Answered step by step

Verified Expert Solution

Question

1 Approved Answer

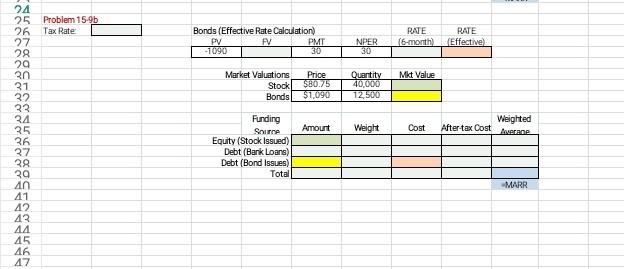

please solve the table below and show all formulas used. thanks Problem 15-9b Tax Rate Bonds (Effective Rate Calculation) PV FV PMT - 1090 30

please solve the table below and show all formulas used. thanks

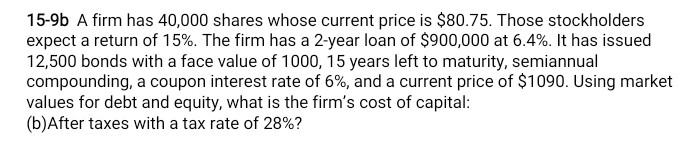

Problem 15-9b Tax Rate Bonds (Effective Rate Calculation) PV FV PMT - 1090 30 RATE (6-month NPER 30 RATE (Effective) 24 25 26 27 28 20 30 31 32 33 24 25 36 Mkt Value Market Valuations Price Stock $80.75 Bonds $1,090 Quantity 40,000 12,500 Amount Weight Cost After tax Cost Weighted Awerane 27 Funding Source Equity (Stock Issued) Debt (Bank Loans) Debt (Bond Issues) Total 28 29 an MARR 41 42 43 44 45 46 47 15-9b A firm has 40,000 shares whose current price is $80.75. Those stockholders expect a return of 15%. The firm has a 2-year loan of $900,000 at 6.4%. It has issued 12,500 bonds with a face value of 1000, 15 years left to maturity, semiannual compounding, a coupon interest rate of 6%, and a current price of $1090. Using market values for debt and equity, what is the firm's cost of capital: (b)After taxes with a tax rate of 28%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started