Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve this using Excel and show the respective formula or cell reference! Thank you. 6) (20 points) Shiny Silver, a small cutlery manufacturer, is

Please solve this using Excel and show the respective formula or cell reference! Thank you.

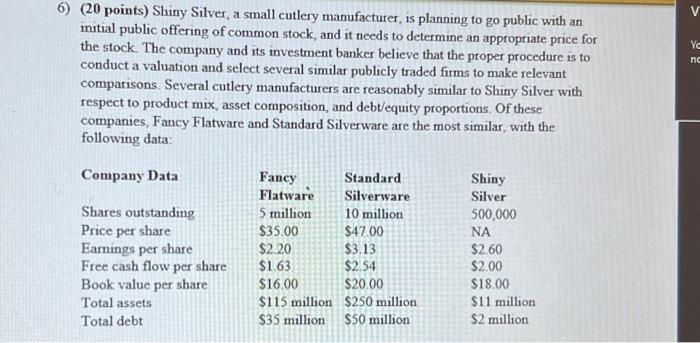

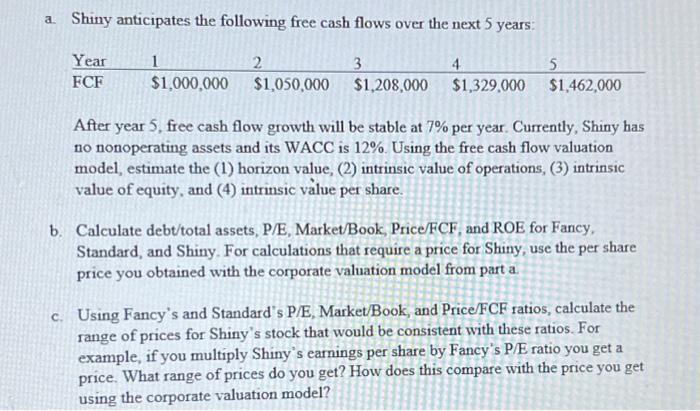

6) (20 points) Shiny Silver, a small cutlery manufacturer, is planning to go public with an initial public offering of common stock, and it needs to determine an appropriate price for the stock. The company and its investment banker believe that the proper procedure is to conduct a valuation and select several similar publicly traded firms to make relevant comparisons. Several cutlery manufacturers are reasonably similar to Shiny Silver with respect to product mix, asset composition, and debtequity proportions. Of these companies, Fancy Flatware and Standard Silverware are the most similar, with the following data: a. Shiny anticipates the following free cash flows over the next 5 years: After year 5 , free cash flow growth will be stable at 7% per year. Currently, Shiny has no nonoperating assets and its WACC is 12%. Using the free cash flow valuation model, estimate the (1) horizon value, (2) intrinsic value of operations, (3) intrinsic value of equity, and (4) intrinsic value per share. b. Calculate debt/total assets, P/E, Market/Book, Price/FCF, and ROE for Fancy, Standard, and Shiny. For calculations that require a price for Shiny, use the per share price you obtained with the corporate valuation model from part a. c. Using Fancy's and Standard's P/E, Market/Book, and Price/FCF ratios, calculate the range of prices for Shiny's stock that would be consistent with these ratios. For example, if you multiply Shiny's earnings per share by Fancy's P/E ratio you get a price. What range of prices do you get? How does this compare with the price you get using the corporate valuation model? 6) (20 points) Shiny Silver, a small cutlery manufacturer, is planning to go public with an initial public offering of common stock, and it needs to determine an appropriate price for the stock. The company and its investment banker believe that the proper procedure is to conduct a valuation and select several similar publicly traded firms to make relevant comparisons. Several cutlery manufacturers are reasonably similar to Shiny Silver with respect to product mix, asset composition, and debtequity proportions. Of these companies, Fancy Flatware and Standard Silverware are the most similar, with the following data: a. Shiny anticipates the following free cash flows over the next 5 years: After year 5 , free cash flow growth will be stable at 7% per year. Currently, Shiny has no nonoperating assets and its WACC is 12%. Using the free cash flow valuation model, estimate the (1) horizon value, (2) intrinsic value of operations, (3) intrinsic value of equity, and (4) intrinsic value per share. b. Calculate debt/total assets, P/E, Market/Book, Price/FCF, and ROE for Fancy, Standard, and Shiny. For calculations that require a price for Shiny, use the per share price you obtained with the corporate valuation model from part a. c. Using Fancy's and Standard's P/E, Market/Book, and Price/FCF ratios, calculate the range of prices for Shiny's stock that would be consistent with these ratios. For example, if you multiply Shiny's earnings per share by Fancy's P/E ratio you get a price. What range of prices do you get? How does this compare with the price you get using the corporate valuation model Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started