Please type the answer by computer so I can see it clearly, thank you!!!

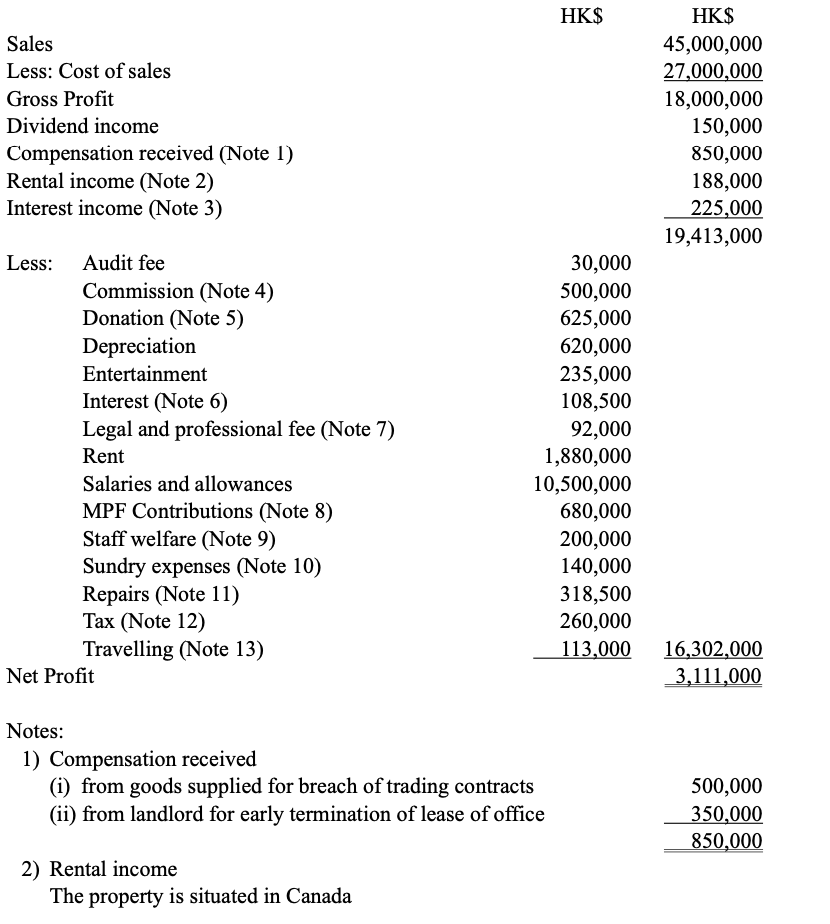

Tung On Limited is a Hong Kong firm that does business in Hong Kong and earns all of its income there. The following is the company's income statement for the year ending December 31, 2020:

