Answered step by step

Verified Expert Solution

Question

1 Approved Answer

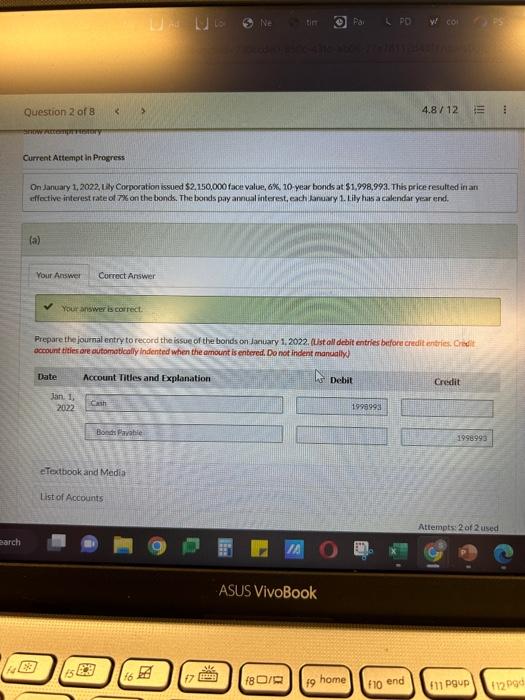

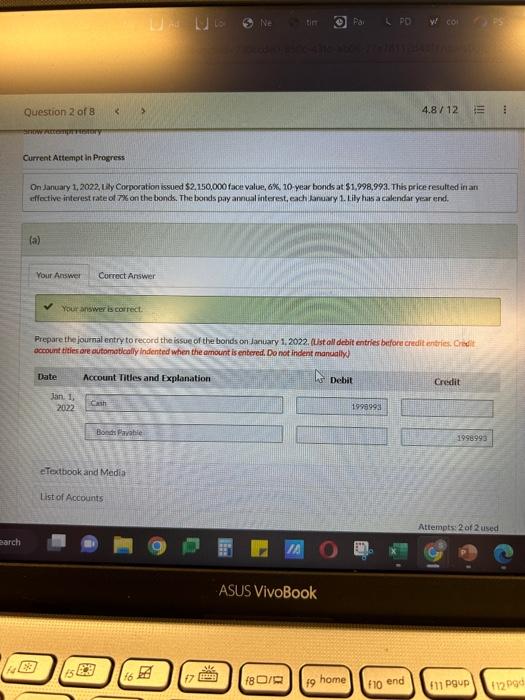

please solve this On january 1,2022, 1. y Corporation issued $2,150,000 face value, 6%6,10 year bends at $1,998,993. This price fesulted in an effoctive interest

