PLEASE TAKE THE TIME TO COMPLETE ALL FIVE PARTS (A-E).

FEEL FREE TO COMMENT WITH ANY QUESTIONS, I AM HERE TO ASSIST YOU.

THANK YOU AND GOD BLESS.

(Below are each picture in a separate screenshot ot better help you, if needed)

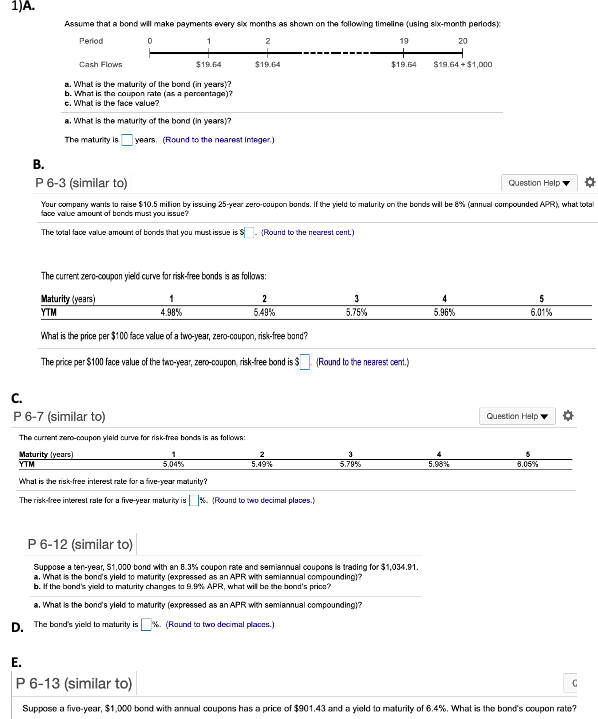

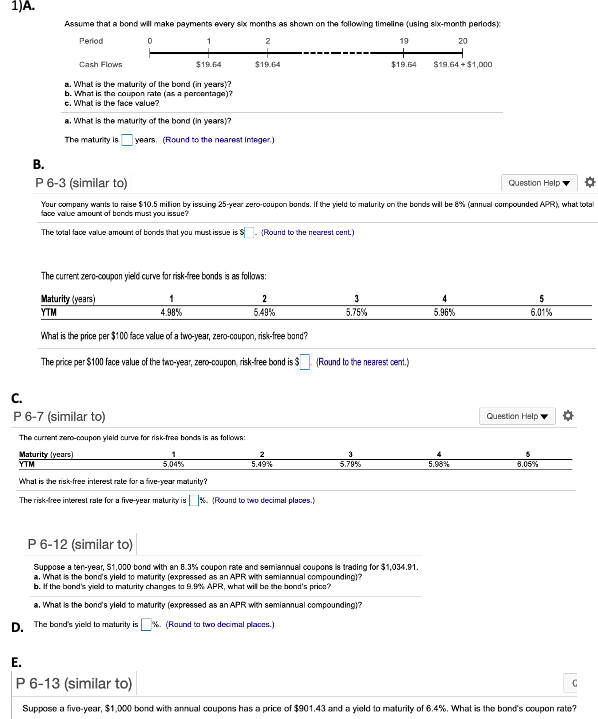

A)

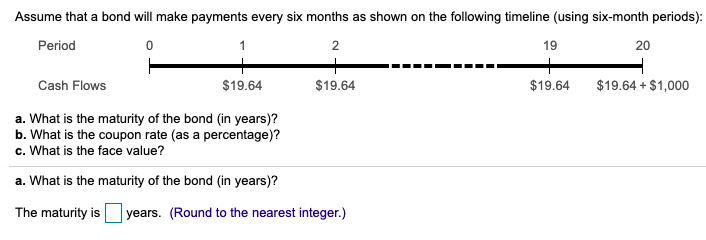

B)

