Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this carefully and explain your answer Consider the following simple model of the value of a financial asset in which a, b and

Please solve this carefully and explain your answer

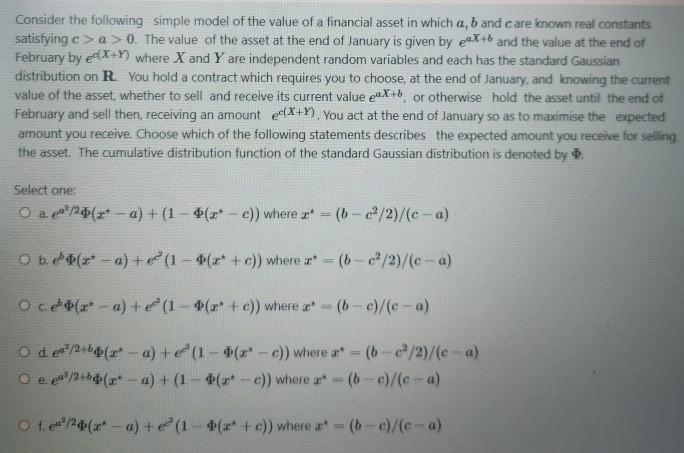

Consider the following simple model of the value of a financial asset in which a, b and care known real constants satisfying c> a > 0. The value of the asset at the end of January is given by eX+6 and the value at the end of February by eX+Y) where X and Y are independent random variables and each has the standard Gaussian distribution on R. You hold a contract which requires you to choose at the end of January, and knowing the current value of the asset, whether to sell and receive its current value euX+b, or otherwise hold the asset until the end of February and sell then, receiving an amount (X+Y). You act at the end of January so as to maximise the expected amount you receive. Choose which of the following statements describes the expected amount you receive for selling the asset. The cumulative distribution function of the standard Gaussian distribution is denoted by Select one a?/24 (** -a) + (1 - 4(x*- c)) where 3* (6 - 12/2)/(c-a) O b.er* - a) + (1 -"(** + c)) where r* = (6-22/2)/(e-a) Oce(x-a) + (1 - 4(x* +e)) where r* (6 - e)/(e -a) O d. ed?/2+b*(** -a) + (1 - ** -c)) where ar* = (be/2)/(e-a) O e.es/2+60(2* - a) + (1 - 4(* - c)) where r = (b - e)/le-a) Ofe/(r* - a) + (1 - (x + c)) where x* = (b -e)/(e-a) Consider the following simple model of the value of a financial asset in which a, b and care known real constants satisfying c> a > 0. The value of the asset at the end of January is given by eX+6 and the value at the end of February by eX+Y) where X and Y are independent random variables and each has the standard Gaussian distribution on R. You hold a contract which requires you to choose at the end of January, and knowing the current value of the asset, whether to sell and receive its current value euX+b, or otherwise hold the asset until the end of February and sell then, receiving an amount (X+Y). You act at the end of January so as to maximise the expected amount you receive. Choose which of the following statements describes the expected amount you receive for selling the asset. The cumulative distribution function of the standard Gaussian distribution is denoted by Select one a?/24 (** -a) + (1 - 4(x*- c)) where 3* (6 - 12/2)/(c-a) O b.er* - a) + (1 -"(** + c)) where r* = (6-22/2)/(e-a) Oce(x-a) + (1 - 4(x* +e)) where r* (6 - e)/(e -a) O d. ed?/2+b*(** -a) + (1 - ** -c)) where ar* = (be/2)/(e-a) O e.es/2+60(2* - a) + (1 - 4(* - c)) where r = (b - e)/le-a) Ofe/(r* - a) + (1 - (x + c)) where x* = (b -e)/(e-a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started