Answered step by step

Verified Expert Solution

Question

1 Approved Answer

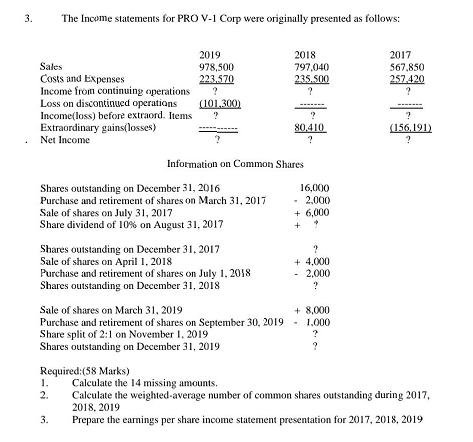

3. The Income statements for PRO V-1 Corp were originally presented as follows: 2019 978,500 223.570 ? 2018 797,040 235.500 2017 567,850 257.420 Sales

3. The Income statements for PRO V-1 Corp were originally presented as follows: 2019 978,500 223.570 ? 2018 797,040 235.500 2017 567,850 257.420 Sales Costs and Expenses Income from continuing operations Loss on discontinued operations Income(loss) before extraord. Items Extraordinary gains(losses) (101,300) 80.410 (156,191) Net Income Information on Common Shares Shares outstanding on December 31, 2016 Purchase and retirement of shares on March 31, 2017 Sale of shares on July 31, 2017 Share dividend of 10% on August 31, 2017 16,000 - 2,000 + 6,000 Shares outstanding on December 31. 2017 Sale of shares on April 1, 2018 Purchase and retirement of shares on July 1, 2018 Shares outstanding on December 31, 2018 + 4,000 - 2,000 Sale of shares on March 31, 2019 Purchase and retirement of shares on September 30, 2019 - 1.000 Share split of 2:1 on November 1, 2019 Shares outstanding on December 31, 2019 + 8,000 Required:(58 Marks) Calculate the 14 missing amounts. 1. 2. Calculate the weighted-average number of common shares outstanding during 2017, 2018, 2019 3. Prepare the earnings per share income statement presentation for 2017, 2018, 2019

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

2019 2018 2017 Sales 978500 797040 567850 Costs and expenses 223570 235500 257420 Income from co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started