Answered step by step

Verified Expert Solution

Question

1 Approved Answer

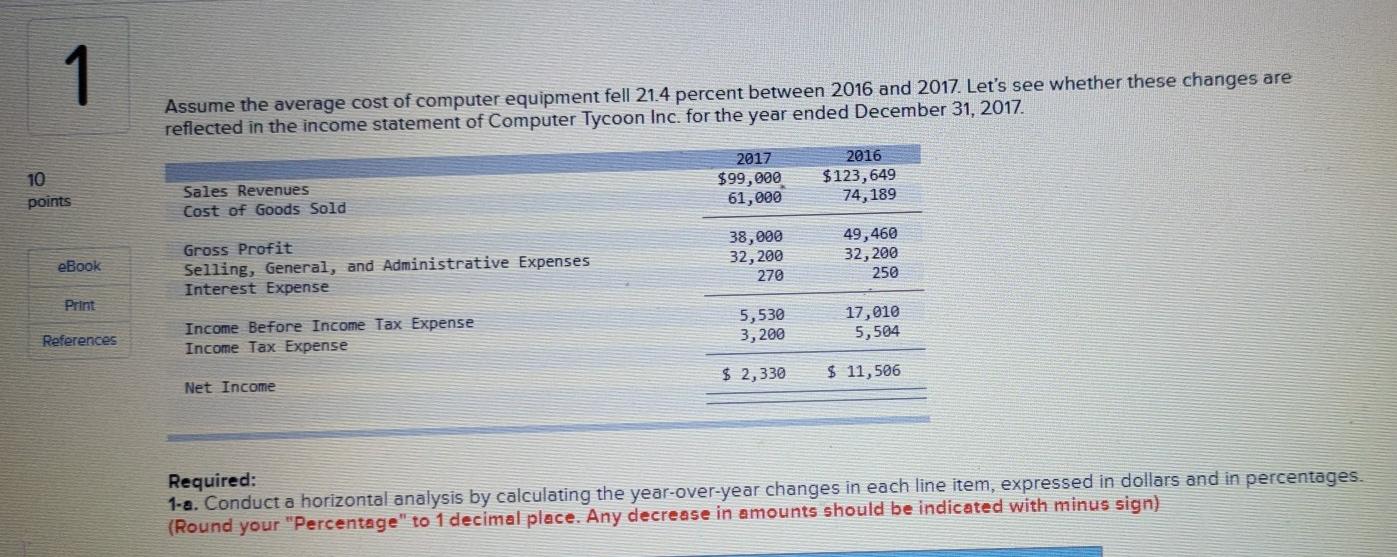

please solve this question completely correctly and clearly thanks 1 Assume the average cost of computer equipment fell 21.4 percent between 2016 and 2017. Let's

