Please solve with precision. Correct answers only. Thanks

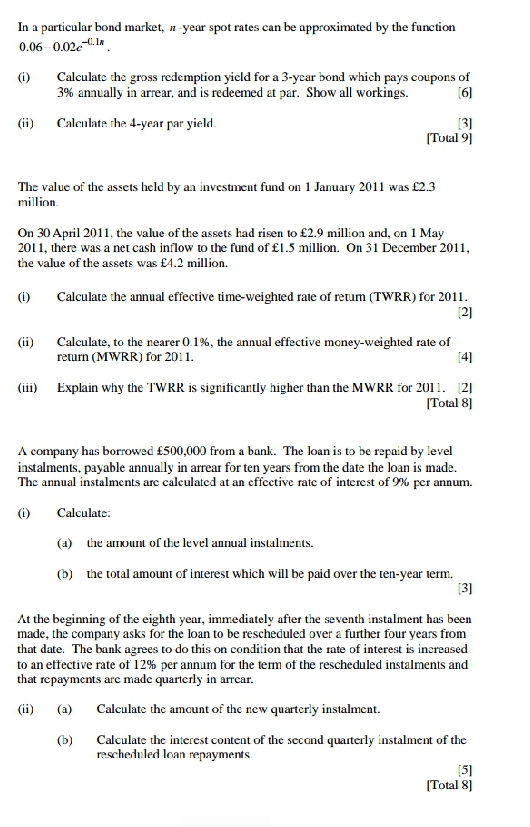

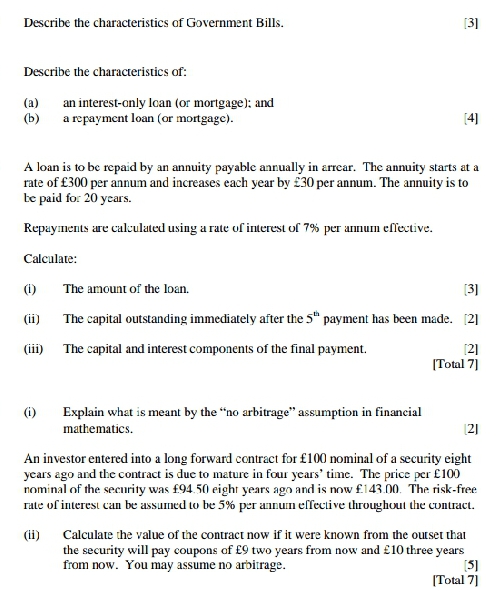

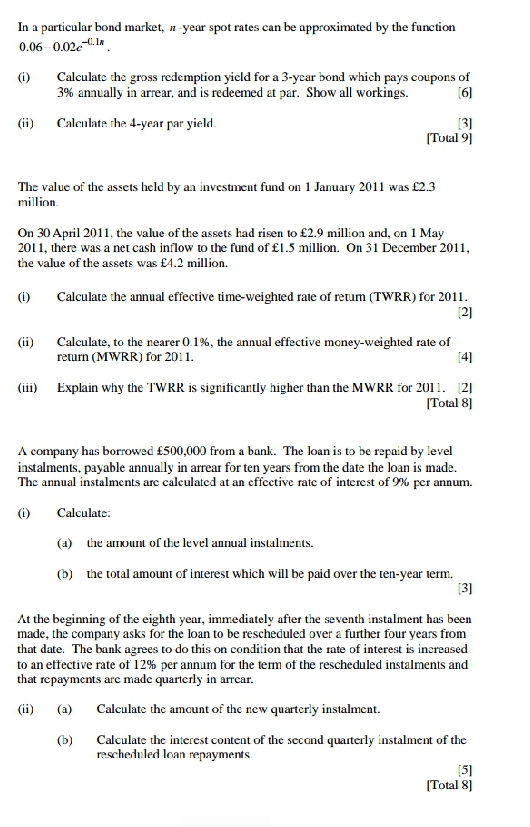

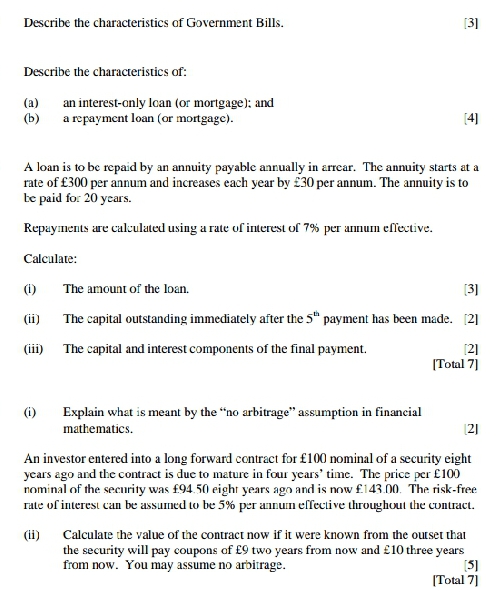

In a particular bond market, a-year spot rates can be approximated by the function 0.06-0.02e-la . (1) Calculate the gross redemption yield for a 3-year bond which pays coupons of 3% annually in arrear, and is redeemed at par. Show all workings. [6] (ii) Calculate the 4-year par yield. [31 [Total 9] The value of the assets held by an investment fund on 1 January 2011 was $2.3 million. On 30 April 2011, the value of the assets had risen to C2.9 million and, on 1 May 201 1, there was a net cash inflow to the fund of fl.5 million. On 31 December 2011, the value of the assets was $4.2 million. (1) Calculate the annual effective time-weighted rate of retum (TWRR) for 2011. [2] (ii) Calculate, to the nearer 0.1%, the annual effective money-weighted rate of return (MWRR) for 201 1. 141 (iii) Explain why the TWRK is significantly higher than the MWRK for 201 1. (2] [Total 8] A company has borrowed $500,000 from a bank. The loan is to be repaid by level instalments. payable annually in arrear for ten years from the date the loan is made. The annual instalments are calculated at an effective rate of interest of % per annum. Calculate: (a) the amount of the level annual instalments. (b) the total amount of interest which will be paid over the ten-year term. [3] At the beginning of the eighth year, immediately after the seventh instalment has been made, the company asks for the loan to be rescheduled over a further four years from that date. The bank agrees to do this on condition that the rate of interest is increased to an effective rate of 12% per annum for the term of the rescheduled instalments and that repayments are made quarterly in arrear. (ii) (a) Calculate the amount of the new quarterly instalment. (b) Calculate the interest content of the second quarterly instalment of the rescheduled loan repayments. [5] [Total 8]Describe the characteristics of Government Bills. 13] Describe the characteristics of: (a) an interest-only loan (or mortgage): and (b) a repayment loan ( or mortgage). [4] A loan is to be repaid by an annuity payable annually in arrear. The annuity starts at a rate of f300 per annum and increases each year by $30 per annum. The annuity is to be paid for 20 years. Repayments are calculated using a rate of interest of 7% per armum effective. Calculate: (1) The amount of the loan. [3] ii) The capital outstanding immediately after the 5" payment has been made. [2] (iii) The capital and interest components of the final payment. 121 [Total 7] (i) Explain what is meant by the "no arbitrage" assumption in financial mathematics. 121 An investor entered into a long forward contract for f100 nominal of a security eight years ago and the contract is due to mature in four years' time. The price per (100 nominal of the security was f94 50 eight years ago and is now f.143.00. The risk-free rate of interest can be assumed to be 5% per annum effective throughout the contract. Calculate the value of the contract now if it were known from the ourset that the security will pay coupons of $9 two years from now and $10 three years from now. You may assume no arbitrage. [5] [Total 7]