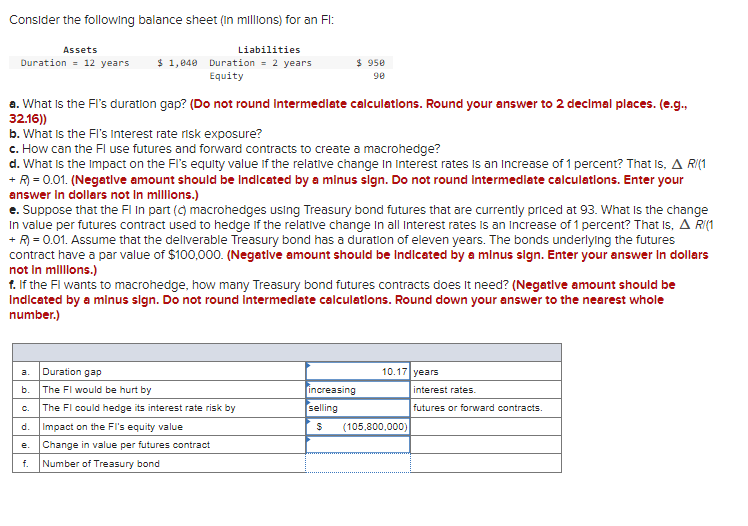

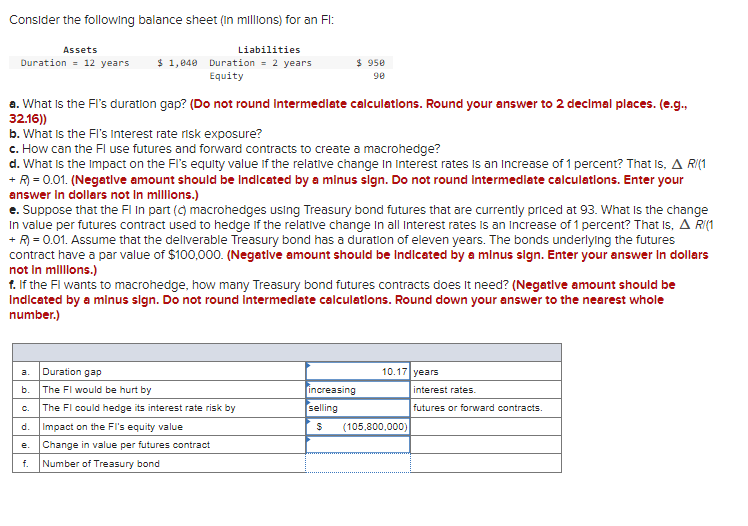

Please solve the remaining parts E&F

Consider the following balance sheet (in millions) for an Fl: $ 950 90 Assets Liabilities Duration - 12 years $ 1,640 Duration - 2 years Equity a. What is the Fi's duration gap? (Do not round Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) b. What is the Fl's Interest rate risk exposure? c. How can the Fl use futures and forward contracts to create a macrohedge? d. What is the impact on the Fi's equity value if the relative change in Interest rates is an Increase of 1 percent? That is, A RI(1 + R) = 0.01. (Negative amount should be Indicated by a minus sign. Do not round Intermediate calculations. Enter your answer in dollars not in millions.) e. Suppose that the Fl In part ( macrohedges using Treasury bond futures that are currently priced at 93. What is the change In value per futures contract used to hedge if the relative change in all Interest rates is an increase of 1 percent? That is, A R (1 + R) = 0.01. Assume that the deliverable Treasury bond has a duration of eleven years. The bonds underlying the futures contract have a par value of $100,000. (Negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions.) f. If the Fl wants to macrohedge, how many Treasury bond futures contracts does It need? (Negative amount should be Indicated by a minus sign. Do not round intermediate calculations. Round down your answer to the nearest whole number.) 10.17 years . b. a. Duration gap The Fl would be hurt by The FI could hedge its interest rate risk by Impact on the Fi's equity value e. Change in value per futures contract Number of Treasury bond increasing interest rates. selling futures or forward contracts. $ (105.800.000) d. . f. Consider the following balance sheet (in millions) for an Fl: $ 950 90 Assets Liabilities Duration - 12 years $ 1,640 Duration - 2 years Equity a. What is the Fi's duration gap? (Do not round Intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) b. What is the Fl's Interest rate risk exposure? c. How can the Fl use futures and forward contracts to create a macrohedge? d. What is the impact on the Fi's equity value if the relative change in Interest rates is an Increase of 1 percent? That is, A RI(1 + R) = 0.01. (Negative amount should be Indicated by a minus sign. Do not round Intermediate calculations. Enter your answer in dollars not in millions.) e. Suppose that the Fl In part ( macrohedges using Treasury bond futures that are currently priced at 93. What is the change In value per futures contract used to hedge if the relative change in all Interest rates is an increase of 1 percent? That is, A R (1 + R) = 0.01. Assume that the deliverable Treasury bond has a duration of eleven years. The bonds underlying the futures contract have a par value of $100,000. (Negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions.) f. If the Fl wants to macrohedge, how many Treasury bond futures contracts does It need? (Negative amount should be Indicated by a minus sign. Do not round intermediate calculations. Round down your answer to the nearest whole number.) 10.17 years . b. a. Duration gap The Fl would be hurt by The FI could hedge its interest rate risk by Impact on the Fi's equity value e. Change in value per futures contract Number of Treasury bond increasing interest rates. selling futures or forward contracts. $ (105.800.000) d. . f