Answered step by step

Verified Expert Solution

Question

1 Approved Answer

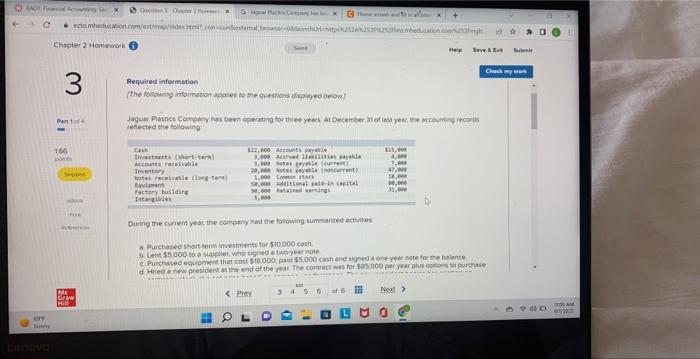

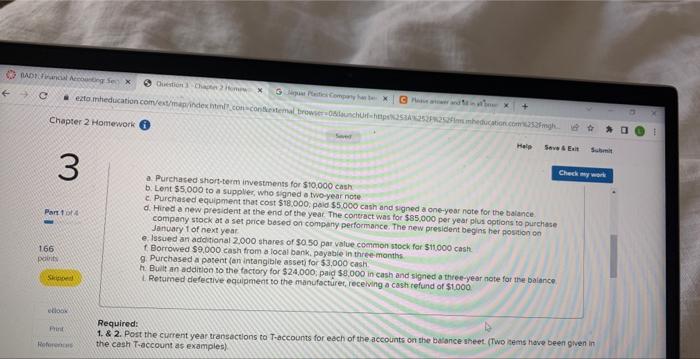

Please somone help full this out Required information [re foliowng infirmaton apalew to the questions vtapoyed below? Jaguar Plasincs Comporty kas been operating tor thres

