Answered step by step

Verified Expert Solution

Question

1 Approved Answer

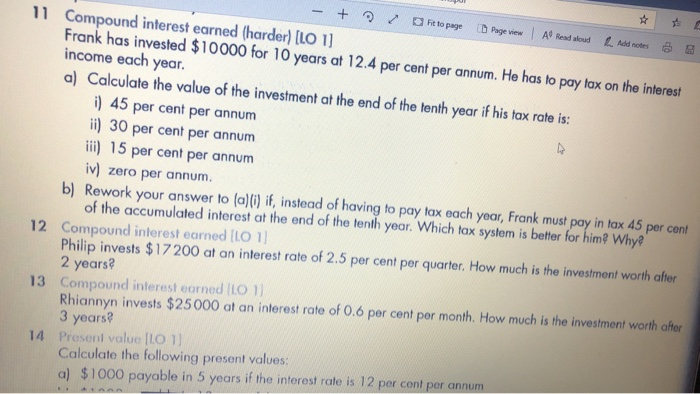

Please Solve these numericals. - + Fit to page Page View All Read aloud L Add notes Compound interest earned (harder) [LO 1] Frank has

Please Solve these numericals.

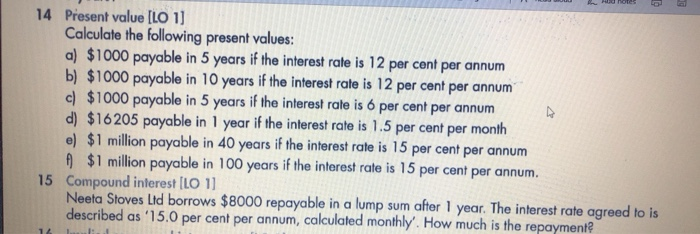

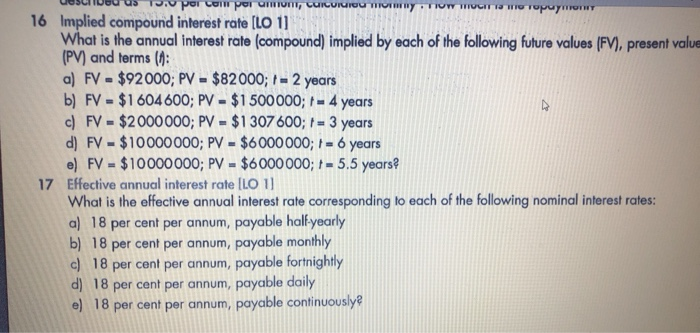

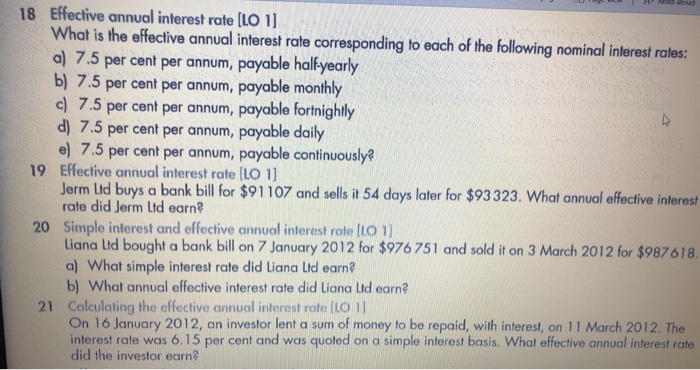

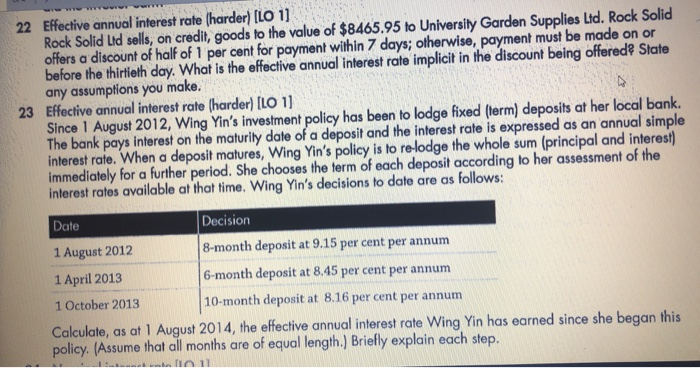

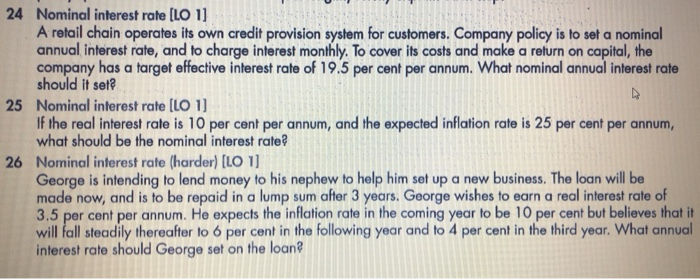

- + Fit to page Page View All Read aloud L Add notes Compound interest earned (harder) [LO 1] Frank has invested $10000 for 10 years at 12.4 per cent per annum. He has to pay tax on the interest income each year. a) Calculate the value of the investment at the end of the tenth year if his tax rate is: i) 45 per cent per annum ii) 30 per cent per annum iii) 15 per cent per annum iv) zero per annum b) Rework your answer to (a)(i) if, instead of having to pay tax each year, Frank must pay in tax 45 per cent of the accumulated interest at the end of the tenth year. Which tax system is better for him? Why?' 12 Compound interest earned [LO 1) Philip invests $17200 at an interest rate of 2.5 per cent per quarter. How much is the investment worth after 2 years? Compound interest earned ILO 11 Rhiannyn invests $25000 at an interest rate of 0.6 per cent per month. How much is the investment worth after 13 14 3 years Present value [LO 1] Calculate the following present values: a) $1000 payable in 5 years if the interest rate is 12 per cent per annum 14 Present value [LO 1] Calculate the following present values: a) $1000 payable in 5 years if the interest rate is 12 per cent per annum b) $1000 payable in 10 years if the interest rate is 12 per cent per annum cl $1000 payable in 5 years if the interest rate is 6 per cent per annum d) $16205 payable in 1 year if the interest rate is 1.5 per cent per month e) $1 million payable in 40 years if the interest rate is 15 per cent per annum A $1 million payable in 100 years if the interest rate is 15 per cent per annum. 15 Compound interest (LO 11 Neeta Sloves Lid borrows $8000 repayable in a lump sum after 1 year. The interest rate agreed to is described as '15.0 per cent per annum, calculated monthly'. How much is the repayment? uestive us Tiv per com per unum, CUICUIUIDU Turn IW MOIT a more 16 Implied compound interest rate [LO 1) What is the annual interest rate (compound) implied by each of the following future values (FV), present value (PV) and terms (A: a) FV = $92000; PV - $82000; 1 - 2 years b) FV = $1604600; PV = $1500000; * = 4 years c) FV - $2000000; PV - $1307 600; 1 = 3 years d) FV - $10000000; PV - $6000000; 7 = 6 years e) FV - $10000000; PV - $6000000; + - 5.5 years 17 Effective annual interest rate [LO 11 What is the effective annual interest rate corresponding to each of the following nominal interest rates: a) 18 per cent per annum, payable half-yearly b) 18 per cent per annum, payable monthly c) 18 per cent per annum, payable fortnightly d) 18 per cent per annum, payable daily e) 18 per cent per annum, payable continuously H oud 18 Effective annual interest rate (LO 1] What is the effective annual interest rate corresponding to each of the following nominal interest rates: a) 7.5 per cent per annum, payable half-yearly b) 7.5 per cent per annum, payable monthly c) 7.5 per cent per annum, payable fortnightly d) 7.5 per cent per annum, payable daily e) 7.5 per cent per annum, payable continuously? 