Please start from part A. First two images are of part B.

Please start from part A. First two images are of part B.

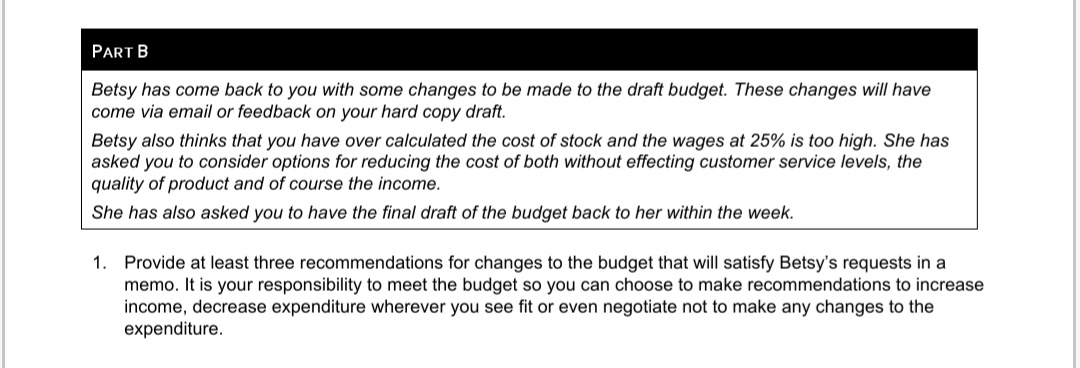

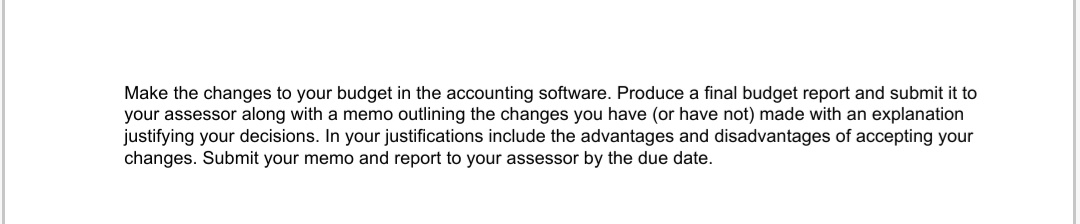

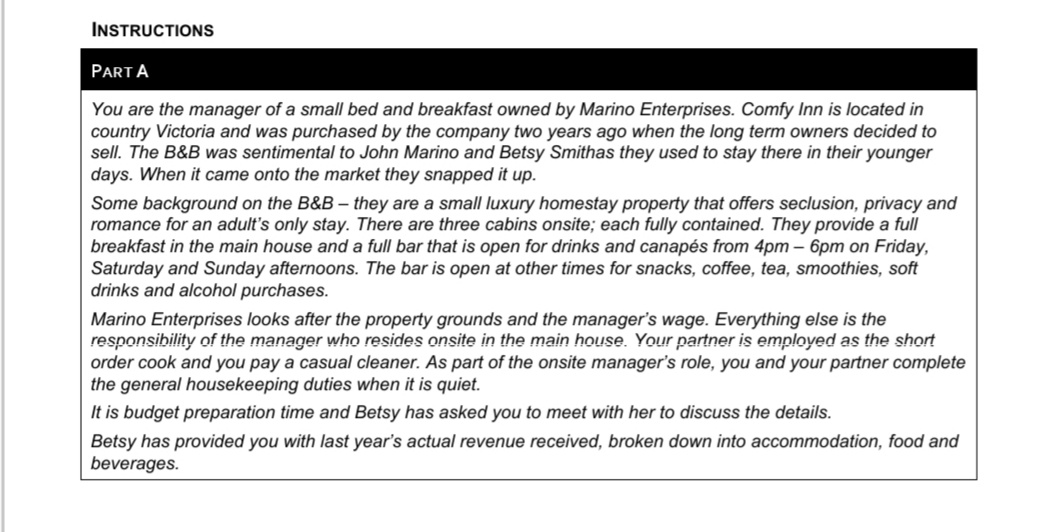

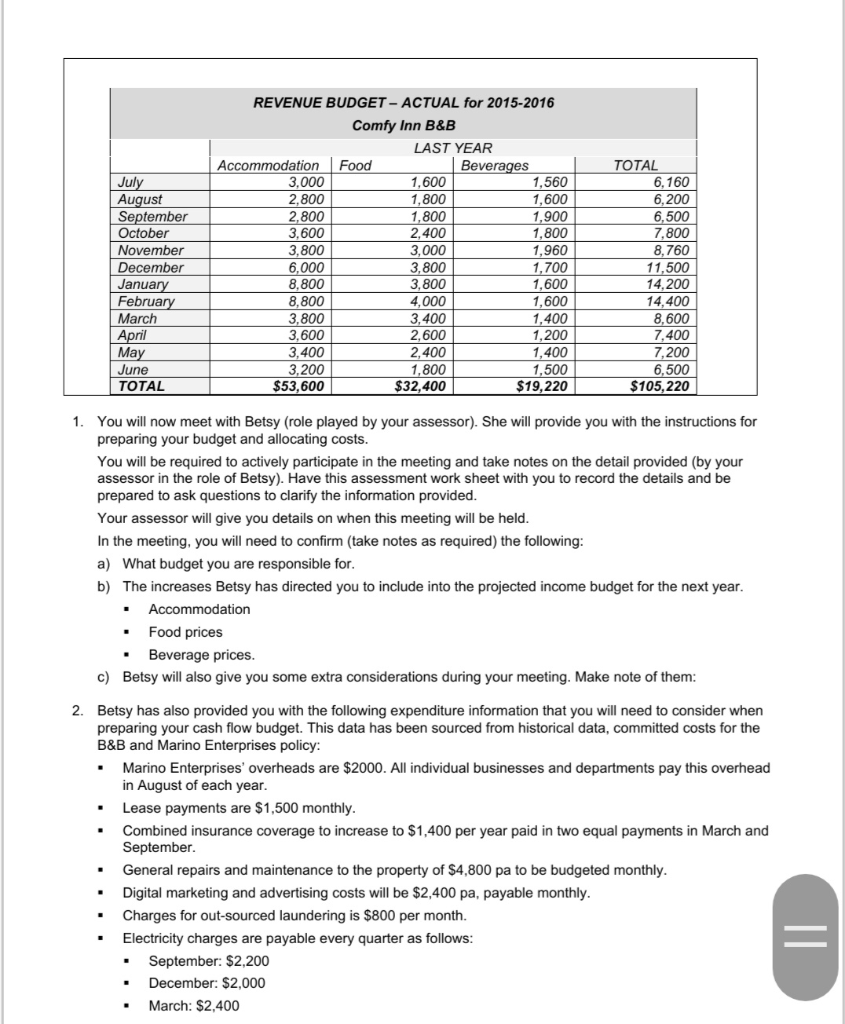

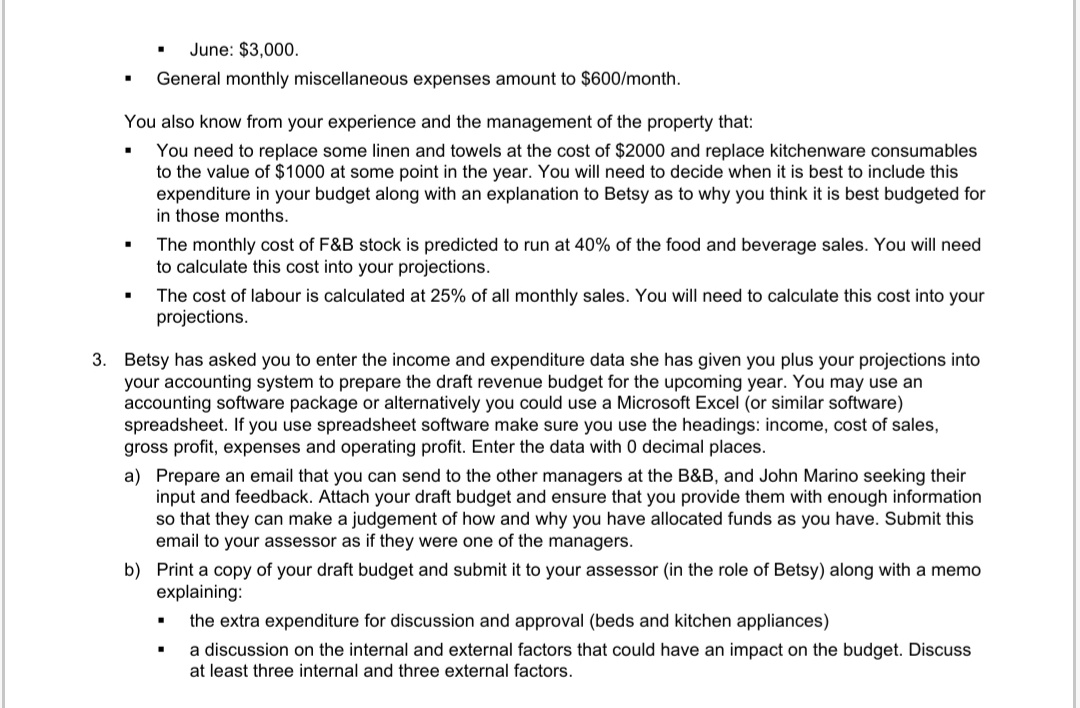

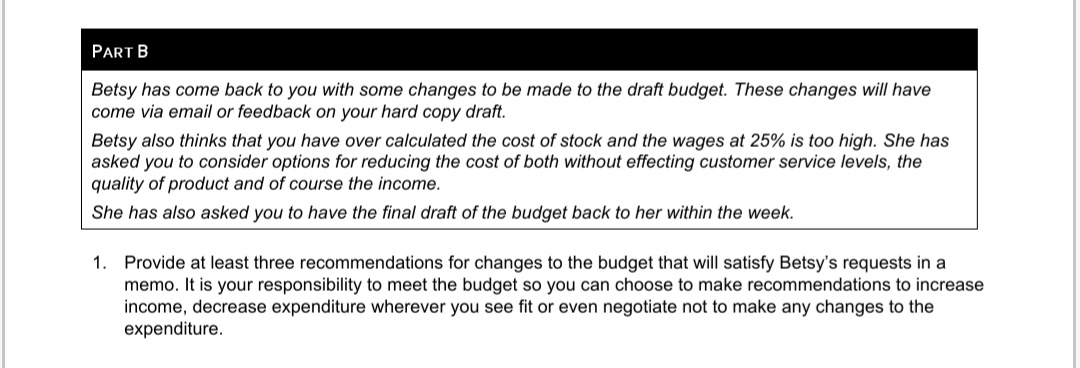

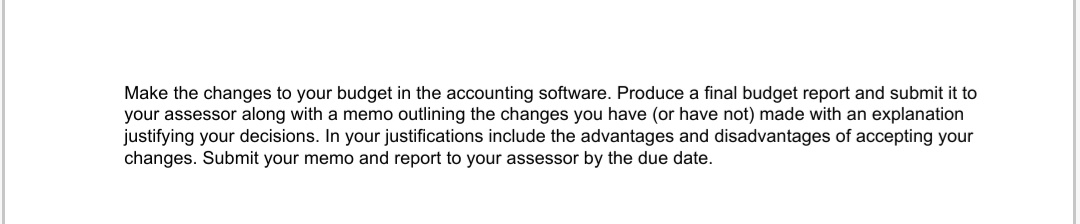

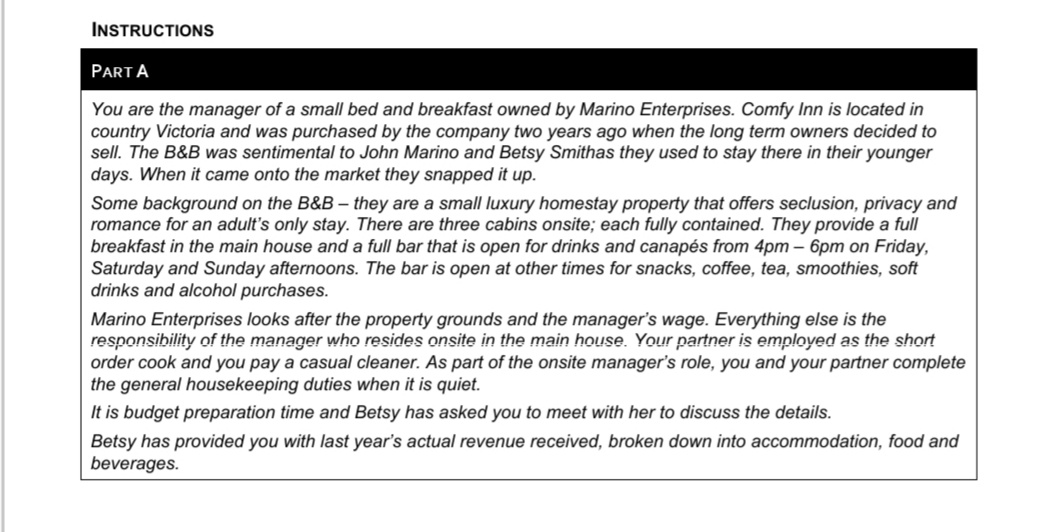

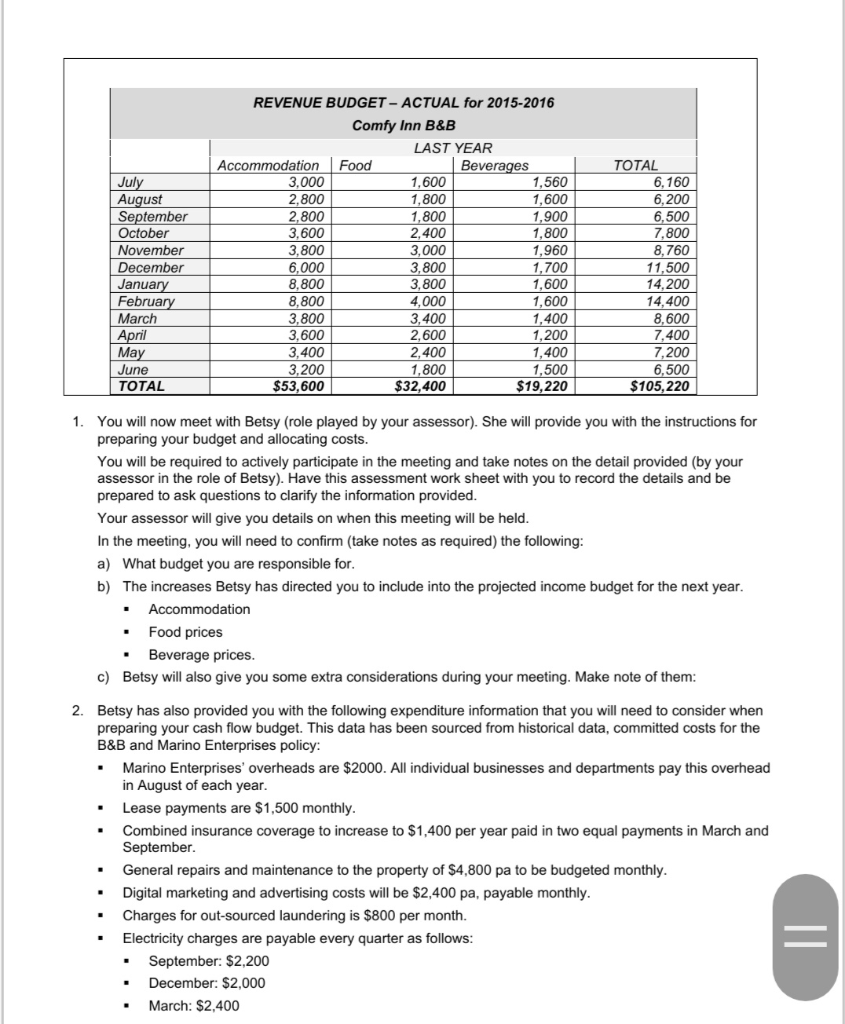

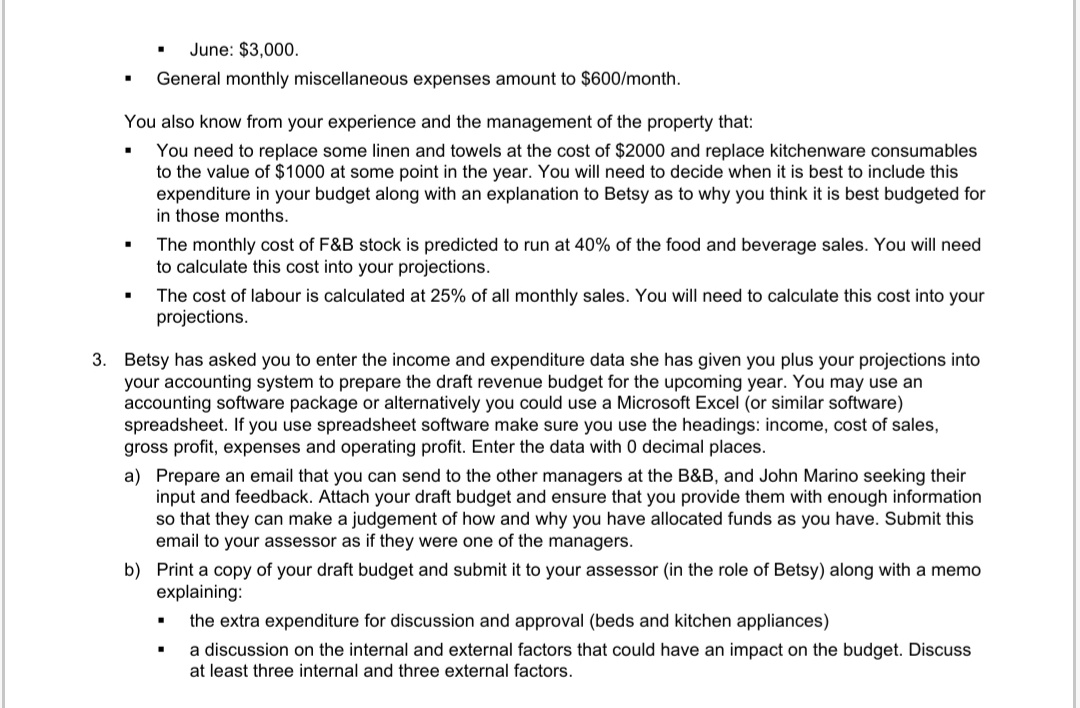

PARTB Betsy has come back to you with some changes to be made to the draft budget. These changes will have come via email or feedback on your hard copy draft. Betsy also thinks that you have over calculated the cost of stock and the wages at 25% is too high. She has asked you to consider options for reducing the cost of both without effecting customer service levels, the quality of product and of course the income. She has also asked you to have the final draft of the budget back to her within the week. 1. Provide at least three recommendations for changes to the budget that will satisfy Betsy's requests in a memo. It is your responsibility to meet the budget so you can choose to make recommendations to increase income, decrease expenditure wherever you see fit or even negotiate not to make any changes to the expenditure. Make the changes to your budget in the accounting software. Produce a final budget report and submit it to your assessor along with a memo outlining the changes you have (or have not) made with an explanation justifying your decisions. In your justifications include the advantages and disadvantages of accepting your changes. Submit your memo and report to your assessor by the due date. INSTRUCTIONS PARTA You are the manager of a small bed and breakfast owned by Marino Enterprises. Comfy Inn is located in country Victoria and was purchased by the company two years ago when the long term owners decided to sell. The B&B was sentimental to John Marino and Betsy