Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please there is some questions that is link to each other please answer me all questions because all are link to each other ASAP Question

please there is some questions that is link to each other please answer me all questions because all are link to each other ASAP

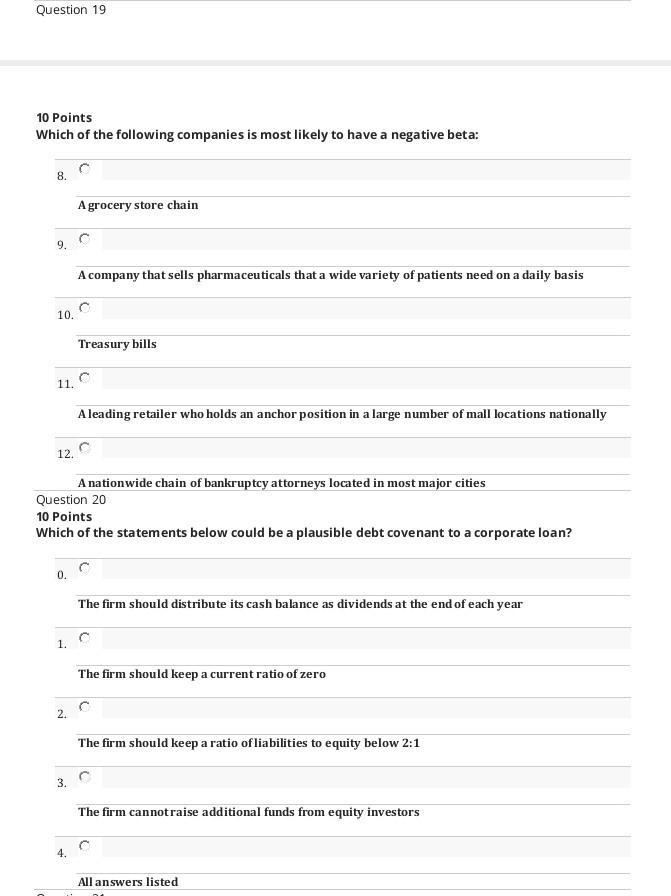

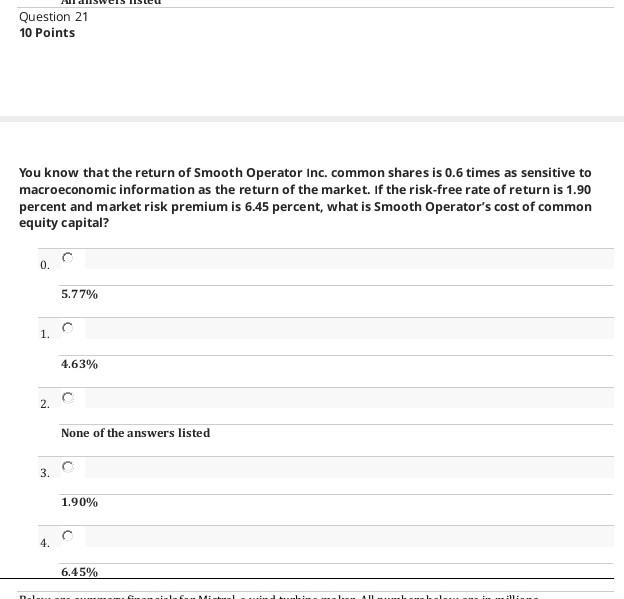

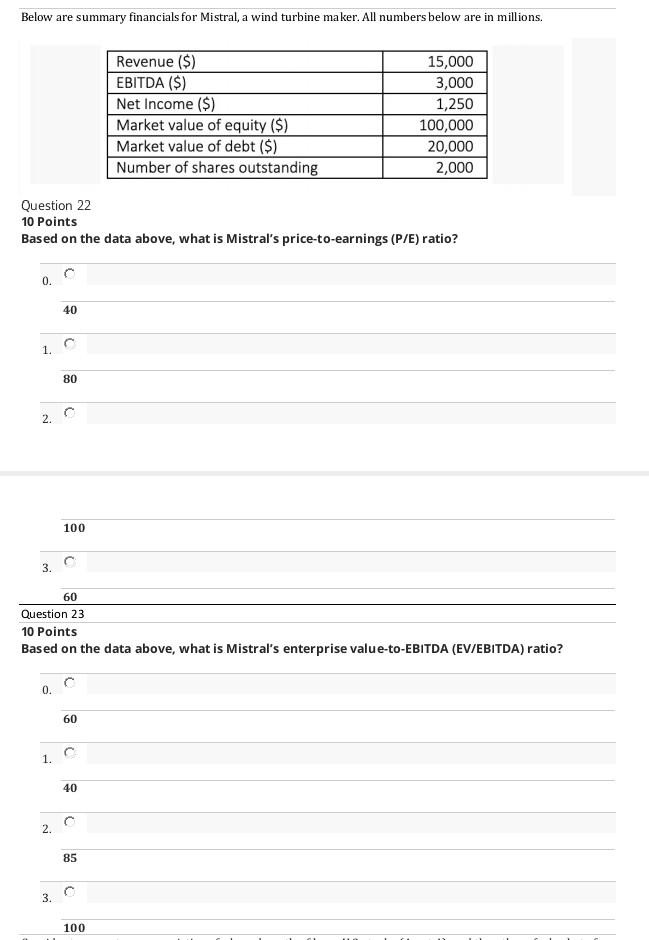

Question 19 10 Points Which of the following companies is most likely to have a negative beta: 8. Agrocery store chain 9. A company that sells pharmaceuticals that a wide variety of patients need on a daily basis 10. Treasury bills A leading retailer who holds an anchor position in a large number of mall locations nationally 12. A nationwide chain of bankruptcy attorneys located in most major cities Question 20 10 Points Which of the statements below could be a plausible debt covenant to a corporate loan? 0. The firm should distribute its cash balance as dividends at the end of each year 1. The firm should keep a current ratio of zero 2. The firm should keep a ratio of liabilities to equity below 2:1 3. The firm cannot raise additional funds from equity investors 4. All answers listed Question 21 10 Points You know that the return of Smooth Operator Inc. common shares is 0.6 times as sensitive to macroeconomic information as the return of the market. If the risk-free rate of return is 1.90 percent and market risk premium is 6.45 percent, what is Smooth Operator's cost of common equity capital? 0. 5.77% 1. 4.63% 2. None of the answers listed 3. 1.90% c 4. 6.45% win in illi Below are summary financials for Mistral, a wind turbine maker. All numbers below are in millions. Revenue ($) 15,000 EBITDA ($) 3,000 Net Income ($) 1,250 Market value of equity ($) 100,000 Market value of debt ($) 20,000 Number of shares outstanding 2,000 Question 22 10 Points Based on the data above, what is Mistral's price-to-earnings (P/E) ratio? 0. 40 1. 80 2. 100 3. 60 Question 23 10 Points Based on the data above, what is Mistral's enterprise value-to-EBITDA (EV/EBITDA) ratio? 0. 60 1. C 40 0 2. 85 C 3. 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started