Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve the question and compare it with the solution that I have I want to know how my teacher got these amounts UUPII Duubos

please solve the question and compare it with the solution that I have I want to know how my teacher got these amounts

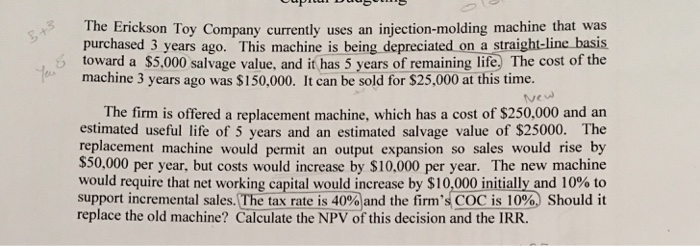

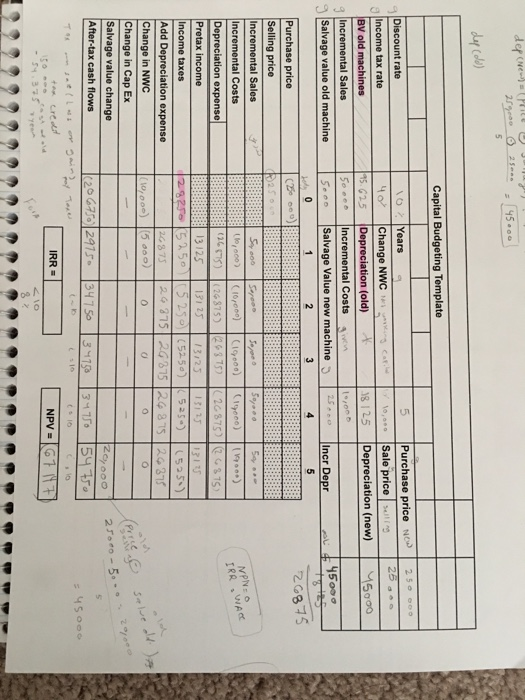

UUPII Duubos +3 The Erickson Toy Company currently uses an injection-molding machine that was purchased 3 years ago. This machine is being depreciated on a straight-line basis toward a $5,000 salvage value, and it has 5 years of remaining life. The cost of the machine 3 years ago was $150.000. It can be sold for $25,000 at this time. New The firm is offered a replacement machine, which has a cost of $250,000 and an estimated useful life of 5 years and an estimated salvage value of $25000. The replacement machine would permit an output expansion so sales would rise by $50,000 per year, but costs would increase by $10,000 per year. The new machine would require that net working capital would increase by $10,000 initially and 10% to support incremental sales. The tax rate is 40% and the firm's COC is 10%. Should it replace the old machine? Calculate the NPV of this decision and the IRR. departe 2892- = 45. dep colo) Capital Budgeting Template Discount rate Income tax rate BV old machines Incremental Sales Salvage value old machine 10 40 15.625 50 - 5. Years Change NWC wing core Depreciation (old) * Incremental Costs given Salvage Value new machine 5 10.0** 18125 Purchase price Now | 250- Sale price sting Depreciation (new) 45900 - Incr Depr o n 0 26875 (2 con NPO IRR WAR Purchase price Selling price Incremental Sales Incremental Costs Depreciation expense Pretax income Income taxes Add Depreciation expense Change in NWC Change in Cap Ex Salvage value change After-tax cash flows 50,000 50,000 Sopoo 50,000 5 . 10,000) (10000) (19000) (19000) ) 026595) 26875) 124875) 26875) 124 315) 13125 13125 13:25 1311 29255250 5250 5250 525-) (5251) 26875 26875 2G875 2689526375 10,000) 5.000 0 0 0 0 27 27*** - 5... 120 67502975 34 7 50 34756 3475 2001 5475 4500 IRR = NPV = 67 (17)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started