Smithas they used to stay there in their younger days. When it came onto the market they snapped it up. Some background on the B&B - they are a small luxury homestay property that offers seclusion, privacy and romance for an adult's only stay. There are three cabins onsite; each fully contained. They provide a full breakfast in the main house and a full bar that is open for drinks and canaps from 4pm 6pm on Friday, Saturday and Sunday afternoons. The bar is open at other times for snacks, coffee, tea, smoothies, soft drinks and alcohol purchases. Marino Enterprises looks after the property grounds and the manager's wage. Everything else is the responsibility of the manager who resides onsite in the main house. Your partner is employed as the short order cook and you pay a casual cleaner. As part of the onsite manager's role, you and your partner complete the general housekeeping duties when it is quiet. It is budget preparation time and Betsy has asked you to meet with her to discuss the details. Betsy has provided you with last year's actual revenue received, broken down into accommodation, food and beverages. July August September October November December January February March April REVENUE BUDGET - ACTUAL for 2015-2016 Comfy Inn B&B LAST YEAR Accommodation Food Beverages 3.000 1,600 1,560 2.800 1,800 1,600 2,800 1,800 1,900 3,600 2,400 1.800 3,800 3.000 1,960 6,000 3,800 1,700 8,800 3,800 1,600 8,800 4,000 1,600 3,800 3,400 1,400 3,600 2,600 1,200 3,400 2,400 1,400 3,200 1,800 1,500 $53,600 $32,400 $19, 220 TOTAL 6,160 6,200 6,500 7,800 8,760 11,500 14,200 14.400 8,600 7,400 7,200 6,500 $105,220 May June TOTAL 1. You will now meet with Betsy (role played by your assessor). She will provide you with the instructions for preparing your budget and allocating costs. You will be required to actively participate in the eting and take notes on the detail provided (by your assessor in the role of Betsy). Have this assessment work sheet with you to record the details and be prepared to ask questions to clarify