Question

Please type the answer by computer, so i can see it clearly, thank you!! Consider a Tencent Holdings option (0700) When it trades at 380,

Please type the answer by computer, so i can see it clearly, thank you!!

Consider a Tencent Holdings option (0700) When it trades at 380, the strike price is 400, the interest rate is 5% per year with continuous compounding, the volatility is 30%, and the maturity date is three months. Tencent is anticipated to pay no dividends during the option life. An option is for a share of Tencent.

Questions:

1(a) what is the price of the option if it is a European call?

1(b) To achieve delta neutral, how many shares of Tencent should be bought or sold if 50 European calls are written?

1(c) What is the price of the option if it is an Americal call?

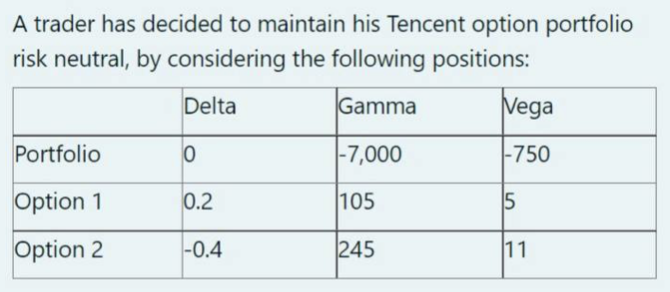

1(d) How many units of options 1 and 2 are required to make the portfolio gamma and vega neutral?

1(e) In addition to the hedge in (d), how many shares of Tencent are required to make the portfolio delta neutral? Should the shares be long or short?

A trader has decided to maintain his Tencent option portfolio risk neutral, by considering the following positions: Delta Gamma Nega Portfolio 0 |-7,000 -750 Option 1 0.2 105 5 Option 2 -0.4 245 111 A trader has decided to maintain his Tencent option portfolio risk neutral, by considering the following positions: Delta Gamma Nega Portfolio 0 |-7,000 -750 Option 1 0.2 105 5 Option 2 -0.4 245 111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started