Please somone help full this out

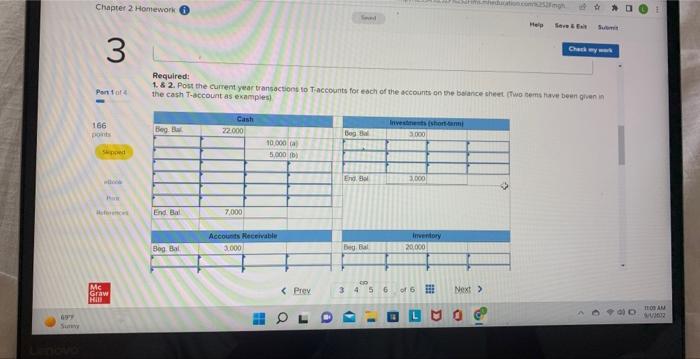

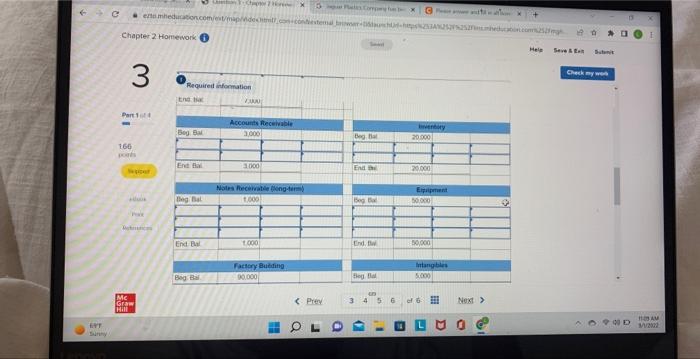

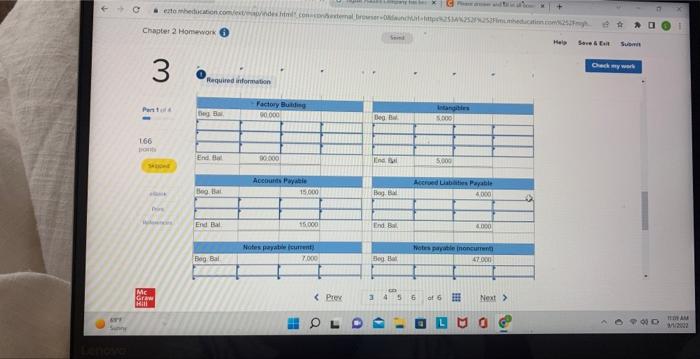

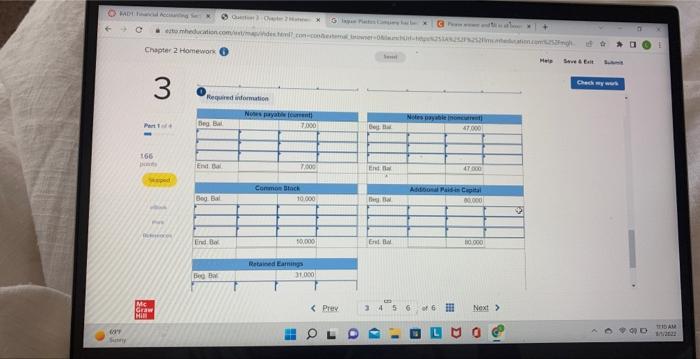

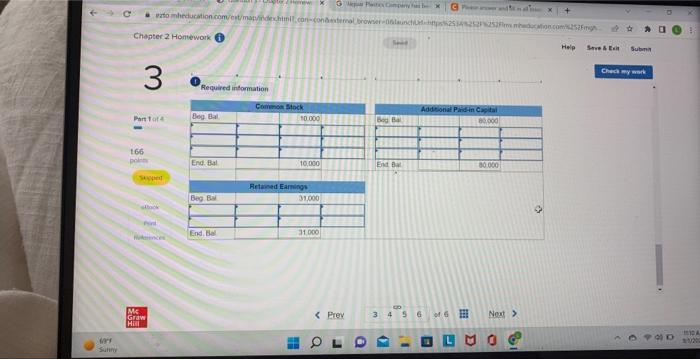

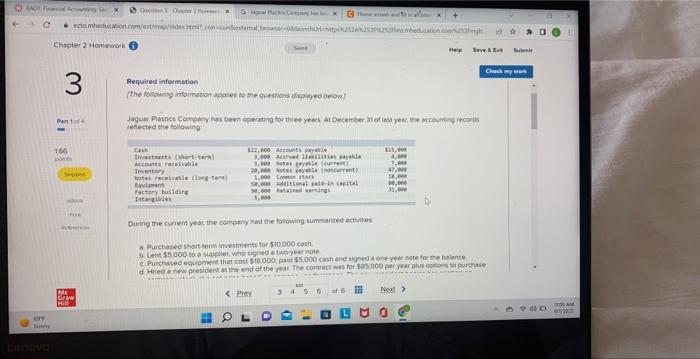

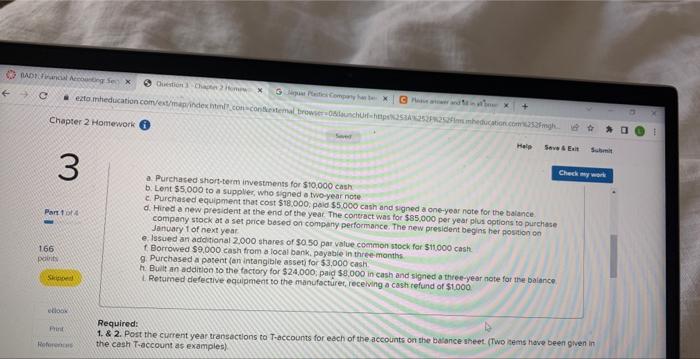

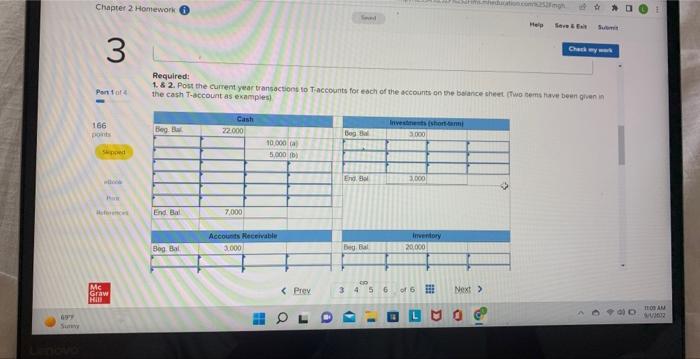

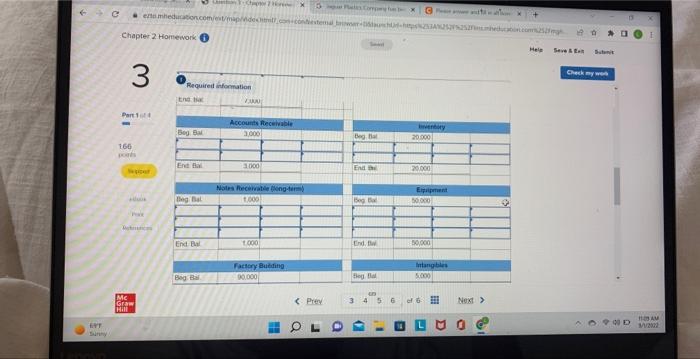

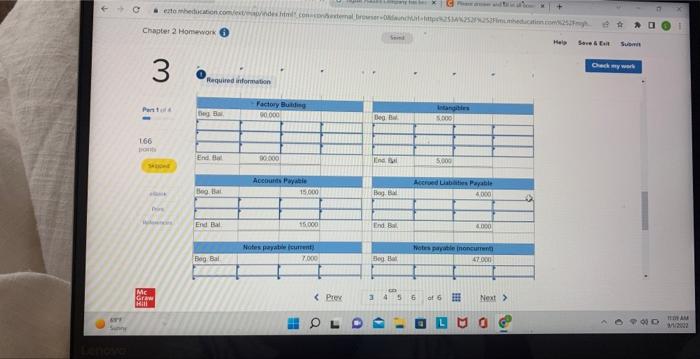

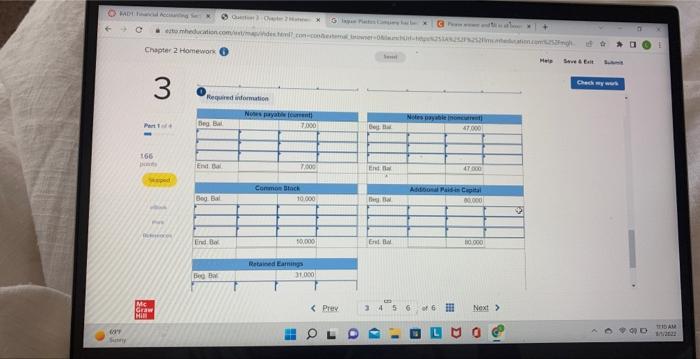

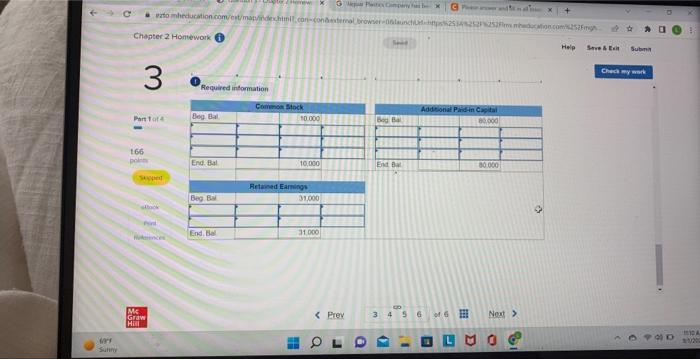

Required information [re foliowng infirmaton apalew to the questions vtapoyed below? Jaguar Plasincs Comporty kas been operating tor thres yeers at December 31 of last yew, the accourting ieconds tenected the followifg Duing the owiemt year, the coimpany nad the foldowing summanted activites: a Purchased short-4ent investmers for $10000 eash b Lect 35,000 to a suppliet, who signed a teroyear note c. Purctiaced eckeperient that cost 518,000 , paid 55,000 cost and signed a one-yeef more for the hounte d. Hired a rew president at the end of the yese. Fee contract was for 3 shoco per year pius oetont to puechise a. Purchased shert-term imvestmenss for 510,000cash b. Lent \$5,000 to a suppler, who signed a two-year note c. Purchased equipment that cost $18.000; peid $5.000 cash and sgned an on-year note for the balance. d. Hired a new president at the end of theyear. The contract was for $85000 per year plus ootions to purchase. company stock at a set price based on comphany performance. The new presicient begins her postion ca. January 1 of next year: e- Is sued an adolional 2,000 shares of 3050 par value coenmon stock far 311000 cashe f. Eorrowed $9,000 cash from a local bank, payabie in three-months 9. Purchased a pasent fen intangible asser) for 53,000cash. h. Euilt an addition so the factory for $24,000; paid $9.000 in cash and signed a three-year note for the balance. 1. Retamed defective equipmeat to the nanufacturet, recehing a cash refund of $1000. Required: 1. \& 2. Post the current year transactions to Traccounts for each of the accounts on she baismce sheet. (Two kems have been ewen in the cash Toaccount as examplest. Required: 1. 