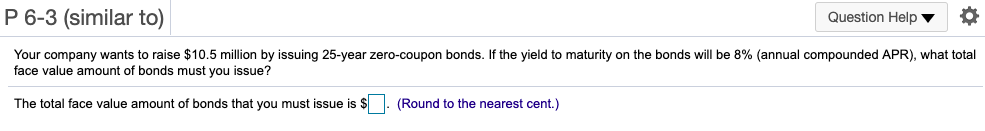

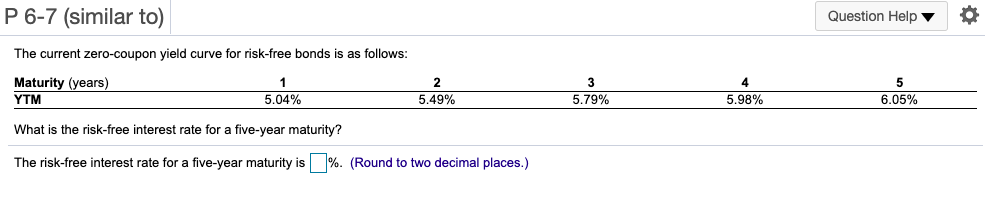

C)

C)

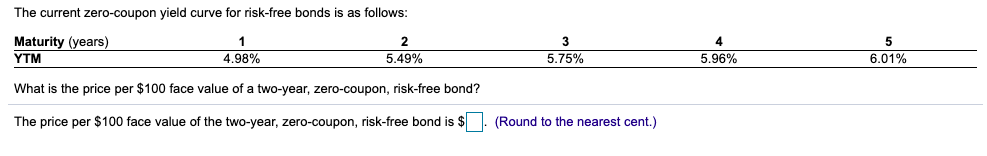

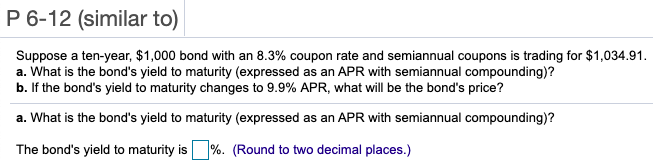

D)

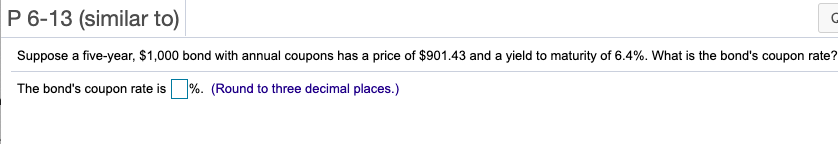

E)

