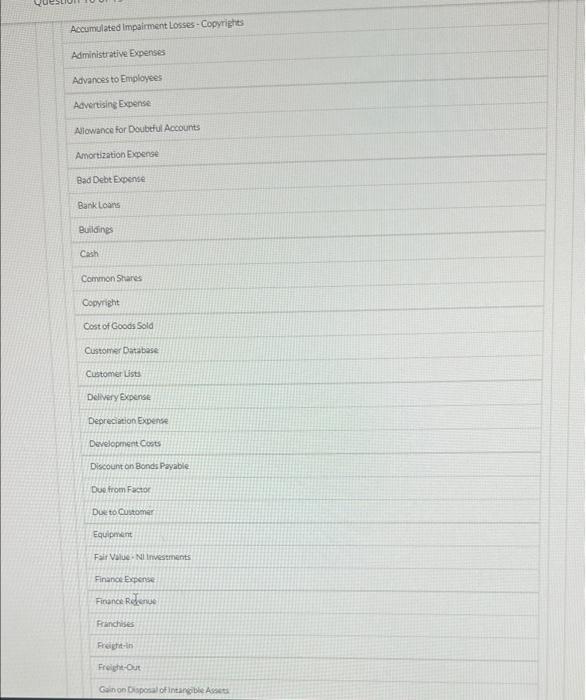

please use accounts name from the list available.

