Question

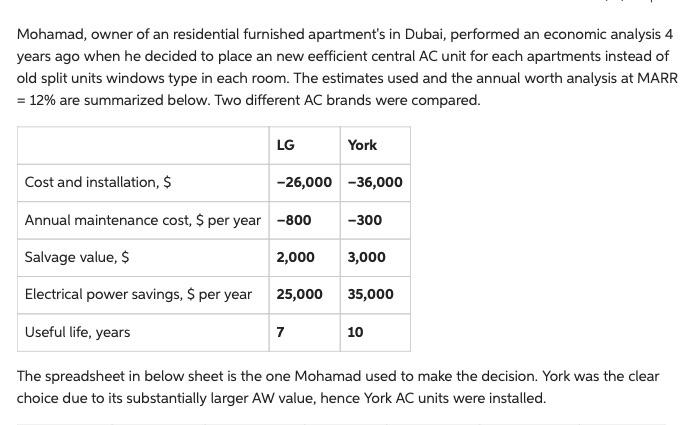

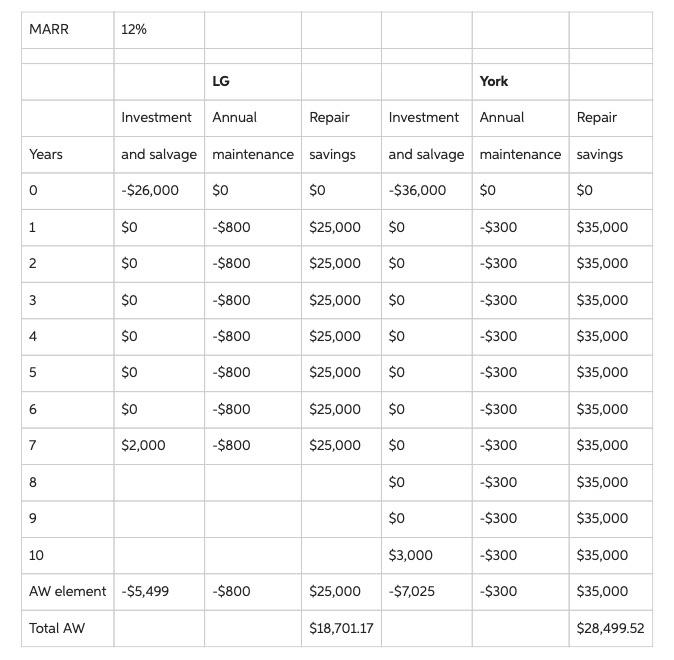

please solve the two questions with clear steps. I attached the correct answer but I want to know how to solve it. During a quick

During a quick review (year 4 of operation), it was obvious that the maintaince cost and repair savings have not followed (and will not follow) the estimates made 4 years ago. In fact, the maintenance contract cost is going from $300 this year (year 4) to $1200 per year next year and will then increase 9% per year for the next 6 years. Also, the electrical power savings for the last 4 years were $31,312 ( year 1) , $27,565 ( year 2), $30,493( year3), and $32,903( year4), as best as Mohamad can determine. He believes savings will decrease by $1,500 per year hereafter. Finally, these 4-year-old AC units are worth nothing on the market now, so the salvage is zero, not $3000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started