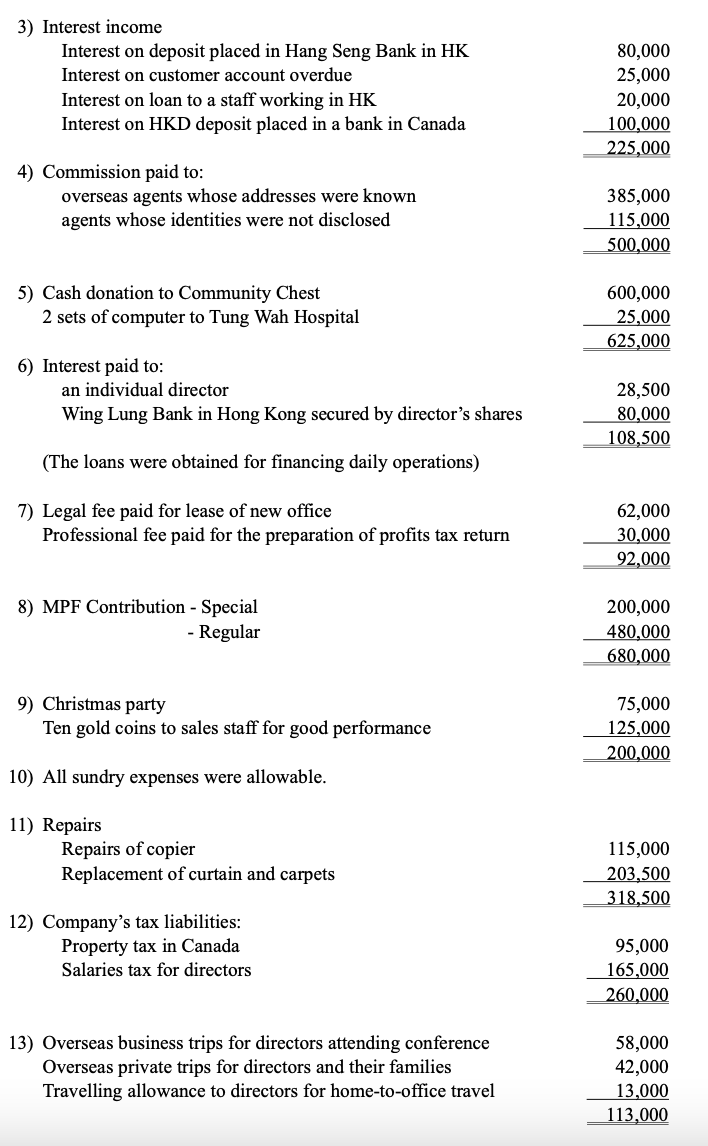

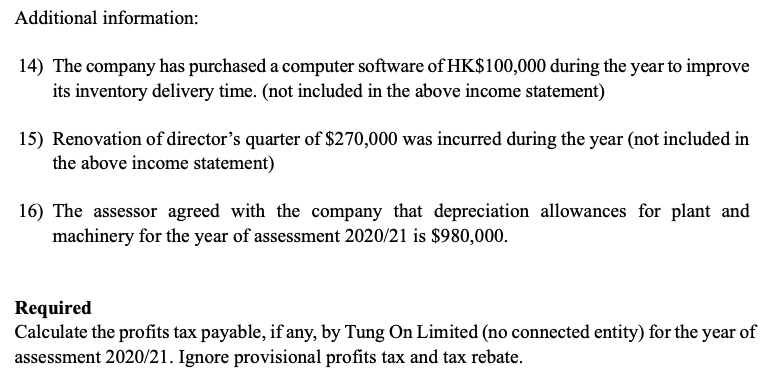

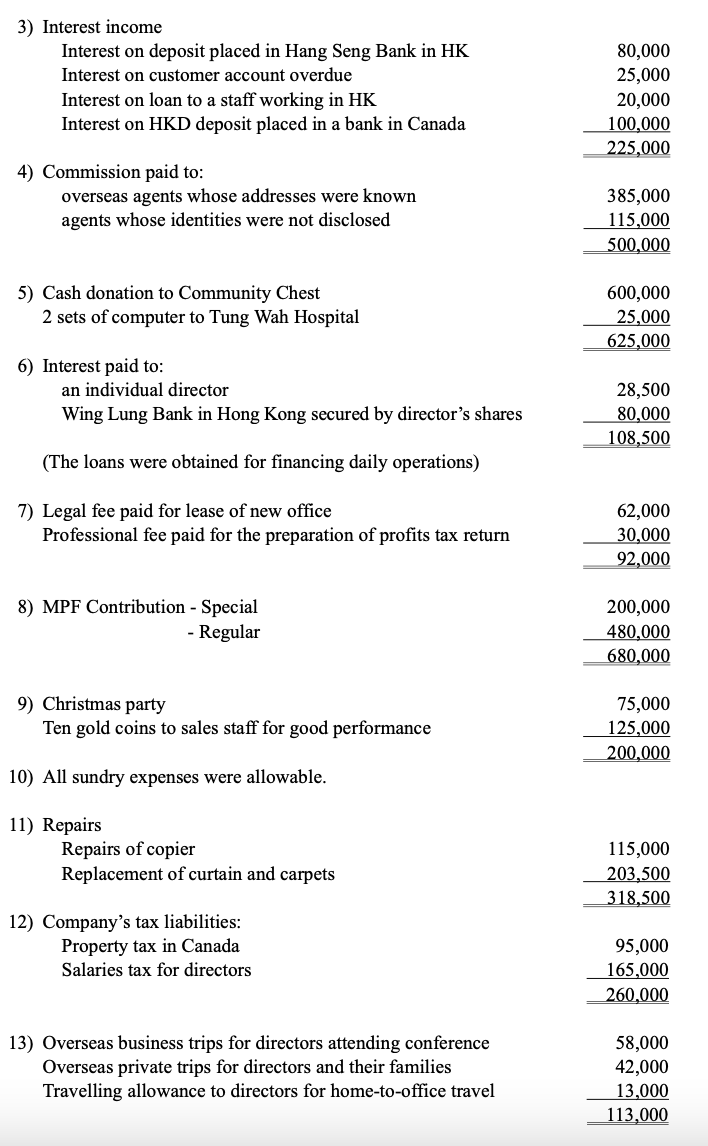

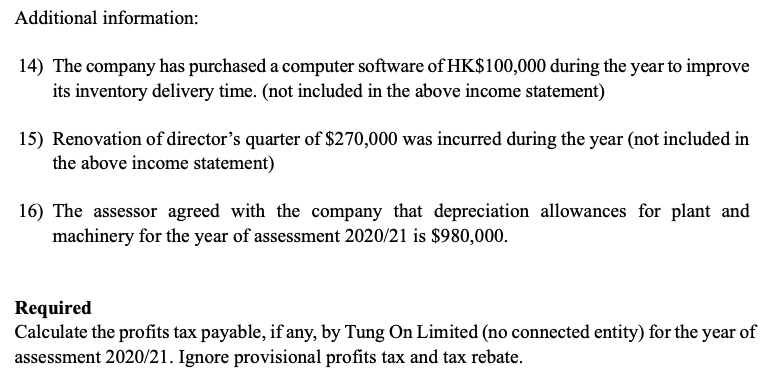

Sales Less: Cost of sales Gross Profit Dividend income Compensation received (Note 1) Rental income (Note 2) Interest income (Note 3) Less: Audit fee HK$ 30,000 500,000 625,000 620,000 235,000 108,500 92,000 1,880,000 10,500,000 680,000 200,000 140,000 318,500 260,000 113,000 Commission (Note 4) Donation (Note 5) Depreciation Entertainment Interest (Note 6) Legal and professional fee (Note 7) Rent Salaries and allowances MPF Contributions (Note 8) Staff welfare (Note 9) Sundry expenses (Note 10) Repairs (Note 11) Tax (Note 12) Travelling (Note 13) Net Profit Notes: 1) Compensation received (i) from goods supplied for breach of trading contracts (ii) from landlord for early termination of lease of office 2) Rental income The property is situated in Canada HK$ 45,000,000 27,000,000 18,000,000 150,000 850,000 188,000 225,000 19,413,000 16,302,000 3,111,000 500,000 350,000 850,000 3) Interest income Interest on deposit placed in Hang Seng Bank in HK Interest on customer account overdue Interest on loan to a staff working in HK Interest on HKD deposit placed in a bank in Canada overseas agents whose addresses were known agents whose identities were not disclosed 5) Cash donation to Community Chest 2 sets of computer to Tung Wah Hospital 6) Interest paid to: an individual director Wing Lung Bank in Hong Kong secured by director's shares (The loans were obtained for financing daily operations) 7) Legal fee paid for lease of new office Professional fee paid for the preparation of profits tax return 8) MPF Contribution - Special - Regular 9) Christmas party Ten gold coins to sales staff for good performance 10) All sundry expenses were allowable. 