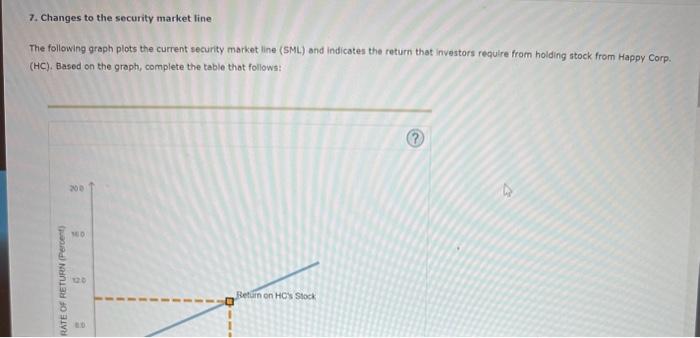

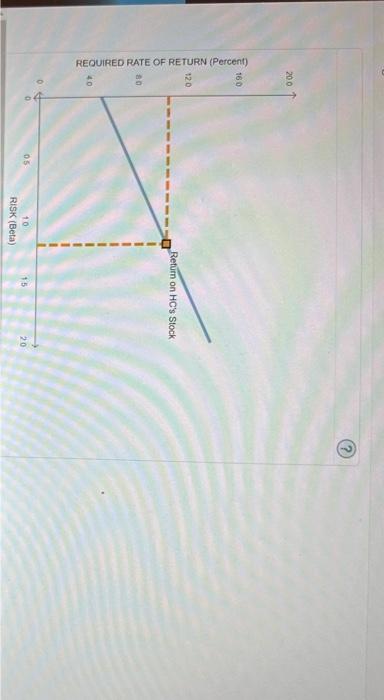

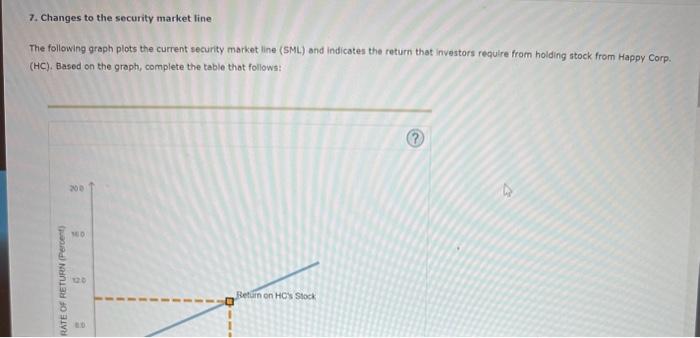

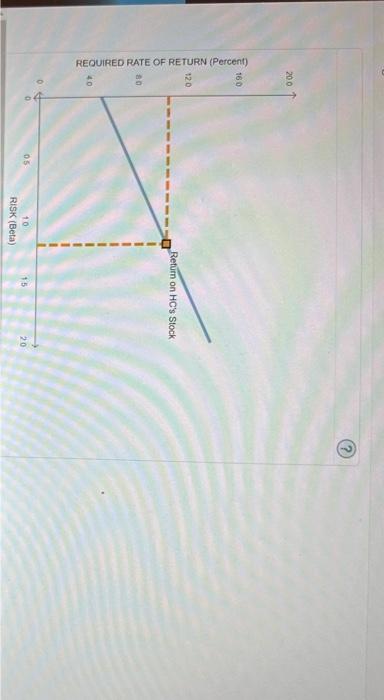

please tell me what exactly to do for 2nd graph

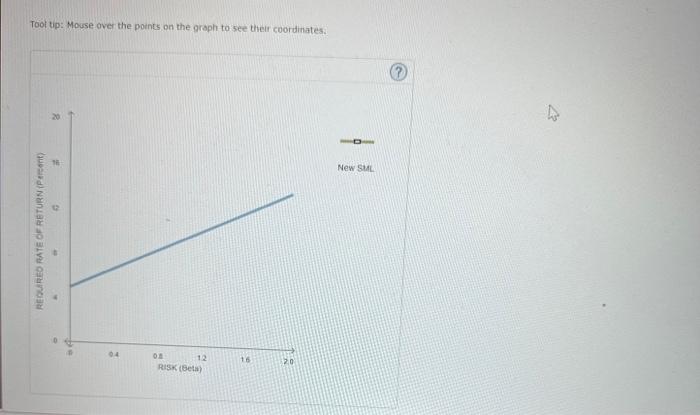

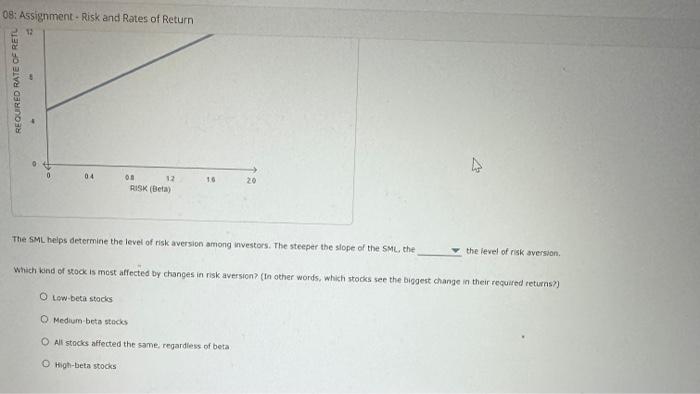

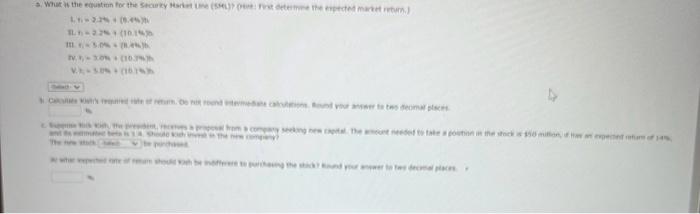

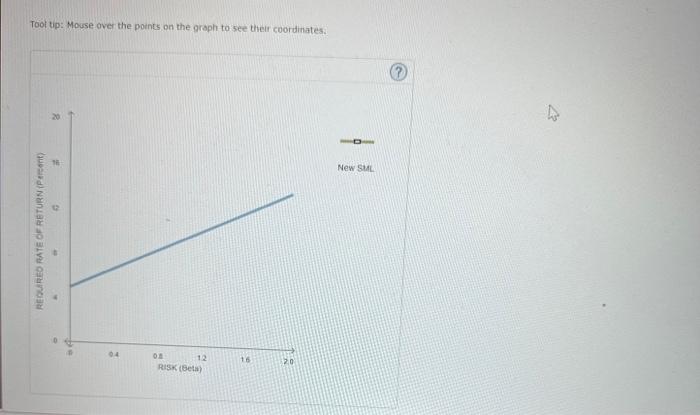

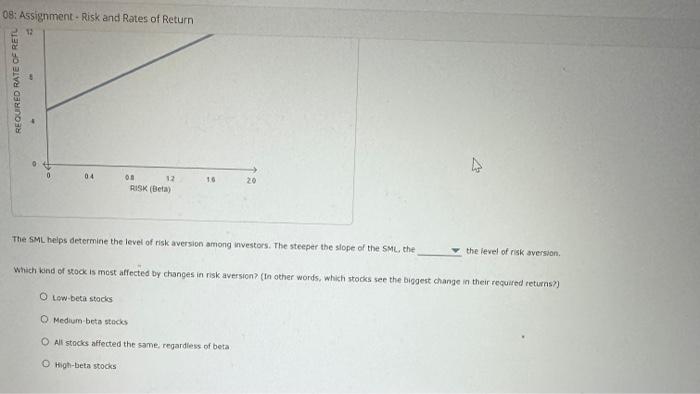

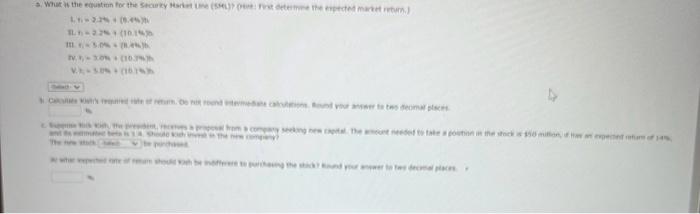

7. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC), Based on the groph, complete the table thot follows: Toof tip: Mouse over the points on the graph to see theif coordinates. 08: A5signment - Risk and Rates of Return The sML helps determine the level of risk aversion among investors. The steeper the slope of the SML, the the ievel of risk sversion. Which kind of rook is most affected by changes in risk aversion? (in other words, which stocks see the biggest change in their required returns?) Low-beta stocis Medium-beta stacks All stacks affected the same, regardiess of beta High-beta stocks 7+n=22t+(1014)n A stock is expected to pay a dlvidend of 50.75 at the end of the year (i.e., D1=$0.75 ), and it should continue to grow at a constant rate of ase a year. If its reauired return is 134, what is the stock's expected price 2 years from today? Do not round intermediate calculations. Round your answer to the nenrest cerit. Avondein Astenhutics hes perpetusl preferred thock outstanding with a par value of $100. The thock pays a quarterfy dividend of 33 , 00 arid is currant price is 5111. B. What is its nominhi annual rete of retum? Do not round intermediate calculations. Round your answer to tho decimal places. b. What in its effective ennuti iste of return? Do not round intermediate calcuiatians, Round your answee to two decmal places. 7. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC), Based on the groph, complete the table thot follows: Toof tip: Mouse over the points on the graph to see theif coordinates. 08: A5signment - Risk and Rates of Return The sML helps determine the level of risk aversion among investors. The steeper the slope of the SML, the the ievel of risk sversion. Which kind of rook is most affected by changes in risk aversion? (in other words, which stocks see the biggest change in their required returns?) Low-beta stocis Medium-beta stacks All stacks affected the same, regardiess of beta High-beta stocks 7+n=22t+(1014)n A stock is expected to pay a dlvidend of 50.75 at the end of the year (i.e., D1=$0.75 ), and it should continue to grow at a constant rate of ase a year. If its reauired return is 134, what is the stock's expected price 2 years from today? Do not round intermediate calculations. Round your answer to the nenrest cerit. Avondein Astenhutics hes perpetusl preferred thock outstanding with a par value of $100. The thock pays a quarterfy dividend of 33 , 00 arid is currant price is 5111. B. What is its nominhi annual rete of retum? Do not round intermediate calculations. Round your answer to tho decimal places. b. What in its effective ennuti iste of return? Do not round intermediate calcuiatians, Round your answee to two decmal places