Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please step by step process Question 2 a) According to Damodatan (2002), valuation of a business is not an objective exercise, and any preconceptions and

please step by step process

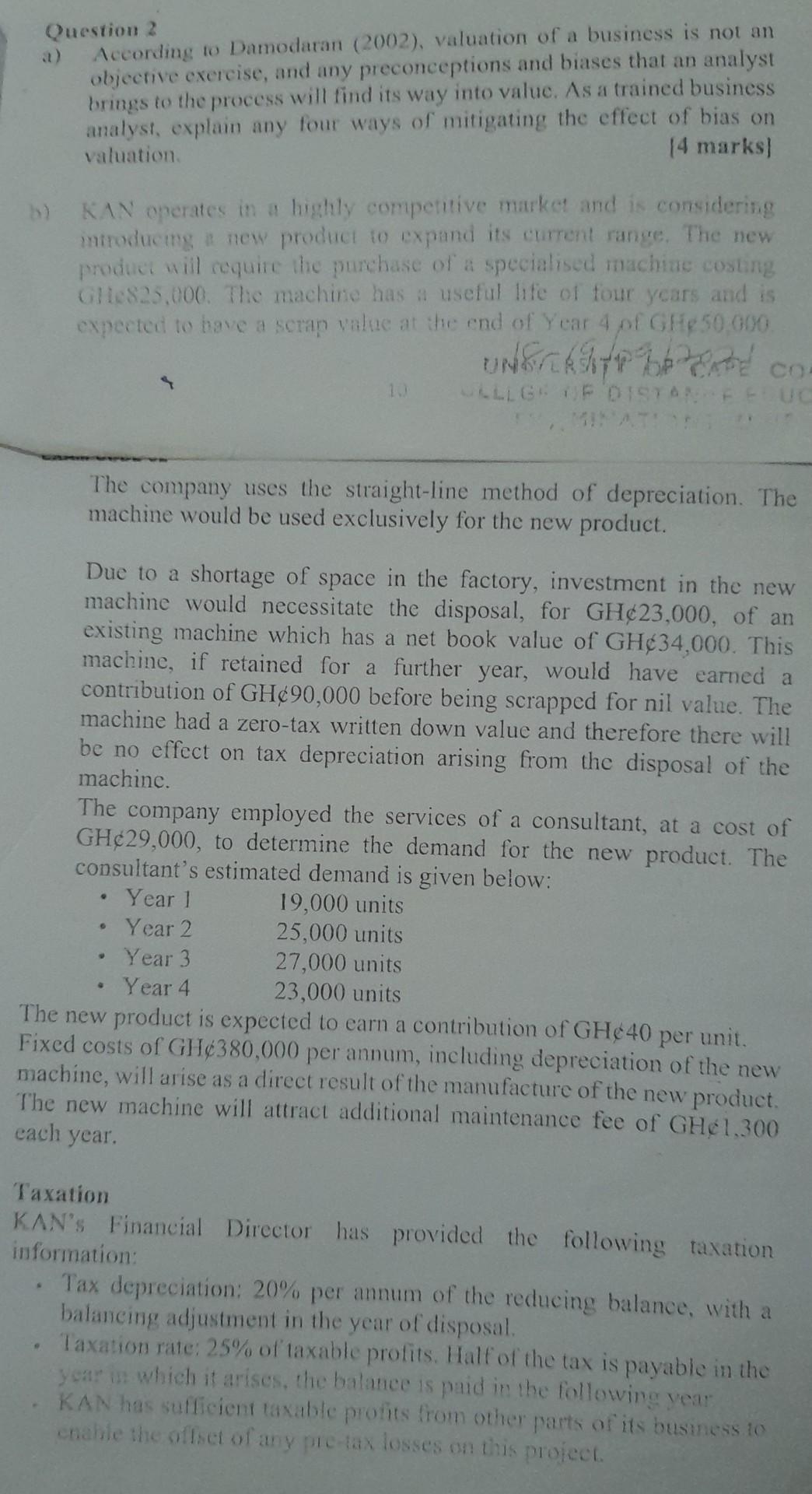

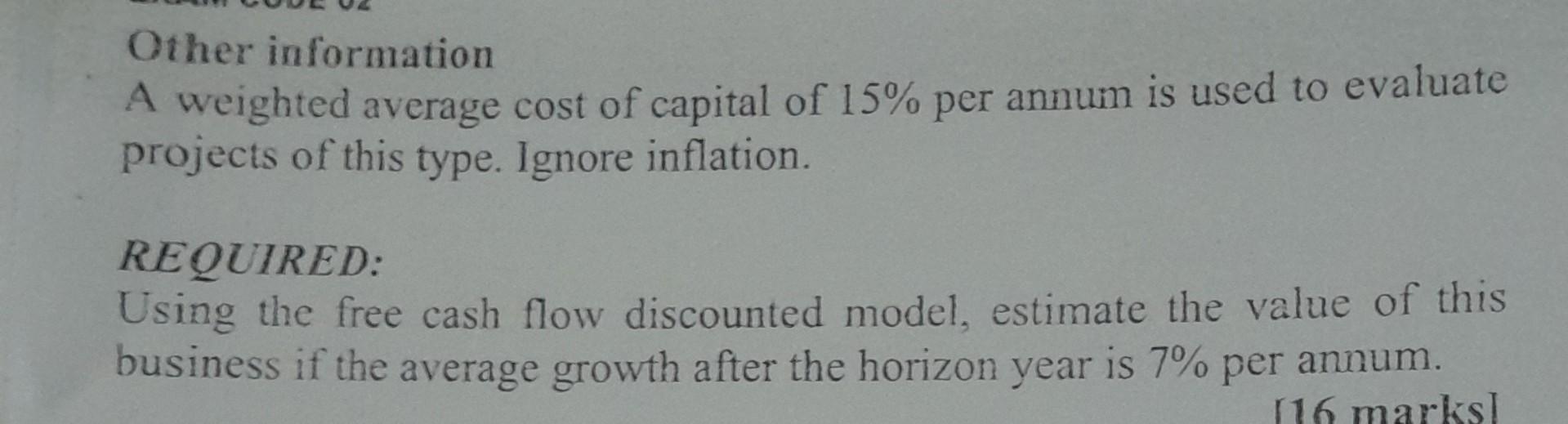

Question 2 a) According to Damodatan (2002), valuation of a business is not an objective exercise, and any preconceptions and biases that an analyst brings to the process will find its way into value. As a trained business analyst, explain any four ways of mitigating the effect of bias on valuation. [4 marks] b) KAN operates in a highly competitive market and is considering imtroducing an new product to expand its current range. The new product will require the purchase of a specialised machize costing GHe825,000. The machine has a useful life of four years and is expected to have a scrap value at the end of Year 4 of GHe 50,000 The company uses the straight-line method of depreciation. The machine would be used exclusively for the new product. Due to a shortage of space in the factory, investment in the new machine would necessitate the disposal, for GH\&23,000, of an existing machine which has a net book value of GH\&34,000. This machine, if retained for a further year, would have earned a contribution of GH\&90,000 before being scrapped for nil value. The machine had a zero-tax written down value and therefore there will be no effect on tax depreciation arising from the disposal of the machine. The company employed the services of a consultant, at a cost of GHc29,000, to determine the demand for the new product. The consultant's estimated demand is given below: The new product is expected to earn a contribution of GHe40 per unit. Fixed costs of GHc380,000 per annum, including depreciation of the new machine, will arise as a direct result of the manufacture of the new product. The new machine will attract additional maintenance fee of GHel,300 each year. Taxation KAN's Financial Director has provided the following taxation information: - Tax depreciation: 20\% per annum of the reducing balance, with a balancing adjustment in the year of disposal. - Taxation rate: 25% of taxable prolits. Half of the tax is payable in the year in which it arises, the balance is paid in the following year - KAN has sufficient taxable profits from other parts of its buseness to chable the officet of any pretax losses on this project. Other information A weighted average cost of capital of 15% per annum is used to evaluate projects of this type. Ignore inflation. REQUIRED: Using the