Answered step by step

Verified Expert Solution

Question

1 Approved Answer

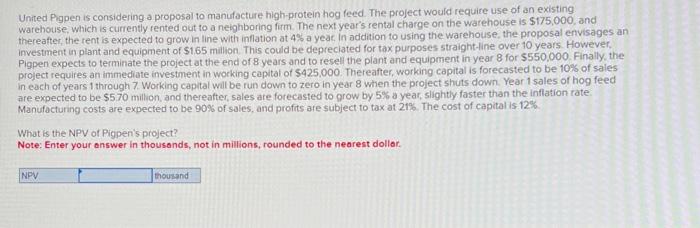

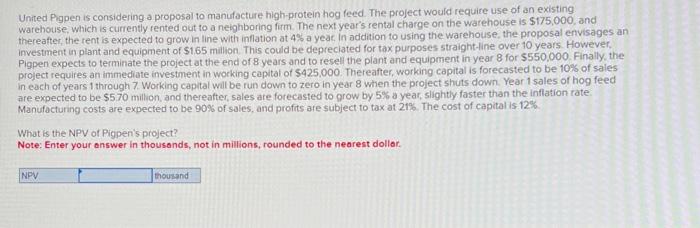

please solve United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would require use of an existing warehouse. which is currently

please solve

United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would require use of an existing warehouse. which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $175,000, and thereatter, the rent is expected to grow in line with inflation at 4% a yeac. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1,65 milion. This could be depreclated for tax purposes straight-line over 10 years. However. Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $550,000. Finally, the project requires an immediate investment in working capital of $425,000. Thereafter, working capital is forecasted to be 1075 of sales in each of years 1 through 7. Working capital wilt be run down to zero in year 8 when the project shuts down. Year 1 sales of hog feed are expected to be $570 million, and thereatter, sales are forecasted to grow by 5% y year, slightly faster than the inflation rate. Manufacturing costs are expected to be 90% of sales, and profits are subject to tax at 21%. The cost of capital is 12% What is the NPV of Pigpen's project? Note: Enter your answer in thousands, not in millions, rounded to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started