Please type the answer

******Dscus the non-price considerations of the offers. Which, if any, bid would you vote to accept for the purchase of Hershey Foods Corporation? Is your decision primarily based on the economics of the bids or the desire to honor the legacy of Milton S. Hershey?

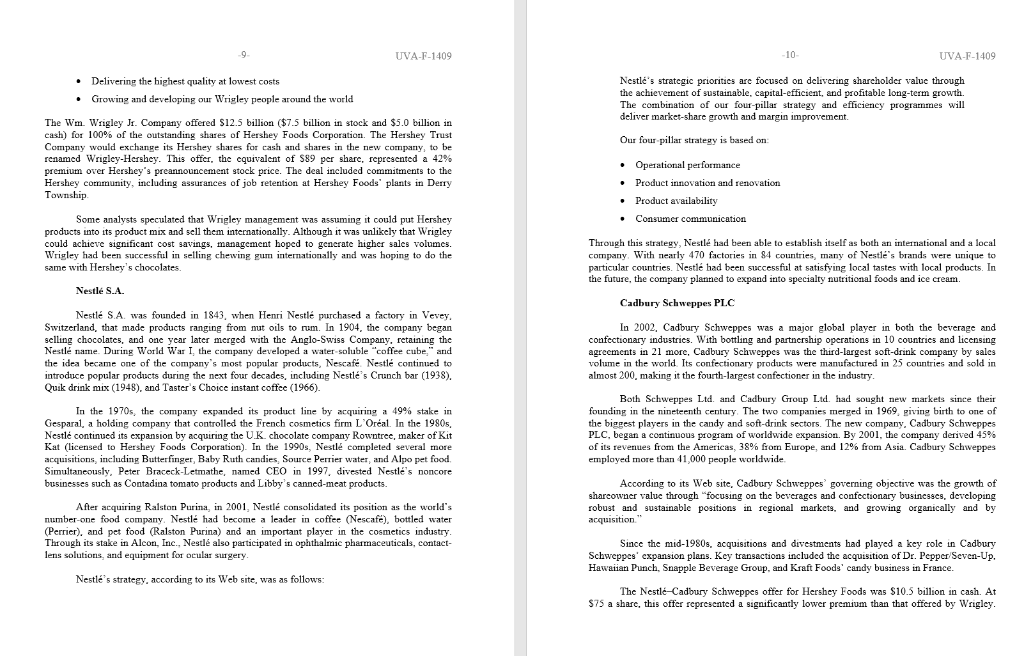

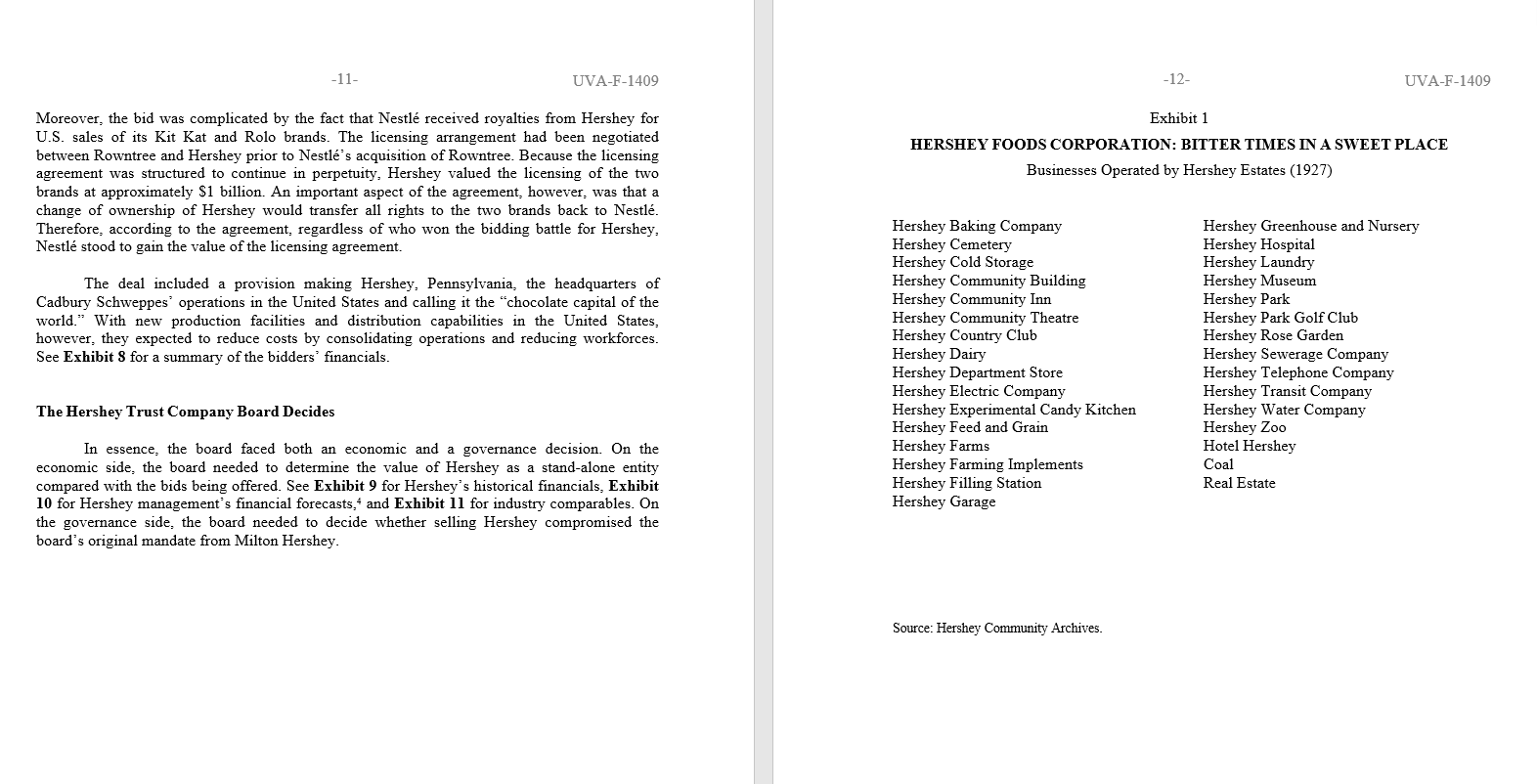

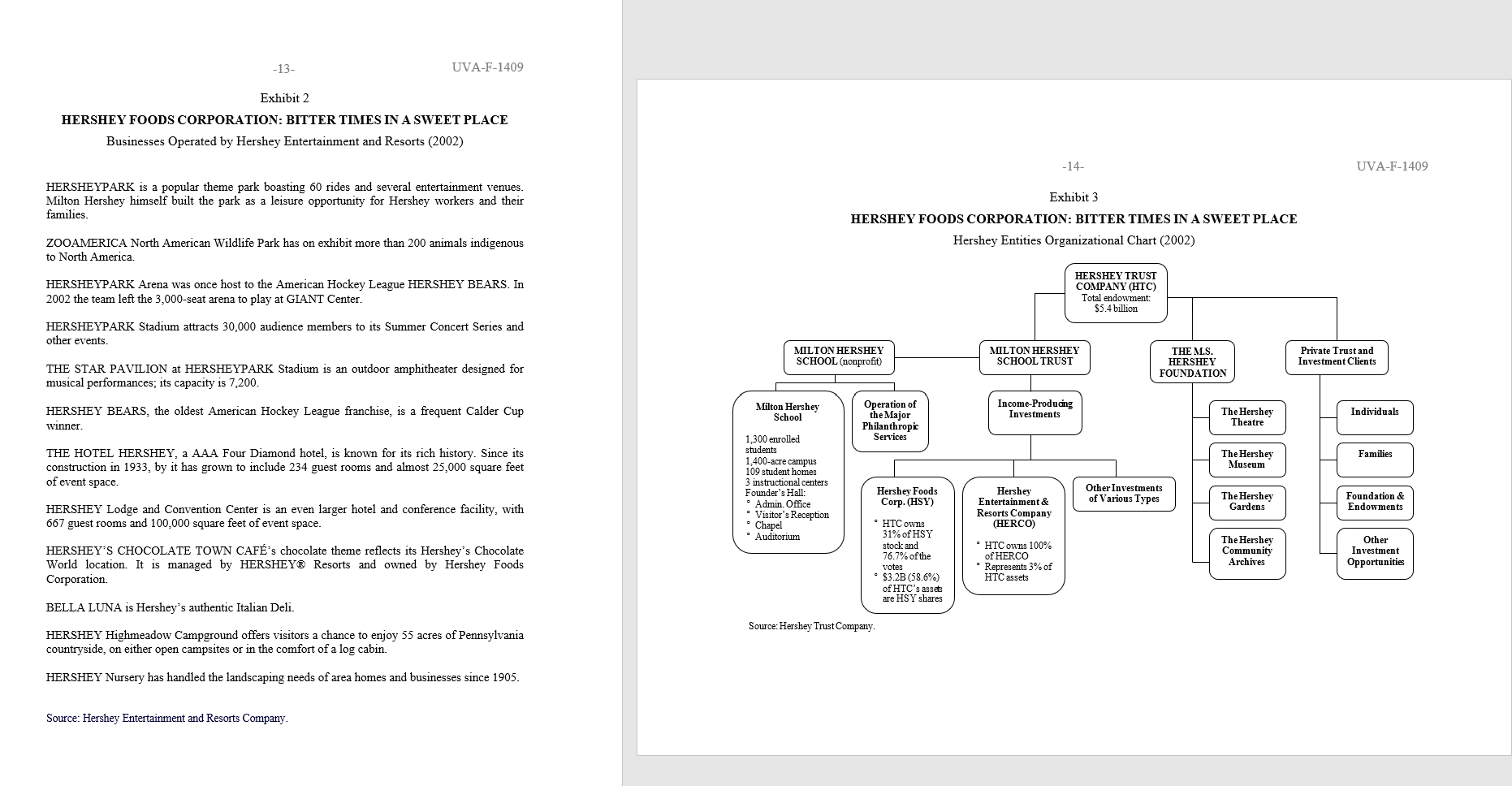

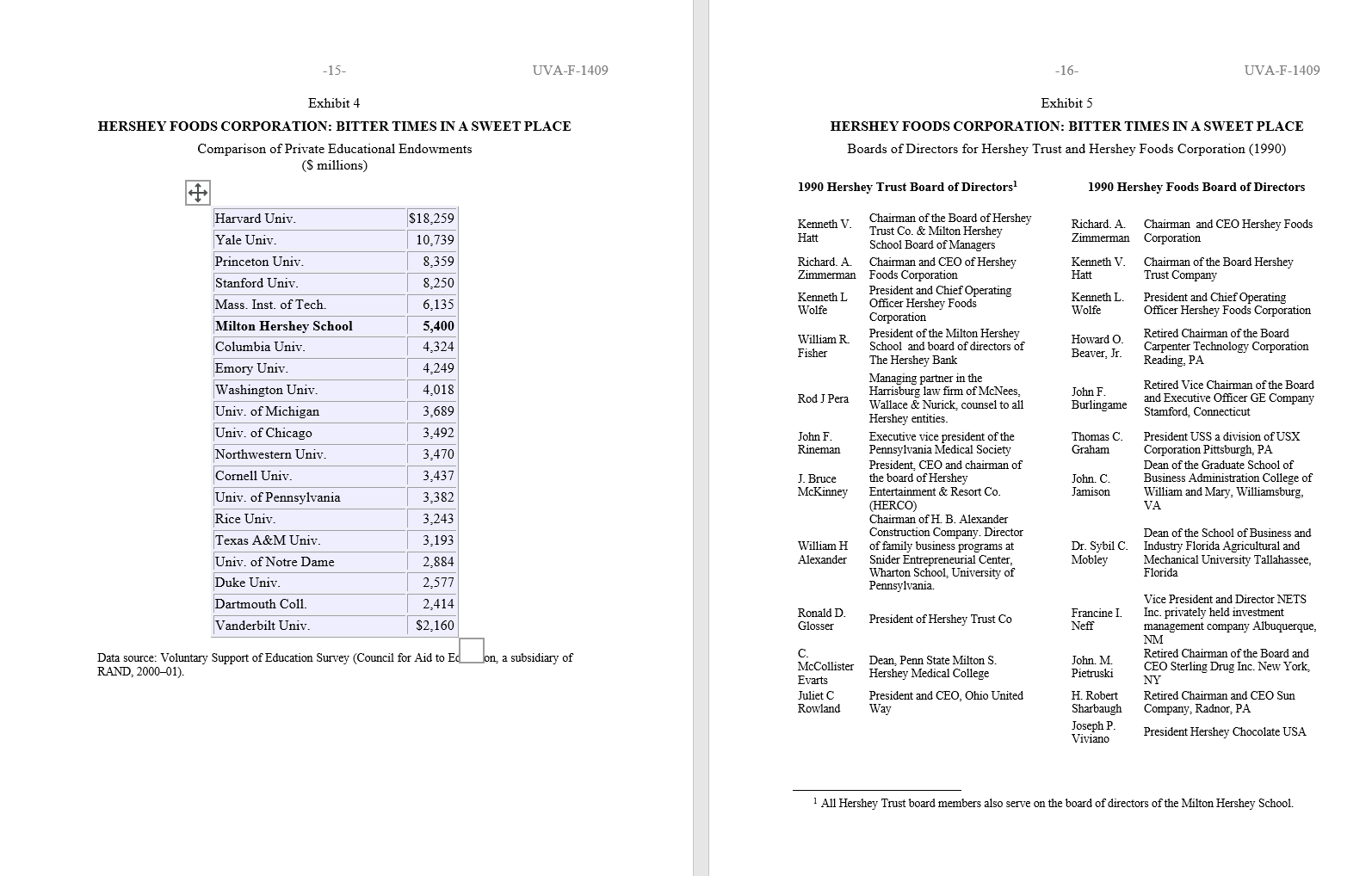

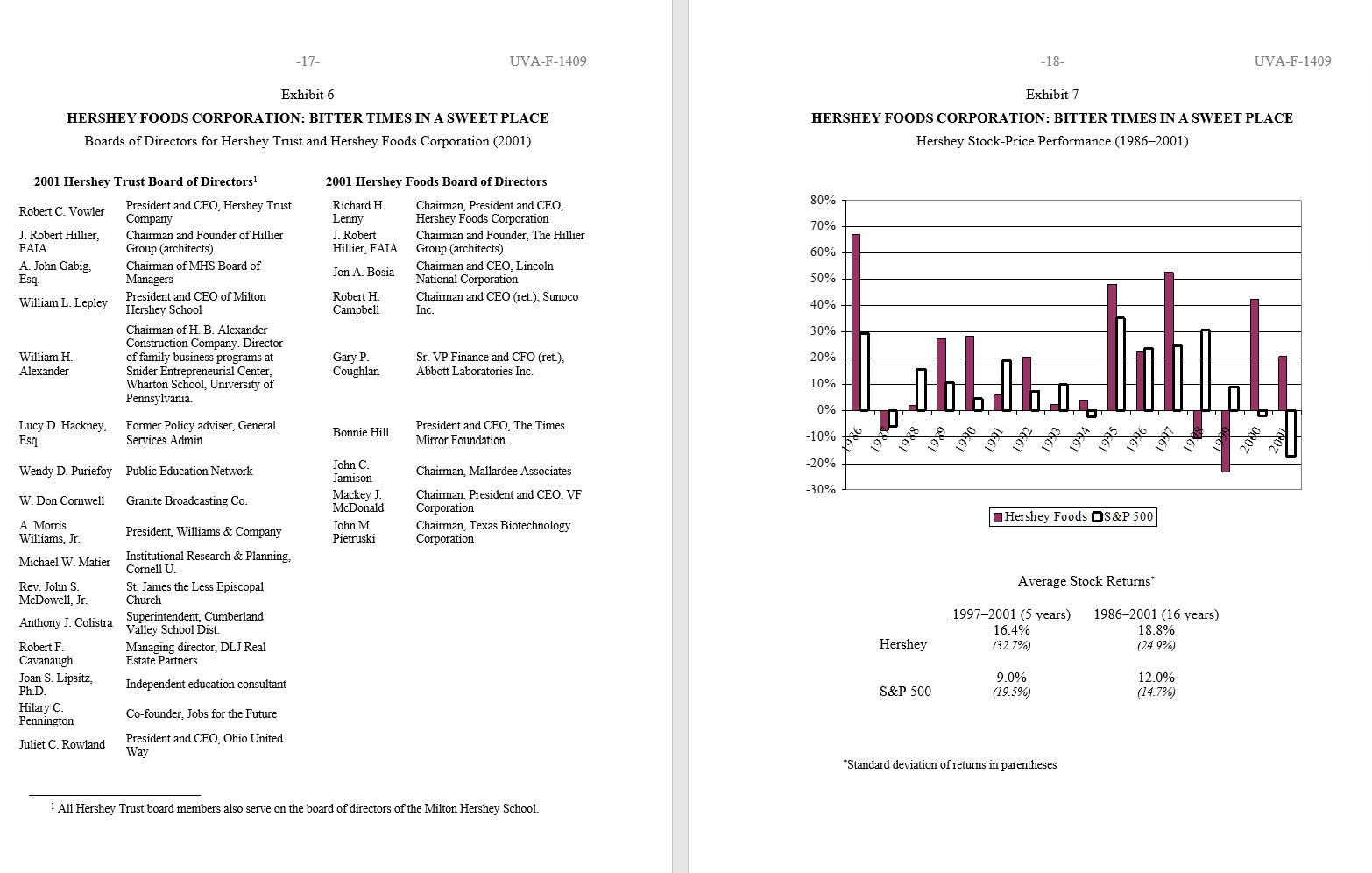

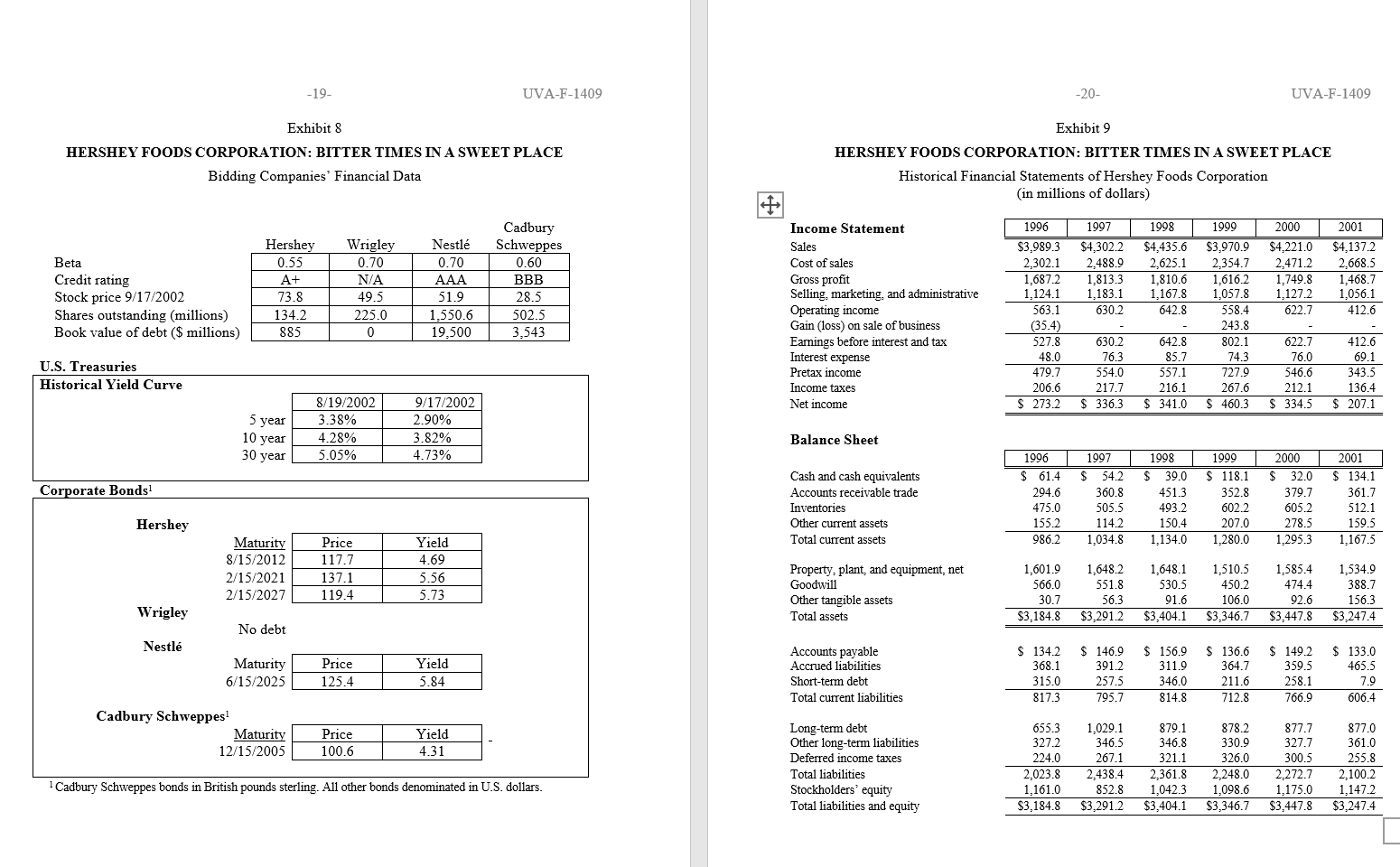

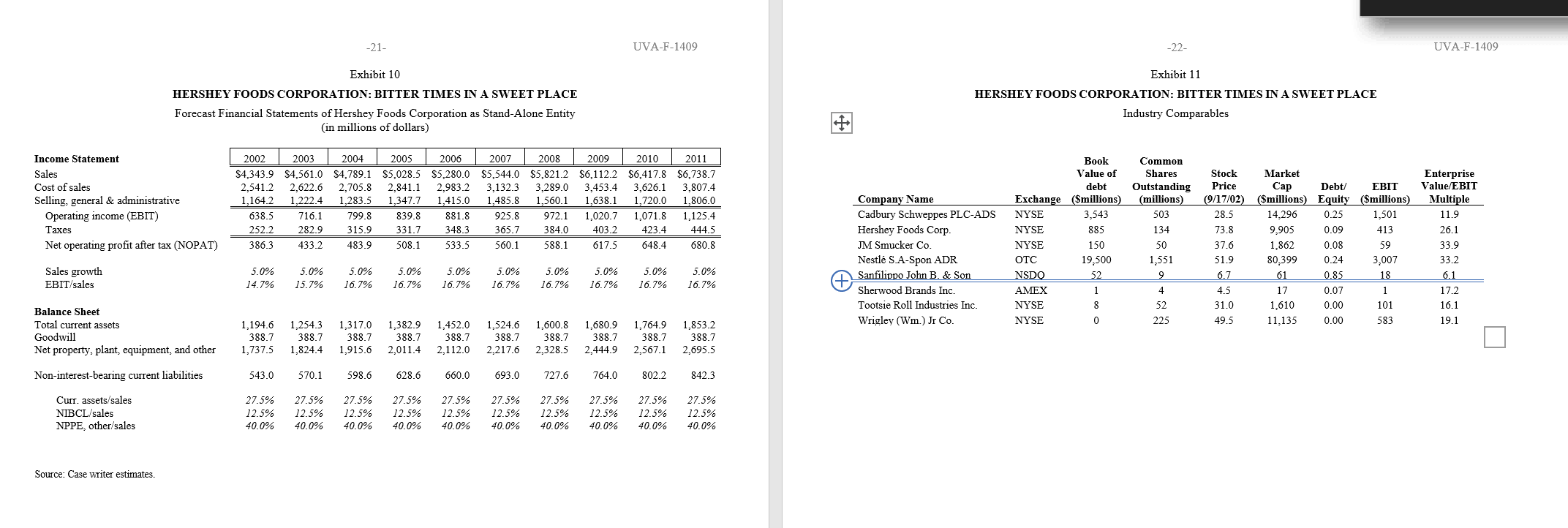

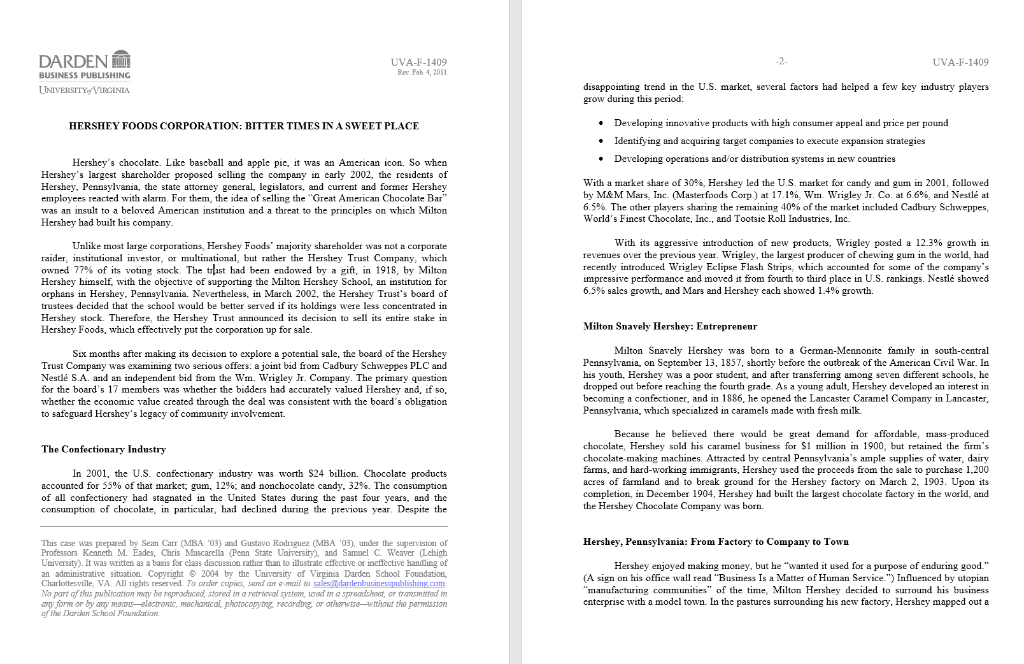

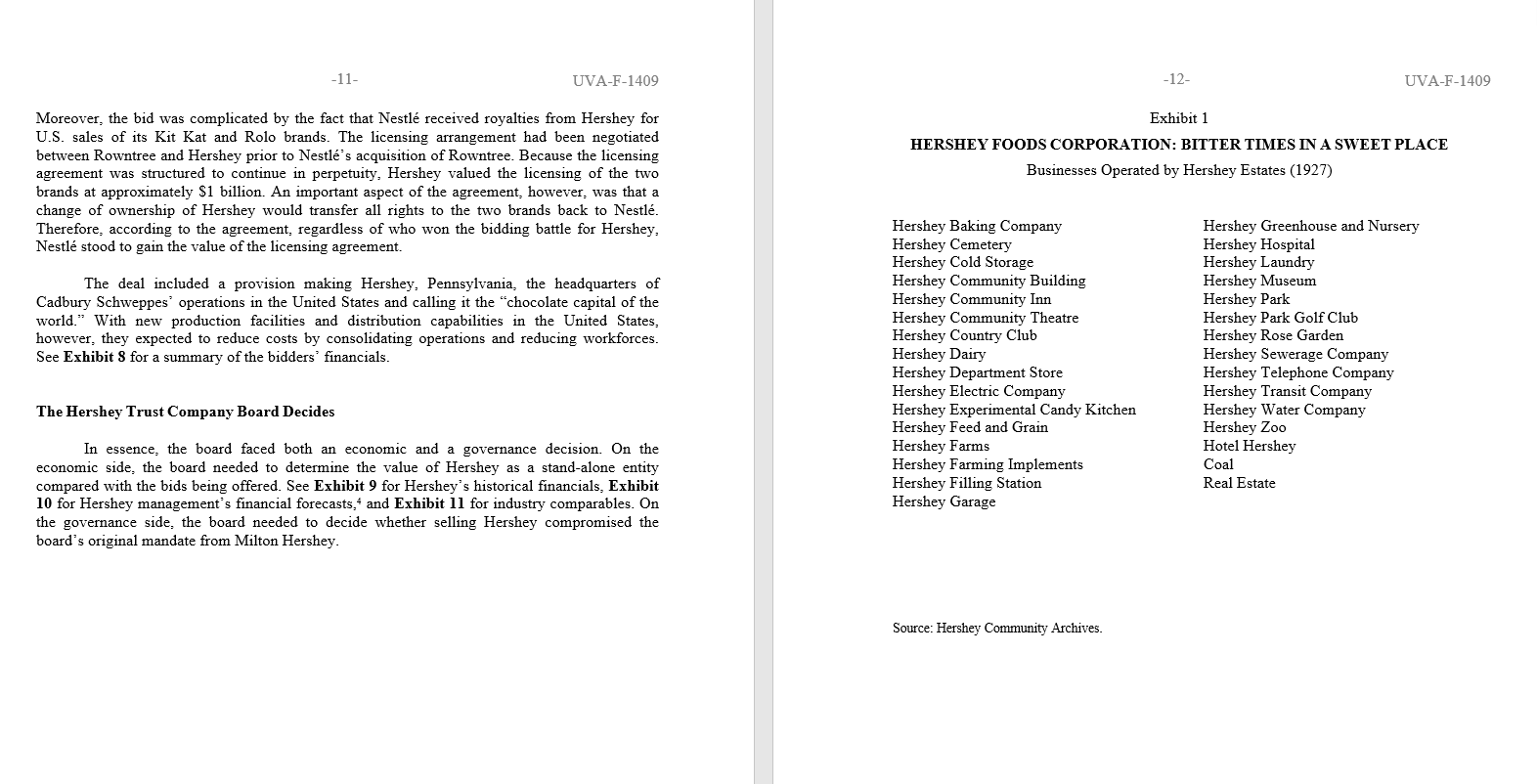

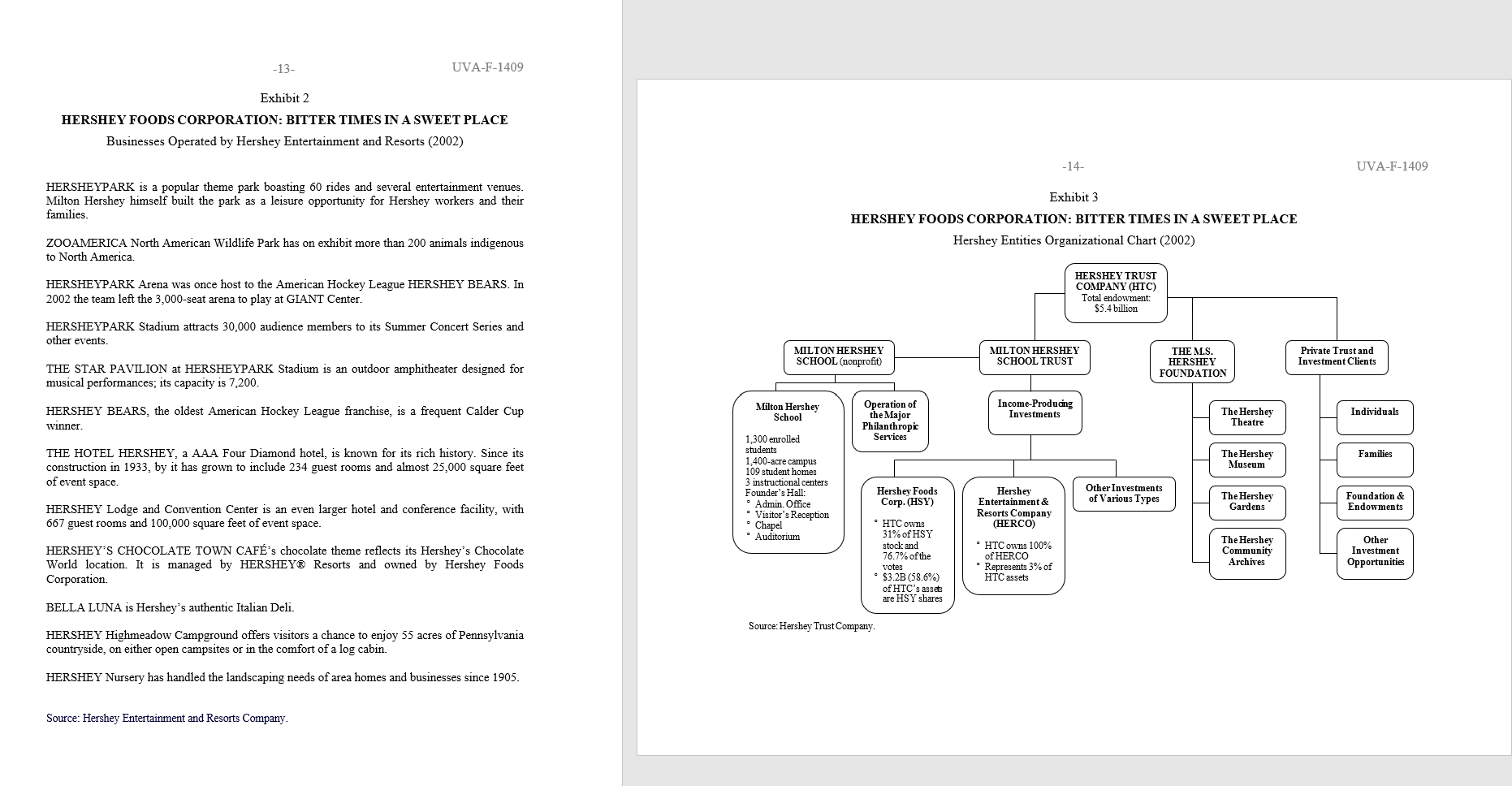

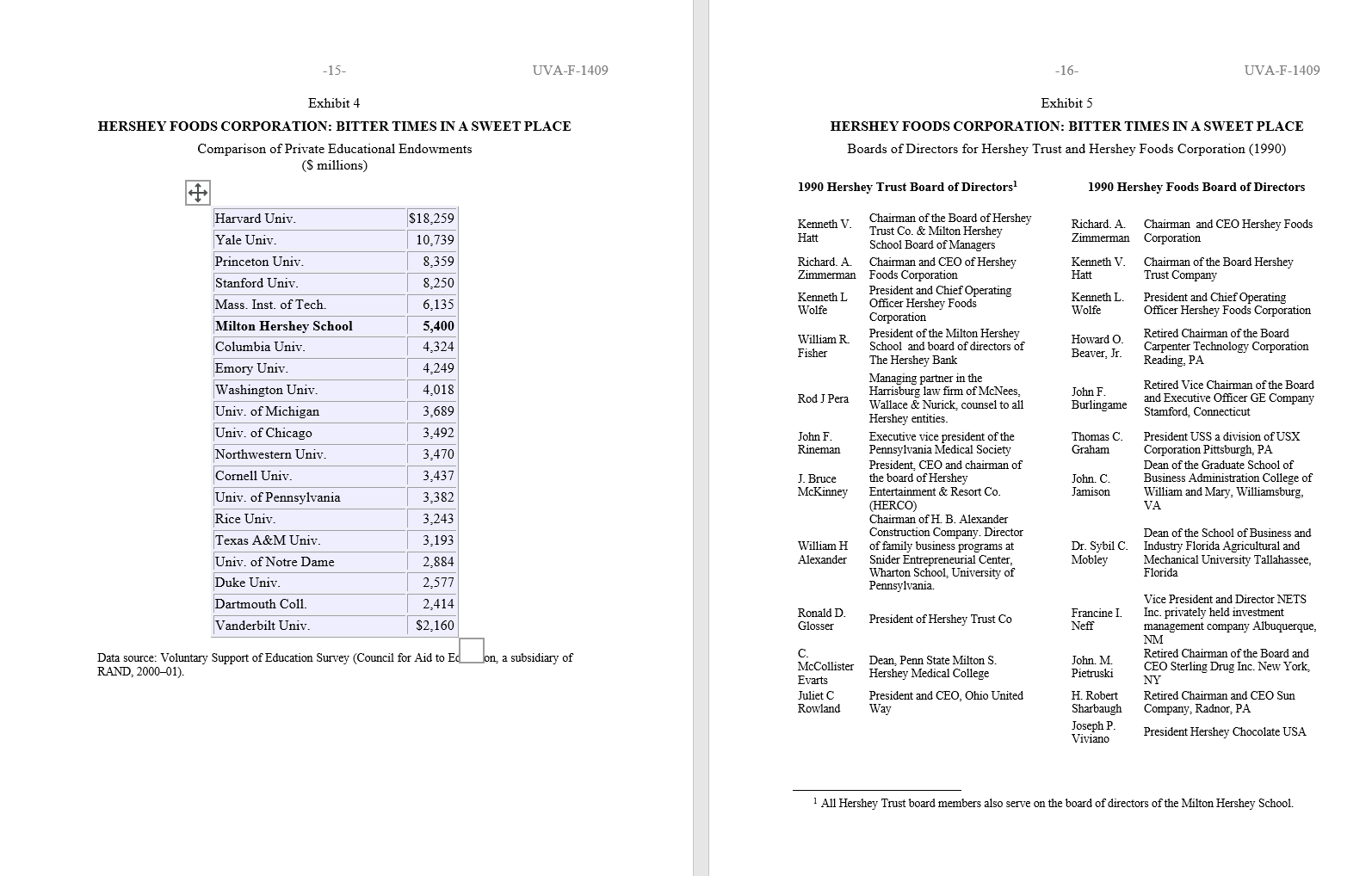

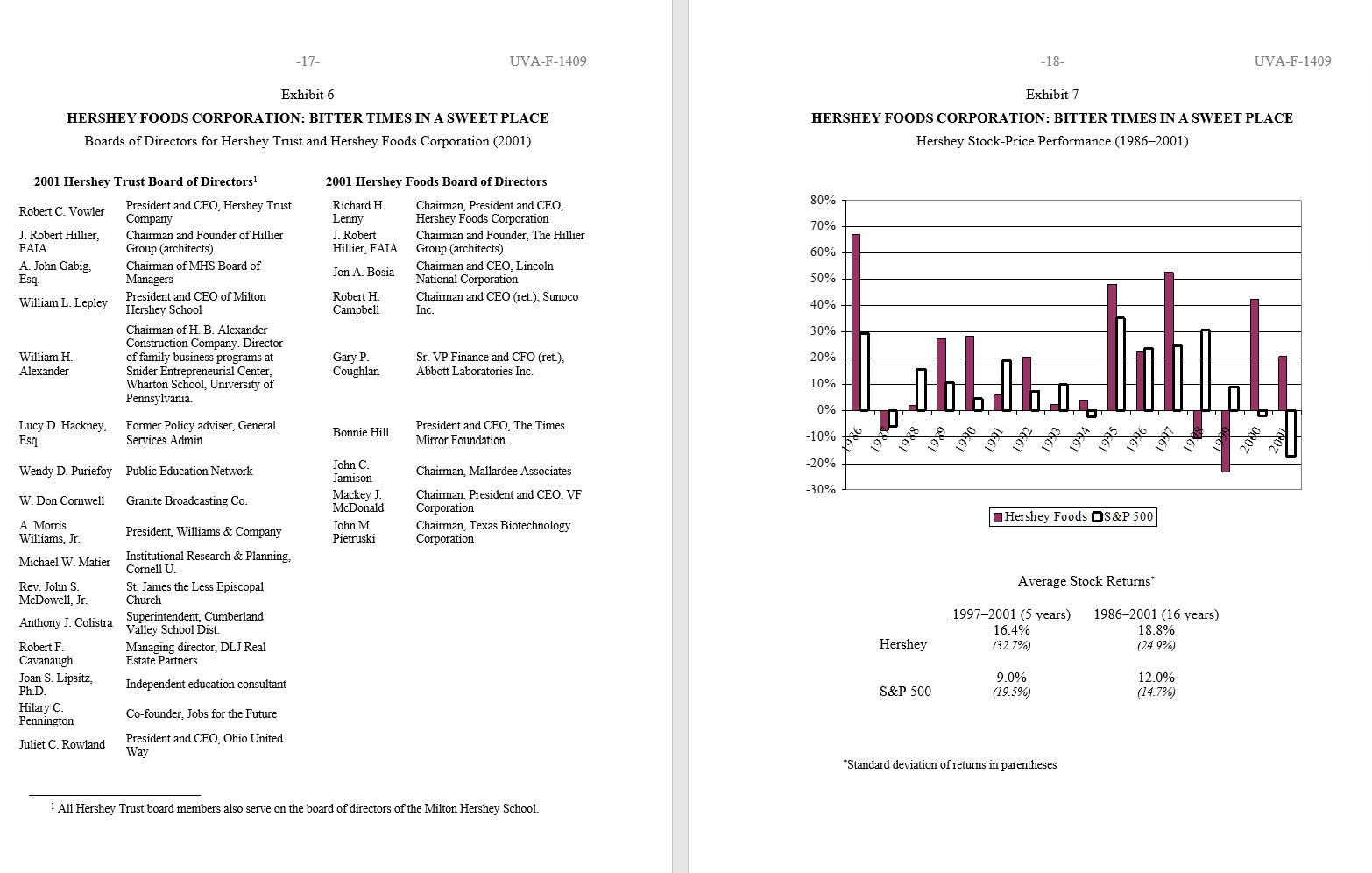

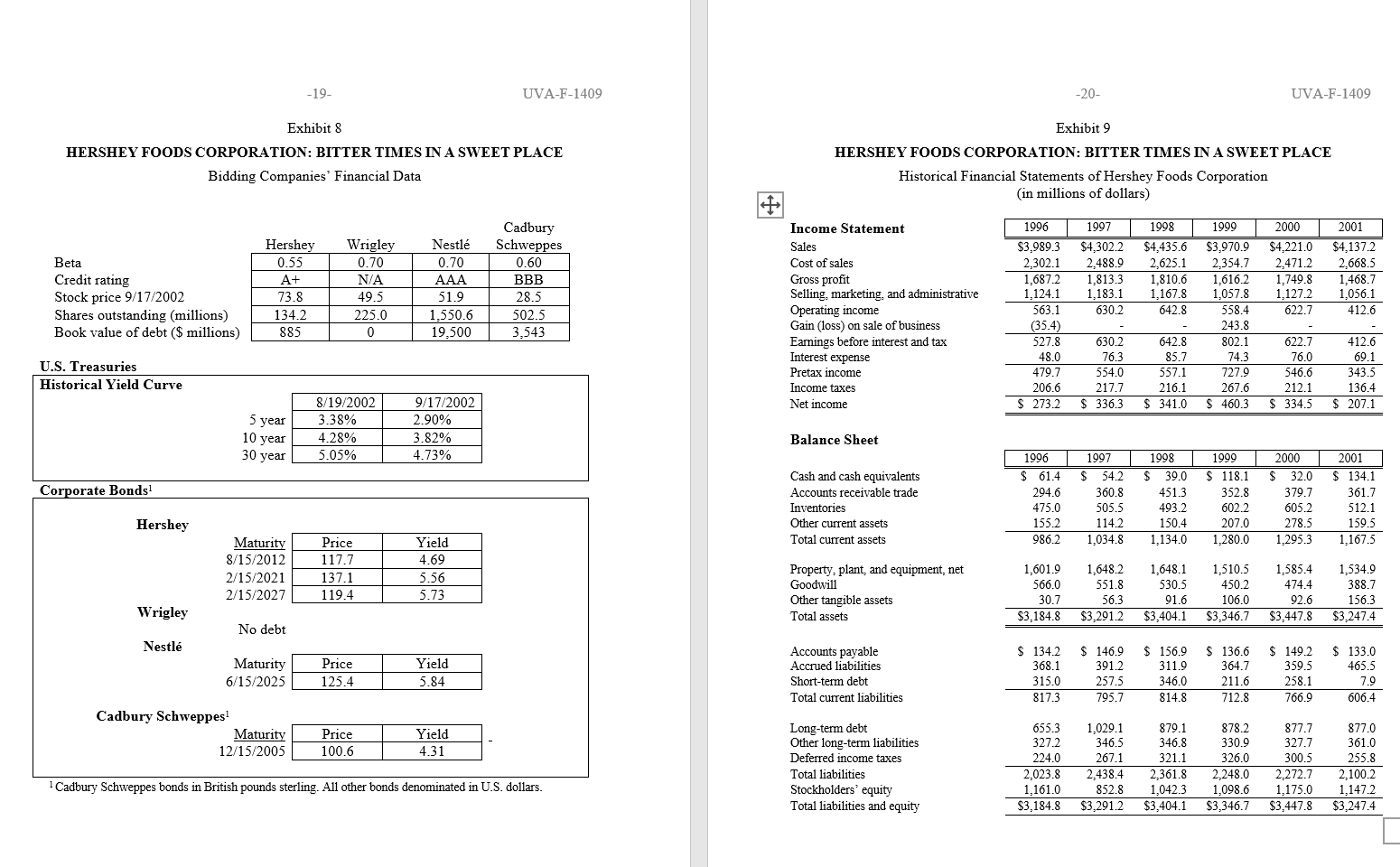

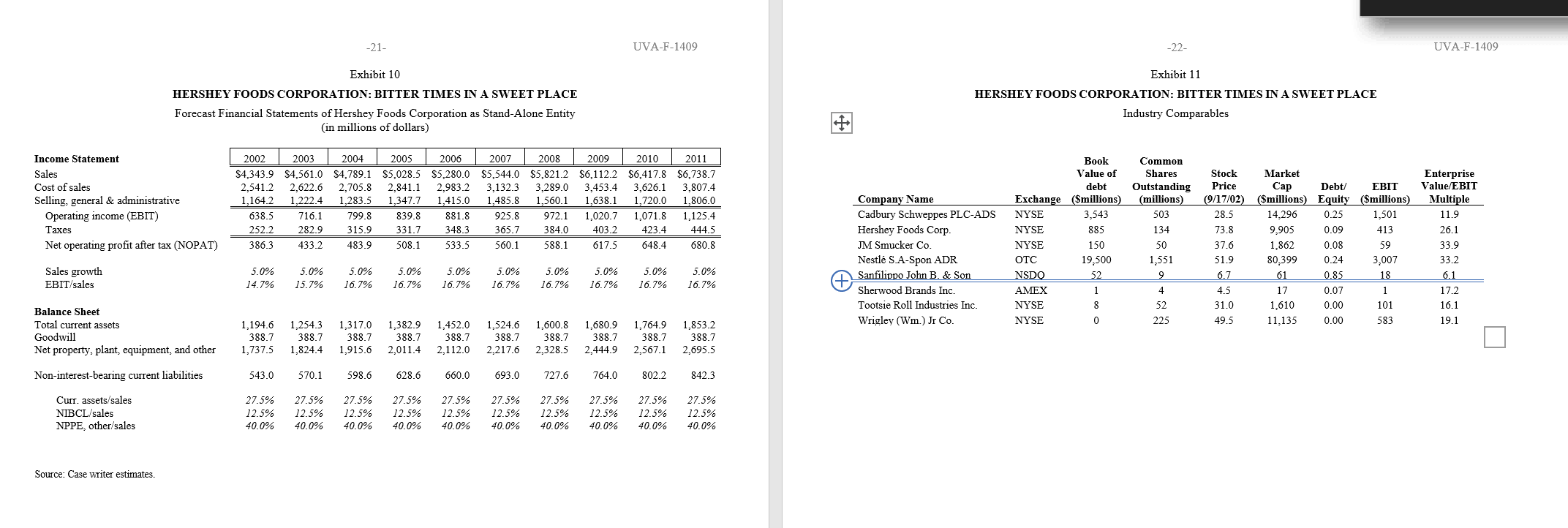

-2- DARDEN BUSINESS PUBLISHING UNIVERSITY VIRGINIA UVA-F-1409 Rev. Feb 4, 2011 UVA-F-1409 disappointing trend in the U.S. market, several factors had helped a few key industry players grow during this period: HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Developing innovative products with high consumer appeal and price per pound Identifying and acquiring target companies to execute expansion strategies Developing operations and/or distribution systems in new countries With a market share of 30%, Hershey led the U.S. market for candy and gum in 2001, followed by M&M Mars, Inc. (Masterfoods Corp) at 17.1%. Wm. Wrigley St. Co at 6.6% and Nestl at 6.5%. The other players sharing the remaining 40% of the market included Cadbury Schweppes, World's Finest Chocolate, Inc., and Tootsie Roll Industries, Inc Hershey's chocolate. Like baseball and apple pic, it was an American icon. So when Hershey's largest shareholder proposed selling the company in carly 2002, the residents of Hershey. Pennsylvania, the state attorney general, legislators, and current and former Hershey employees reacted with alarm. For them, the idea of selling the "Great American Chocolate Bar" was an insult to a beloved American institution and a threat to the principles on which Milton Hershey had built his company. Unlike most large corporations. Hershey Foods' majority shareholder was not a corporate raider, institutional investor, or multinational, but rather the Hershey Trust Company, which owned 77% of its voting stock. The last had been endowed by a gift, in 1918, by Milton Hershey himself, with the objective of supporting the Milton Hershey School, an institution for orphans in Hershey, Pennsylvania. Nevertheless, in March 2002, the Hershey Trust's board of trustees decided that the school would be better served if its holdings were less concentrated in Hershey stock. Therefore, the Hershey Trust announced its decision to sell its entire stake in Hershey Foods, which effectively put the corporation up for sale. With its aggressive introduction of new products, Wrigley posted a 12.3% growth in revenues over the previous year. Wrigley, the largest producer of chewing gum in the world, had recently introduced Wrigley Eclipse Flash Strips, which accounted for some of the company's impressive performance and moved it from fourth to third place in U.S. rankings. Nestl showed 6.5% sales growth, and Mars and Hershey cach showed 1.4% growth. Milton Snavely Hershey: Entrepreneur Six months after making its decision to explore a potential sale, the board of the Hershey Trust Company was examining two serious offers: a joint bid from Cadbury Schweppes PLC and Nestl S.A. and an independent bid from the Wm. Wrigley Jr. Company. The primary question for the board's 17 members was whether the bidders had accurately valued Hershey and, if so, whether the economic value created through the deal was consistent with the board's obligation to safeguard Hershey's legacy of community involvement Milton Snavely Hershey was born to a German-Mennonite family in south-central Pennsylvania, on September 13, 1857, shortly before the outbreak of the American Civil War. In his youth. Hershey was a poor student, and after transferring among seven different schools, he dropped out before reaching the fourth grade As a young adult, Hershey developed an interest in becoming a confectioner, and in 1886, he opened the Lancaster Caramel Company in Lancaster, Pennsylvania, which specialized in caramels made with fresh milk Because he believed there would be great demand for affordable, mass produced chocolate, Hershey sold his caramel business for $1 million in 1900, but retained the firm's chocolate-making machines Attracted by central Pennsylvania's ample supplies of water, dairy farms, and hard-working immigrants, Hershey used the proceeds from the sale to purchase 1.200 acres of farmland and to break ground for the Hershey factory on March 2. 1903. Upon its completion, in December 1904, Hershey had built the largest chocolate factory in the world, and the Hershey Chocolate Company was bom. The Confectionary Industry In 2001, the U.S. confectionary industry was worth $24 billion. Chocolate products accounted for 55% of that market, gum, 12% and nonchocolate candy. 