PLEASE SOLVE USING EXCEL WITH CALCULATIONS SHOWN FOR POSITIVE REVIEW

PLEASE SOLVE USING EXCEL WITH CALCULATIONS SHOWN FOR POSITIVE REVIEW

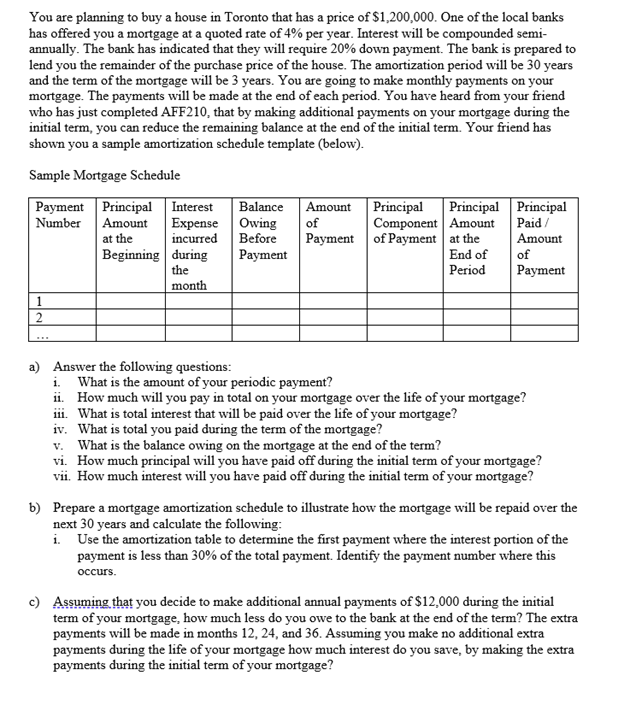

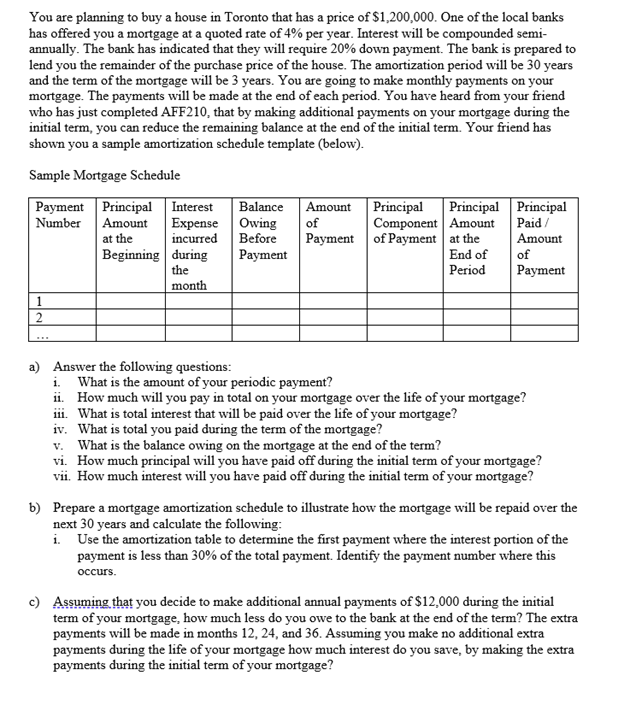

You are planning to buy a house in Toronto that has a price of $1,200,000. One of the local banks has offered you a mortgage at a quoted rate of 4% per year. Interest will be compounded semi- annually. The bank has indicated that they will require 20% down payment. The bank is prepared to lend you the remainder of the purchase price of the house. The amortization period will be 30 years and the term of the mortgage will be 3 years. You are going to make monthly payments on your mortgage. The payments will be made at the end of each period. You have heard from your friend who has just completed AFF210, that by making additional payments on your mortgage during the initial term, you can reduce the remaining balance at the end of the initial term. Your friend has shown you a sample amortization schedule template (below). Sample Mortgage Schedule Payment Principal Interest Balance Amount Principal Principal Principal Number Amount Expense Owing of Component Amount Paid at the incurred Before Payment of Payment at the Amount Beginning during Payment End of of the Period Payment month 1 2 a) Answer the following questions: i. What is the amount of your periodic payment? ii. How much will you pay in total on your mortgage over the life of your mortgage? 11. What is total interest that will be paid over the life of your mortgage? iv. What is total you paid during the term of the mortgage? v. What is the balance owing on the mortgage at the end of the term? vi. How much principal will you have paid off during the initial term of your mortgage? vii. How much interest will you have paid off during the initial term of your mortgage? b) Prepare a mortgage amortization schedule to illustrate how the mortgage will be repaid over the next 30 years and calculate the following: i. Use the amortization table to determine the first payment where the interest portion of the payment is less than 30% of the total payment. Identify the payment number where this occurs. c) Assuming that you decide to make additional annual payments of $12,000 during the initial term of your mortgage, how much less do you owe to the bank at the end of the term? The extra payments will be made in months 12, 24, and 36. Assuming you make no additional extra payments during the life of your mortgage how much interest do you save, by making the extra payments during the initial term of your mortgage

PLEASE SOLVE USING EXCEL WITH CALCULATIONS SHOWN FOR POSITIVE REVIEW

PLEASE SOLVE USING EXCEL WITH CALCULATIONS SHOWN FOR POSITIVE REVIEW