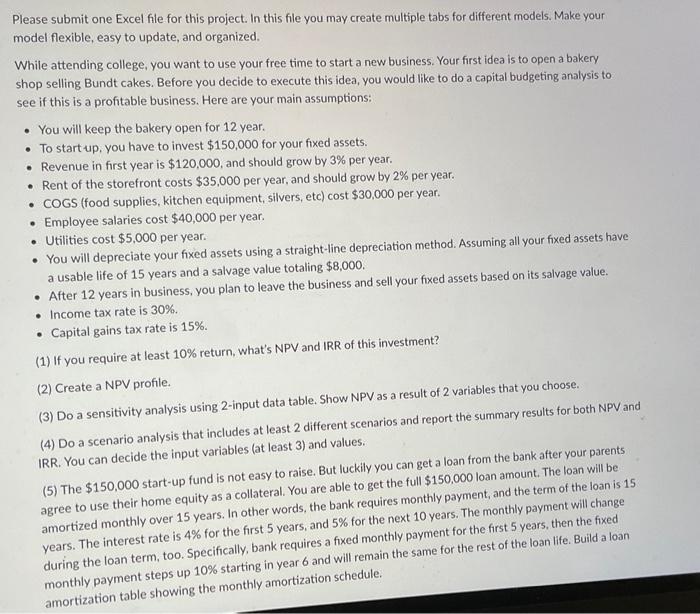

Please submit one Excel file for this project. In this file you may create multiple tabs for different models. Make your model flexible, easy to update, and organized. While attending college, you want to use your free time to start a new business. Your first idea is to open a bakery shop selling Bundt cakes. Before you decide to execute this idea, you would like to do a capital budgeting analysis to see if this is a profitable business. Here are your main assumptions: - You will keep the bakery open for 12 year. - To start up, you have to invest $150,000 for your fixed assets. - Revenue in first year is $120,000, and should grow by 3% per year. - Rent of the storefront costs $35,000 per year, and should grow by 2% per year. - COGS (food supplies, kitchen equipment, silvers, etc) cost $30,000 per year. - Employee salaries cost $40,000 per year. - Utilities cost $5,000 per year. - You will depreciate your fixed assets using a straight-line depreciation method. Assuming all your fixed assets have a usable life of 15 years and a salvage value totaling $8,000. - After 12 years in business, you plan to leave the business and sell your fixed assets based on its salvage value. - Income tax rate is 30%. - Capital gains tax rate is 15%. (1) If you require at least 10% return, what's NPV and IRR of this investment? (2) Create a NPV profile. (3) Do a sensitivity analysis using 2-input data table. Show NPV as a result of 2 variables that you choose. (4) Do a scenario analysis that includes at least 2 different scenarios and report the summary results for both NPV and IRR. You can decide the input variables (at least 3 ) and values. (5) The $150,000 start-up fund is not easy to raise. But luckily you can get a loan from the bank after your parents agree to use their home equity as a collateral. You are able to get the full $150,000 loan amount. The loan will be amortized monthly over 15 years. In other words, the bank requires monthly payment, and the term of the loan is 15 years. The interest rate is 4% for the first 5 years, and 5% for the next 10 years. The monthly payment will change during the loan term, too. Specifically, bank requires a fixed monthly payment for the first 5 years, then the fixed monthly payment steps up 10% starting in year 6 and will remain the same for the rest of the loan life. Build a loan amortization table showing the monthly amortization schedule. Please submit one Excel file for this project. In this file you may create multiple tabs for different models. Make your model flexible, easy to update, and organized. While attending college, you want to use your free time to start a new business. Your first idea is to open a bakery shop selling Bundt cakes. Before you decide to execute this idea, you would like to do a capital budgeting analysis to see if this is a profitable business. Here are your main assumptions: - You will keep the bakery open for 12 year. - To start up, you have to invest $150,000 for your fixed assets. - Revenue in first year is $120,000, and should grow by 3% per year. - Rent of the storefront costs $35,000 per year, and should grow by 2% per year. - COGS (food supplies, kitchen equipment, silvers, etc) cost $30,000 per year. - Employee salaries cost $40,000 per year. - Utilities cost $5,000 per year. - You will depreciate your fixed assets using a straight-line depreciation method. Assuming all your fixed assets have a usable life of 15 years and a salvage value totaling $8,000. - After 12 years in business, you plan to leave the business and sell your fixed assets based on its salvage value. - Income tax rate is 30%. - Capital gains tax rate is 15%. (1) If you require at least 10% return, what's NPV and IRR of this investment? (2) Create a NPV profile. (3) Do a sensitivity analysis using 2-input data table. Show NPV as a result of 2 variables that you choose. (4) Do a scenario analysis that includes at least 2 different scenarios and report the summary results for both NPV and IRR. You can decide the input variables (at least 3 ) and values. (5) The $150,000 start-up fund is not easy to raise. But luckily you can get a loan from the bank after your parents agree to use their home equity as a collateral. You are able to get the full $150,000 loan amount. The loan will be amortized monthly over 15 years. In other words, the bank requires monthly payment, and the term of the loan is 15 years. The interest rate is 4% for the first 5 years, and 5% for the next 10 years. The monthly payment will change during the loan term, too. Specifically, bank requires a fixed monthly payment for the first 5 years, then the fixed monthly payment steps up 10% starting in year 6 and will remain the same for the rest of the loan life. Build a loan amortization table showing the monthly amortization schedule