the information provided. Your assessor will give you details on when this meeting will be held. In the meeting, you will need to confirm (take notes as required) the following: a) What budget you are responsible for. b) The increases Betsy has directed you to include into the projected income budget for the next year. Accommodation Food prices Beverage prices. c) Betsy will also give you some extra considerations during your meeting. Make note of them: . . . 2. Betsy has also provided you with the following expenditure information that you will need to consider when preparing your cash flow budget. This data has been sourced from historical data, committed costs for the B&B and Marino Enterprises policy: Marino Enterprises' overheads are $2000. All individual businesses and departments pay this overhead in August of each year. Lease payments are $1,500 monthly. Combined insurance coverage to increase to $1,400 per year paid in two equal payments in March and September General repairs and maintenance to the property of $4,800 pa to be budgeted monthly. Digital marketing and advertising costs will be $2,400 pa, payable monthly. Charges for out-sourced laundering is $800 per month. Electricity charges are payable every quarter as follows: September: $2,200 December: $2,000 March: $2,400 = . . June: $3,000. General monthly miscellaneous expenses amount to $600/month. You also know from your experience and the management of the property that: You need to replace some linen and towels at the cost of $2000 and replace kitchenware consumables to the value of $1000 at some point in the year. You will need to decide when it is best to include this expenditure in your budget along with an explanation to Betsy as to why you think it is best budgeted for in those months. The monthly cost of F&B stock is predicted to run at 40% of the food and beverage sales. You will need to calculate this cost into your projections. The cost of labour is calculated at 25% of all monthly sales. You will need to calculate this cost into your projections. 