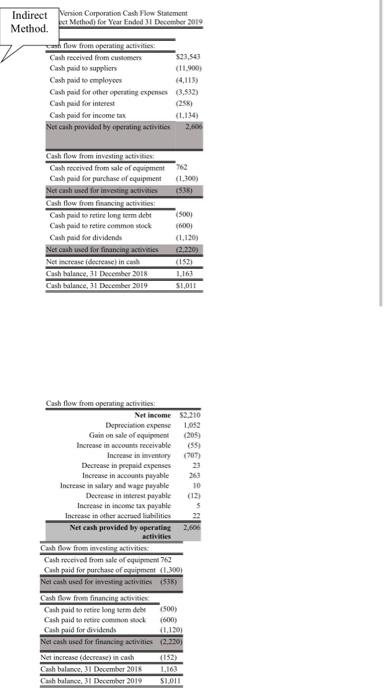

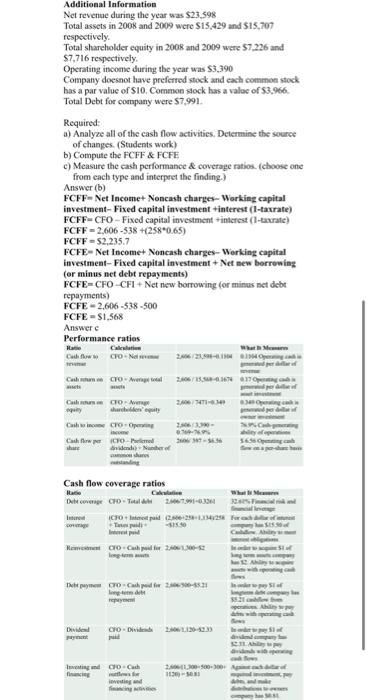

Cash flow from operating activities: Additional Information Net revenue during the year was $23,398 Total assets in 2008 and 2009 were $15,429 and $15,797 respectively. Total shareholder equity in 2008 and 2009 were 57,226 and $7,716 respectively. Opcrating incoane during the year was 53,390 Company docsnot have preferted stock and each common stock. has a par value of $10. Common dock has a valuc of 53.966 . Total Debt for company were $7,991. Required: a) Analyze all of the cash flow activities. Determine the source of changes. (Students work) b) Compute the FCFF \& FCFE c) Measure the cash performance \& coverage ratios. (choose one from cach type and interpect the finding.) Answer (b) FCFF = Net Income+ Noncash charges- Working capital investment- Fixed capital investment +interest (I-taxrate) FCFF=CFO - Fixed capital investment tinterest (1-tavatc) FCFF=2,606538+(2580.65) FCFF=$2,235.7 FCFE = Net Income+ Noncash charses- Werking capital investment- Fixed capital investment + Net new borrowing (or minus net debt repayments) FCFE=CFOCFI+ Net new borrowing (or minas act debe repayments) FCFE=2,606538500 FCFE=51.568 Answer c Cash flow from operating activities: Additional Information Net revenue during the year was $23,398 Total assets in 2008 and 2009 were $15,429 and $15,797 respectively. Total shareholder equity in 2008 and 2009 were 57,226 and $7,716 respectively. Opcrating incoane during the year was 53,390 Company docsnot have preferted stock and each common stock. has a par value of $10. Common dock has a valuc of 53.966 . Total Debt for company were $7,991. Required: a) Analyze all of the cash flow activities. Determine the source of changes. (Students work) b) Compute the FCFF \& FCFE c) Measure the cash performance \& coverage ratios. (choose one from cach type and interpect the finding.) Answer (b) FCFF = Net Income+ Noncash charges- Working capital investment- Fixed capital investment +interest (I-taxrate) FCFF=CFO - Fixed capital investment tinterest (1-tavatc) FCFF=2,606538+(2580.65) FCFF=$2,235.7 FCFE = Net Income+ Noncash charses- Werking capital investment- Fixed capital investment + Net new borrowing (or minus net debt repayments) FCFE=CFOCFI+ Net new borrowing (or minas act debe repayments) FCFE=2,606538500 FCFE=51.568 Answer c