32%. The consumption of all confectionery had stagnated in the United States during the past four years, and the consumption of chocolate, in particular, had declined during the previous year. Despite the Hershey, Pennsylvania: From Factory to Company to Town This case was prepared by Sean Carr (MBA '03) and Gustavo Rodriguez (MBA '03), under the supervision of Professors Kenneth M. Eades, Chris Muscarella (Penn State University), and Samuel C. Weaver (Lehigh University). It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2004 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an email to sales@dardenbusinesapublishing.com No part of this publication may be reproduced, stored in a retrieval system red in a spreadshest, or transmitted in any form or by any meclectronic, mechanical, photocopying recording or otherwisewithout the permission of the Darder School Foundation Hershey enjoyed making money, but he "wanted it used for a purpose of enduring good." (A sign on his office wall read "Business Is a Matter of Human Service") Influenced by utopian "manufacturing communities of the time, Milton Hershey decided to surround his business cnterprise with a model town. In the pastures surrounding his new factory, Hershey mapped out a , -3- UVA-F-1409 -4- UVA-F-1409 Milton Hershey's Commitment: The Milton Hershey School village, with tree-lined streets whose names evoked the exotic lands of the cocoa bean, including Trinidad. Caracas, and Ceylon (Sri Lanka). Milton Hershey created the Hershey Improvement Company, a division of Hershey Chocolate, which built a complete infrastructure, including roads, sewers, utilities, houses, and public buildings. In 1906, the village of Derry Church, Pennsylvania, was renamed Hershey. The development of Hershey, Pennsylvania, followed the ebb and flow of the company's fortunes. Following financial difficulties in 1920. Milton Hershey reorganized and refinanced his company, creating three new entities: In 1909, at the suggestion of his wife, Kitty, the unschooled Milton Hershey created a residence and school for homeless boys. In 1918, three years after his wife's death, the childless Milton Hershey bequeathed his entire personal fortune to the Milton Hershey School, including thousands of acres of land and all his stock in the Hershey Chocolate Company. The Hersheys designated the newly created Hershey Trust Company as the sole trustee for the school. According to the deed of trust the trustee was responsible for managing the trust's considerable endowment and for reporting to the school's managers. Ever since the bequest, the Hershey Trust Company had had a controlling interest in every major Hershey entity. Moreover, the school's managers and the trust's board comprised the same 17 individuals. Hershey Foods' board, however, was, for the most part, an independent entity with only one of its nine members also serving on the trust's board. See Exhibit 3 for an organizational chart. Hershey Chocolate Corporation, which acquired all the chocolate properties; Hershey Corporation, which acquired the company's 65,000 acres of sugar-cane fields and eight sugar-processing plants in Cuba; Hershey Estates, which continued the work of the Hershey Improvement Company. . Through Hershey Estates, the Hershey Chocolate Company played an ever-larger role in the lives of Hershey's citizens. By 1927, Hershey Estates had a hand in more than 30 nonchocolate interests, including the telephone company, a department store, the hospital, and the cemetery. See Exhibit 1 for a list of Hershey Estates' enterprises. By 2002, the Milton Hershey School (MHS) admitted both boys and girls without regard to race and provided instruction from kindergarten through the 12th grade. MHS enrolled 1.300 students, who lived on the school's 1,400-acre campus. Annual spending per student was $96,000, which included housing, food, clothing, and medical care. MHS's endowment, administered by the Hershey Trust Company, had grown from its initial bequest of $60 million to approximately $5.4 billion, making it one of the largest educational endowments in the United States. See Exhibit 4 for a comparison of private educational endowments. Hershey Foods Corporation Milton Hershey's dedication to his employees and the residents of the town was steadfast. During the Great Depression, despite a 50% drop in sales, Hershey refused to lay off any local employees. Instead, between 1929 and 1939, he launched a series of massive building projects that resulted in the construction of most of Hershey's major buildings, including the Hershey Community Center, the lavish Hotel Hershey, the high school, the Hershey Sports Arena, Hershey Stadium, and the Hershey Chocolate Corporation headquarters, at 19 East Chocolate Avenue. Milton Hershey learned that the secret of mass production for his chocolate lay in the manufacture of huge quantities of one item, standardized in design, and with a continuity of streamlined output that held down costs. The plain milk-chocolate bar and the milk-chocolate bar with almonds were the bread and butter of the Hershey Chocolate Company. With this recipe, Hershey had generated sales of $5 million by 1911, more than eight times the company's first- year revenues. By 1921. Hershey's sales had soared to $20 million. Hershey Estates served the town well but operated at a financial loss. During Milton Hershey's lifetime, profit for the Estates division was never a primary consideration. In fact, after 1927, Milton Hershey relied on profits from the company's Cuban sugar operations to provide the capital for his many construction projects. Following Hershey's death, in 1945, pressure grew to reduce Hershey Chocolate's involvement in the town. In the 1960s, owing to increased regulation, competition for financing, and a poor