3. Betsy has asked you to enter the income and expenditure data she has given you plus your projections into your accounting system to prepare the draft revenue budget for the upcoming year. You may use an accounting software package or alternatively you could use a Microsoft Excel (or similar software) spreadsheet. If you use spreadsheet software make sure you use the headings: income, cost of sales, gross profit, expenses and operating profit. Enter the data with 0 decimal places. a) Prepare an email that you can send to the other managers at the B&B, and John Marino seeking their input and feedback. Attach your draft budget and ensure that you provide them with enough information so that they can make a judgement of how and why you have allocated funds as you have. Submit this email to your assessor as if they were one of the managers. b) Print a copy of your draft budget and submit it to your assessor (in the role of Betsy) along with a memo explaining: the extra expenditure for discussion and approval (beds and kitchen appliances) a discussion on the internal and external factors that could have an impact on the budget. Discuss at least three internal and three external factors. . PARTB Betsy has come back to you with some changes to be made to the draft budget. These changes will have come via email or feedback on your hard copy draft. Betsy also thinks that you have over calculated the cost of stock and the wages at 25% is too high. She has asked you to consider options for reducing the cost of both without effecting customer service levels, the quality of product and of course the income. She has also asked you to have the final draft of the budget back to her within the week. 1. Provide at least three recommendations for changes to the budget that will satisfy Betsy's requests in a memo. It is your responsibility to meet the budget so you can choose to make recommendations to increase income, decrease expenditure wherever you see fit or even negotiate not to make any