Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please take your time to answer this question based off the information I provided you in the screenshots. Please pass the question to another expert

Please take your time to answer this question based off the information I provided you in the screenshots. Please pass the question to another expert if you are unable to solve. You guys have been ignoring my questions and leaving them unanswered so please do not do that. Please complete part A-C to the best of your ability for a thumbs up. Thank you!

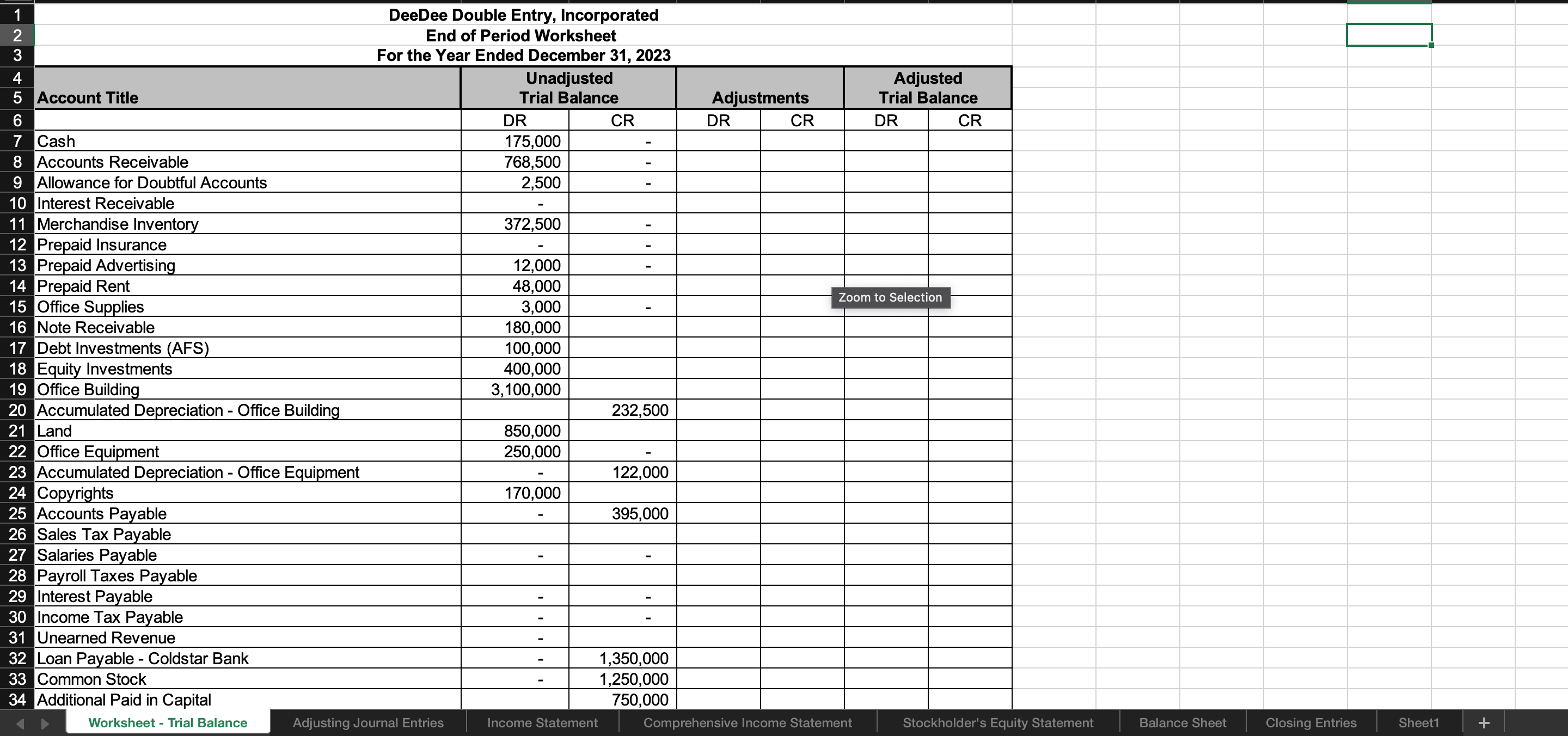

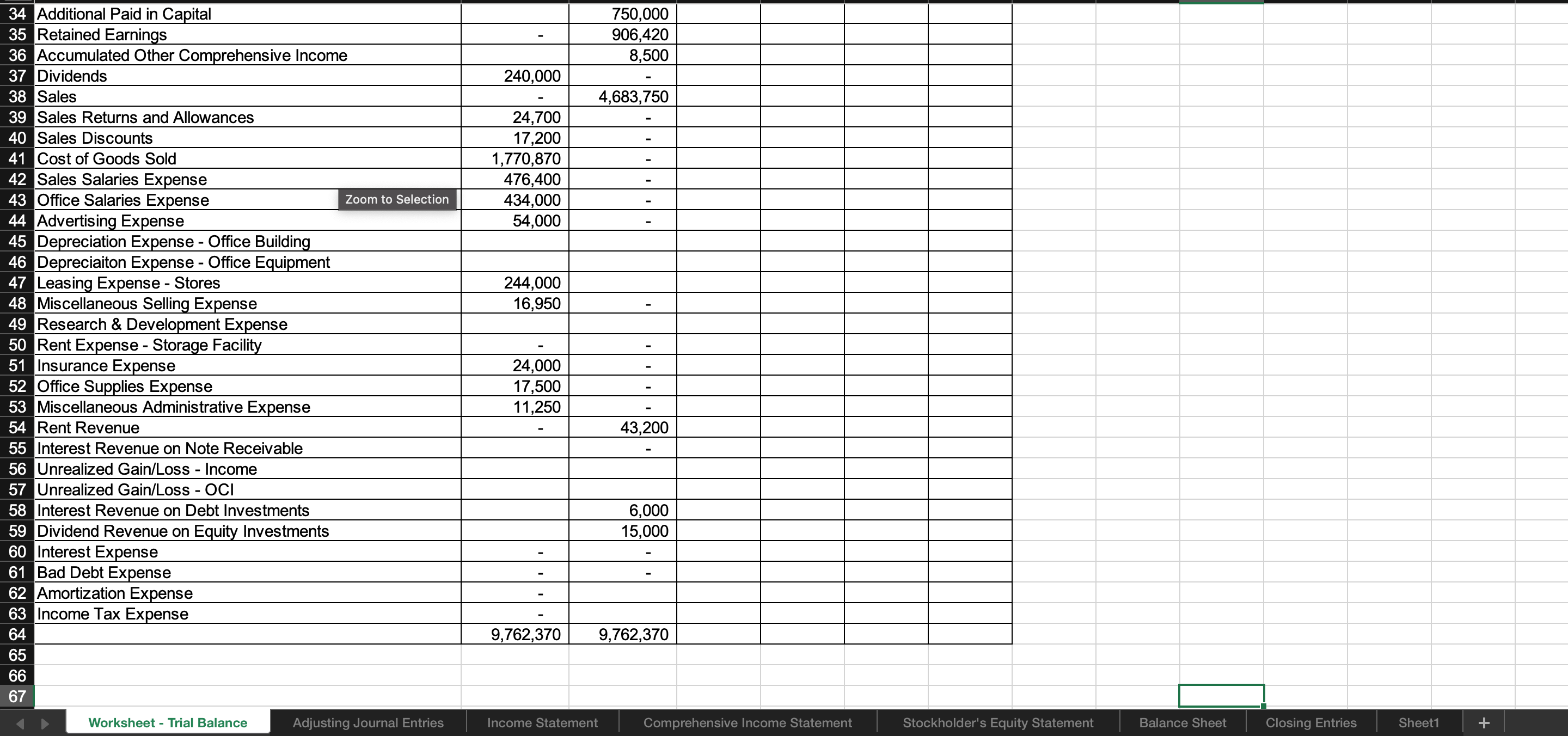

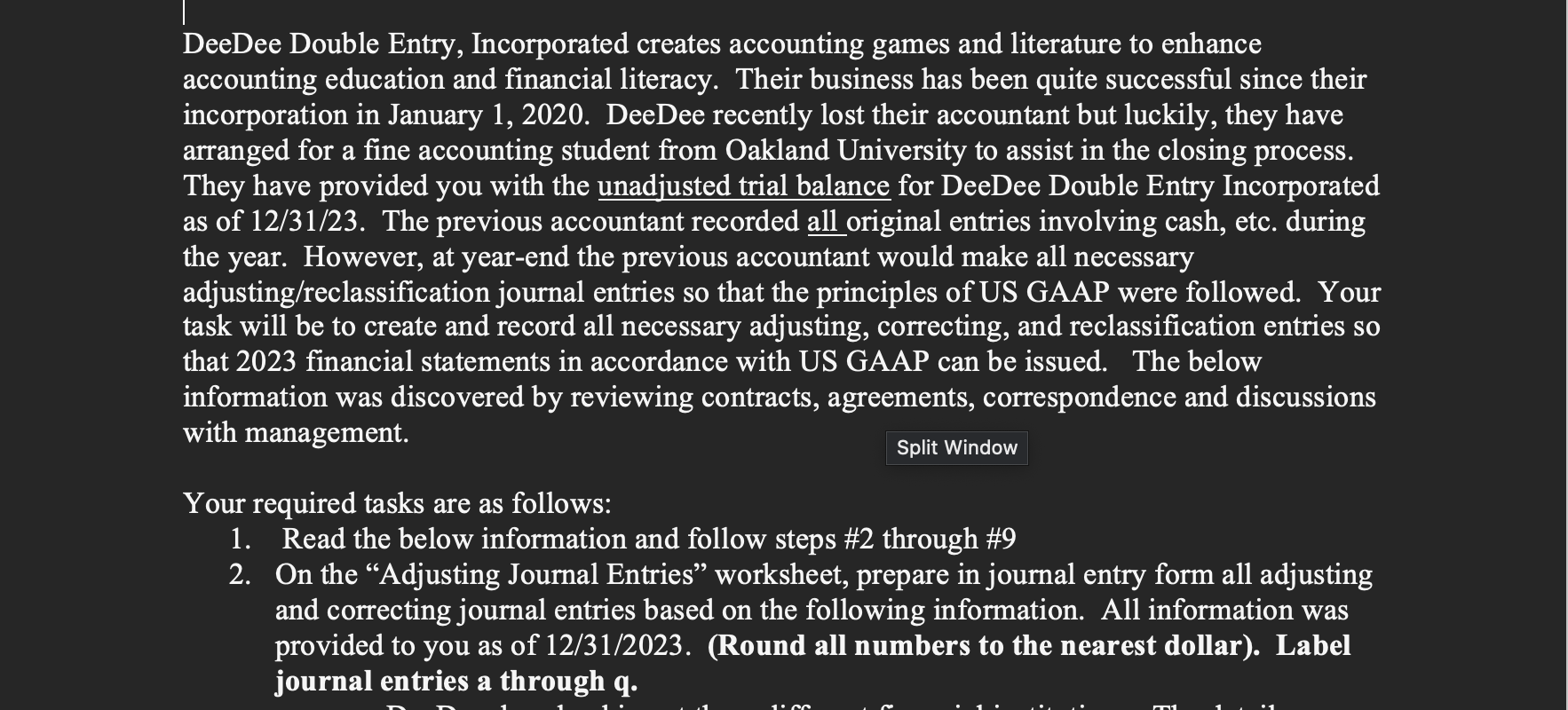

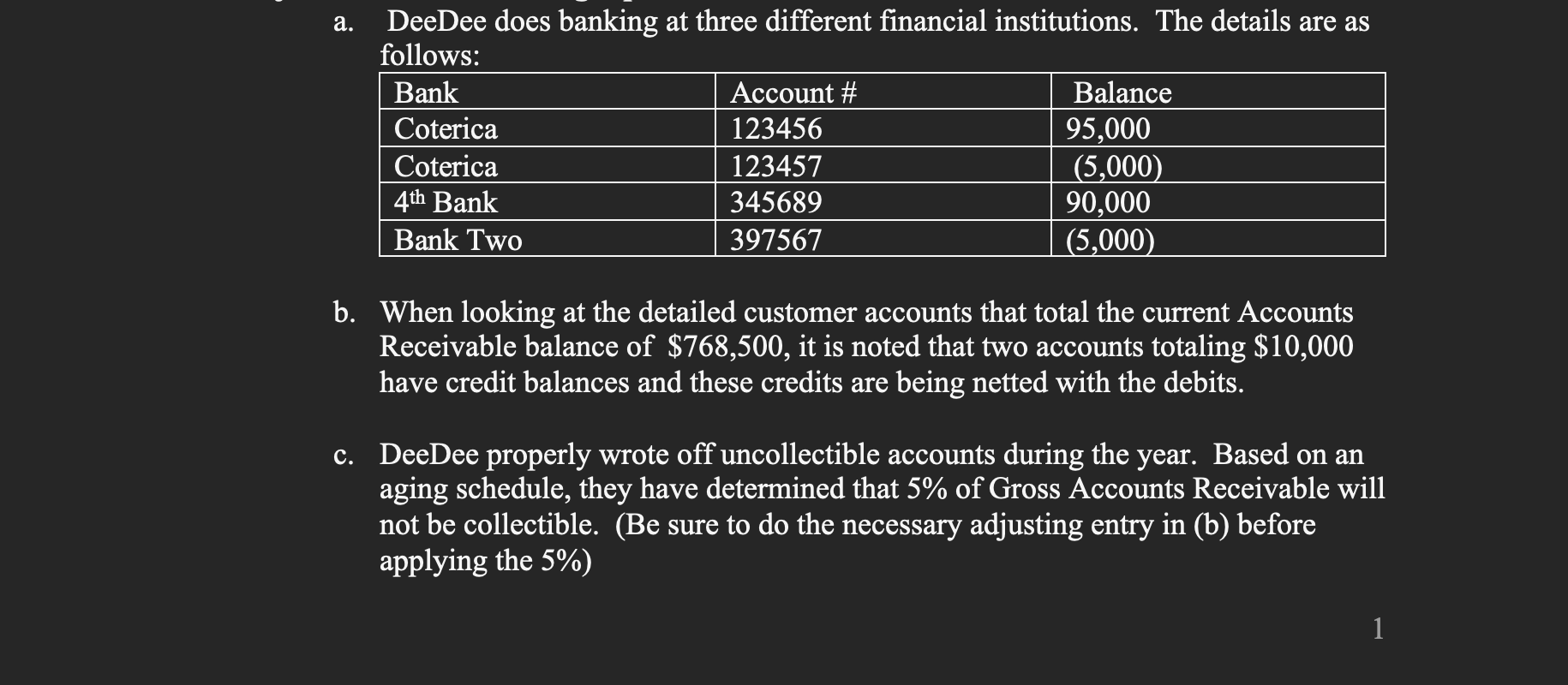

DeeDee Double Entry, Incorporated creates accounting games and literature to enhance accounting education and financial literacy. Their business has been quite successful since their incorporation in January 1, 2020. DeeDee recently lost their accountant but luckily, they have arranged for a fine accounting student from Oakland University to assist in the closing process. They have provided you with the unadjusted trial balance for DeeDee Double Entry Incorporated as of 