Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the problems Please solve the problems P11-6 The operating and investing sections of the cash flow statement of Wallace Computer Consolidated Statements of

Please solve the problems

Please solve the problems

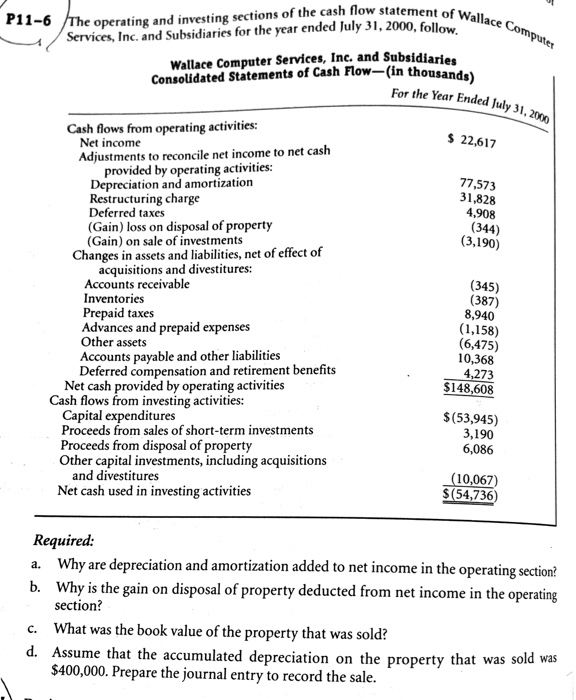

P11-6 The operating and investing sections of the cash flow statement of Wallace Computer Consolidated Statements of Cash Flow-(in thousands) Wallace Computer Services, Inc. and Subsidiaries For the Year Ended July 31, 2000 $ 22,617 77,573 31,828 4,908 (344) (3,190) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Restructuring charge Deferred taxes (Gain) loss on disposal of property (Gain) on sale of investments Changes in assets and liabilities, net of effect of acquisitions and divestitures: Accounts receivable Inventories Prepaid taxes Advances and prepaid expenses Other assets Accounts payable and other liabilities Deferred compensation and retirement benefits Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Proceeds from sales of short-term investments Proceeds from disposal of property Other capital investments, including acquisitions and divestitures Net cash used in investing activities (345) (387) 8,940 (1,158) (6,475) 10,368 4,273 $148,608 $(53,945) 3,190 6,086 (10,067) $(54,736 Required: a. Why are depreciation and amortization added to net income in the operating section? b. Why is the gain on disposal of property deducted from net income in the operating section? What was the book value of the property that was sold? d. Assume that the accumulated depreciation on the property that was sold was $400,000. Prepare the journal entry to record the sale. C Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started