Answered step by step

Verified Expert Solution

Question

1 Approved Answer

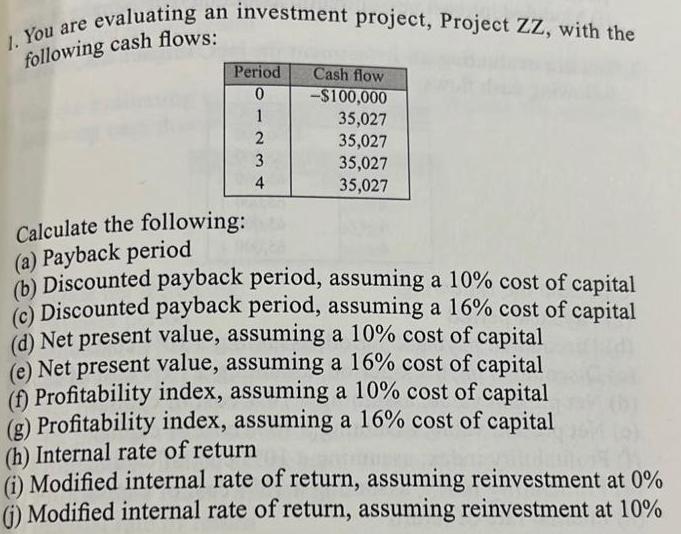

1. You are evaluating an investment project, Project ZZ, with the following cash flows: Period 0 1 2 3 4 Cash flow -$100,000 35,027

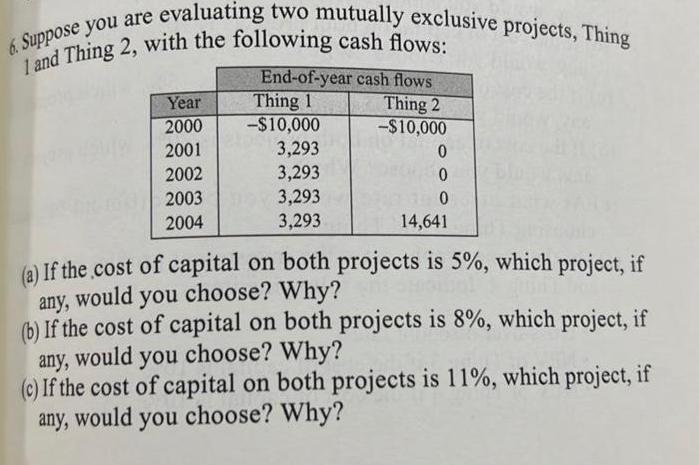

1. You are evaluating an investment project, Project ZZ, with the following cash flows: Period 0 1 2 3 4 Cash flow -$100,000 35,027 35,027 35,027 35,027 Calculate the following: (a) Payback period (b) Discounted payback period, assuming a 10% cost of capital (c) Discounted payback period, assuming a 16% cost of capital (d) Net present value, assuming a 10% cost of capital (e) Net present value, assuming a 16% cost of capital (f) Profitability index, assuming a 10% cost of capital (g) Profitability index, assuming a 16% cost of capital (h) Internal rate of return (i) Modified internal rate of return, assuming reinvestment at 0% Modified internal rate of return, assuming reinvestment at 10% 6. Suppose you are evaluating two mutually exclusive projects, Thing 1 and Thing 2, with the following cash flows: Year 2000 2001 2002 2003 2004 End-of-year cash flows Thing 1 -$10,000 3,293 3,293 3,293 3,293 Thing 2 -$10,000 0 0 0 14,641 (a) If the cost of capital on both projects is 5%, which project, if would choose? Why? any, you (b) If the cost of capital on both projects is 8%, which project, if any, would you choose? Why? (c) If the cost of capital on both projects is 11%, which project, if any, would you choose? Why? (d) If the cost of capital on both projects is 14%, which project, if any, would you choose? Why? (e) At what discount rate would you be indifferent between choos- ing Thing 1 and Thing 2? (f) On the same graph, draw the investment profiles of Thing 1 and Thing 2. Indicate the following items: cross-over discount rate NPV of Thing 1 if the cost of capital is 5% NPV of Thing 2 if cost of capital is 5% IRR of Thing 1 IRR of Thing 2

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Use MIRR function of spreadsheet to compute MIRR Enter values and formulas in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started