Answered step by step

Verified Expert Solution

Question

1 Approved Answer

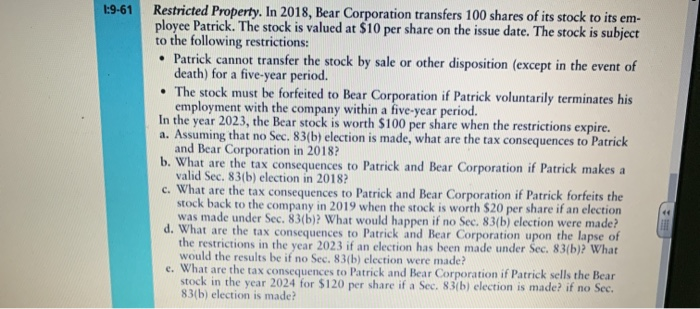

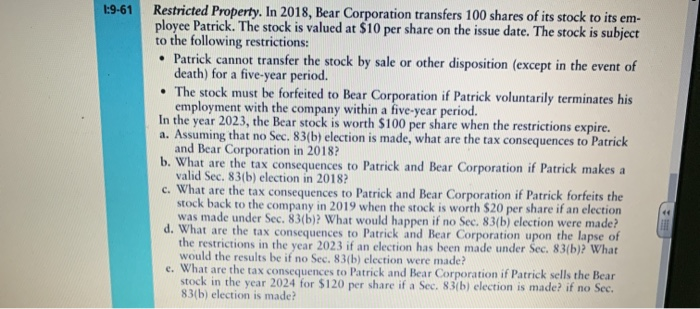

please type the answer by computer dont write it by hand 1:9-61 Restricted Property. In 2018, Bear Corporation transfers 100 shares of its stock to

please type the answer by computer dont write it by hand

1:9-61 Restricted Property. In 2018, Bear Corporation transfers 100 shares of its stock to its em- ployee Patrick. The stock is valued at $10 per share on the issue date. The stock is subject to the following restrictions: Patrick cannot transfer the stock by sale or other disposition (except in the event of death) for a five-year period. The stock must be forfeited to Bear Corporation if Patrick voluntarily terminates his employment with the company within a five-year period. In the year 2023, the Bear stock is worth $100 per share when the restrictions expire. a. Assuming that no Sec. 83(b) election is made, what are the tax consequences to Patrick and Bear Corporation in 2018? b. What are the tax consequences to Patrick and Bear Corporation if Patrick makes a valid Sec. 83(b) election in 2018? c. What are the tax consequences to Patrick and Bear Corporation if Patrick forfeits the stock back to the company in 2019 when the stock is worth $20 per share if an election was made under Sec. 83(b)? What would happen if no Sec. 83(b) election were made? d. What are the tax consequences to Patrick and Bear Corporation upon the lapse of the restrictions in the year 2023 if an election has been made under Sec. 83(b)? What would the results be if no Sec. 83(b) election were made? e. What are the tax consequences to Patrick and Bear Corporation if Patrick sells the Bear stock in the year 2024 for $120 per share if a Sec. 83(b) election is made? if no Sec. 83(b) election is made

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started