business climate, Hershey Estates divested its electric, water, sewer, and telephone utilities. The lumberyard and creamery were also sold, the ballroom torn down, the pool filled in, and the community center turned over to Hershey Foods for office space. In 1937, the quartermaster of the United States Army asked the Hershey Chocolate Corporation to develop a military-ration bar that could meet the needs of soldiers in the field. The requirements for the bar were that it should weigh about four ounces, be able to withstand high temperatures, and taste "just a little better than a boiled potato." The result was the Field Ration D. By the end of World War II. Hershey was producing 24 million units of Field Ration D per week. In 1970, after years of benign neglect, Hershey Estates began to focus on Hersheypark, an amusement park, as a revenue generator, and approved a five-year plan to revitalize it. Later, Hershey Estates was renamed Hershey Entertainment and Resorts Company (HERCO), and committed itself to managing Hershey's entertainment properties. See Exhibit 2 for a description of HERCO's businesses. And so, while other confectioners were forced to limit or even cease production during the war, the Hershey Chocolate Corporation was winning millions of loyal consumers, as well as a place in American history. Between 1940 and 1945, more than three billion units of Field Ration D bars were made and distributed to soldiers around the world. UVA-F-1409 UVA F-1409 The trust's large holding amounted to 31% of Hershey Foods' common shares and 77% of the stockholders' votes. Shortly after the end of World War II, Milton S. Hershey died at age 88. on October 13. 1945. Hershey's passing, however, did not diminish the strength of his business. By 1951, sales had grown to $154 million, and by 1962, sales had reached $183 million. In 1963, the Hershey Chocolate Corporation undertook its first major acquisition when it purchased the H. B. Reese Candy Company, Inc., makers of Reese's Peanut Butter Cups. This move began a string of acquisitions by Hershey that would continue for the next 25 years. During the 1960s, Hershey diversified by acquiring several major pasta manufacturers, including San Giorgio Macaroni, Inc., and Delmonico Foods, Ine. By the 1980s, the company had become the largest pasta manufacturer in the United States. This diversification away from chocolate products led to a change in the company's name to Hershey Foods Corporation in 1984. By 1999. however, the company had changed its strategy again and sold its U.S. pasta business, the Hershey Pasta Group, to New World Pasta, LLC, for $450 million plus equity By 2002, Hershey remained the number one candy maker in the United States, with sales comprising roughly 80% chocolate and 20% nonchocolate foods. Its largest customer was Wal- Mart, which represented 17% of the company's total sales. Other major Hershey customers included Kmart, Target, Albertsons, and CVS. Sales outside the United States accounted for 10% of total revenues. According to Money magazine, Hershey Foods' stock ranked as the 28th-best performer of the last 30 years, with annualized returns of 17.4% During the past 16 years, Hershey's stock had shown variable performance, but had significantly outperformed Standard & Poor's 500-stock index by an average of 6.8% per year (see Exhibit 7). Despite the overall strong investment performance of the trust and its gradual diversification away from Hershey shares, by carly 2002 there was an increasing concern among board members that the trust was compromising its fiduciary responsibility by concentrating a disproportionate amount of the endowment fund in the shares of Hershey Foods Corporation. Therefore, during a meeting in March 2002, the trust's board voted 15-2 to "explore a potential sale" of its holdings in Hershey Foods. The board believed that a sale of the trust's entire stake in Hershey Foods would garner a higher premium than if its shares were sold piecemeal: therefore, the decision to sell was tantamount to putting Hershey Foods Corporation on the block. According to Robert C. Vowler. president and CEO of the Hershey Trust Company, the trust planned to invest the profits from the sale in a variety of U.S. cquities and fixed-income and international securities to provide more "straight lines of return and not the volatility of one stock." Following the March board meeting, a delegation from the trust told the chairman and CEO of Hershey Foods Corporation, Richard H. Lenny, to begin the process of finding suitable bidders for the company. But Lenny opposed the idea of a sale and asked for time to make a counterproposal. In May. Lenny presented a stock-buyback offer to the head of the trust's investment committee, J. Robert Hillier, who also sat on the board of Hershey Foods. The plan called for Hershey Foods to purchase half of the trust's shares at a 10% premium. Hershey Foods would also help the trust sell the remainder of its shares over the next three to five years. The trust's board, however, rejected the plan on the ground that the 10% premium was insufficient. On July 25, 2002, a day that would become known by those opposed to the sale as Black Thursday, the trust made public its decision to sell its portion of the outstanding shares of Hershey Foods Corporation. Following news of the announcement, Hershey's stock price soared from $63 to 879 per share. In the ensuing weeks, rumors swirled about potential bidders. Among