Please somewhat show work if possible

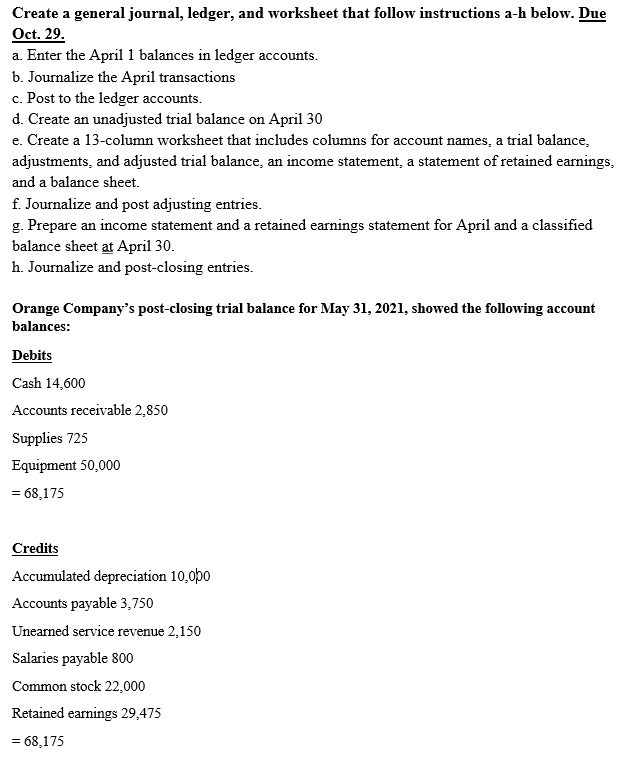

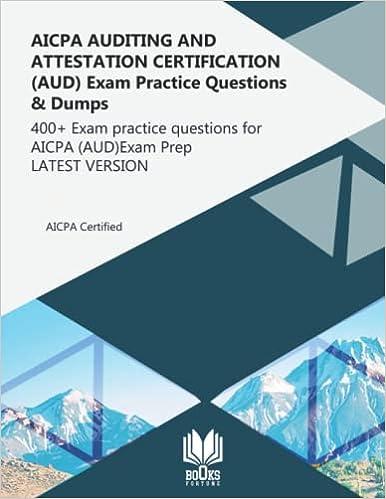

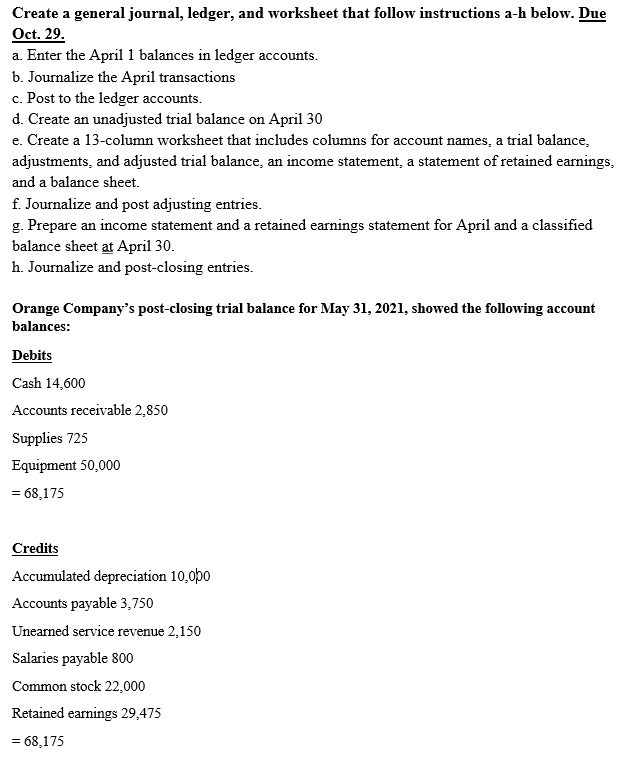

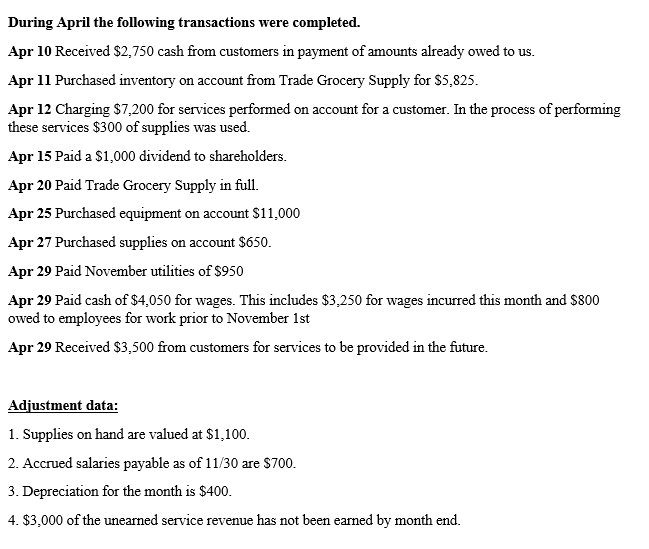

Create a general journal, ledger, and worksheet that follow instructions a-h below. Due Oct. 29. a. Enter the April 1 balances in ledger accounts. b. Journalize the April transactions c. Post to the ledger accounts. d. Create an unadjusted trial balance on April 30 e. Create a 13-column worksheet that includes columns for account names, a trial balance, adjustments, and adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet. f. Journalize and post adjusting entries. g. Prepare an income statement and a retained earnings statement for April and a classified balance sheet at April 30 . h. Journalize and post-closing entries. Orange Company's post-closing trial balance for May 31, 2021, showed the following account balances: Debits Cash 14,600 Accounts receivable 2,850 Supplies 725 Equipment 50,000 =68,175 Credits Accumulated depreciation 10,0p0 Accounts payable 3,750 Unearned service revenue 2,150 Salaries payable 800 Common stock 22,000 Retained earnings 29,475 =68,175 During April the following transactions were completed. Apr 10 Received $2,750 cash from customers in payment of amounts already owed to us. Apr 11 Purchased inventory on account from Trade Grocery Supply for $5,825. Apr 12 Charging $7,200 for services performed on account for a customer. In the process of performing these services $300 of supplies was used. Apr 15 Paid a $1,000 dividend to shareholders. Apr 20 Paid Trade Grocery Supply in full. Apr 25 Purchased equipment on account $11,000 Apr 27 Purchased supplies on account $650. Apr 29 Paid November utilities of $950 Apr 29 Paid cash of $4,050 for wages. This includes $3,250 for wages incurred this month and $800 owed to employees for work prior to November 1st Apr 29 Received $3,500 from customers for services to be provided in the future. Adjustment data: 1. Supplies on hand are valued at $1,100. 2. Accrued salaries payable as of 11/30 are $700. 3. Depreciation for the month is $400. 