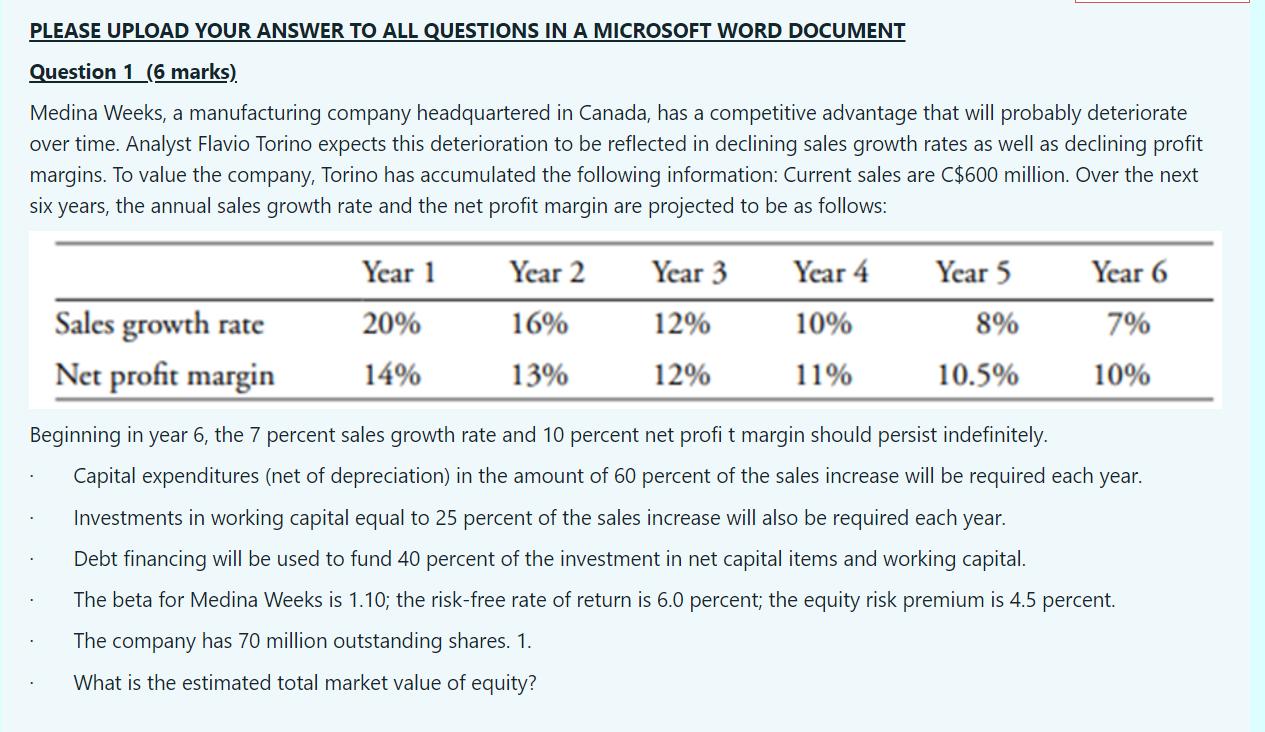

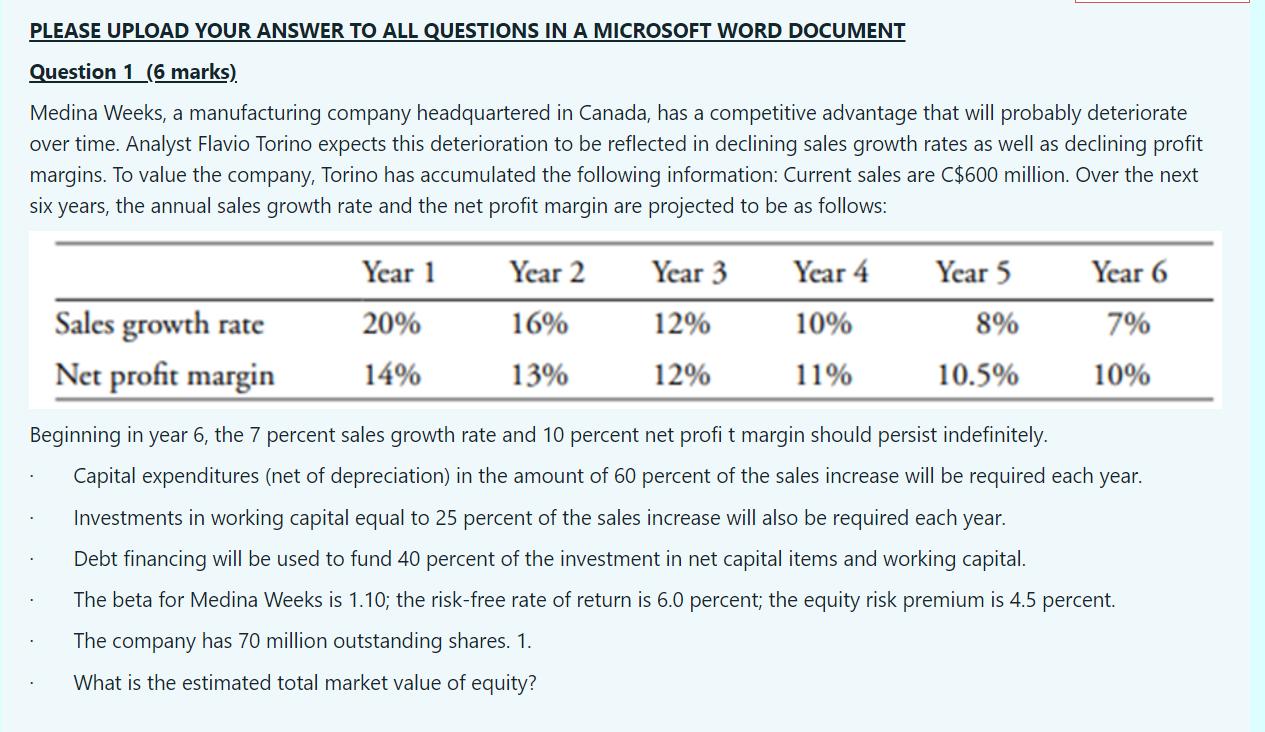

PLEASE UPLOAD YOUR ANSWER TO ALL QUESTIONS IN A MICROSOFT WORD DOCUMENT Question 1 (6 marks) Medina Weeks, a manufacturing company headquartered in Canada, has a competitive advantage that will probably deteriorate over time. Analyst Flavio Torino expects this deterioration to be reflected in declining sales growth rates as well as declining profit margins. To value the company, Torino has accumulated the following information: Current sales are C$600 million. Over the next six years, the annual sales growth rate and the net profit margin are projected to be as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Sales growth rate 20% 16% 12% 10% 8% 7% 14% 13% 12% 11% 10.5% 10% Net profit margin Beginning in year 6, the 7 percent sales growth rate and 10 percent net profit margin should persist indefinitely. Capital expenditures (net of depreciation) in the amount of 60 percent of the sales increase will be required each year. Investments in working capital equal to 25 percent of the sales increase will also be required each year. Debt financing will be used to fund 40 percent of the investment in net capital items and working capital. The beta for Medina Weeks is 1.10; the risk-free rate of return is 6.0 percent; the equity risk premium is 4.5 percent. The company has 70 million outstanding shares. 1. What is the estimated total market value of equity? PLEASE UPLOAD YOUR ANSWER TO ALL QUESTIONS IN A MICROSOFT WORD DOCUMENT Question 1 (6 marks) Medina Weeks, a manufacturing company headquartered in Canada, has a competitive advantage that will probably deteriorate over time. Analyst Flavio Torino expects this deterioration to be reflected in declining sales growth rates as well as declining profit margins. To value the company, Torino has accumulated the following information: Current sales are C$600 million. Over the next six years, the annual sales growth rate and the net profit margin are projected to be as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Sales growth rate 20% 16% 12% 10% 8% 7% 14% 13% 12% 11% 10.5% 10% Net profit margin Beginning in year 6, the 7 percent sales growth rate and 10 percent net profit margin should persist indefinitely. Capital expenditures (net of depreciation) in the amount of 60 percent of the sales increase will be required each year. Investments in working capital equal to 25 percent of the sales increase will also be required each year. Debt financing will be used to fund 40 percent of the investment in net capital items and working capital. The beta for Medina Weeks is 1.10; the risk-free rate of return is 6.0 percent; the equity risk premium is 4.5 percent. The company has 70 million outstanding shares. 1. What is the estimated total market value of equity