Please Solve the problem no E9- 12 of accounting

Required

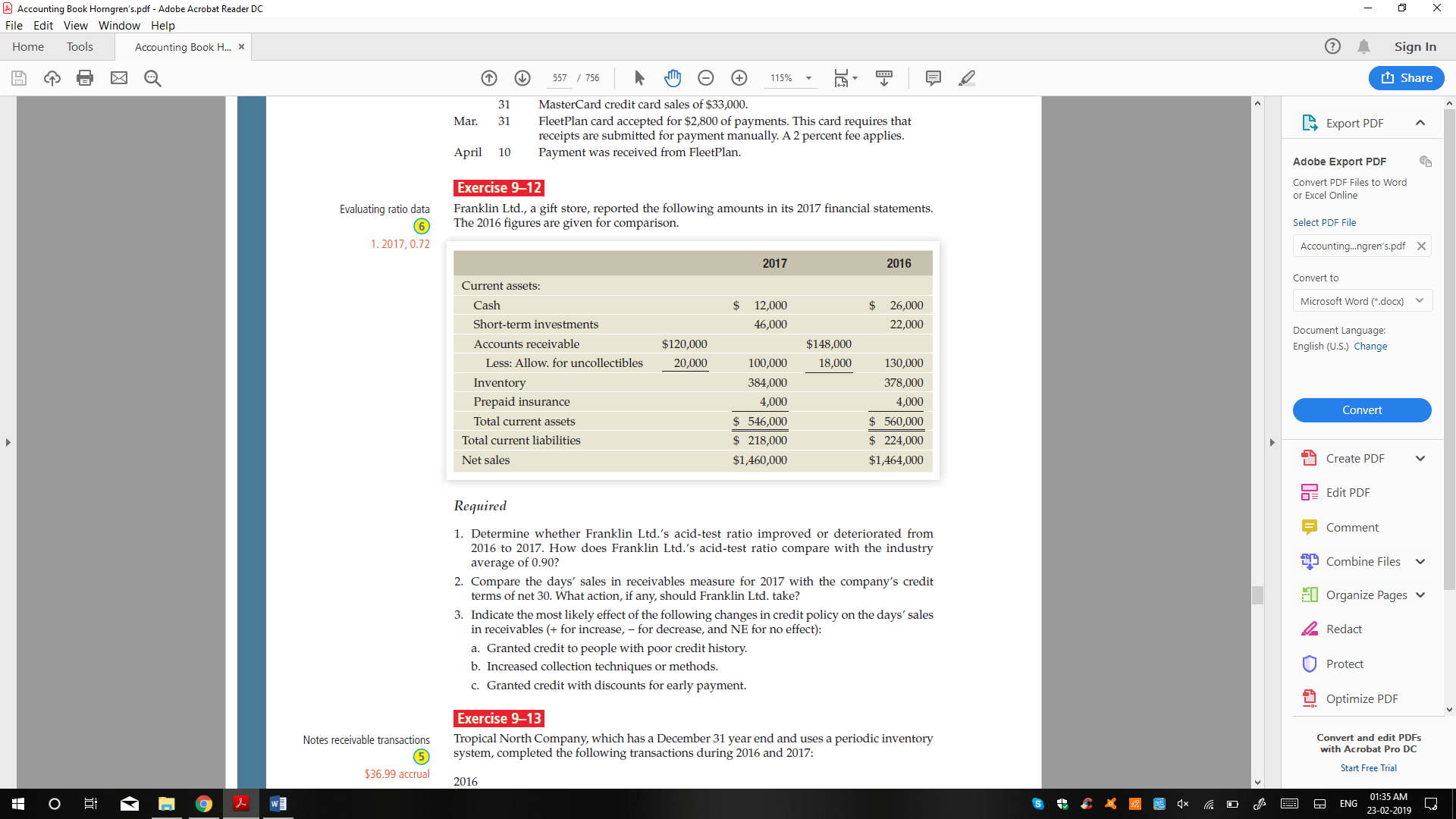

1. Determine whether Franklin Ltd.'s acid-test ratio improved or deteriorated from?

2016 to 2017. How does Franklin Ltd.'s acid-test ratio compare with the industry

average of 0.90?

2. Compare the days' sales in receivables measure for 2017 with the company's credit

terms of net 30. What action, if any, should Franklin Ltd. take?

3. Indicate the most likely effect of the following changes in credit policy on the days' sales

in receivables (+ for increase, ? for decrease, and NE for no effect):

a. Granted credit to people with poor credit history.

b. Increased collection techniques or methods.

c. Granted credit with discounts for early payment.

??

Accounting Book Horngren's.pdf - Adobe Acrobat Reader DC X File Edit View Window Help Home Tools Accounting Book H... x Sign In H Q E ZQ 557 / 756 115% T] Share 31 MasterCard credit card sales of $33,000. Mar. 31 FleetPlan card accepted for $2,800 of payments. This card requires that receipts are submitted for payment manually. A 2 percent fee applies. Export PDF April 10 Payment was received from FleetPlan. Adobe Export PDF Exercise 9-12 Convert PDF Files to Word or Excel Online Evaluating ratio data Franklin Ltd., a gift store, reported the following amounts in its 2017 financial statements. 6 The 2016 figures are given for comparison. Select PDF File 1. 2017, 0.72 Accounting...ngren's.pdf X 2017 2016 Current assets: Convert to Cash 12,000 $ 26,000 Microsoft Word (*.docx) v Short-term investments 46,000 22,000 Document Language: Accounts receivable $120,000 $148,000 English (U.S.) Change Less: Allow. for uncollectibles 20,000 100,000 18,000 130,000 Inventory 384,000 378,000 Prepaid insurance 4,000 4,000 Total current assets $ 546,000 560,000 Convert Total current liabilities $ 218,000 $ 224,000 Net sales $1,460,000 $1,464,000 Create PDF Required Edit PDF 1. Determine whether Franklin Ltd.'s acid-test ratio improved or deteriorated from =Comment 2016 to 2017. How does Franklin Ltd.'s acid-test ratio compare with the industry average of 0.90? Combine Files V 2. Compare the days' sales in receivables measure for 2017 with the company's credit terms of net 30. What action, if any, should Franklin Ltd. take? Organize Pages 3. Indicate the most likely effect of the following changes in credit policy on the days' sales in receivables (+ for increase, - for decrease, and NE for no effect): _ Redact a. Granted credit to people with poor credit history. b. Increased collection techniques or methods. Protect Granted credit with discounts for early payment. Optimize PDF Exercise 9-13 Notes receivable transactions Tropical North Company, which has a December 31 year end and uses a periodic inventory Convert and edit PDFs 5 system, completed the following transactions during 2016 and 2017: with Acrobat Pro DC $36.99 accrual Start Free Trial 2016 W s ENG 01:35 AM 23-02-2019