the names to emerge were the Wm. Wrigley Jr. Company. Nestl S.A., Cadbury Schweppes PLC, Kraft Foods, the Coca-Cola Company, and PepsiCo. The Hershey Trust Company Considers a Sale Over the years, both the composition and the size of Hershey Trust's board of directors had changed (see Exhibits 5 and 6). In particular, the trust's board had expanded from 10 members, in 1990, to 17 members, in 2002, and the composition of the board had shifted toward education professionals. Hershey School alumni, and various public sector leaders. The board's mandate, however, remained that of serving the interests of the Milton Hershey School, the primary beneficiary of the trust's endowment. The endowment had grown from Milton Hershey's original gift of $60 million of Hershey stock to its current level of $5.4 billion. Beginning in the 1990s. Hershey Foods had reduced the concentration in Hershey shares through a share-repurchase program. In all, Hershey Foods repurchased $1.2 billion of its own shares so that, by 2002, only 58.6% of the endowment comprised Hershey Foods' shares. In 1984. Hershey Foods introduced "super voting stock" (10 votes per share) for the trust, which consolidated ownership of Hershey Foods the class B common stock its majority red a 10% lower the to compensate for the superior voting nebey Foods regular common stock. If the trust's stake in ever dropped below 15%, its special voting stock reverted to common. With the exception of Hershey and a select group of other finns, the New York Stock Exchange did not allow companies to maintain dual classes common stock 2 According to Money magazine, Hershey Foods ranked as the 28th best performing stock of the past 30 years UVA-F-1409 UVA-F-1409 Swift reaction The prospect of a sale of Hershey Foods, an American icon and the paternalistic benefactor of a town, produced a groundswell of opposition by employees, local businesses, and politicians who feared Hershey would become part of someone else's global empire. Many residents of Hershey, Pennsylvania, whose population of 22,400 included 6,200 Hershey employees, were concerned that the legacy of Hershey's involvement in the community would be compromised and many jobs might be lost. Community leaders organized rallies and developed a Web site www.friendsofhershey.org, gathering 6.500 signatures of people opposed to the sale The Bids: Wrigley and Nestl-Cadbury Schweppes By September 14, 2002, the final date by which bids could be submitted, the Hershey Trust Company board was considering two serious offers a $12.5 billion bid from the Wm Wrigley Jr. Company and a $10.5 billion joint-bid from Nestl S.A. and Cadbury Schweppes PLC The Wm. Wrigley Jr. Company The controversy over the proposed sale of Hershey Foods became increasingly public as protests by company employees and retirees and Milton Hershey School alumni came to the attention of Pennsylvania's attorney general, whose office oversaw trusts and charities the state. On August 12, the attorney general filed a petition asking that any sale of Hershey Foods be subject to approval by the Dauphin County Orphan's Court, which had jurisdiction over charitable trusts. On August 24, the attorney general sought an injunction to stop the sale altogether The issues underlying the controversy emerged during the ensuing court proceedings The world's largest maker of chewing gum had been based in Chicago since 1892, when William Wrigley, while working as a salesman for his family's soap factory, begat offering customers chewing gumn. In 1898, he merged his company with one of his suppliers to form the Wm. Wrigley Jr. Company, and by 1910, the firm's spearmint gum was the leading U.S. brand. As late as 1961, the company still offered its original five-cent price and product line. But by 1971, as it faced competitive and economic pressures, the company increased its price to seven cents and launched several new products, including the following: Big Red (1975) Hubba Bubba (1978) Orbit, a sugar-free gum (1977) Extra (1980) Wrigley continued to expand its business by launching operations in Eastern Europe and China (1993). In 1999, Bill Wrigley, a member of the fourth generation of Wrigleys to lead the company, became president and CEO After 2000, the company focused on testing innovative gums with such attributes as cough suppression and teeth whitening In 2002, the Wrigley family owned about 35% of the company and controlled 60% of its voting shares. With 2001 revenues of $2.4 billion, Wrigley commanded a 50% share of the global gum market and sold its products in more than 150 countries. Nearly all its revenues were derived from gum. Wrigley's Web site described its business strategy as follows: Jack Stover, lawyer for the Hershey Trust Company: The injunction] causes irreparable harm to us. . It ties the hands of the Trustees with regard to its single largest asset ... Who in the courtroom has not read in the paper what happens in today's economy when you invest too heavily in a single stock?" Judge James Gardner Collins: "What makes the attorney general's office better financial managers than the board of the Hershey Trust, and literally the worldwide experts they have hired as we11?" Jerry Pappert, deputy attomey general: "Because we're managing different clients. We're managing the interests of the public, and we have an opportunity and a duty under law to make sure that the ultimate beneficiary of the trust the public, is not harmed." Wrigley is