Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the rest of this question Spellbound Corporation's income statement and balance sheet at the end of fiscal years 2020 and 2019 are presented

Please solve the rest of this question

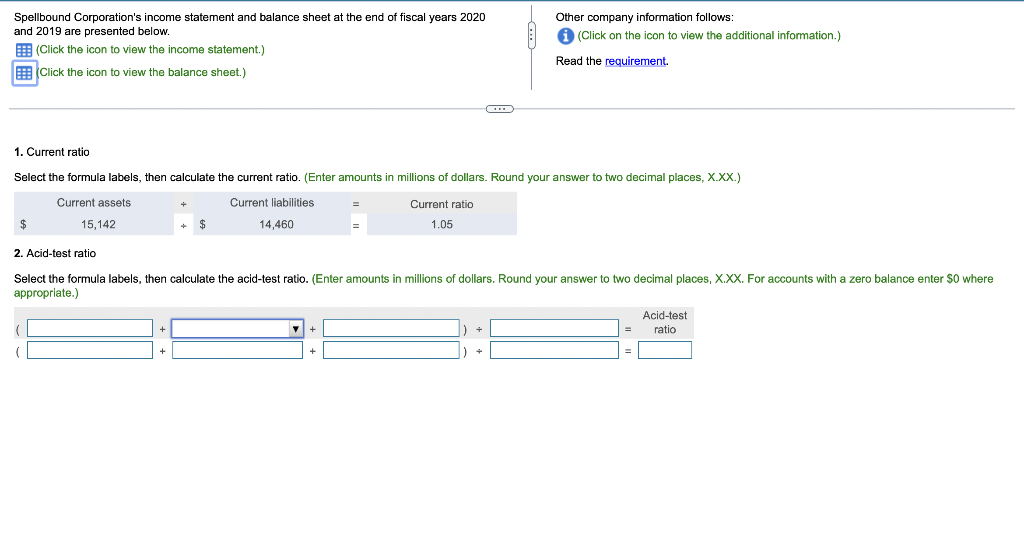

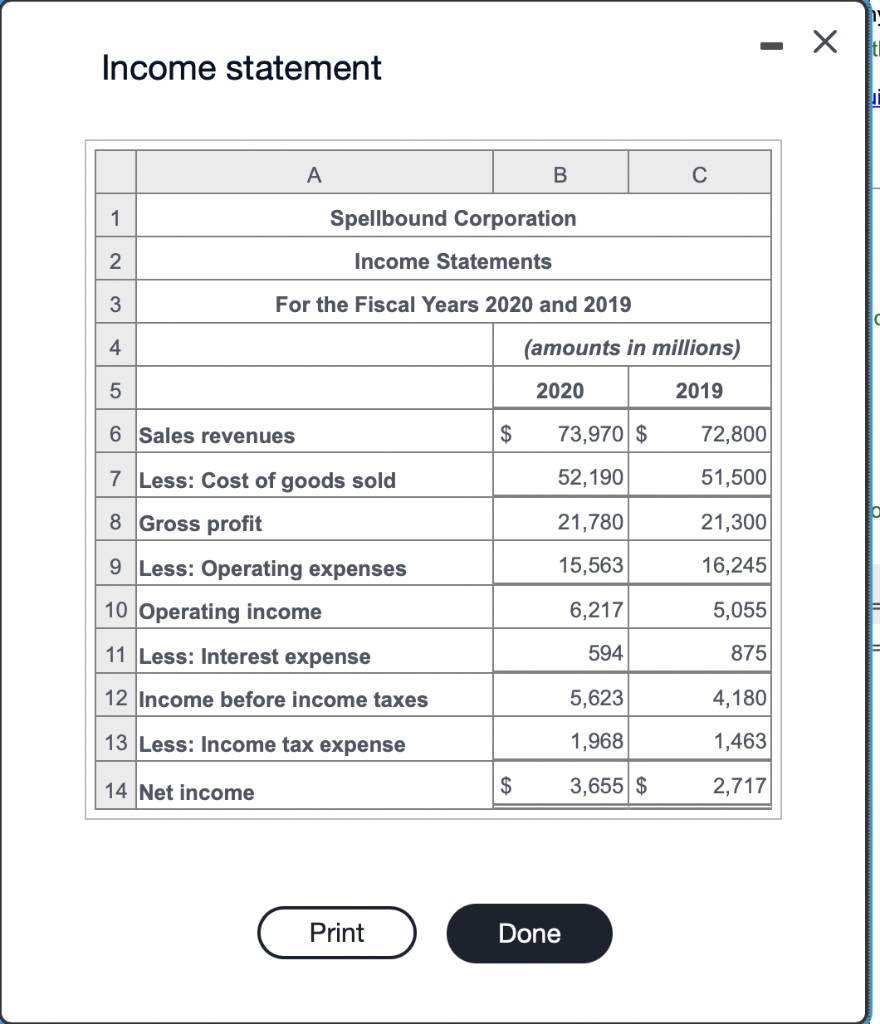

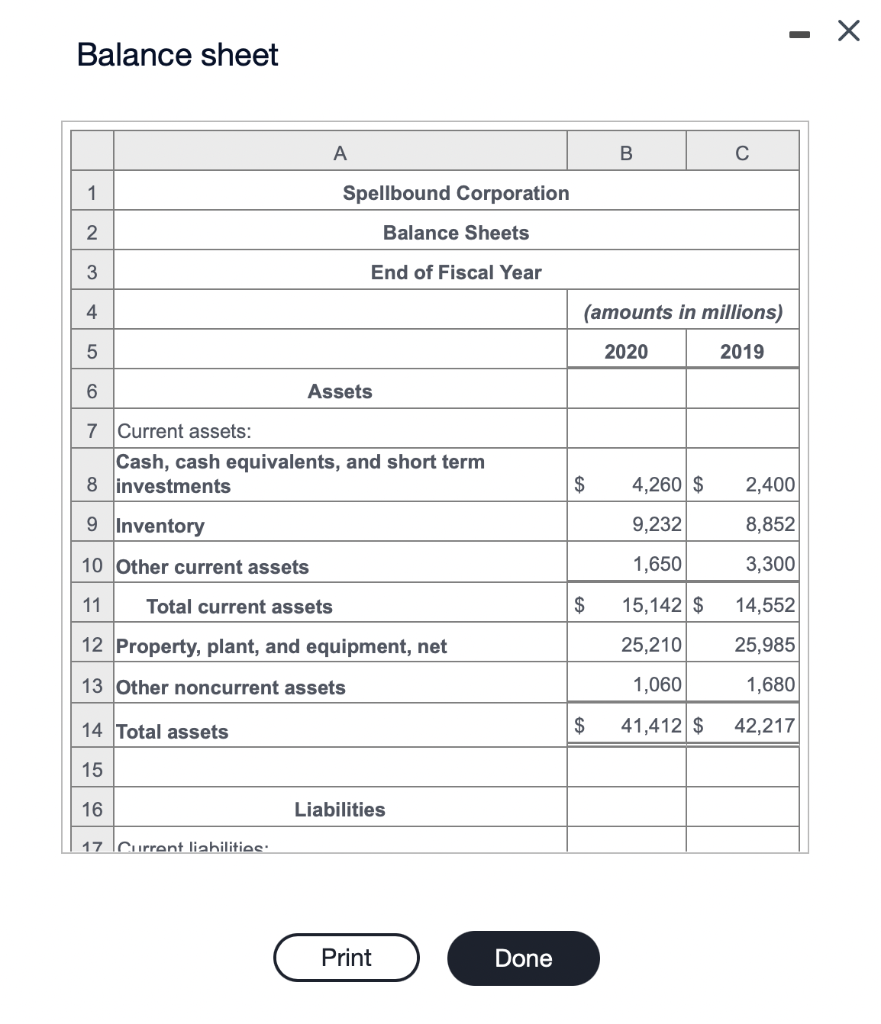

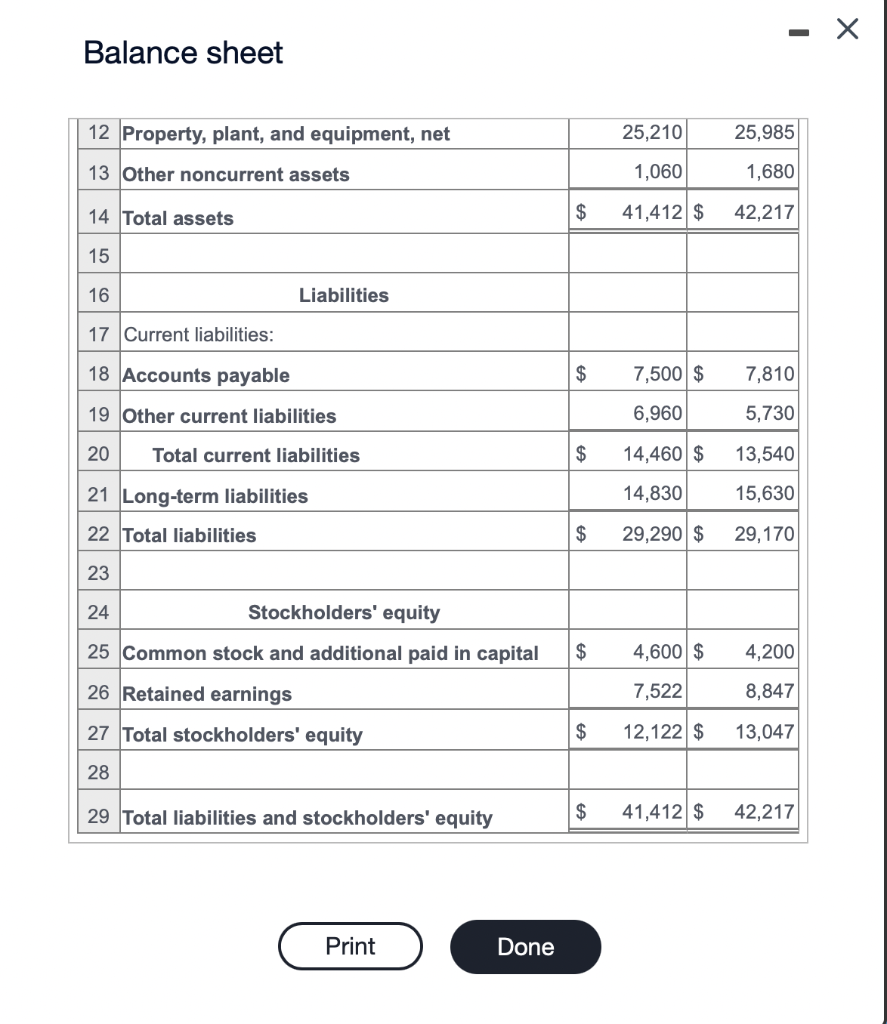

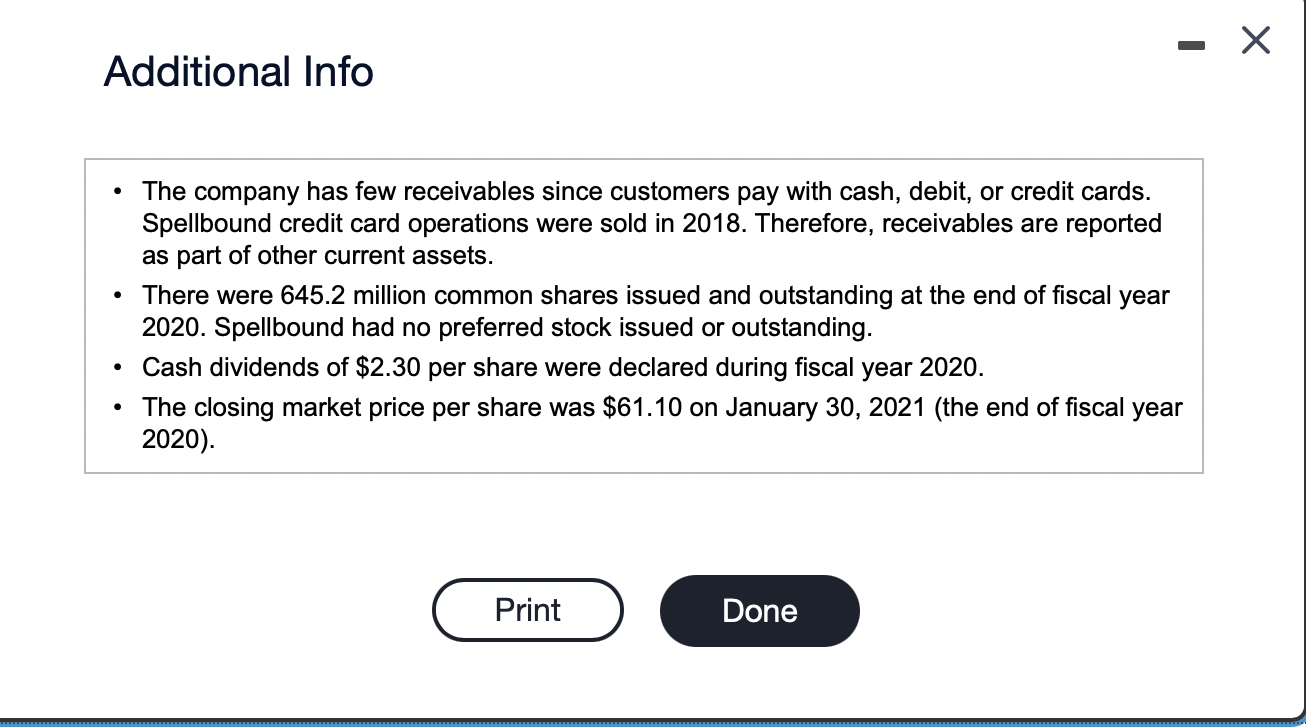

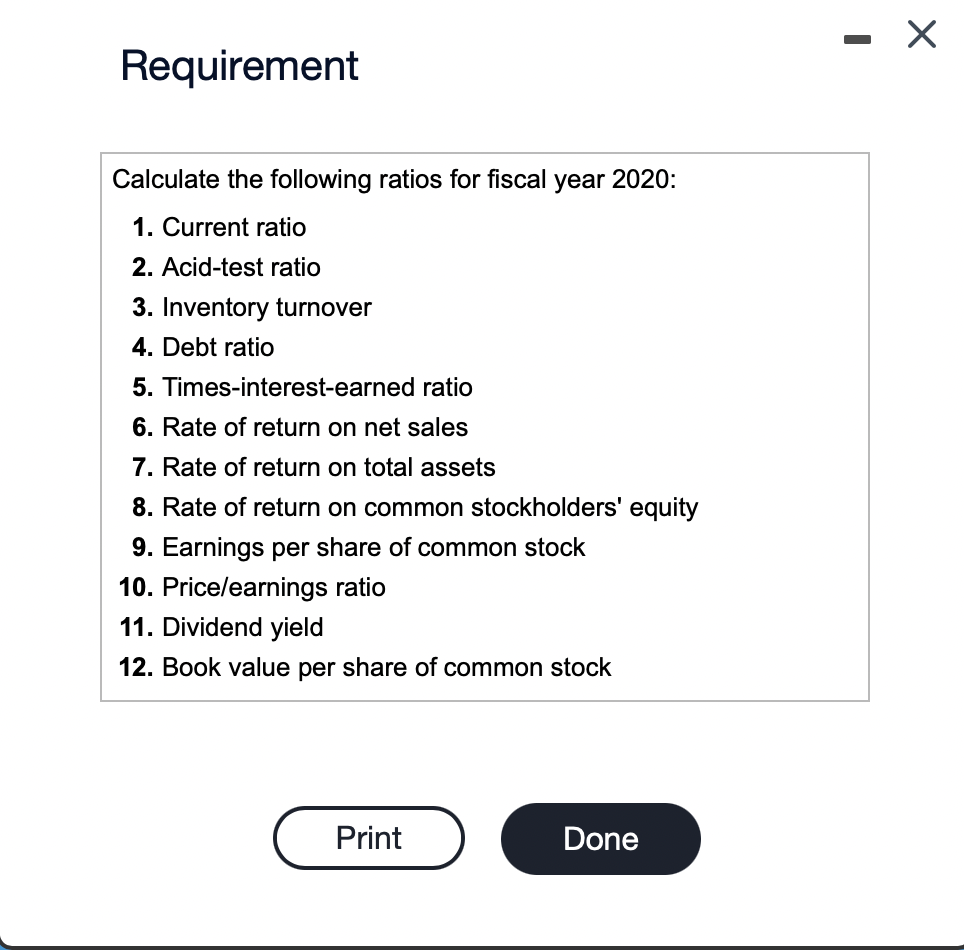

Spellbound Corporation's income statement and balance sheet at the end of fiscal years 2020 and 2019 are presented below. (Click the icon to view the income statement.) Click the icon to view the balance sheet.) 1. Current ratio Select the formula labels, then calculate the current ratio. (Enter amounts in millions of dollars. Round your answer to two decimal places, X.XX.) Income statement Balance sheet Balance sheet Additional Info - The company has few receivables since customers pay with cash, debit, or credit cards. Spellbound credit card operations were sold in 2018 . Therefore, receivables are reported as part of other current assets. - There were 645.2 million common shares issued and outstanding at the end of fiscal year 2020. Spellbound had no preferred stock issued or outstanding. - Cash dividends of \$2.30 per share were declared during fiscal year 2020. - The closing market price per share was $61.10 on January 30,2021 (the end of fiscal year 2020). Requirement Calculate the following ratios for fiscal year 2020: 1. Current ratio 2. Acid-test ratio 3. Inventory turnover 4. Debt ratio 5. Times-interest-earned ratio 6. Rate of return on net sales 7. Rate of return on total assets 8. Rate of return on common stockholders' equity 9. Earnings per share of common stock 10. Price/earnings ratio 11. Dividend yield 12. Book value per share of common stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started