changes to the expenditure. Make the changes to your budget in the accounting software. Produce a final budget report and submit it to your assessor along with a memo outlining the changes you have (or have not) made with an explanation justifying your decisions. In your justifications include the advantages and disadvantages of accepting your changes. Submit your memo and report to your assessor by the due date. INSTRUCTIONS PARTA You are the manager of a small bed and breakfast owned by Marino Enterprises. Comfy Inn is located in country Victoria and was purchased by the company two years ago when the long term owners decided to sell. The B&B was sentimental to John Marino and Betsy Smithas they used to stay there in their younger days. When it came onto the market they snapped it up. Some background on the B&B - they are a small luxury homestay property that offers seclusion, privacy and romance for an adult's only stay. There are three cabins onsite; each fully contained. They provide a full breakfast in the main house and a full bar that is open for drinks and canaps from 4pm 6pm on Friday, Saturday and Sunday afternoons. The bar is open at other times for snacks, coffee, tea, smoothies, soft drinks and alcohol purchases. Marino Enterprises looks after the property grounds and the manager's wage. Everything else is the responsibility of the manager who resides onsite in the main house. Your partner is employed as the short order cook and you pay a casual cleaner. As part of the onsite manager's role, you and your partner complete the general housekeeping duties when it is quiet. It is budget preparation time and Betsy has asked you to meet with her to discuss the details. Betsy has provided you with last year's actual revenue received, broken down into accommodation, food and beverages. July August September October November December January February March April REVENUE BUDGET - ACTUAL for 2015-2016 Comfy Inn B&B LAST YEAR Accommodation Food Beverages 3.000 1,600 1,560 2.800 1,800 1,600 2,800 1,800 