19 Effective annual interest rate [LO 1] Jerm Lid buys a bank bill for $91 107 and sells it 54 days later for $93323. What annual effective interest rate did Jerm Ltd earn 20 Simple interest and effective annual interest rate (lo 1] Liana Lid bought a bank bill on 7 January 2012 for $976 751 and sold it on 3 March 2012 for $987618. a) What simple interest rate did Liana Lid earn b) What annual effective interest rate did Liana Lid earn 21 Calculating the effective annual interest rate (LO 11 On 16 January 2012, an investor lent a sum of money to be repaid, with interest, on 11 March 2012. The interest rate was 6.15 per cent and was quoted on a simple interest basis. What effective annual interest rate did the investor earn? 22 Effective annual interest rate (harder) (LO 1] Rock Solid Lid sells, on credit, goods to the value of $8465.95 to University Garden Supplies Ltd. Rock Solid offers a discount of half of 1 per cent for payment within 7 days; otherwise, payment must be made on or before the thirtieth day. What is the effective annual interest rate implicit in the discount being offerede State any assumptions you make. Effective annual interest rate (harder) [LO 1] Since 1 August 2012, Wing Yin's investment policy has been to lodge fixed (term) deposits at her local bank. The bank pays interest on the maturity date of a deposit and the interest rate is expressed as an annual simple interest rate. When a deposit matures, Wing Yin's policy is to re-lodge the whole sum (principal and interest) immediately for a further period. She chooses the term of each deposit according to her assessment of the Interest rates available at that time. Wing Yin's decisions to date are as follows: Date Decision 1 August 2012 8-month deposit at 9.15 per cent per annum 1 April 2013 6-month deposit at 8.45 per cent per annum 1 October 2013 10-month deposit at 8.16 per cent per annum Calculate, as at 1 August 2014, the effective annual interest rate Wing Yin has earned since she began this policy. (Assume that all months are of equal length.) Briefly explain each step. 24 Nominal interest rate (LO 1] A retail chain operates its own credit provision system for customers. Company policy is to set a nominal annual interest rate, and to charge interest monthly. To cover its costs and make a return on capital, the company has a target effective interest rate of 19.5 per cent per annum. What nominal annual interest rate should it seta 25 Nominal interest rate [LO 1] If the real interest rate is 10 per cent per annum, and the expected inflation rate is 25 per cent per annum, what should be the nominal interest rate? 26 Nominal interest rate (harder) (LO 1] George is intending to lend money to his nephew to help him set up a new business. The loan will be made now, and is to be repaid in a lump sum after 3 years. George wishes to earn a real interest rate of 3.5 per cent per annum. He expects the inflation rate in the coming year to be 10 per cent but believes that it will fall steadily thereafter lo 6 per cent in the following year and to 4 per cent in the third year. What annual interest rate should George set on the loan? 41 Calculating principal and interest repayments [LO 4] Luke borrows $800000 from a bank to set up a medical practice. He agrees to pay a fixed interest rate of 10.2 per cent per annum (calculated monthly) and to repay by equal monthly instalments over 10 years. Calculate the monthly repayment. By how much does Luke's first repayment reduce the principale if the loan is paid off as planned, by how much will the last repayment