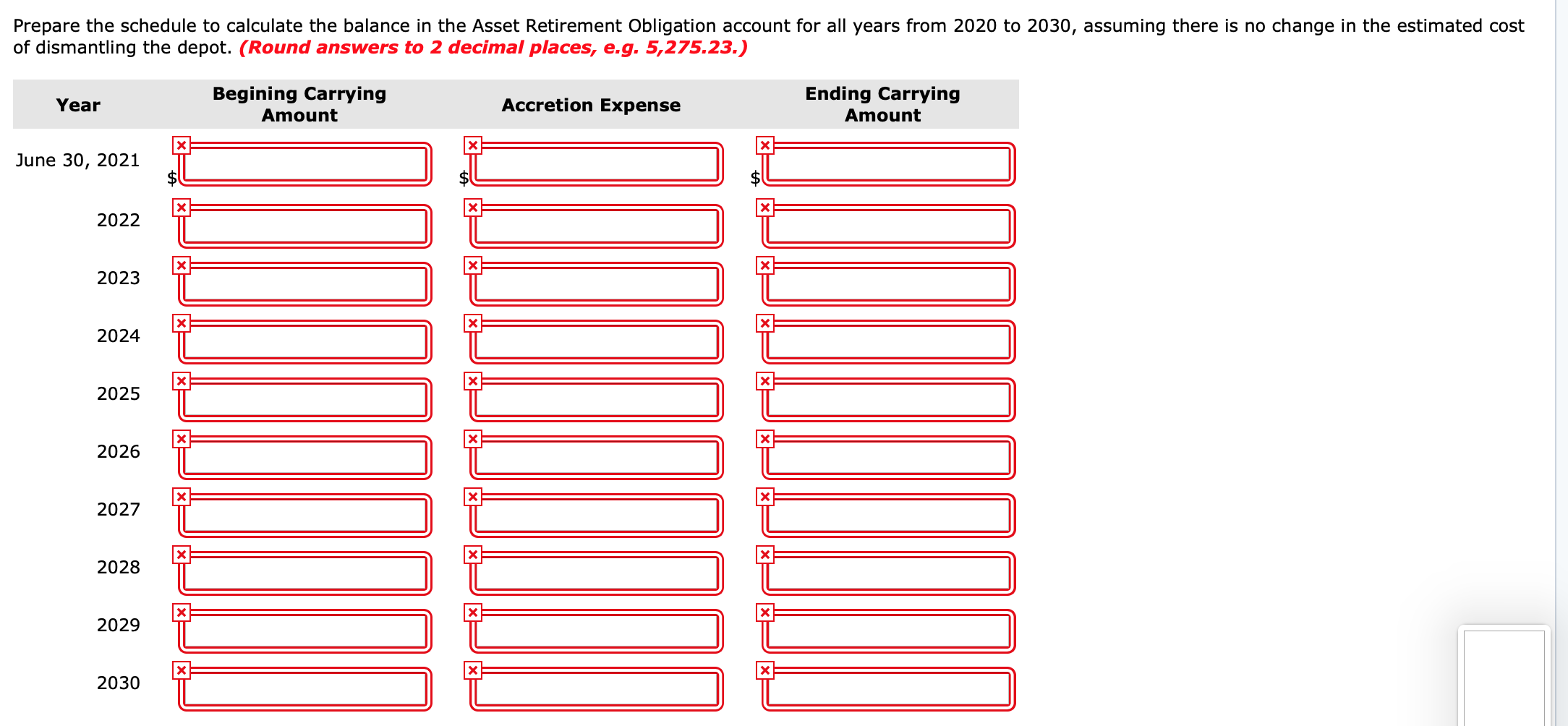

Exercise 13-16 Sarasota Limited purchased an oil tanker depot on July 2, 2020, at a cost of $612,000 and expects to operate the depot for 10 years. After the 10 years, the company is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $76,500 to do this at the end of the depot's useful life. Sarasota follows ASPE. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is correct. Calculate the present value of the asset retirement obligation (that is, its fair value) on the date of acquisition, based on an effective interest rate of 6%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) Present Value of the Asset Retirement Obligation 42717 SHOW SOLUTION Your answer is partially correct. Try again. Prepare the journal entries to record the acquisition of the depot and the accrual for the asset retirement obligation for the depot on July 2, 2020. Use (1) factor Table A.2, (2) a financial calculator, or (3) Excel function PV in your calculations. (Hint: For a review of present value concepts, see Chapter 3 of Volume 1.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit July 2, 2020 T Oil Tanker Depot 612,000T . X ............ Cash 612,000 IIIIIIIIIIIIIIIIIIII (To record purchase of depot) x . July 2, 2020 7 Oil Tanker Depot LLLLLLIIIIIIIIIIIIIIIIIIIIII 42717 42717 x L X ======== .... ======= = ====== = ====== = = - Asset Retirement Obligation 42717 DIRI (To record asset retirement obligation) Your answer is partially correct. Try again. Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020. Sarasota uses straight-line depreciation. The estimated residual value of the depot is zero. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amo Date Account Titles and Explanation Debit Credit I EEE.... Dec. 31, 2020 T Depreciation Expense 61200T Accumulated Depreciation - Oil Tanker Depot 61200 (To record depreciation expense) Dec. 31, 2020 T Accretion Expense Asset Retirement Obligation (To record accretion expense) Show how all relevant amounts will be reported on Sarasota Limited's financial statements at December 31, 2020. (Round answers to 0 decimal places, e.g. 5,250.) Sarasota Limited Balance Sheet (Partial) As at December 31, 2020 Current Assets x Add Long-Term Investments Sarasota Limited Income Statement (Partial) For the Year Ended December 31, 2020 Net Profit / (Loss) Prepare the schedule to calculate the balance in the Asset Retirement Obligation account for all years from 2020 to 2030, assuming there is no change in the estimated cost of dismantling the depot. (Round answers to 2 decimal places, e.g. 5,275.23.) Year Begining Carrying Amount Accretion Expense Ending Carrying Amount | June 30, 2021 2022 2023 2024 2025 2026 UUUUUUUUU 2027 2028 2029 2030 Exercise 13-16 Sarasota Limited purchased an oil tanker depot on July 2, 2020, at a cost of $612,000 and expects to operate the depot for 10 years. After the 10 years, the company is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $76,500 to do this at the end of the depot's useful life. Sarasota follows ASPE. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is correct. Calculate the present value of the asset retirement obligation (that is, its fair value) on the date of acquisition, based on an effective interest rate of 6%. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 5,275.) Present Value of the Asset Retirement Obligation 42717 SHOW SOLUTION Your answer is partially correct. Try again. Prepare the journal entries to record the acquisition of the depot and the accrual for the asset retirement obligation for the depot on July 2, 2020. Use (1) factor Table A.2, (2) a financial calculator, or (3) Excel function PV in your calculations. (Hint: For a review of present value concepts, see Chapter 3 of Volume 1.) (Round factor values to 5 decimal places, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit July 2, 2020 T Oil Tanker Depot 612,000T . X ............ Cash 612,000 IIIIIIIIIIIIIIIIIIII (To record purchase of depot) x . July 2, 2020 7 Oil Tanker Depot LLLLLLIIIIIIIIIIIIIIIIIIIIII 42717 42717 x L X ======== .... ======= = ====== = ====== = = - Asset Retirement Obligation 42717 DIRI (To record asset retirement obligation) Your answer is partially correct. Try again. Prepare any journal entries required for the depot and the asset retirement obligation at December 31, 2020. Sarasota uses straight-line depreciation. The estimated residual value of the depot is zero. (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amo Date Account Titles and Explanation Debit Credit I EEE.... Dec. 31, 2020 T Depreciation Expense 61200T Accumulated Depreciation - Oil Tanker Depot 61200 (To record depreciation expense) Dec. 31, 2020 T Accretion Expense Asset Retirement Obligation (To record accretion expense) Show how all relevant amounts will be reported on Sarasota Limited's financial statements at December 31, 2020. (Round answers to 0 decimal places, e.g. 5,250.) Sarasota Limited Balance Sheet (Partial) As at December 31, 2020 Current Assets x Add Long-Term Investments Sarasota Limited Income Statement (Partial) For the Year Ended December 31, 2020 Net Profit / (Loss) Prepare the schedule to calculate the balance in the Asset Retirement Obligation account for all years from 2020 to 2030, assuming there is no change in the estimated cost of dismantling the depot. (Round answers to 2 decimal places, e.g. 5,275.23.) Year Begining Carrying Amount Accretion Expense Ending Carrying Amount | June 30, 2021 2022 2023 2024 2025 2026 UUUUUUUUU 2027 2028 2029 2030

.

.