Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please thank you solve this qs instead. BE6.33 (LO 10, 12, 14) During 2020, Darwin Corporation started a construction job with a contract price of

please

thank you

solve this qs instead.

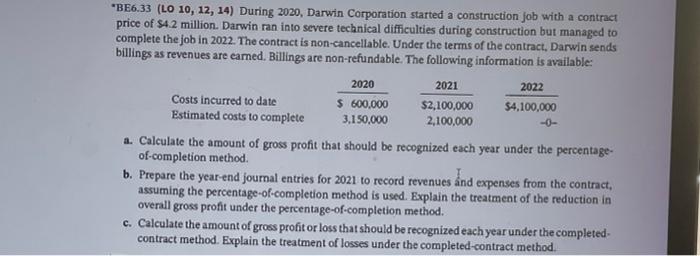

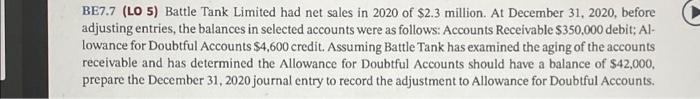

"BE6.33 (LO 10, 12, 14) During 2020, Darwin Corporation started a construction job with a contract price of $4.2 million. Darwin ran into severe technical difficulties during construction but managed to complete the job in 2022. The contract is non-cancellable. Under the terms of the contract, Darwin sends billings as revenues are cared. Billings are non-refundable. The following information is available: 2020 2021 2022 Costs incurred to date $ 600,000 $2,100,000 $4,100,000 Estimated costs to complete 3,150,000 2,100,000 -0- a. Calculate the amount of gross profit that should be recognized each year under the percentage- of-completion method b. Prepare the year-end journal entries for 2021 to record revenues and expenses from the contract, assuming the percentage-of-completion method is used. Explain the treatment of the reduction in overall gross profit under the percentage-of-completion method. c. Calculate the amount of gross profit or loss that should be recognized each year under the completed- contract method. Explain the treatment of losses under the completed-contract method. BE7.7 (LO 5) Battle Tank Limited had net sales in 2020 of $2.3 million. At December 31, 2020, before adjusting entries, the balances in selected accounts were as follows: Accounts Receivable $350,000 debit: Al- lowance for Doubtful Accounts $4,600 credit. Assuming Battle Tank has examined the aging of the accounts receivable and has determined the Allowance for Doubtful Accounts should have a balance of $42,000, prepare the December 31, 2020 journal entry to record the adjustment to Allowance for Doubtful Accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started