4. $3,000 of the unearned service revenue has not been earned by month end. Create a general journal, ledger, and worksheet that follow instructions a-h below. Due Oct. 29. a. Enter the April 1 balances in ledger accounts. b. Journalize the April transactions c. Post to the ledger accounts. d. Create an unadjusted trial balance on April 30 e. Create a 13-column worksheet that includes columns for account names, a trial balance, adjustments, and adjusted trial balance, an income statement, a statement of retained earnings, and a balance sheet. f. Journalize and post adjusting entries. g. Prepare an income statement and a retained earnings statement for April and a classified balance sheet at April 30 . h. Journalize and post-closing entries. Orange Company's post-closing trial balance for May 31, 2021, showed the following account balances: Debits Cash 14,600 Accounts receivable 2,850 Supplies 725 Equipment 50,000 =68,175 Credits Accumulated depreciation 10,0p0 Accounts payable 3,750 Unearned service revenue 2,150 Salaries payable 800 Common stock 22,000 Retained earnings 29,475 =68,175 During April the following transactions were completed. Apr 10 Received $2,750 cash from customers in payment of amounts already owed to us. Apr 11 Purchased inventory on account from Trade Grocery Supply for $5,825. Apr 12 Charging $7,200 for services performed on account for a customer. In the process of performing these services $300 of supplies was used. Apr 15 Paid a $1,000 dividend to shareholders. Apr 20 Paid Trade Grocery Supply in full. Apr 25 Purchased equipment on account $11,000 Apr 27 Purchased supplies on account $650. Apr 29 Paid November utilities of $950 Apr 29 Paid cash of $4,050 for wages. This includes $3,250 for wages incurred this month and $800 owed to employees for work prior to November 1st Apr 29 Received $3,500 from customers for services to be provided in the future. Adjustment data: 1. Supplies on hand are valued at $1,100. 2. Accrued salaries payable as of 11/30 are $700. 3. Depreciation for the month is $400. 4. $3,000 of the unearned service revenue has not been earned by month end