Please solve these three questions. It's for my assignment.

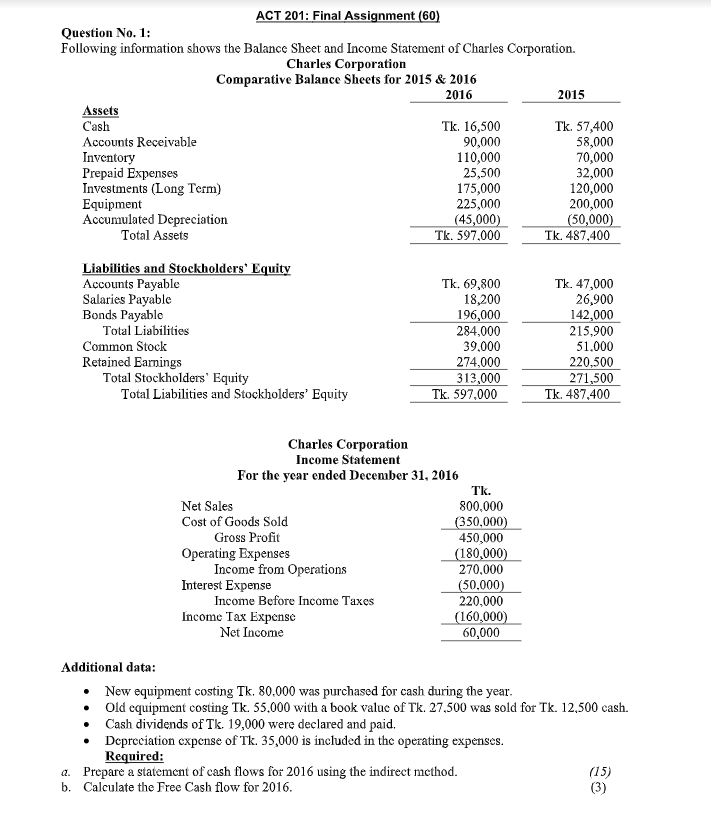

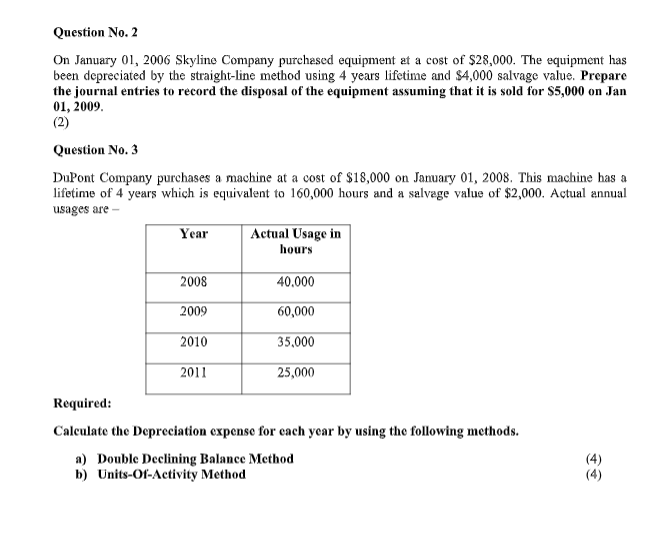

ACT 201: Final Assignment (60) Question No. 1: Following information shows the Balance Sheet and Income Statement of Charles Corporation. Charles Corporation Comparative Balance Sheets for 2015 & 2016 2016 2015 Assets Cash Th. 16,500 Tk. 57,400 Accounts Receivable 90.000 58,000 Inventory 110,000 70,000 Prepaid Expenses 25,500 32,000 Investments (Long Term) 175,000 120,000 Equipment 225,000 200,000 Accumulated Depreciation (45,000) (50,000) Total Assets TK. 597.000 TK. 487.400 Liabilities and Stockholders' Equity Accounts Payable Th. 69,800 Tk. 47,000 Salaries Payable 18,200 26,900 Bonds Payable 196,000 142,000 Total Liabilities 284,000 215,900 Common Stock 39.000 51.000 Retained Earnings 274,000 220.500 Total Stockholders' Equity 313,000 271,500 Total Liabilities and Stockholders' Equity Tk. 597,000 Tk. 487,400 Charles Corporation Income Statement For the year ended December 31, 2016 Th. Net Sales 800,000 Cost of Goods Sold (350,000) Gross Profit 450,000 Operating Expenses (180,000) Income from Operations 270,000 Interest Expense (50,000) Income Before Income Taxes 220,000 Income Tax Expense (160,000) Net Income 60,000 Additional data: . New equipment costing Tk, 80.000 was purchased for cash during the year. Old equipment costing TK. 55.000 with a book value of TK. 27.500 was sold for Tk. 12,500 cash. . . Cash dividends of Tk. 19,000 were declared and paid. Depreciation expense of TK. 35,000 is included in the operating expenses. Required: Prepare a statement of cash flows for 2016 using the indirect method. (15) b. Calculate the Free Cash flow for 2016. (3)Question No. 2 On January 01, 2006 Skyline Company purchased equipment at a cost of $28,000. The equipment has been depreciated by the straight-line method using 4 years lifetime and $4,000 salvage value. Prepare the journal entries to record the disposal of the equipment assuming that it is sold for $5,000 on Jan 01, 2009. (2) Question No. 3 DuPont Company purchases a machine at a cost of $18,000 on January 01, 2008. This machine has a lifetime of 4 years which is equivalent to 160,000 hours and a salvage value of $2,000. Actual annual usages are - Year Actual Usage in hours 2008 40.000 2009 60,000 2010 35,000 2011 25,000 Required: Calculate the Depreciation expense for each year by using the following methods. a) Double Declining Balance Method (4) b) Units-Of-Activity Method (4)