1,900 3,600 2,400 1.800 3,800 3.000 1,960 6,000 3,800 1,700 8,800 3,800 1,600 8,800 4,000 1,600 3,800 3,400 1,400 3,600 2,600 1,200 3,400 2,400 1,400 3,200 1,800 1,500 $53,600 $32,400 $19, 220 TOTAL 6,160 6,200 6,500 7,800 8,760 11,500 14,200 14.400 8,600 7,400 7,200 6,500 $105,220 May June TOTAL 1. You will now meet with Betsy (role played by your assessor). She will provide you with the instructions for preparing your budget and allocating costs. You will be required to actively participate in the eting and take notes on the detail provided (by your assessor in the role of Betsy). Have this assessment work sheet with you to record the details and be prepared to ask questions to clarify the information provided. Your assessor will give you details on when this meeting will be held. In the meeting, you will need to confirm (take notes as required) the following: a) What budget you are responsible for. b) The increases Betsy has directed you to include into the projected income budget for the next year. Accommodation Food prices Beverage prices. c) Betsy will also give you some extra considerations during your meeting. Make note of them: . . . 2. Betsy has also provided you with the following expenditure information that you will need to consider when preparing your cash flow budget. This data has been sourced from historical data, committed costs for the B&B and Marino Enterprises policy: Marino Enterprises' overheads are $2000. All individual businesses and departments pay this overhead in August of each year. Lease payments are $1,500 monthly. Combined insurance coverage to increase to $1,400 per year paid in two equal payments in March and September General repairs and maintenance to the property of $4,800 pa to be budgeted monthly. Digital marketing and advertising costs will be $2,400 pa, payable monthly. Charges for out-sourced laundering is $800 per month. Electricity charges are payable every quarter as follows: September: $2,200 December: $2,000 March: $2,400 = . . June: $3,000. General monthly