please solve this

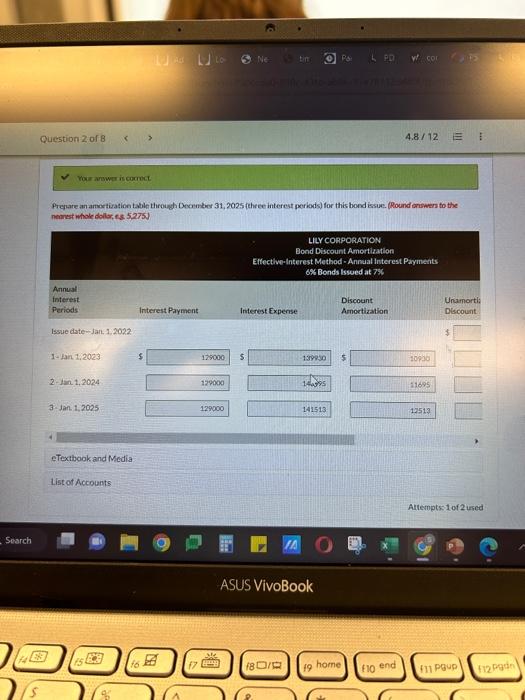

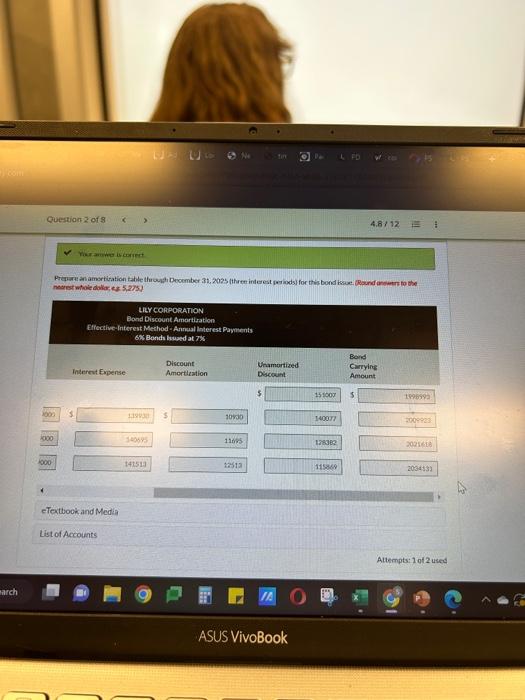

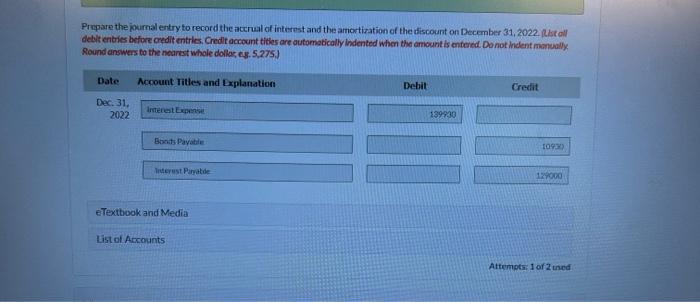

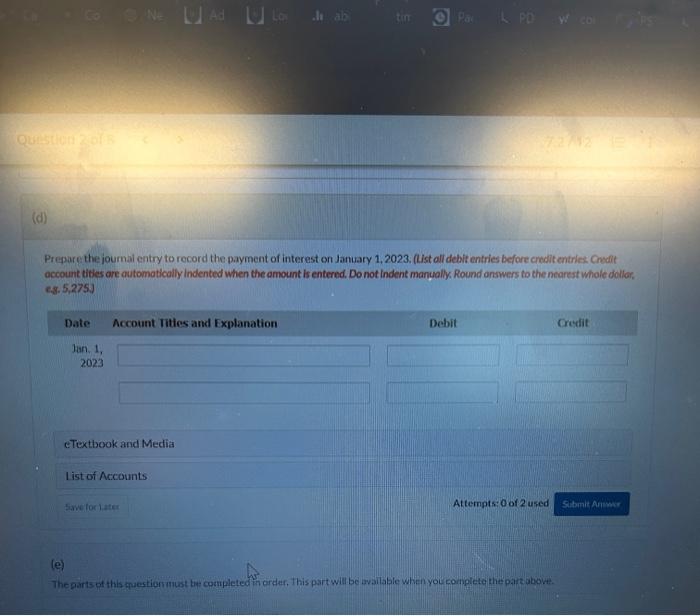

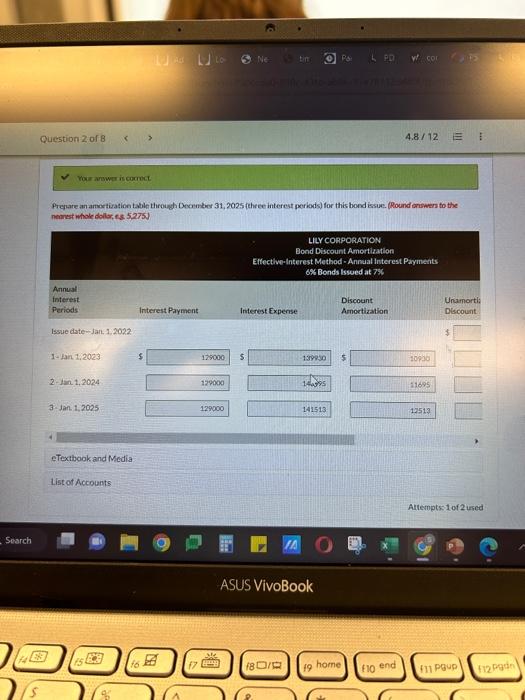

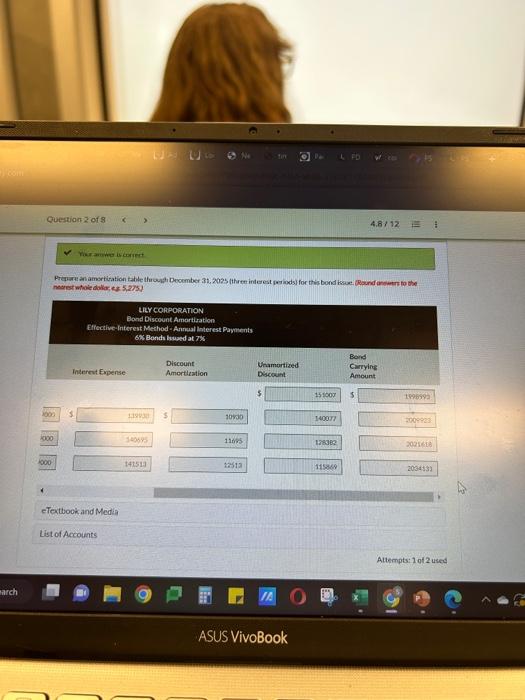

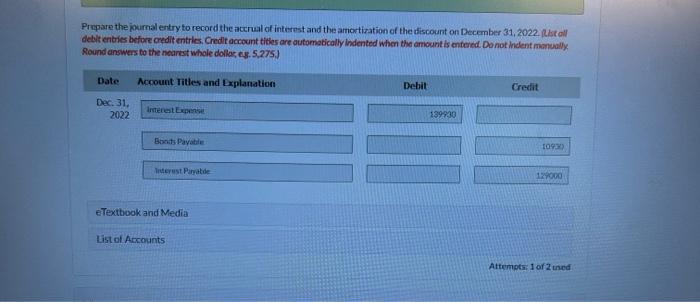

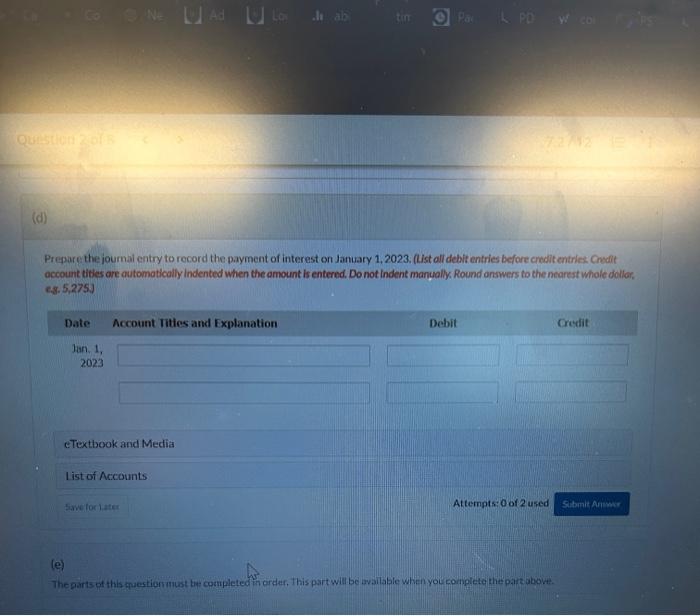

On january 1,2022, 1. y Corporation issued $2,150,000 face value, 6%6,10 year bends at $1,998,993. This price fesulted in an effoctive interest fate of 7% on the bonds. The bonds pay annual interest, each lanuary 1 . Lily has a calendat year end. (a) Your ansiber is correct. Prepare the journal entry to record the issue of the bonds on danuary 1,2022. Qist oll deait entries before credit entries: Crike it acmount titier are avtomatcally indented when the amouint is entered, Do not indent manually Prephate an amestiration table through Decumker 31,2025 the ee interest periods) for this bond issue (Round onswern to the nenast whole dollar fis. 5,275) *h meir anome is codrect nedrest whivie dollar ez 5,275 ) Prepare the journal entry to record the accrual of internst and the amortization of the discount on December 31,2022,2b all debit entries before oredit entrics. Credi account tither are automabicolly indented when the amiount is enfered. Do not indent monually. Round answers to the nearest whole dollas ey. 5,275) Prepare the joumai entry to rocord the payment of interest on January 1, 2023. (List oll debit entries before credit entries: Cmoit occount tibes are automatically indented when the amount is entered, Do not indent manyally Round answers to the nearest whole dollar. es. 5,275.3 eTextbook and Media list of Accounts Attempts: of of 2 used (e) The garts of this prestien must be completeds order, This part will be avalable when you comptete the palt above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started