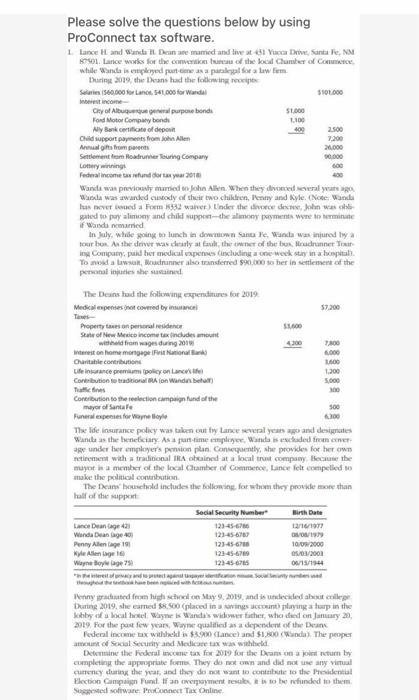

Please solve the questions below by using ProConnect tax software. I Lance Hand Wanda Dean ane mamed and live at Yar Drive, Santa Vie, NM 1. Lance works for the convention of the food Chlumber of Commerce while anda is employed part come as a park for a low fem. During 2019, the Deans had the following recipe Suri 560.000 for Lane, S4,000 for Wardal Gay of Albuquel purpose bonds $1.000 Ford Motor Company bonde 1100 Ny Bank certificate of deport 2.500 Child Support payments from John Allen Arom Settlement from Roadrunner Touring Company 90.000 Lottery wings 600 Federal income tax refund orta year 2018 Wanda was previowly married to John Allen. When they divered overalta Wanda was awarded custody of their two children, Penny and Kyle. (Note Wanda Is Devered a Form 32 walver) Inder the divorce de John was ated to pay almony and child support the alimony payments were to terminate if Wandamarried In July, while going to lunch in Santa Fe, Wanda was injured by a our bor. As the driver was deadly at fast, the ner of the box Headranner ing Company, paid ber medical expenses including a week stay in a bopital Tomoda, dunner also tensferred $1.000 het in sentiment of the personal injuries she said The Dead the following expenditures for 2019 Medical expenses not covered by insurance 57.200 Property own persona residence State of New Mexico income tax includes amount withheld fromage during 2014 7800 Interest on home mogager National Bank Charitable contribution 1.000 Life insurance premium policy on Lacoste 1.200 Contribution to traditional Aion Wandbehar 5.000 Tales Contribution to the election campaign fund of the mayor of Santale 500 Funeral expenses for Vineyle 000 The lidelsurance policy was taken out w lance several years ago and designates Wante as the beneficiary As pratime employee Wanda schaded from comer age under her employers person plan. Consequently, she provides for her own retirement with traditional IRA obtained at a local tront company the the mayor is a member of the local Chamber of Commerce Lancer felt compelled to make the political contration The Dean' bouschold includes the following for whom they provide more than half of the support Social Security Number Birth Date Lance Dean age 48 123-45-678 102 Wanda Dean age 40 123-45-678 1979 Penny Alen Lage 1 123-45-678 100/2000 Kyle Allenge 123-45-6700 05/02/2001 Wayne Biolage 7 01/13/14 There are Penny graduated from high school on Stay 9.2019 and is undeckled about college During 2019, she camed $8.500 placed in a playing a up in the Jobby of local hotel Wayne Wanda's widower father, who died on January 23, 2019. For the past few years, Wayner qualified as a dependent of the Dean Federal income tax with 5.200 ancel and $1.00 (Wed) The proper amount of Social Security and Medicare tax was withheld Defemmine the Federal income tax for 2019 for the Dean on a joint retum by completing the appropriate forms. They do not own and did not any virtual Currency during the year, and they do not want to come to the Presidential lection Campaign Fund. If an empayment is to be refunded to them Sisted software ProConnect Tax Online Please solve the questions below by using ProConnect tax software. I Lance Hand Wanda Dean ane mamed and live at Yar Drive, Santa Vie, NM 1. Lance works for the convention of the food Chlumber of Commerce while anda is employed part come as a park for a low fem. During 2019, the Deans had the following recipe Suri 560.000 for Lane, S4,000 for Wardal Gay of Albuquel purpose bonds $1.000 Ford Motor Company bonde 1100 Ny Bank certificate of deport 2.500 Child Support payments from John Allen Arom Settlement from Roadrunner Touring Company 90.000 Lottery wings 600 Federal income tax refund orta year 2018 Wanda was previowly married to John Allen. When they divered overalta Wanda was awarded custody of their two children, Penny and Kyle. (Note Wanda Is Devered a Form 32 walver) Inder the divorce de John was ated to pay almony and child support the alimony payments were to terminate if Wandamarried In July, while going to lunch in Santa Fe, Wanda was injured by a our bor. As the driver was deadly at fast, the ner of the box Headranner ing Company, paid ber medical expenses including a week stay in a bopital Tomoda, dunner also tensferred $1.000 het in sentiment of the personal injuries she said The Dead the following expenditures for 2019 Medical expenses not covered by insurance 57.200 Property own persona residence State of New Mexico income tax includes amount withheld fromage during 2014 7800 Interest on home mogager National Bank Charitable contribution 1.000 Life insurance premium policy on Lacoste 1.200 Contribution to traditional Aion Wandbehar 5.000 Tales Contribution to the election campaign fund of the mayor of Santale 500 Funeral expenses for Vineyle 000 The lidelsurance policy was taken out w lance several years ago and designates Wante as the beneficiary As pratime employee Wanda schaded from comer age under her employers person plan. Consequently, she provides for her own retirement with traditional IRA obtained at a local tront company the the mayor is a member of the local Chamber of Commerce Lancer felt compelled to make the political contration The Dean' bouschold includes the following for whom they provide more than half of the support Social Security Number Birth Date Lance Dean age 48 123-45-678 102 Wanda Dean age 40 123-45-678 1979 Penny Alen Lage 1 123-45-678 100/2000 Kyle Allenge 123-45-6700 05/02/2001 Wayne Biolage 7 01/13/14 There are Penny graduated from high school on Stay 9.2019 and is undeckled about college During 2019, she camed $8.500 placed in a playing a up in the Jobby of local hotel Wayne Wanda's widower father, who died on January 23, 2019. For the past few years, Wayner qualified as a dependent of the Dean Federal income tax with 5.200 ancel and $1.00 (Wed) The proper amount of Social Security and Medicare tax was withheld Defemmine the Federal income tax for 2019 for the Dean on a joint retum by completing the appropriate forms. They do not own and did not any virtual Currency during the year, and they do not want to come to the Presidential lection Campaign Fund. If an empayment is to be refunded to them Sisted software ProConnect Tax Online