please solve this question completely correctly and clearly thanks

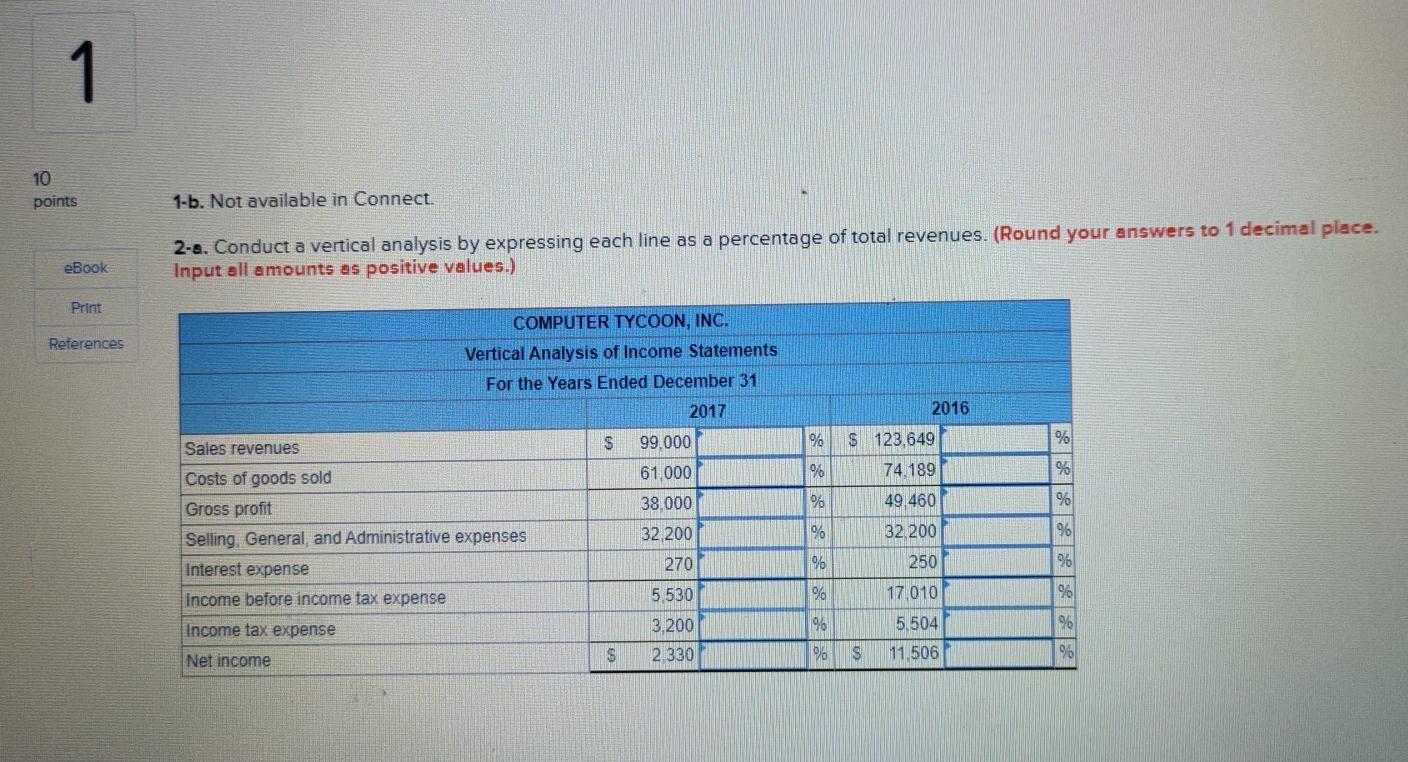

1 Assume the average cost of computer equipment fell 21.4 percent between 2016 and 2017. Let's see whether these changes are reflected in the income statement of Computer Tycoon Inc. for the year ended December 31, 2017 10 points 2017 $99,000 61,000 2016 $123,649 74, 189 Sales Revenues Cost of Goods Sold 38,090 32,200 270 49,460 32,200 Gross Profit Selling, General, and Administrative Expenses Interest Expense eBook 250 Print 5,530 3,200 Income Before Income Tax Expense Income Tax Expense 17,010 5,504 References $ 2,330 $ 11,506 Net Income Required: 1-a. Conduct a horizontal analysis by calculating the year-over-year changes in each line item, expressed in dollars and in percentages. (Round your "Percentage" to 1 decimal place. Any decrease in amounts should be indicated with minus sign) 1 10 points 1-b. Not available in Connect. 2-a. Conduct a vertical analysis by expressing each line as a percentage of total revenues. (Round your answers to 1 decimal place. Input all amounts as positive values.) eBook Print References COMPUTER TYCOON, INC. Vertical Analysis of Income Statements For the Years Ended December 31 2017 $ % % 2016 S 123.649 74.189 49,460 % % % Sales revenues Costs of goods sold Gross profit Selling, General and Administrative expenses Interest expense Income before income tax expense 99.000 61,000 38.000 32,200 270 5.530 32.200 % % % 250 % 17.010 Income tax expense 9 3,200 2.330 5,504 11.506 $ Net income $ 96 2-b. Excluding income tax, interest, and selling, general, and administrative expenses, did Computer Tycoon earn more profit per dollar of sales in 2017 compared to 2016? O No YesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started