miscellaneous expenses amount to $600/month. You also know from your experience and the management of the property that: You need to replace some linen and towels at the cost of $2000 and replace kitchenware consumables to the value of $1000 at some point in the year. You will need to decide when it is best to include this expenditure in your budget along with an explanation to Betsy as to why you think it is best budgeted for in those months. The monthly cost of F&B stock is predicted to run at 40% of the food and beverage sales. You will need to calculate this cost into your projections. The cost of labour is calculated at 25% of all monthly sales. You will need to calculate this cost into your projections. 3. Betsy has asked you to enter the income and expenditure data she has given you plus your projections into your accounting system to prepare the draft revenue budget for the upcoming year. You may use an accounting software package or alternatively you could use a Microsoft Excel (or similar software) spreadsheet. If you use spreadsheet software make sure you use the headings: income, cost of sales, gross profit, expenses and operating profit. Enter the data with 0 decimal places. a) Prepare an email that you can send to the other managers at the B&B, and John Marino seeking their input and feedback. Attach your draft budget and ensure that you provide them with enough information so that they can make a judgement of how and why you have allocated funds as you have. Submit this email to your assessor as if they were one of the managers. b) Print a copy of your draft budget and submit it to your assessor (in the role of Betsy) along with a memo explaining: the extra expenditure for discussion and approval (beds and kitchen appliances) a discussion on the internal and external factors that could have an impact on the budget. Discuss at least three internal and three external factors

Please start from part A. First two images are of part B.

Please start from part A. First two images are of part B.