committed to achieving generational growth and prosperity for our stakeholders. To achieve this mission, we are executing against a long-term strategic business plan based on six key objectives. Those objectives include: During the injunction hearings, several former Hershey Foods executives testified against the sale, including Richard Zimmerman, former CEO of Hershey Foods, and Bruce McKinney. former CEO of HERCO. Representative James Sensenbrenner (R-Wis.). chairman of the House Judiciary Committee, asked the Federal Trade Commission to scrutinize carefully any antitrust implications of the potential sale of Hershey Foods. Boosting our core chewing gum business Expanding business geographically and into new channels Diversifying our product line in "close to home" areas . Focusing on innovation in our products, marketing, and business processes 3 The attcomey general, Mike Fisher was a Republican candidate for governor of Pennsylvania at the time 9 UVA-F-1409 10 UVA-F-1409 Nestle's strategic priorities are focused on delivering shareholder value through the achievement of sustainable, capital-efficient, and profitable long-term growth The combination of our four-pillar strategy and efficiency programmes will deliver market share growth and margin improvement Our four pillar strategy is based on Delivering the highest quality at lowest costs Growing and developing our Wrigley people around the world The Wm. Wrigley Jr. Company offered $12.5 billion $7.5 billion in stock and $5.0 billion in cash) for 100% of the outstanding shares of Hershey Foods Corporation. The Hershey Trust Company would exchange its Hershey shares for cash and shares in the new company, to be renamed Wrigley-Hershey. This offer, the equivalent of $89 per share, represented a 42% premium over Hershey's preannouncement stock price. The deal included commitments to the Hershey community, including assurances of job retention at Hershey Foods' plants in Derry Township Some analysts speculated that Wrigley management was assuming it could put Hershey products into its product mix and sell them internationally. Although it was unlikely that Wrigley could achieve significant cost savings, management hoped to generate higher sales volumes. Wrigley had been successful in selling chewing gum internationally and was hoping to do the same with Hershey's chocolates Operational performance Product innovation and renovation Product availability Consumer communication Through this strategy, Nestl had been able to establish itself as both an international and a local company. With nearly 470 factories in 84 countries, many of Nestle's brands were unique to particular countries. Nestl had been successful at satisfying local tastes with local products. In the future, the company planned to expand into specialty nutritional foods and ice cream. Cadbury Schweppes PLC Nestl S.A. Nestl S.A. was founded in 1843, when Henri Nestl purchased a factory in Vevey. Switzerland, that made products ranging from nut oils to rum. In 1904, the company began selling chocolates, and one year later merged with the Anglo-Swiss Company, retaining the Nestle name. During World War I, the company developed a water soluble coffee cube" and the idea became one of the company's most popular products, Nescaf Nestl continued to introduce popular products during the next four decades, including Nestle's Cranch bar (1938). Quik drink mix (1948), and Taster's Choice instant coffee (1966). In 2002, Cadbury Schweppes was a major global player in both the beverage and confectionary industries. With bottling and partnership operations in 10 countries and licensing agreements in 21 more, Cadbury Schweppes was the third-largest soft-drink company by sales volume in the world. Its confectionary products were manufactured in 25 countries and sold in almost 200, making it the fourth-largest confectioner in the industry. Both Schweppes Ltd. and Cadbury Group Ltd. had sought new markets since their founding in the nineteenth century. The two companies merged in 1969, giving birth to one of the biggest players in the candy and soft drink sectors. The new company, Cadbury Schweppes PLC, began a continuous program of worldwide expansion. By 2001, the company derived 45% of its revenues from the Americas, 38% from Europe, and 12% from Asia. Cadbury Schweppes employed more than 11,000 people worldwide In the 1970s, the company expanded its product line by acquiring a 49% stake in Gesparal, a holding company that controlled the French cosmetics firm L'Oral. In the 1980s. Nestl continued its expansion by acquiring the UK. chocolate company Rowntree, maker of Kit Kat (licensed to Hershey Foods Corporation. In the 1990s, Nestl completed several more acquisitions, including Butterfinger, Baby Ruth candies. Source Perrier water, and Alpo pet food, Simultaneously, Peter Braceck-Letmathe, named CEO in 1997, divested Nestle's noncore businesses such as Contadina tomato products and Libby's canned-meat products. After acquiring Ralston Purina, in 2001, Nestl consolidated its position as the world's number one food company. Nestl had become a leader in coffee (Nescafe), bottled water (Perrier), and pet food (Ralston Purina) and an important player in the cosmetics industry. Through its stake in Alcon, Inc., Nestl also participated in ophthalmic pharmaceuticals, contact- lens solutions, and equipment for ocular surgery Nestl's strategy, according to its Web site, was as follows: According to its Web