11) Repairs Repairs of copier Replacement of curtain and carpets 12) Company's tax liabilities: Property tax in Canada Salaries tax for directors 13) Overseas business trips for directors attending conference Overseas private trips for directors and their families Travelling allowance to directors for home-to-office travel 4) Commission paid to: 80,000 25,000 20,000 100,000 225,000 385,000 115,000 500,000 600,000 25,000 625,000 28,500 80,000 108,500 62,000 30,000 92,000 200,000 480,000 680,000 75,000 125,000 200,000 115,000 203,500 318,500 95,000 165,000 260,000 58,000 42,000 13,000 113,000 Additional information: 14) The company has purchased a computer software of HK$100,000 during the year to improve its inventory delivery time. (not included in the above income statement) 15) Renovation of director's quarter of $270,000 was incurred during the year (not included in the above income statement) 16) The assessor agreed with the company that depreciation allowances for plant and machinery for the year of assessment 2020/21 is $980,000. Required Calculate the profits tax payable, if any, by Tung On Limited (no connected entity) for the year of assessment 2020/21. Ignore provisional profits tax and tax rebate. Sales Less: Cost of sales Gross Profit Dividend income Compensation received (Note 1) Rental income (Note 2) Interest income (Note 3) Less: Audit fee HK$ 30,000 500,000 625,000 620,000 235,000 108,500 92,000 1,880,000 10,500,000 680,000 200,000 140,000 318,500 260,000 113,000 Commission (Note 4) Donation (Note 5) Depreciation Entertainment Interest (Note 6) Legal and professional fee (Note 7) Rent Salaries and allowances MPF Contributions (Note 8) Staff welfare (Note 9) Sundry expenses (Note 10) Repairs (Note 11) Tax (Note 12) Travelling (Note 13) Net Profit Notes: 1) Compensation received (i) from goods supplied for breach of trading contracts (ii) from landlord for early termination of lease of office 2) Rental income The property is situated in Canada HK$ 45,000,000 27,000,000 18,000,000 150,000 850,000 188,000 225,000 19,413,000 16,302,000 3,111,000 500,000 350,000 850,000 3) Interest income