12/31/23. The previous accountant recorded all original entries involving cash, etc. during the year. However, at year-end the previous accountant would make all necessary adjusting/reclassification journal entries so that the principles of US GAAP were followed. Your task will be to create and record all necessary adjusting, correcting, and reclassification entries so that 2023 financial statements in accordance with US GAAP can be issued. The below information was discovered by reviewing contracts, agreements, correspondence and discussions with management. Your required tasks are as follows: 1. Read the below information and follow steps \#2 through \#9 2. On the "Adjusting Journal Entries" worksheet, prepare in journal entry form all adjusting and correcting journal entries based on the following information. All information was provided to you as of 12/31/2023. (Round all numbers to the nearest dollar). Label journal entries a through q. a. DeeDee does banking at three different financial institutions. The details are as follows: b. When looking at the detailed customer accounts that total the current Accounts Receivable balance of $768,500, it is noted that two accounts totaling $10,000 have credit balances and these credits are being netted with the debits. c. DeeDee properly wrote off uncollectible accounts during the year. Based on an aging schedule, they have determined that 5% of Gross Accounts Receivable will not be collectible. (Be sure to do the necessary adjusting entry in (b) before applying the 5% ) DeeDee Double Entry, Incorporated creates accounting games and literature to enhance accounting education and financial literacy. Their business has been quite successful since their incorporation in January 1, 2020. DeeDee recently lost their accountant but luckily, they have arranged for a fine accounting student from Oakland University to assist in the closing process. They have provided you with the unadjusted trial balance for DeeDee Double Entry Incorporated as of 12/31/23. The previous accountant recorded all original entries involving cash, etc. during the year. However, at year-end the previous accountant would make all necessary adjusting/reclassification journal entries so that the principles of US GAAP were followed. Your task will be to create and record all necessary adjusting, correcting, and reclassification entries so that 2023 financial statements in accordance with US GAAP can be issued. The below information was discovered by reviewing contracts, agreements, correspondence and discussions with management. Your required tasks are as follows: 1. Read the below information and follow steps \#2 through \#9 2. On the "Adjusting Journal Entries" worksheet, prepare in journal entry form all adjusting and correcting journal entries based on the following information. All information was provided to you as of 12/31/2023. (Round all numbers to the nearest dollar). Label journal entries a through q. a. DeeDee does banking at three different financial institutions. The details are as follows: b. When looking at the detailed customer accounts that total the current Accounts Receivable balance of $768,500, it is noted that two accounts totaling $10,000 have credit balances and these credits are being netted with the debits. c. DeeDee properly wrote off uncollectible accounts during the year. Based on an aging schedule, they have determined that 5% of Gross Accounts Receivable will not be collectible. (Be sure to do the necessary adjusting entry in (b) before applying the 5% )Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started