8 2. Post the currem year transoctions to Taccoants for eoch of the accounts on be bsance theet thwo cems have been ghen in the cash T-decount as examplesi Required information fueguimid untirmation Required intomation Required information [re foliowng infirmaton apalew to the questions vtapoyed below? Jaguar Plasincs Comporty kas been operating tor thres yeers at December 31 of last yew, the accourting ieconds tenected the followifg Duing the owiemt year, the coimpany nad the foldowing summanted activites: a Purchased short-4ent investmers for $10000 eash b Lect 35,000 to a suppliet, who signed a teroyear note c. Purctiaced eckeperient that cost 518,000 , paid 55,000 cost and signed a one-yeef more for the hounte d. Hired a rew president at the end of the yese. Fee contract was for 3 shoco per year pius oetont to puechise a. Purchased shert-term imvestmenss for 510,000cash b. Lent \$5,000 to a suppler, who signed a two-year note c. Purchased equipment that cost $18.000; peid $5.000 cash and sgned an on-year note for the balance. d. Hired a new president at the end of theyear. The contract was for $85000 per year plus ootions to purchase. company stock at a set price based on comphany performance. The new presicient begins her postion ca. January 1 of next year: e- Is sued an adolional 2,000 shares of 3050 par value coenmon stock far 311000 cashe f. Eorrowed $9,000 cash from a local bank, payabie in three-months 9. Purchased a pasent fen intangible asser) for 53,000cash. h. Euilt an addition so the factory for $24,000; paid $9.000 in cash and signed a three-year note for the balance. 1. Retamed defective equipmeat to the nanufacturet, recehing a cash refund of $1000. Required: 1. \& 2. Post the current year transactions to Traccounts for each of the accounts on she baismce sheet. (Two kems have been ewen in the cash Toaccount as examplest. Required: 1. 8 2. Post the currem year transoctions to Taccoants for eoch of the accounts on be bsance theet thwo cems have been ghen in the cash T-decount as examplesi Required information fueguimid untirmation Required intomation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started