Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve with an explicit explanation all info given We consider two Treasury notes, bonds A and B, with 18 months to maturity and semiannual

please solve with an explicit explanation

all info given

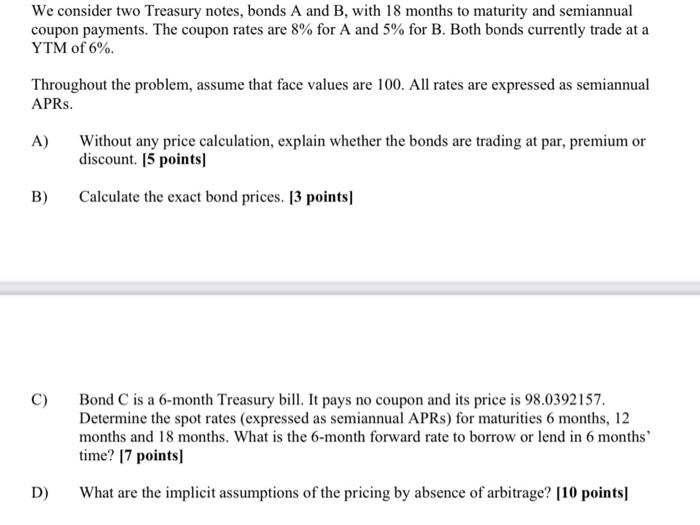

We consider two Treasury notes, bonds A and B, with 18 months to maturity and semiannual coupon payments. The coupon rates are 8% for A and 5% for B. Both bonds currently trade at a YTM of 6%. Throughout the problem, assume that face values are 100. All rates are expressed as semiannual APRs. A) Without any price calculation, explain whether the bonds are trading at par, premium or discount. 15 points) B) Calculate the exact bond prices. [3 points) C) Bond C is a 6-month Treasury bill. It pays no coupon and its price is 98.0392157. Determine the spot rates (expressed as semiannual APRs) for maturities 6 months, 12 months and 18 months. What is the 6-month forward rate to borrow or lend in 6 months time? 17 points) What are the implicit assumptions of the pricing by absence of arbitrage? [10 points] D) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started