Interest on deposit placed in Hang Seng Bank in HK Interest on customer account overdue Interest on loan to a staff working in HK Interest on HKD deposit placed in a bank in Canada overseas agents whose addresses were known agents whose identities were not disclosed 5) Cash donation to Community Chest 2 sets of computer to Tung Wah Hospital 6) Interest paid to: an individual director Wing Lung Bank in Hong Kong secured by director's shares (The loans were obtained for financing daily operations) 7) Legal fee paid for lease of new office Professional fee paid for the preparation of profits tax return 8) MPF Contribution - Special - Regular 9) Christmas party Ten gold coins to sales staff for good performance 10) All sundry expenses were allowable. 11) Repairs Repairs of copier Replacement of curtain and carpets 12) Company's tax liabilities: Property tax in Canada Salaries tax for directors 13) Overseas business trips for directors attending conference Overseas private trips for directors and their families Travelling allowance to directors for home-to-office travel 4) Commission paid to: 80,000 25,000 20,000 100,000 225,000 385,000 115,000 500,000 600,000 25,000 625,000 28,500 80,000 108,500 62,000 30,000 92,000 200,000 480,000 680,000 75,000 125,000 200,000 115,000 203,500 318,500 95,000 165,000 260,000 58,000 42,000 13,000 113,000 Additional information: 14) The company has purchased a computer software of HK$100,000 during the year to improve its inventory delivery time. (not included in the above income statement) 15) Renovation of director's quarter of $270,000 was incurred during the year (not included in the above income statement) 16) The assessor agreed with the company that depreciation allowances for plant and machinery for the year of assessment 2020/21 is $980,000. Required Calculate the profits tax payable, if any, by Tung On Limited (no connected entity) for the year of assessment 2020/21. Ignore provisional profits tax and tax rebate