Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please try to answer all in 30 minute just need final answer Assume that an average coefficient of risk aversion in economy is 4, the

Please try to answer all in 30 minute just need final answer

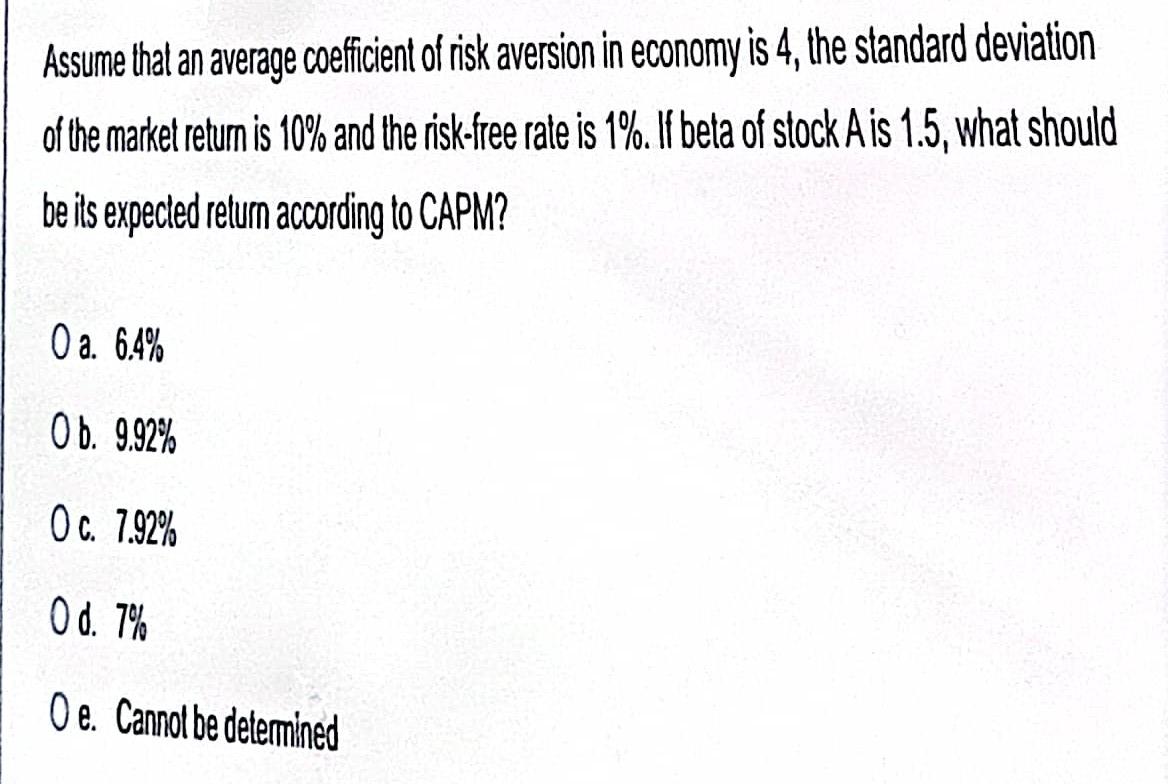

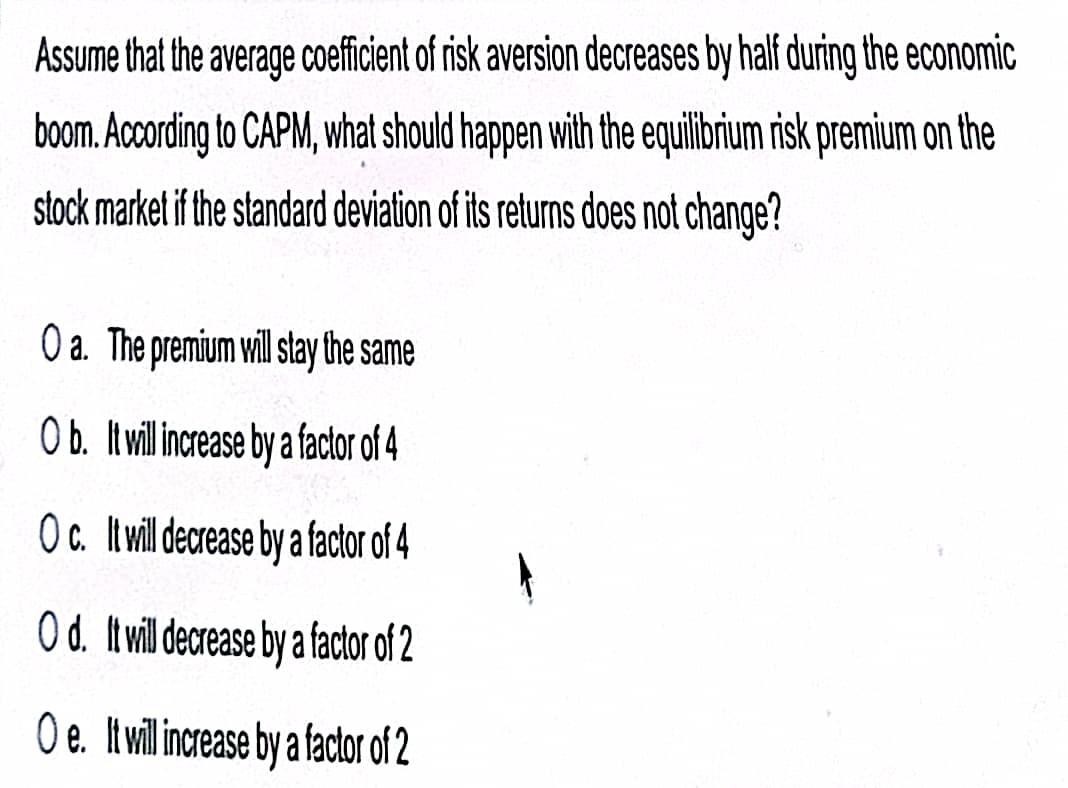

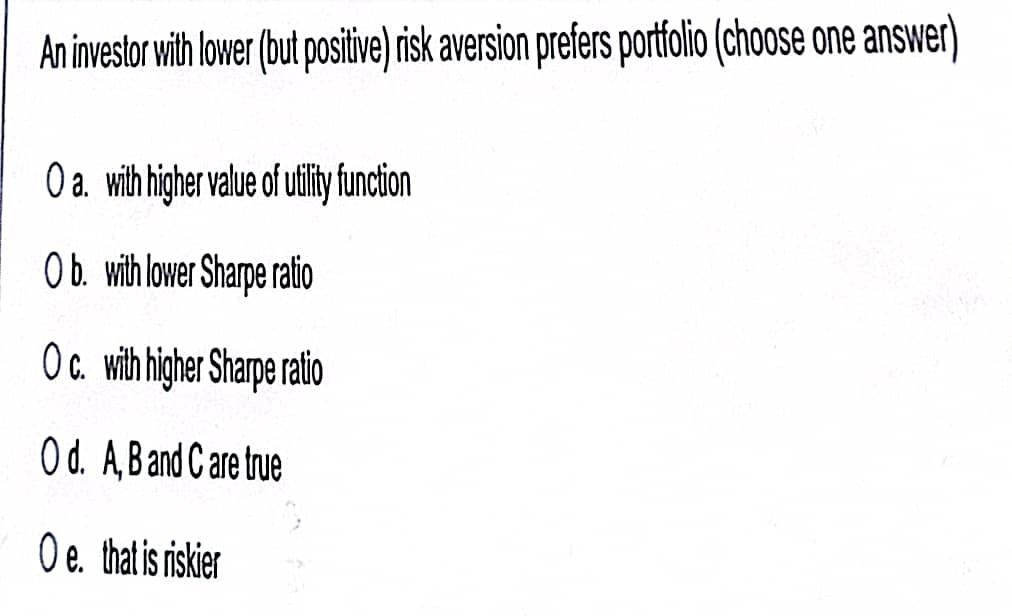

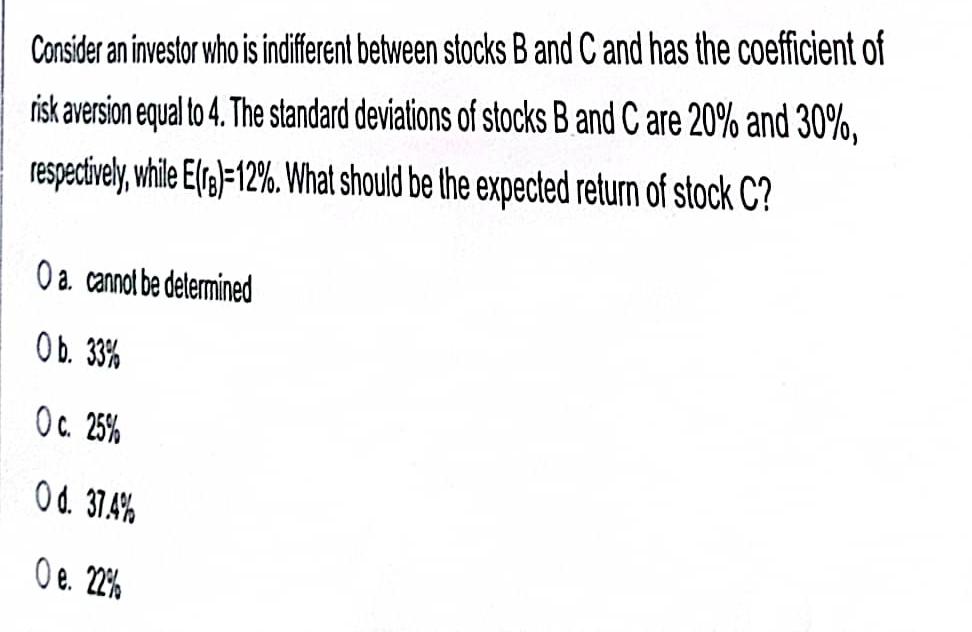

Assume that an average coefficient of risk aversion in economy is 4, the standard deviation of the market return is 10% and the risk-free rate is 1%. Il beta of stock A is 1.5, what should be its expected return according to CAPM? O a. 6.4% O b. 9.92% O c. 7.92% O d. 7% Oe. Cannot be determined Assume that the average coefficient of risk aversion decreases by half during the economic boom. According to CAPM, what should happen with the equilibrium risk premium on the stock market if the standard deviation of its returns does not change? O a. The premium will stay the same O b. It will increase by a factor of 4 Oc. It will decrease by a factor of 4 O d. It will decrease by a factor of 2 O e. It will increase by a factor of 2 An investor with lower (but positive) risk aversion prefers portfolio (choose one answer ) O a. with higher value of utility function O b. with lower Sharpe ratio Oc. with higher Sharpe ratio Od. A, B and Care true Oe that is riskier Consider an investor who is indifferent between stocks B and C and has the coefficient of risk aversion equal to 4. The standard deviations of stocks B and Care 20% and 30%. respectively, while E(ra)=12%. What should be the expected return of stock C? O a. cannot be determined Ob 33% Oc. 25% 0 d. 37.4% O e. 22%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started