Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( Please use an Excel Spreadsheet to answer this question. Provide screenshot of the Excel Spreadsheet showing the numbers as well as another screenshot showing

Please use an Excel Spreadsheet to answer this question. Provide screenshot of the Excel Spreadsheet showing the numbers as well as another screenshot showing formulas please.

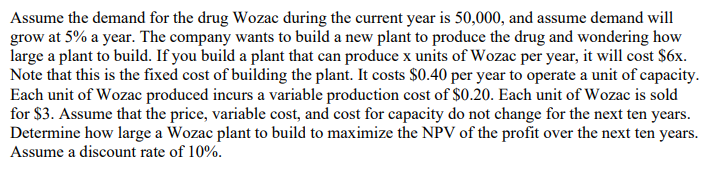

Assume the demand for the drug Wozac during the current year is and assume demand will grow at a year. The company wants to build a new plant to produce the drug and wondering how

large a plant to build. If you build a plant that can produce units of Wozac per year, it will cost $Note that this is the fixed cost of building the plant. It costs $ per year to operate a unit of capacity.

Each unit of Wozac produced incurs a variable production cost of $ Each unit of Wozac is soldfor $ Assume that the price, variable cost, and cost for capacity do not change for the next ten years.

Determine how large a Wozac plant to build to maximize the NPV of the profit over the next ten years.Assume a discount rate of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started