free cash flow discounted model, estimate the value of this business if the average growth after the horizon year is 7% per annum. Question 2 a) According to Damodatan (2002), valuation of a business is not an objective exercise, and any preconceptions and biases that an analyst brings to the process will find its way into value. As a trained business analyst, explain any four ways of mitigating the effect of bias on valuation. [4 marks] b) KAN operates in a highly competitive market and is considering imtroducing an new product to expand its current range. The new product will require the purchase of a specialised machize costing GHe825,000. The machine has a useful life of four years and is expected to have a scrap value at the end of Year 4 of GHe 50,000 The company uses the straight-line method of depreciation. The machine would be used exclusively for the new product. Due to a shortage of space in the factory, investment in the new machine would necessitate the disposal, for GH\&23,000, of an existing machine which has a net book value of GH\&34,000. This machine, if retained for a further year, would have earned a contribution of GH\&90,000 before being scrapped for nil value. The machine had a zero-tax written down value and therefore there will be no effect on tax depreciation arising from the disposal of the machine. The company employed the services of a consultant, at a cost of GHc29,000, to determine the demand for the new product. The consultant's estimated demand is given below: The new product is expected to earn a contribution of GHe40 per unit. Fixed costs of GHc380,000 per annum, including depreciation of the new machine, will arise as a direct result of the manufacture of the new product. The new machine will attract additional maintenance fee of GHel,300 each year. Taxation KAN's Financial Director has provided the following taxation information: - Tax depreciation: 20\% per annum of the reducing balance, with a balancing adjustment in the year of disposal. - Taxation rate: 25% of taxable prolits. Half of the tax is payable in the year in which it arises, the balance is paid in the following year - KAN has sufficient taxable profits from other parts of its buseness to chable the officet of any pretax losses on this project. Other information A weighted average cost of capital of 15% per annum is used to evaluate projects of this type. Ignore inflation. REQUIRED: Using the free cash flow discounted model, estimate the value of this business if the average growth after the horizon year is 7% per annumStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started