Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this only on MATLAB and send me all screen shots. Please The volatility index (VIX) is a financial instrument that is receiving more

Please solve this only on MATLAB and send me all screen shots. Please

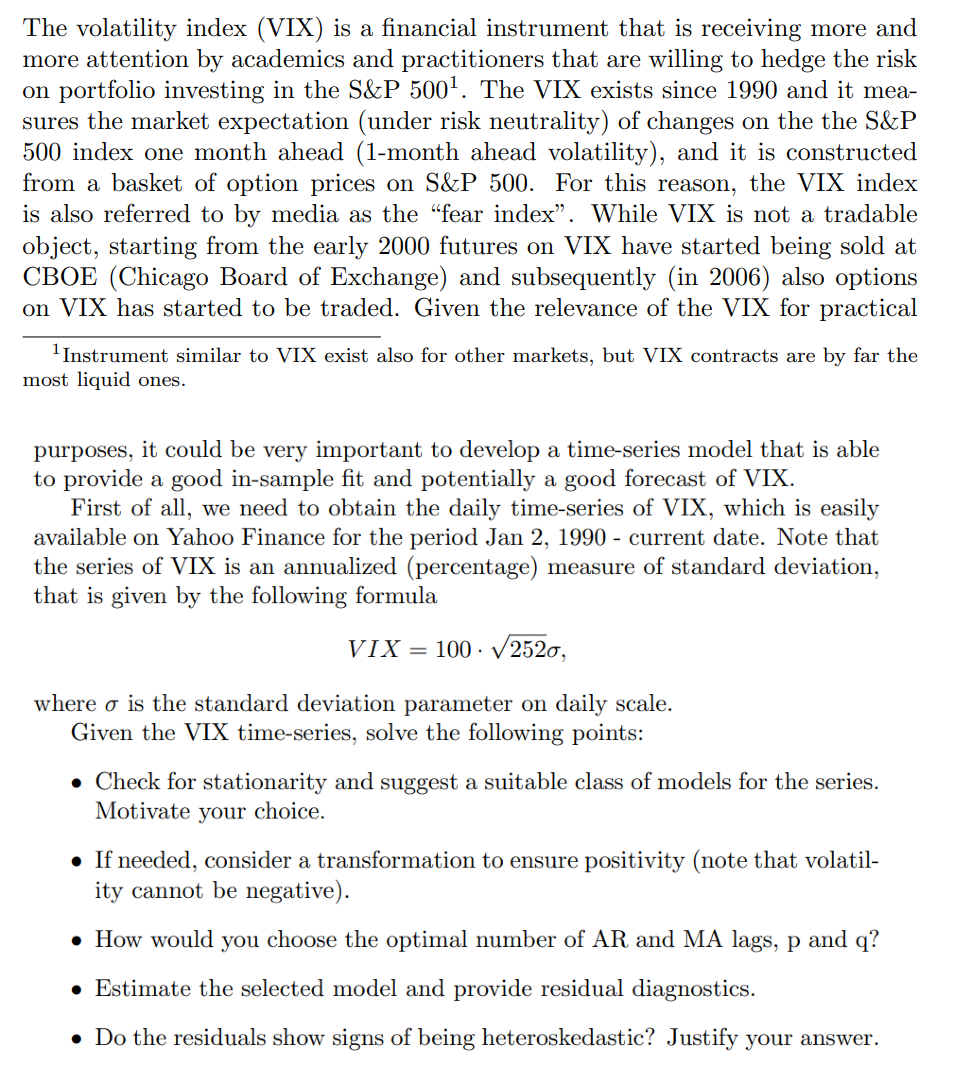

The volatility index (VIX) is a financial instrument that is receiving more and more attention by academics and practitioners that are willing to hedge the risk on portfolio investing in the S\&P 5001. The VIX exists since 1990 and it measures the market expectation (under risk neutrality) of changes on the the S&P 500 index one month ahead (1-month ahead volatility), and it is constructed from a basket of option prices on S\&P 500. For this reason, the VIX index is also referred to by media as the "fear index". While VIX is not a tradable object, starting from the early 2000 futures on VIX have started being sold at CBOE (Chicago Board of Exchange) and subsequently (in 2006) also options on VIX has started to be traded. Given the relevance of the VIX for practical 1 Instrument similar to VIX exist also for other markets, but VIX contracts are by far the most liquid ones. purposes, it could be very important to develop a time-series model that is able to provide a good in-sample fit and potentially a good forecast of VIX. First of all, we need to obtain the daily time-series of VIX, which is easily available on Yahoo Finance for the period Jan 2, 1990 - current date. Note that the series of VIX is an annualized (percentage) measure of standard deviation, that is given by the following formula VIX=100252, where is the standard deviation parameter on daily scale. Given the VIX time-series, solve the following points: - Check for stationarity and suggest a suitable class of models for the series. Motivate your choice. - If needed, consider a transformation to ensure positivity (note that volatility cannot be negative). - How would you choose the optimal number of AR and MA lags, p and q? - Estimate the selected model and provide residual diagnostics. - Do the residuals show signs of being heteroskedastic? Justify your answer. The volatility index (VIX) is a financial instrument that is receiving more and more attention by academics and practitioners that are willing to hedge the risk on portfolio investing in the S\&P 5001. The VIX exists since 1990 and it measures the market expectation (under risk neutrality) of changes on the the S&P 500 index one month ahead (1-month ahead volatility), and it is constructed from a basket of option prices on S\&P 500. For this reason, the VIX index is also referred to by media as the "fear index". While VIX is not a tradable object, starting from the early 2000 futures on VIX have started being sold at CBOE (Chicago Board of Exchange) and subsequently (in 2006) also options on VIX has started to be traded. Given the relevance of the VIX for practical 1 Instrument similar to VIX exist also for other markets, but VIX contracts are by far the most liquid ones. purposes, it could be very important to develop a time-series model that is able to provide a good in-sample fit and potentially a good forecast of VIX. First of all, we need to obtain the daily time-series of VIX, which is easily available on Yahoo Finance for the period Jan 2, 1990 - current date. Note that the series of VIX is an annualized (percentage) measure of standard deviation, that is given by the following formula VIX=100252, where is the standard deviation parameter on daily scale. Given the VIX time-series, solve the following points: - Check for stationarity and suggest a suitable class of models for the series. Motivate your choice. - If needed, consider a transformation to ensure positivity (note that volatility cannot be negative). - How would you choose the optimal number of AR and MA lags, p and q? - Estimate the selected model and provide residual diagnostics. - Do the residuals show signs of being heteroskedastic? Justify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started