Answered step by step

Verified Expert Solution

Question

1 Approved Answer

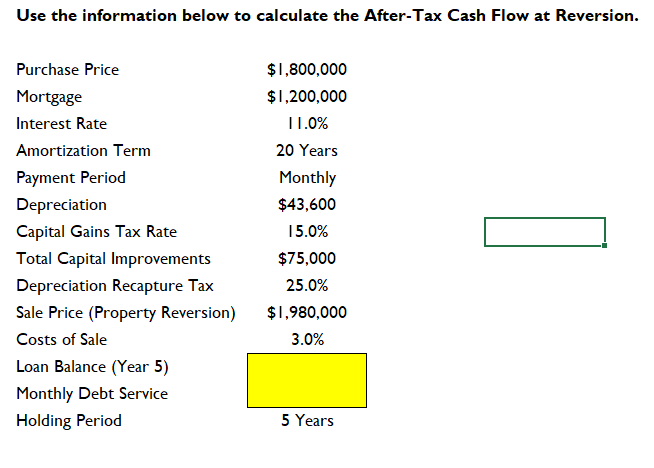

Please solve using EXCEL. Thank you Use the information below to calculate the After-Tax Cash Flow at Reversion. Purchase Price Mortgage Interest Rate Amortization Term

Please solve using EXCEL.

Thank you

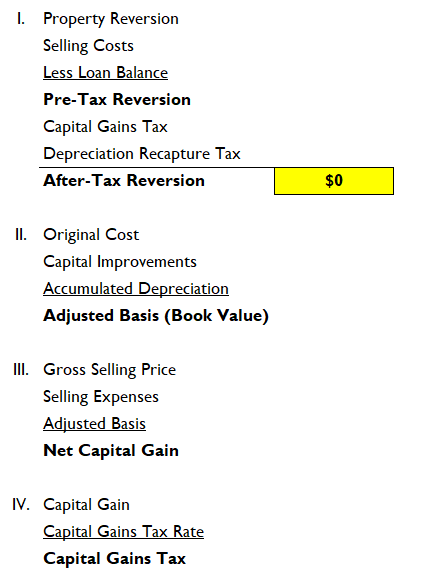

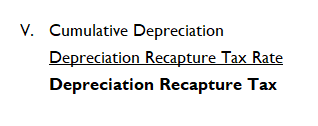

Use the information below to calculate the After-Tax Cash Flow at Reversion. Purchase Price Mortgage Interest Rate Amortization Term Payment Period Depreciation Capital Gains Tax Rate Total Capital Improvements Depreciation Recapture Tax Sale Price (Property Reversion) Costs of Sale Loan Balance (Year 5) Monthly Debt Service Holding Period $1,800,000 $1,200,000 11.0% 20 Years Monthly $43,600 15.0% $75,000 25.0% $1,980,000 3.0% 5 Years 1. Property Reversion Selling Costs Less Loan Balance Pre-Tax Reversion Capital Gains Tax Depreciation Recapture Tax After-Tax Reversion $0 II. Original Cost Capital Improvements Accumulated Depreciation Adjusted Basis (Book Value) III. Gross Selling Price Selling Expenses Adjusted Basis Net Capital Gain IV. Capital Gain Capital Gains Tax Rate Capital Gains Tax V. Cumulative Depreciation Depreciation Recapture Tax Rate Depreciation Recapture Tax Use the information below to calculate the After-Tax Cash Flow at Reversion. Purchase Price Mortgage Interest Rate Amortization Term Payment Period Depreciation Capital Gains Tax Rate Total Capital Improvements Depreciation Recapture Tax Sale Price (Property Reversion) Costs of Sale Loan Balance (Year 5) Monthly Debt Service Holding Period $1,800,000 $1,200,000 11.0% 20 Years Monthly $43,600 15.0% $75,000 25.0% $1,980,000 3.0% 5 Years 1. Property Reversion Selling Costs Less Loan Balance Pre-Tax Reversion Capital Gains Tax Depreciation Recapture Tax After-Tax Reversion $0 II. Original Cost Capital Improvements Accumulated Depreciation Adjusted Basis (Book Value) III. Gross Selling Price Selling Expenses Adjusted Basis Net Capital Gain IV. Capital Gain Capital Gains Tax Rate Capital Gains Tax V. Cumulative Depreciation Depreciation Recapture Tax Rate Depreciation Recapture TaxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started