dont use other names

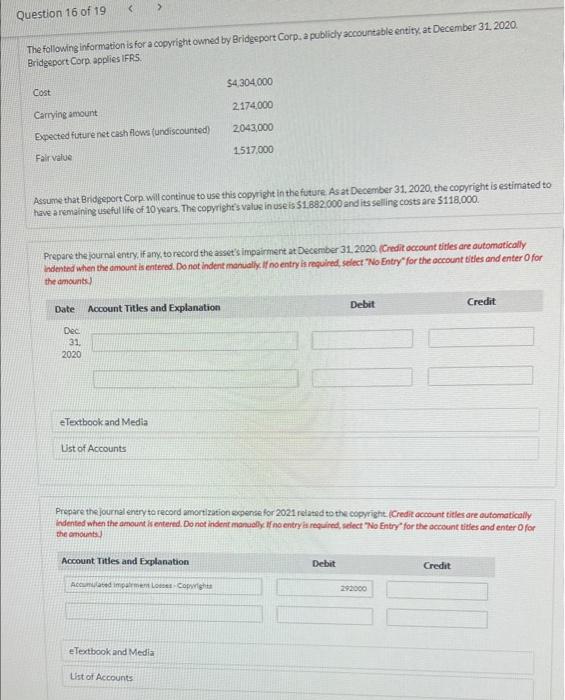

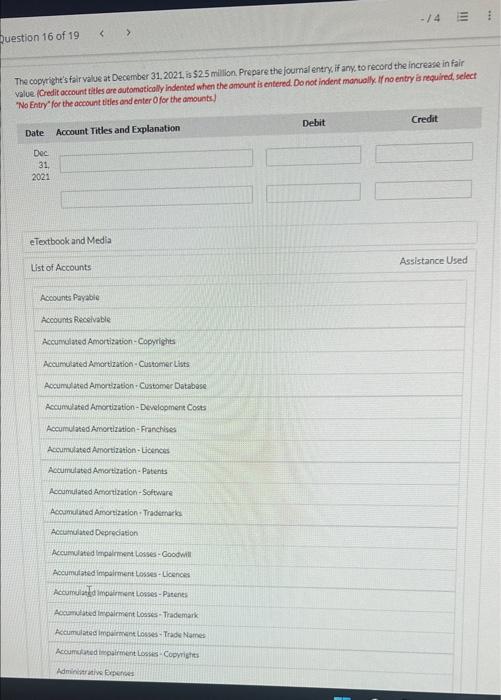

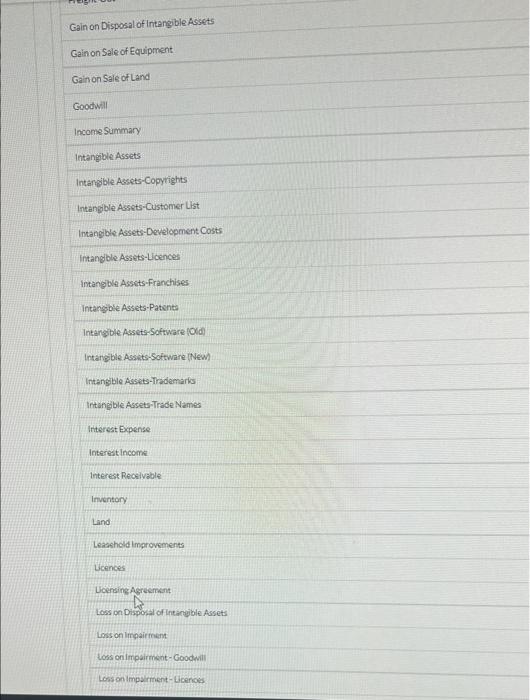

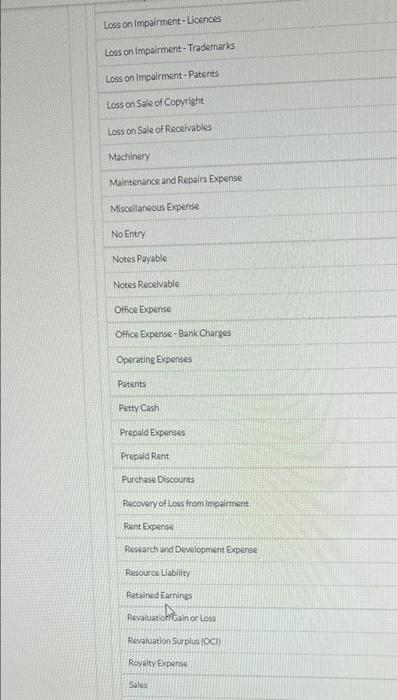

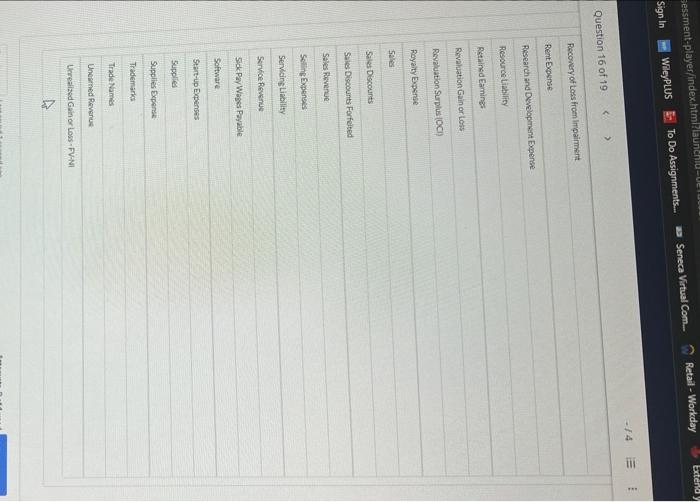

Question 16 of 19 The following information is for a copyright owned by Bridgeport Corp. a publicly accountable entity at December 31, 2020. Bridgeport Corp, applies IFRS. $4304.000 Cost 2174000 Carrying amount Expected future net cash flows fundiscounted) 2043000 1517.000 Fair value Assume that Bridgeport Corp will continue to use this copyright in the future. As at December 31, 2020. the copyright is estimated to have a remaining useful life of 10 years. The copyright's value in uses $1.882.000 and its selling costs are $118,000. Prepare the journal entry, if any, to record the asset's impairment at December 31, 2020. (Credit occount titles are automatically Indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts Date Credit Debit Account Titles and Explanation Dec 31 2020 eTextbook and Media Ust of Accounts Prepare the journal entry to record amortization expense for 2021 related to the copyright. (Credit account titles are automatically indented when the amount is entered. Do not inden manually. If no entry is required, select "No Entry for the account titles and enter for the amount Account Titles and Explanation Debit Credit Acum impamento Copright 292000 eTextbook and Media List of Accounts -/4 Question 16 of 19 The copyright's fair value at December 31, 2021. Is $2.5 milion, Prepare the journal entry, if any, to record the increase in fair value Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation Dec 31. 2021 eTextbook and Media Assistance Used List of Accounts Accounts Payable Accounts Receivable Accumulated Amortization - Copyrights Accumulated Amortization Customer Lists Accumulated Amortization Customer Database Accumulated Amortization Development Costs Accumulated Amortization - Franchises Accumulated Amortization Licences Accumulated Amortization - Patents Accumulated Amortization Software Accumulated Amortization. Trademarks Accumulated Depreciation Accumulated Impalment losses-Goodwill Accumulated impairment Loses Licences Accuma pairmentlones- Putenes Accumulated moment tosses-Trademark Accumulate immat Loss-Trade Names Accumundarment Loss Copyrights Administrative Accumulated Impairment Losses - Copyrights Administrative Expenses Advances to Employees Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Bank Loans Buildings Cach Common Shares Copyright Cost of Goods Sold Customer Database Customer Usts Delivery Expense Depreciation Expense Development Costs Discount on Bonds Payable Due from Factor Due to customer Equipment Fair Value Investments Finance Expense Finance Rene Ranchises Freight Freight-Out Gainon Disposal of intangible Gain on Disposal of Intangible Assets Gain on Sale of Equipment Gain on Sale of Land Goodwill Income Summary Intangible Assets Intangible Assets-Copyrights Intangible Assets-Customer List Intangible Assets Development Costs Intangible Assets Licences Intangible Assets-Franchises Intangible Assets-Patents Intangible Assets-Software Old Intangible Assets-Software New Intangible Assets Trademarks Intangible Assets-Trade Names Interest Expense Interest Income Interest Receivable Inventory Land Leasehold improvements Licences Licensing Agreement Loss on Disposal of Intangible Assets Loss on impairment Loss on impairment - Goodwill Loss on impairment - Licences Loss on Impairment Licences Loss on Impairment - Trademarks Loss on Impairment - Patents Loss on Sale of Copyright Loss on Sale of Receivables Machinery Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Recevable Office Expense Office Expense-Bank Charges Operating Expenses Patents Petty Cash Prepaid Expenses Prepaid Rent Purchase Discounts Recovery of Loss from impairment Rent Expense Research and Development Expense Resource Liability Retained Earnings RevaluatioGain or loss Revaluation Surplus (OCI) Royalty Expense Sales bendy Retail - Workday Seneca Virtual Com sessment-player/index.html?launch-UE DU Sign In WileyPLUS To Do Assignments. -74 III > Question 16 of 19 Recovery of Loss from Impalment Rent Expense Research and Development Expense Resource tability Retained Earnings Revaluation Gainor Los Revaluation Surplus IOCI) Royalty Expense Sales Sales Discounts Sales Discounts Forfeited Sales Revenue Selling Expenses Servicing Liability Service Revenue Sick Pay Wages Payable Software Start-up Expenses Supplies Supplies Expense Trademarks Trade Names Uneamed Ravenue Ured Gain or lossFV-NI M