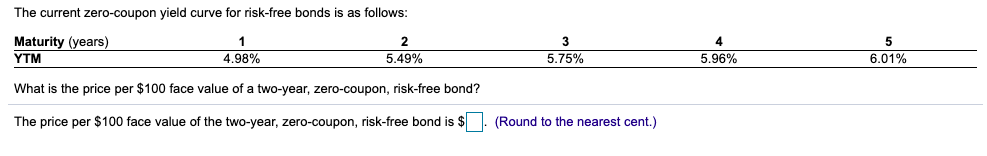

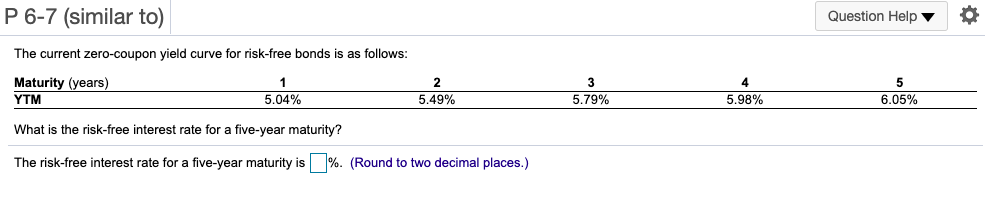

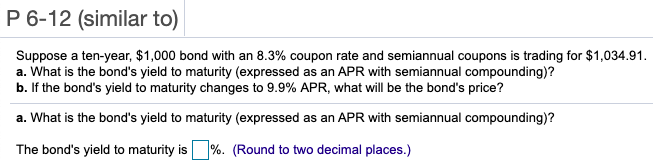

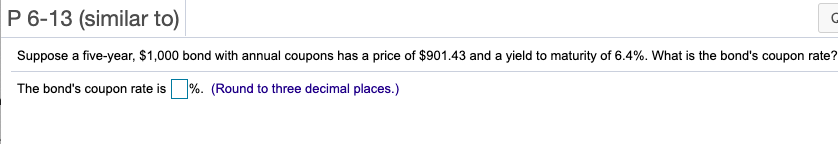

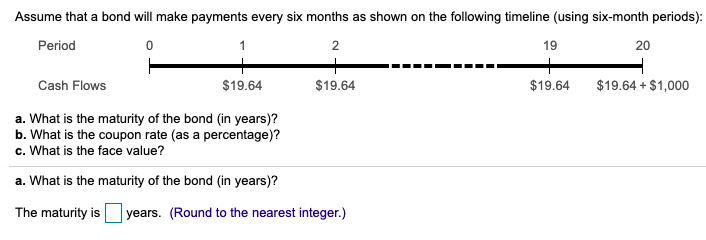

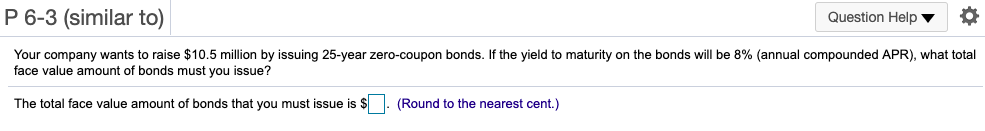

1)A. Assume that a bond will make payments every six months as shown on the following timeline (using six- month periods Period 0 2 19 20 Cash Flows $19.64 $19.64 $19.64 $19.64 +$1,000 a. What is the maturity of the bond (in years? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years, (Round to the nearest Integer) B. P 6-3 (similar to) Question Help Your company wants to raise $10.5 milion by issuing 25-year zero-coupon bonds. If the yield to maturity on the bonds will be 8% (annual compounded APR), what total face value amount of bords must you issue? The total face value amount of bonds that you must issue iss (Round to the nearest cent) o The current zero-coupon yield curve for risk-free bonds is as follows: Maturity (years) YTM 1 4.98% 2 5.49% 3 5.75% 6.96% 5 6.01% What is the price per $100 face value of a two-year, zero-caupon, risk-free band? The price per $100 face value of the two-year, zero-coupon, risk-free bond is {Round to the nearest cent.) C. P 6-7 (similar to) Question Help is as follow The current-coupon yield curve for risk-fran ho Maturity Iyears) 1 5.04% 2 YTM 5.19% 5/995 5.98% 8.05% What is the risk-free interest rate for a five-year maturity? The risk-free interest rate for a five-year maturity is X. {Round to two decimal places.) P 6-12 (similar to) Suppose a ter-year, $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.91. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding? b. If the band's yield to maturity charges to 9.9% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding? D. The band's yield to maturity is %. (Raund ta two decimal places.) E. P 6-13 (similar to) C Suppose a five-year, $1,000 bond with annual coupons has a price of $901.43 and a yield to maturity of 6.4%. What is the bond's coupon rate? Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 0 1 2 19 20 Cash Flows $19.64 $19.64 $19.64 $19.64 + $1,000 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) P 6-3 (similar to) Question Help o Your company wants to raise $10.5 million by issuing 25-year zero-coupon bonds. If the yield to maturity on the bonds will be 8% (annual compounded APR), what total face value amount of bonds must you issue? The total face value amount of bonds that you must issue is $ (Round to the nearest cent.) The current zero-coupon yield curve for risk-free bonds is as follows: Maturity (years) YTM 1 4.98% 2 5.49% 3 5.75% 4 5.96% 5 6.01% What is the price per $100 face value of a two-year, zero-coupon, risk-free bond? The price per $100 face value of the two-year, zero-coupon, risk-free bond is $. (Round to the nearest cent.) P 6-7 (similar to) Question Help The current zero-coupon yield curve for risk-free bonds is as follows: Maturity (years) YTM 1 5.04% 2 5.49% 3 5.79% 5 6.05% 5.98% What is the risk-free interest rate for a five-year maturity? The risk-free interest rate for a five-year maturity is %. (Round to two decimal places.) P 6-12 (similar to) Suppose a ten-year, $1,000 bond with an 8.3% coupon rate and semiannual coupons is trading for $1,034.91. a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? b. If the bond's yield to maturity changes to 9.9% APR, what will be the bond's price? a. What is the bond's yield to maturity (expressed as an APR with semiannual compounding)? The bond's yield to maturity is %. (Round to two decimal places.) P 6-13 (similar to) Suppose a five-year, $1,000 bond with annual coupons has a price of $901.43 and a yield to maturity of 6.4%. What is the bond's coupon rate? The bond's coupon rate is %. (Round to three decimal places.)

C)

C)