please use and show execl formulas

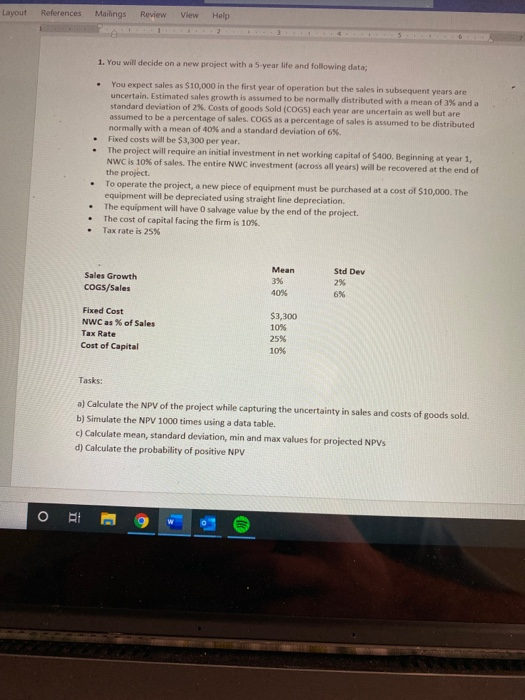

ayout References Mailings Review View Help 1. You will decide on a new project with a 5-year life and following data You expect sales as $10,000 in the first year of operation but the sales in subsequent years are uncertain. Estimated sales growth is assumed to be normally distributed with a mean of 3% anda standard deviation of 2. Costs of goods Sold (COGS) each year are uncertain as well but are assumed to be a percentage of sales. COGS as a percentage of sales is assumed to be distributed normally with a mean of 40% and a standard deviation of 6% Fixed costs will be $3,300 per year. The project will require an initial investment in net working capital of 5400. Beginning at year 1, NWC is 10% of sales. The entire NWC investment (across all years) will be recovered at the end of the project. To operate the project, a new piece of equipment must be purchased at a cost of $10,000. The equipment will be depreciated using straight line depreciation. The equipment will have 0 salvage value by the end of the project. The cost of capital facing the firm is 10% Tax rate is 25% Mean Std Dev Sales Growth COGS/Sales 40% $3,300 109 Fixed Cost NWC as of Sales Tax Rate Cost of Capital 25% 10% Tasks: a) Calculate the NPV of the project while capturing the uncertainty in sales and costs of goods sold. b) Simulate the NPV 1000 times using a datatable. c) Calculate mean, standard deviation, min and max values for projected NPVS d) Calculate the probability of positive NPV ayout References Mailings Review View Help 1. You will decide on a new project with a 5-year life and following data You expect sales as $10,000 in the first year of operation but the sales in subsequent years are uncertain. Estimated sales growth is assumed to be normally distributed with a mean of 3% anda standard deviation of 2. Costs of goods Sold (COGS) each year are uncertain as well but are assumed to be a percentage of sales. COGS as a percentage of sales is assumed to be distributed normally with a mean of 40% and a standard deviation of 6% Fixed costs will be $3,300 per year. The project will require an initial investment in net working capital of 5400. Beginning at year 1, NWC is 10% of sales. The entire NWC investment (across all years) will be recovered at the end of the project. To operate the project, a new piece of equipment must be purchased at a cost of $10,000. The equipment will be depreciated using straight line depreciation. The equipment will have 0 salvage value by the end of the project. The cost of capital facing the firm is 10% Tax rate is 25% Mean Std Dev Sales Growth COGS/Sales 40% $3,300 109 Fixed Cost NWC as of Sales Tax Rate Cost of Capital 25% 10% Tasks: a) Calculate the NPV of the project while capturing the uncertainty in sales and costs of goods sold. b) Simulate the NPV 1000 times using a datatable. c) Calculate mean, standard deviation, min and max values for projected NPVS d) Calculate the probability of positive NPV