reduce the principale Calculating principal outstanding (LO 4] After making 21 monthly repayments, Luke (see Problem 41) inherits a large sum of money and decides to repay the remaining) loan. When the twenly second repayment is due he asks for the payout figure. How much should it be Calculating the loan term (LO 4] John decides that he desperately needs a new Italian suit priced at $1999. He borrows the money and agrees to pay $71.07 each month at an interest rate of 16.8 per cent per annum, payable monthly. For how long will he be making repayments? 44 Annual rate of return (LO 4] What is the approximate annual rate of return on an investment with an initial cash outlay of $10000 and net cash inflows of $2770 per year for 5 years? 45 Nominal interest rate and effective interest rate (LO 4) Warren Cameron buys a boat for $30000, paying $5000 deposit. The remainder is borrowed from the Goodfriend Loan Co, to be repaid by 15 monthly payments of $2027.50 each. What is the monthly interest rate being chargede What is the nominal annual interest rate? What is the effective annual interest rate? Muri 47 Calculating the loan term (LO 4] Anne Hopewell has just borrowed $70000 to be repaid by monthly repayments over 20 years at an interest rate of 18 per cent per annum. Based on this information, the monthly repayment is approximately $1080 but Anne intends to make higher monthly repayments. She asks you how long it will take to repay the loan if the amount she pays per month is: a) $1100 b) $1200 d) $1500. Annuities (LO 4] Layla borrows $50000, repayable in monthly instalments over 10 years. The nominal interest rate is 12 per cent per annum. What is the monthly repaymente After 3 years have passed, the lender increases the interest rate to 13.5 per cent per annum and Layla is given the choice of either increasing the monthly repayment or extending the term of the loan. What would be the new monthly repayment? What would be the new loan term Annuities (LO 4) Exactly a year ago, Stephen and Lan Kuan borrowed $150000 from a bank, to be repaid in equal monthly instalments over 25 years at an interest rate of 7.8 per cent per annum. Today, the bank told them that it was introducing a monthly fee of $10 but they could continue to repay the loan by making their current monthly payments. However, Stephen and Lan Kuan are worried because if they do this, the loan will take longer to repay. They have asked you to calculate how much longer it will take to repay the loan. 48 1 CUIU TIV mullunyer i WIII IURU IU Tepuy me luun. 49 Effective annual interest rate, repayments and loan terms [LO 4] Don and Jenny wish to borrow $180000, to be repaid over a period of 20 years by monthly instalments. The interest rate (nominal) is 7.8 per cent per annum. The first payment is due at the end of the first month. a) Calculate the effective annual interest rate. b) Calculate the amount of the monthly repayment if the same amount is to be repaid every month for the period of the loan. c) Suppose, instead, that the lender agrees that Don and Jenny will repay $1100 per month for the first 12 months, then $ 1250 per month for the 12 months after that, then $X per month thereafter. Assuming that the term is to stay at 20 years, how much is $X? d) Alternatively, suppose that Don and Jenny decide to repay $2500 per month from the time the money is borrowed until it is repaid. How long would it take to repay the loan? What would be the amount of the final payment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