site, Cadbury Schweppes' governing objective was the growth of shareowner value through "focusing on the beverages and confectionary businesses, developing robust and sustainable positions in regional markets, and growing organically and by acquisition." Since the mid-1980s, acquisitions and divestments had played a key role in Cadbury Schweppes' expansion plans. Key transactions included the acquisition of Dr. Pepper Seven-Up. Hawaiian Punch, Snapple Beverage Group, and Kraft Foods' candy business in France. The Nestl-Cadbury Schweppes offer for Hershey Foods was $10.5 billion in cash. At $75 a share this offer represented a significantly lower premium than that offered by Wrigley. -11- UVA-F-1409 -12- UVA-F-1409 Exhibit 1 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Businesses Operated by Hershey Estates (1927) Moreover, the bid was complicated by the fact that Nestl received royalties from Hershey for U.S. sales of its Kit Kat and Rolo brands. The licensing arrangement had been negotiated between Rowntree and Hershey prior to Nestl's acquisition of Rowntree. Because the licensing agreement was structured to continue in perpetuity, Hershey valued the licensing of the two brands at approximately $1 billion. An important aspect of the agreement, however, was that a change of ownership of Hershey would transfer all rights to the two brands back to Nestl. Therefore, according to the agreement, regardless of who won the bidding battle for Hershey, Nestl stood to gain the value of the licensing agreement. The deal included a provision making Hershey, Pennsylvania, the headquarters of Cadbury Schweppes' operations in the United States and calling it the "chocolate capital of the world." With new production facilities and distribution capabilities in the United States, however, they expected to reduce costs by consolidating operations and reducing workforces. See Exhibit 3 for a summary of the bidders financials. Hershey Baking Company Hershey Cemetery Hershey Cold Storage Hershey Community Building Hershey Community Inn Hershey Community Theatre Hershey Country Club Hershey Dairy Hershey Department Store Hershey Electric Company Hershey Experimental Candy Kitchen Hershey Feed and Grain Hershey Farms Hershey Farming Implements Hershey Filling Station Hershey Garage Hershey Greenhouse and Nursery Hershey Hospital Hershey Laundry Hershey Museum Hershey Park Hershey Park Golf Club Hershey Rose Garden Hershey Sewerage Company Hershey Telephone Company Hershey Transit Company Hershey Water Company Hershey Zoo Hotel Hershey Coal Real Estate The Hershey Trust Company Board Decides In essence, the board faced both an economic and a governance decision. On the economic side, the board needed to determine the value of Hershey as a stand-alone entity compared with the bids being offered. See Exhibit 9 for Hershey's historical financials, Exhibit 10 for Hershey management's financial forecasts, and Exhibit 11 for industry comparables. On the governance side, the board needed to decide whether selling Hershey compromised the board's original mandate from Milton Hershey. Source: Hershey Community Archives. -13- UVA-F-1409 Exhibit 2 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Businesses Operated by Hershey Entertainment and Resorts (2002) -14- UVA-F-1409 HERSHEYPARK is a popular theme park boasting 60 rides and several entertainment venues. Milton Hershey himself built the park as a leisure opportunity for Hershey workers and their families. Exhibit 3 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Hershey Entities Organizational Chart (2002) ZOOAMERICA North American Wildlife Park has on exhibit more than 200 animals indigenous to North America. HERSHEYPARK Arena was once host to the American Hockey League HERSHEY BEARS. In 2002 the team left the 3,000-seat arena to play at GIANT Center. HERSHEY TRUST COMPANY (HTC) Total endowment: $5.4 billion HERSHEYPARK Stadium attracts 30,000 audience members to its Summer Concert Series and other events. MILTON HERSHEY SCHOOL (nonprofit) MILTON HERSHEY SCHOOL TRUST THE M.S. HERSHEY FOUNDATION Private Trust and Investment Clients THE STAR PAVILION at HERSHEYPARK Stadium is an outdoor amphitheater designed for musical performances; its capacity is 7,200. HERSHEY BEARS, the oldest American Hockey League franchise, is a frequent Calder Cup winner Milton Hershey School Operation of the Major Philanthropic Services Income-Producing Investments Individuals The Hershey Theatre Families THE HOTEL HERSHEY, a AAA Four Diamond hotel, is known for its rich history. Since its construction in 1933, by it has grown to include 234 guest rooms and almost 25,000 square feet of event space. The Hershey Museum 1,300 enrolled students 1,400-acre campus 109 student homes 3 instructional centers Founder's Hall: Admin. Office Visitor's Reception Chapel Auditorium Other Investments of Various Types Hershey Entertainment & Resorts Company (HERCO) The Hershey Gardens Foundation & Endowments HERSHEY Lodge and Convention Center is an even larger hotel and conference facility, with 667 guest rooms and 100,000 square feet of event space. HERSHEY'S CHOCOLATE TOWN CAF's chocolate theme reflects its Hershey's Chocolate World location. It is managed by HERSHEY Resorts and owned by Hershey Foods Corporation. Hershey Foods Corp. (HSY) HTC owns 31% of HSY stock and 76.7% of the votes $3.2B (58.6%) of HTC's assets are HSY shares HTC owns 100% of HERCO Represents 3% of HTC assets The Hershey Community