Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve this ASAP Portfolio 2 Mondi Plc makes chassis for caravans. A new chassis has been developed which requires a machine to be bought,

please solve this ASAP

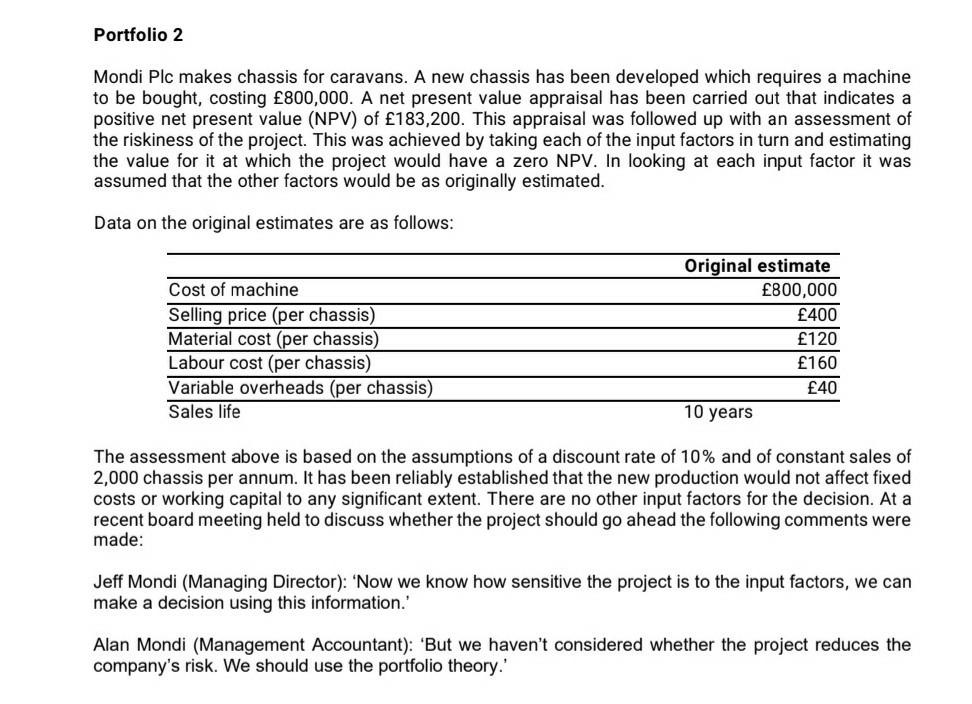

Portfolio 2 Mondi Plc makes chassis for caravans. A new chassis has been developed which requires a machine to be bought, costing 800,000. A net present value appraisal has been carried out that indicates a positive net present value (NPV) of 183,200. This appraisal was followed up with an assessment of the riskiness of the project. This was achieved by taking each of the input factors in turn and estimating the value for it at which the project would have a zero NPV. In looking at each input factor it was assumed that the other factors would be as originally estimated. Data on the original estimates are as follows: Cost of machine Selling price (per chassis) Material cost (per chassis) Labour cost (per chassis) Variable overheads (per chassis) Sales life Original estimate 800,000 400 120 160 40 10 years The assessment above is based on the assumptions of a discount rate of 10% and of constant sales of 2,000 chassis per annum. It has been reliably established that the new production would not affect fixed costs or working capital to any significant extent. There are no other input factors for the decision. At a recent board meeting held to discuss whether the project should go ahead the following comments were made: Jeff Mondi (Managing Director): 'Now we know how sensitive the project is to the input factors, we can make a decision using this information.' Alan Mondi (Management Accountant): 'But we haven't considered whether the project reduces the company's risk. We should use the portfolio theory.' lain Sooraj (Financial Director): What about our shareholders' risk? We should use CAPM to make the decision You are required to: To generate a zero NPV, estimate separately and in turn the values for the discount rate, the annual sales volume and the cost of the machine. Discuss how sensitive the project is to each of these input factors. Ignore taxation and inflation (15 marks) Compare and contrast sensitivity analysis, portfolio theory and the capital asset pricing model as techniques for dealing with risk in project appraisal. (18 marks) (Total 33 marks) Portfolio 2 Mondi Plc makes chassis for caravans. A new chassis has been developed which requires a machine to be bought, costing 800,000. A net present value appraisal has been carried out that indicates a positive net present value (NPV) of 183,200. This appraisal was followed up with an assessment of the riskiness of the project. This was achieved by taking each of the input factors in turn and estimating the value for it at which the project would have a zero NPV. In looking at each input factor it was assumed that the other factors would be as originally estimated. Data on the original estimates are as follows: Cost of machine Selling price (per chassis) Material cost (per chassis) Labour cost (per chassis) Variable overheads (per chassis) Sales life Original estimate 800,000 400 120 160 40 10 years The assessment above is based on the assumptions of a discount rate of 10% and of constant sales of 2,000 chassis per annum. It has been reliably established that the new production would not affect fixed costs or working capital to any significant extent. There are no other input factors for the decision. At a recent board meeting held to discuss whether the project should go ahead the following comments were made: Jeff Mondi (Managing Director): 'Now we know how sensitive the project is to the input factors, we can make a decision using this information.' Alan Mondi (Management Accountant): 'But we haven't considered whether the project reduces the company's risk. We should use the portfolio theory.' lain Sooraj (Financial Director): What about our shareholders' risk? We should use CAPM to make the decision You are required to: To generate a zero NPV, estimate separately and in turn the values for the discount rate, the annual sales volume and the cost of the machine. Discuss how sensitive the project is to each of these input factors. Ignore taxation and inflation (15 marks) Compare and contrast sensitivity analysis, portfolio theory and the capital asset pricing model as techniques for dealing with risk in project appraisal. (18 marks) (Total 33 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started