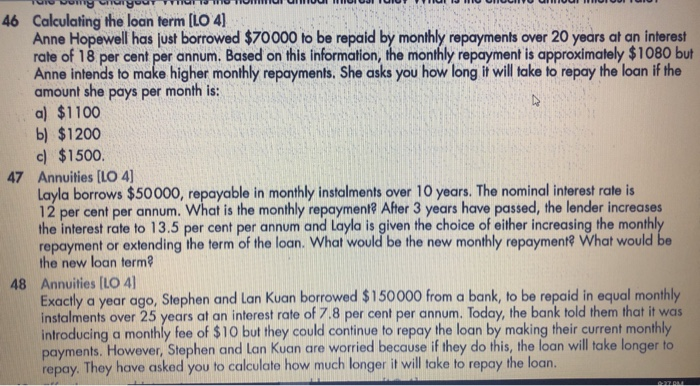

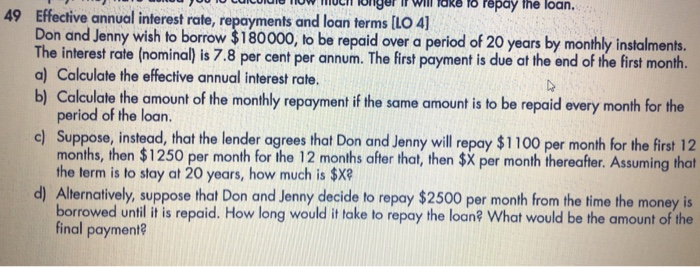

Get Started