Archives Other Investment Opportunities BELLA LUNA is Hershey's authentic Italian Deli. Source: Hershey Trust Company. HERSHEY Highmeadow Campground offers visitors a chance to enjoy 55 acres of Pennsylvania countryside, on either open campsites or in the comfort of a log cabin. HERSHEY Nursery has handled the landscaping needs of area homes and businesses since 1905. Source: Hershey Entertainment and Resorts Company. -15- UVA-F-1409 -16- UVA-F-1409 Exhibit 4 Exhibit 5 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Comparison of Private Educational Endowments (S millions) HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Boards of Directors for Hershey Trust and Hershey Foods Corporation (1990) + 1990 Hershey Trust Board of Directors 1990 Hershey Foods Board of Directors Richard. A Zimmerman Kenneth V. Hatt Kenneth L. Wolfe Chairman and CEO Hershey Foods Corporation Chairman of the Board Hershey Trust Company President and Chief Operating Officer Hershey Foods Corporation Retired Chairman of the Board Carpenter Technology Corporation Reading, PA Howard O. Beaver, Jr. John F. Burlingame Harvard Univ. Yale Univ. Princeton Univ. Stanford Univ. Mass. Inst. of Tech. Milton Hershey School Columbia Univ. Emory Univ. Washington Univ. Univ. of Michigan Univ. of Chicago Northwestern Univ. Cornell Univ. Univ. of Pennsylvania Rice Univ. Texas A&M Univ. Univ. of Notre Dame Duke Univ. Dartmouth Coll. Vanderbilt Univ. Kenneth V. Chairman of the Board of Hershey Hatt Trust Co. & Milton Hershey School Board of Managers Richard. A. Chairman and CEO of Hershey Zimmerman Foods Corporation President and Chief Operating Kenneth L Wolfe Officer Hershey Foods Corporation William R. President of the Milton Hershey School and board of directors of Fisher The Hershey Bank Managing partner in the Harrisburg law firm of McNees, Rod J Pera Wallace & Nurick, counsel to all Hershey entities. John F Executive vice president of the Rineman Pennsylvania Medical Society President, CEO and chairman of J. Bruce the board of Hershey McKinney Entertainment & Resort Co. (HERCO) Chairman of H B. Alexander Construction Company. Director William H of family business programs at Alexander Snider Entrepreneurial Center, Wharton School, University of Pennsylvania. Retired Vice Chairman of the Board and Executive Officer GE Company Stamford, Connecticut $18,259 10,739 8,359 8,250 6,135 5,400 4,324 4,249 4,018 3,689 3,492 3,470 3,437 3,382 3,243 3,193 2.884 2,577 2,414 $2,160 Thomas C. Graham President USS a division of USX Corporation Pittsburgh, PA Dean of the Graduate School of Business Administration College of William and Mary, Williamsburg. VA John C. Jamison Dr. Sybil C. Mobley Dean of the School of Business and Industry Florida Agricultural and Mechanical University Tallahassee, Florida Ronald D Glosser President of Hershey Trust Co Francine I. Neff Data source: Voluntary Support of Education Survey (Council for Aid to Ed RAND, 2000-01). on, a subsidiary of John. M. Pietruski C. McCollister Evarts Juliet C Rowland Dean, Penn State Milton S. Hershey Medical College President and CEO, Ohio United Way Vice President and Director NETS Inc. privately held investment management company Albuquerque, NM Retired Chairman of the Board and CEO Sterling Drug Inc. New York, NY Retired Chairman and CEO Sun Company, Radnor, PA President Hershey Chocolate USA H. Robert Sharbaugh Joseph P. Viviano 1 All Hershey Trust board members also serve on the board of directors of the Milton Hershey School. -17- UVA-F-1409 -18- UVA-F-1409 Exhibit 6 Exhibit 7 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Boards of Directors for Hershey Trust and Hershey Foods Corporation (2001) HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Hershey Stock-Price Performance (1986-2001) 80% 70% 60% 2001 Hershey Foods Board of Directors Richard H. Chairman, President and CEO, Lenny Hershey Foods Corporation J. Robert Chairman and Founder, The Hillier Hillier, FAIA Group (architects) Jon A. Bosia Chairman and CEO Lincoln National Corporation Robert H. Chairman and CEO (ret.), Sunoco Campbell Inc. 2001 Hershey Trust Board of Directors! Robert C. Vowler President and CEO, Hershey Trust Company J. Robert Hillier, Chairman and Founder of Hillier FAIA Group (architects) A. John Gabig Chairman of MHS Board of Esq. Managers William L. Lepley President and CEO of Milton Hershey School Chairman of H. B. Alexander Construction Company. Director William H. of family business programs at Alexander Snider Entrepreneurial Center, Wharton School, University of Pennsylvania. 50% 40% 30% 20% Gary P. Coughlan Sr. VP Finance and CFO (ret.), Abbott Laboratories Inc. abbinalota 10% 0% Lucy D. Hackney Esq. Former Policy adviser, General Services Admin Bonnie Hill President and CEO, The Times Mirror Foundation -10% -20% Wendy D. Purifoy Public Education Network Chairman. Mallardee Associates -30% John C Jamison Mackey J. McDonald John M. Pietruski Chairman, President and CEO, VF Corporation Chairman, Texas Biotechnology Corporation Hershey Foods OS&P 500 Average Stock Returns W. Don Cornwell Granite Broadcasting Co. A. Morris Williams, Jr. President, Williams & Company Michael W. Matier Institutional Research & Planning, Cornell U. Rev. John S. St. James the Less Episcopal McDowell, Jr. Church Anthony J. Colistra Superintendent, Cumberland Valley School Dist. Robert F Managing director, DLJ Real Cavanaugh Estate Partners Joan S. Lipsitz, PhD. Independent education consultant Hilary