Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve the required questions. ols. Information relative WCISES. PROBLEMS. AND 1. Based on the information and two negative aspects. Cost per Unit Total Cost

please solve the required questions.

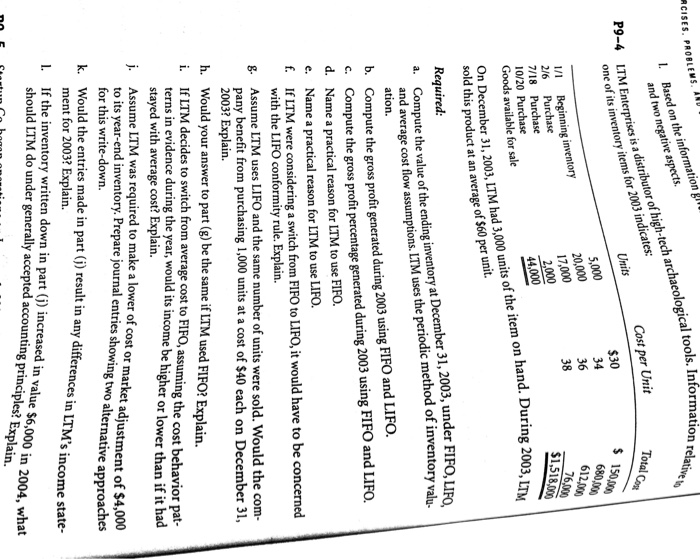

ols. Information relative WCISES. PROBLEMS. AND 1. Based on the information and two negative aspects. Cost per Unit Total Cost P9-4 LTM Enter Units LTM Enterprises is a distributor of high-tech archaeological tools. Info One of its inventory items for 2003 indicates: 5,000 20,000 17,000 $30 34 36 38 $ 1503688 680.99 612.8888 76.36 $1,518.500 1/1 Beginning inventory 2,000 2/6 Purchase 7/18 Purchase 10/20 Purchase Goods available for sale hand. During 2003, LTM 44,000 On December 31, 2003, LTM had 3,000 units of the item on hand. During 200 sold this product at an average of $60 per unit. Required: a. Compute the value of the ending inventory at December 31, 2005, under FIFO, LIFO and average cost flow assumptions. LTM uses the periodic method of inventory valu. ation. b. Compute the gross profit generated during 2003 using FIFO and LIFO. c Compute the gross profit percentage generated during 2003 using FIFO and LIFO. d. Name a practical reason for LTM to use FIFO. Name a practical reason for LTM to use LIFO. If LTM were considering a switch from FIFO to LIFO, it would have to be concerned with the LIFO conformity rule. Explain. & Assume LTM uses LIFO and the same number of units were sold. Would the com- pany benefit from purchasing 1,000 units at a cost of $40 each on December 31, 2003? Explain. i Would your answer to part (g) be the same if LTM used FIFO? Explain. If LTM decides to switch from average cost to FIFO, assuming the cost behavior pat- terns in evidence during the year, would its income be higher or lower than if it had stayed with average cost? Explain. Assume LTM was required to make a lower of cost or market to its year-end inventory. Prepare journal entries showing two alternative approaches ost or market adjustment of $4,000 for this write-down. Would the entries made in part (1) result in any differences in IT Herences in LTM's income state- ment for 2003? Explain. If the inventory written down in part (j) increased in value should LTM do under generally accepted accounting principles 1. ritten down in part ted accounting principles? Explain. increased in value $6,000 in 2004, what nn Santun Cohanan amonti Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started