please to follow with calculation

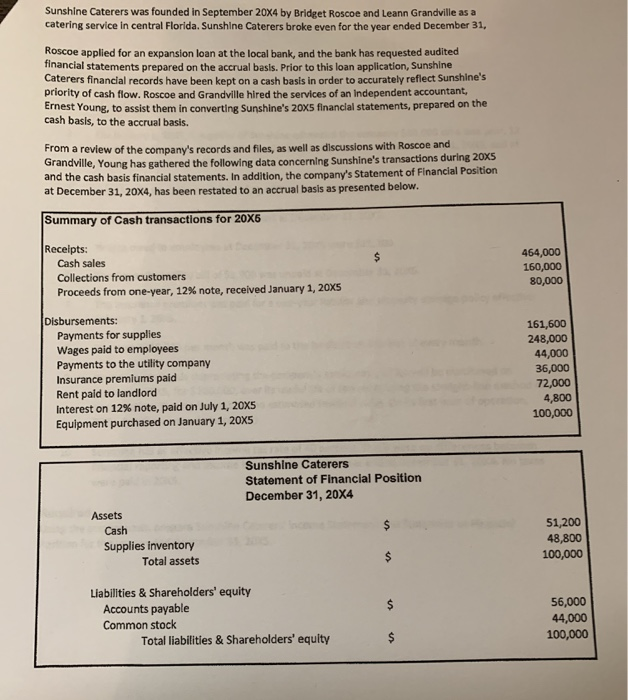

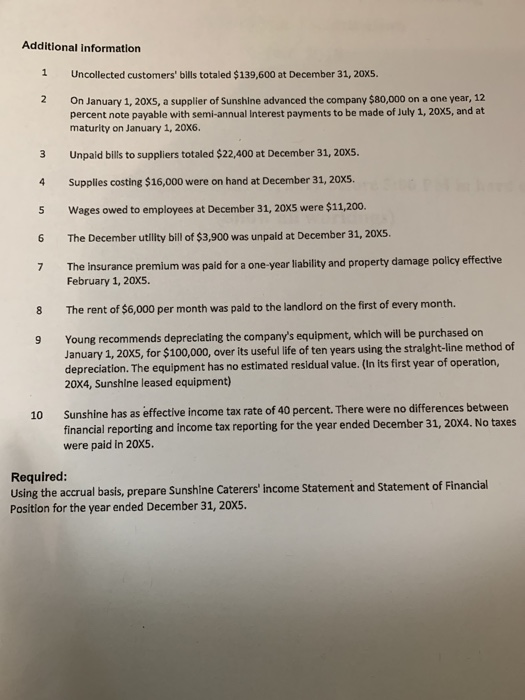

Sunshine Caterers was founded in September 20X4 by Bridget Roscoe and Leann Grandville as a catering service in central Florida. Sunshine Caterers broke even for the year ended December 31, Roscoe applied for an expansion loan at the local bank, and the bank has requested audited Tinancial statements prepared on the accrual basis. Prior to this loan application, Sunshine Caterers financial records have been kept on a cash basis in order to accurately reflect Sunshine's priority of cash flow. Roscoe and Grandville hired the services of an independent accountant, erest Young, to assist them in converting Sunshine's 20x5 financial statements, prepared on the cash basis, to the accrual basis. From a review of the company's records and files, as well as discussions with Roscoe and Grandville, Young has gathered the following data concerning Sunshine's transactions during 20XS and the cash basis financial statements. In addition, the company's Statement of Financial Position at December 31, 20X4, has been restated to an accrual basis as presented below. Summary of Cash transactions for 20X6 Receipts: Cash sales Collections from customers Proceeds from one-year, 12% note, received January 1, 20x5 464,000 160,000 80,000 Disbursements: Payments for supplies Wages paid to employees Payments to the utility company Insurance premiums paid Rent paid to landlord Interest on 12% note, paid on July 1, 20X5 Equipment purchased on January 1, 20x5 161,600 248,000 44,000 36,000 72,000 4,800 100,000 Sunshine Caterers Statement of Financial Position December 31, 20X4 Assets Cash Supplies inventory Total assets 51,200 48,800 100,000 Liabilities & Shareholders' equity Accounts payable Common stock Total liabilities & Shareholders' equity 56,000 44,000 100,000 Additional Information 1 Uncollected customers' bills totaled $139,600 at December 31, 20X5. 2 On January 1, 20x5, a supplier of Sunshine advanced the company $80,000 on a one year, 12 percent note payable with semi-annual Interest payments to be made of July 1, 20X5, and at maturity on January 1, 20x6. Unpaid bills to suppliers totaled $22,400 at December 31, 20X5. Supplies costing $16,000 were on hand at December 31, 20X5. Wages owed to employees at December 31, 20x5 were $11,200. 6 The December utility bill of $3,900 was unpaid at December 31, 20X5. The insurance premium was paid for a one-year liability and property damage policy effective February 1, 20x5. The rent of $6,000 per month was paid to the landlord on the first of every month. Young recommends depreciating the company's equipment, which will be purchased on January 1, 20X5, for $100,000, over its useful life of ten years using the straight-line method of depreciation. The equipment has no estimated residual value. (In its first year of operation, 20X4, Sunshine leased equipment) 10 Sunshine has as effective income tax rate of 40 percent. There were no differences between financial reporting and income tax reporting for the year ended December 31, 20X4. No taxes were paid in 20X5. Required: Using the accrual basis, prepare Sunshine Caterers' income Statement and Statement of Financial Position for the year ended December 31, 20X5