C Co-founder, Jobs for the Future Pennington President and CEO, Ohio United Juliet C. Rowland Way 1997-2001 (5 years) 16.4% (32.7%) 1986-2001 (16 years) 18.8% (24.99 Hershey 9.0% S&P 500 (19.5%) 12.0% (14.7%) *Standard deviation of returns in parentheses All Hershey Trust board members also serve on the board of directors of the Milton Hershey School. -19- UVA-F-1409 -20- UVA-F-1409 Exhibit 8 Exhibit 9 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Bidding Companies' Financial Data HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Historical Financial Statements of Hershey Foods Corporation (in millions of dollars) Beta Credit rating Stock price 9/17/2002 Shares outstanding (millions) Book value of debt ($ millions) Hershey 0.55 A+ 73.8 134.2 885 Wrigley 0.70 N/A 49.5 225.0 0 Nestl 0.70 AAA 51.9 1.550.6 19.500 Cadbury Schweppes 0.60 BBB 28.5 502.5 3,543 1996 $3,989.3 2,302.1 1,687.2 1,124.1 563.1 (35.4) 527.8 48.0 479.7 206.6 $ 273.2 1997 $4,302.2 2.488.9 1.813.3 1,183.1 630.2 1998 $4,435.6 2,625.1 1,810.6 1,167.8 642.8 2000 $4,221.0 2,471.2 1,749.8 1,127.2 622.7 Income Statement Sales Cost of sales Gross profit Selling, marketing, and administrative Operating income Gain (loss) on sale of business Earnings before interest and tax Interest expense Pretax income Income taxes Net income 2001 $4,137.2 2,668.5 1,468.7 1,056.1 412.6 1999 $3.970.9 2.354.7 1,616.2 1,057.8 558.4 243.8 802.1 74.3 727.9 267.6 $ 460.3 U.S. Treasuries Historical Yield Curve 630.2 76.3 554.0 217.7 $ 336.3 642.8 85.7 557.1 216.1 $ 341.0 622.7 76.0 546.6 212.1 $ 334.5 412.6 69.1 343.5 136.4 $ 207.1 5 year 10 year 30 year 8/19/2002 3.38% 4.28% 5.05% 9/17/2002 2.90% 3.82% 4.73% Balance Sheet Corporate Bonds! Cash and cash equivalents Accounts receivable trade Inventories Other current assets Total current assets 1996 $ 61.4 294.6 475.0 155.2 986.2 1997 $ 54.2 360.8 505.5 114.2 1,034.8 1998 $ 39.0 451.3 493.2 150.4 1,134.0 1999 $ 118.1 352.8 602.2 207.0 1,280.0 2000 $ 32.0 379.7 605.2 278.5 1,295.3 2001 $ 134.1 361.7 512.1 1595 1,167.5 Hershey Maturity 8/15/2012 2/15/2021 2/15/2027 Price 117.7 137.1 119.4 Yield 4.69 5.56 5.73 Property, plant, and equipment, net Goodwill Other tangible assets Total assets 1,601.9 566.0 30.7 $3,184.8 1,648.2 551.8 56.3 $3,291.2 1,648.1 530.5 91.6 $3,404.1 1,510.5 450.2 106.0 $3,346.7 1,585.4 474.4 92.6 $3,447.8 1,534.9 388.7 156.3 $3,247.4 Wrigley No debt Nestl Maturity 6/15/2025 Price 125.4 Yield 5.84 Accounts payable Accrued liabilities Short-term debt Total current liabilities S 134.2 368.1 315.0 817.3 $ 146.9 391.2 257.5 795.7 $ 156.9 311.9 346.0 814.8 $ 136.6 364.7 211.6 712.8 $ 149.2 359.5 258.1 766.9 $ 133.0 465.5 7.9 606.4 Cadbury Schweppes Maturity 12/15/2005 Price 100.6 Yield 4.31 Long-term debt Other long-term liabilities Deferred income taxes Total liabilities Stockholders' equity Total liabilities and equity 655.3 327.2 224.0 2,023.8 1,161.0 $3,184.8 1,029.1 346.5 267.1 2,438.4 852.8 $3.291.2 879.1 346.8 321.1 2,361.8 1,042.3 $3,404.1 878.2 330.9 326.0 2,248.0 1,098.6 $3,346.7 877.7 327.7 300.5 2,272.7 1,175.0 $3,447.8 877.0 361.0 255.8 2.100.2 1,147.2 $3,247.4 Cadbury Schweppes bonds in British pounds sterling. All other bonds denominated in U.S. dollars. -21- UVA-F-1409 -22- UVA-F-1409 Exhibit 10 Exhibit 11 HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Forecast Financial Statements of Hershey Foods Corporation as Stand-Alone Entity (in millions of dollars) HERSHEY FOODS CORPORATION: BITTER TIMES IN A SWEET PLACE Industry Comparables + 2002 Income Statement Sales Cost of sales Selling, general & administrative Operating income (EBIT) Taxes Net operating profit after tax (NOPAT) 2003 2004 2005 2006 2007 2008 2009 2010 2011 $4,343.9 $4,561.0 $4,789.1 $5,028.5 $5,280.0 $5,544.0 $5,821.2 $6,112.2 $6,417.8 $6,738.7 2,541.2 2,622.6 2,705.8 2,841.1 2,983.2 3,132.3 3,289.0 3,453.4 3,626.1 3,807.4 1,164.2 1,222.4 1,283.5 1,347.7 1,415.0 1,485.8 1,560.1 1,638.1 1,720.0 1,806.0 638.5 716.1 799.8 839.8 881.8 925.8 972.1 1,020.7 1,071.8 1,125.4 252.2 282.9 315.9 331.7 348.3 365.7 384.0 403.2 423.4 444.5 386.3 433.2 483.9 508.1 533.5 560.1 588.1 617.5 648.4 680.8 Company Name Cadbury Schweppes PLC-ADS Hershey Foods Corp. JM Smucker Co. Nestl S.A-Spon ADR Sanfilippo John B. & Son Sherwood Brands Inc. Tootsie Roll Industries Inc. Wrigley (Wm.) Jr Co. Book Value of debt Exchange ($millions) NYSE 3,543 NYSE 885 NYSE 150 OTC 19,500 NSDO 52 AMEX 1 NYSE 8 NYSE 0 Common Shares Outstanding (millions) 503 134 50 1,551 9 4 52 225 Stock Market Price Cap Debt/ EBIT (9/17/02) (Smillions) Equity (Smillions) 28.5 14,296 0.25 1,501 73.8 9,905 0.09 413 37.6 1,862 0.08 59 51.9 80,399 0.24 3,007 6.7 61 0.85 18 4.5 17 0.07 1 31.0 1,610 0.00 101 49.5 11,135 0.00 583 Enterprise Value/EBIT Multiple 11.9 26.1 33.9 33.2 6.1 17.2 16.1 19.1 Sales growth EBIT/sales 5.0% 14.7% 5.0% 15.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% 5.0% 16.7% Balance Sheet Total current assets Goodwill Net property, plant, equipment, and other 1,194.6 388.7 1,737.5 1,254.3 388.7 1,824.4 1,317.0 388.7 1,915.6 1,382.9 388.7 2,011.4 1,452.0 388.7 2,112.0 1,524.6 388.7 2.217.6 1,600.8 388.7 2,328.5 1,680.9 388.7 2,444.9 1,764.9 388.7 2,567.1 1,853.2 388.7 2,695.5 Non-interest-bearing current liabilities 543.0 570.1 598.6 628.6 660.0 693.0 727.6 764.0 802.2 8423 Curr. assets/sales NIBCL/sales NPPE, other/sales 27.5% 12.5% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 27.5% 12.5% 40.0% 40.0% Source: Case writer estimates